Media OutReach

Gold market: May 2025 overview and June 2025 outlook. A monthly digest by the global broker Octa

Overall, the past month presented a rather bumpy ride for traders as it was fueled by a series of notable market-moving events (outlined below). Gold investors contended with persistent trade-related news, shifting geopolitical dynamics in the Middle East and Eastern Europe, rapidly changing monetary policy expectations and U.S. recession probabilities as well as escalating concerns regarding global debt and weakening U.S. dollar. Demonstrating its traditional role, gold once again highlighted its inherent value as a safe-haven asset, potentially indicating continued positive performance in the near future.

- 5-6 May. XAUUSD rallied by more than 6% in just two days as buying from China increased after its markets reopened following a long Labour Day holiday, which ran from 1 May to 5 May. In addition, President Trump’s announcement of a 100% tariff on foreign films renewed trade war fears, weakened the U.S. dollar, and made gold more appealing to holders of other currencies.

- 7-8 May and 12 May. Gold started to pull back from the $3,430 level as the market began to price in the potential easing of trade tensions ahead of the scheduled meeting between the U.S. Treasury Secretary Scott Bessent and Vice Premier of China He Lifeng in Geneva, Switzerland. Furthermore, the U.S. announced a ‘breakthrough’ trade agreement with Britain, which had an additional bullish impact on the greenback (and a bearish impact on the bullion). Improving risk sentiment and rising hopes for the normalisation of global trade relations culminated on 12 May when the U.S. and China announced that they managed to reach a temporary trade deal. As a result, gold prices plunged by as much as 3% on 12 May and continued to fall for another three trading sessions.

- 15 May. Gold began to erase earlier losses after touching critical support in the 3,150 area, which triggered a flow of pending buy-limit orders, helping pull XAUUSD up by almost 2%. In addition, soft U.S. Producer Price Index (PPI) data prompted investors to expect more rate cuts by the Federal Reserve (Fed), further supporting gold prices.

- 20 May. As investors were still digesting the long-term implications of Moody’s downgrade of the U.S. debt, U.S. President Donald Trump was attempting to convince his fellow Republicans in the U.S. Congress to unite behind a sweeping tax-cut bill, which is widely expected to worsen the federal budget deficit outlook. As a result, the U.S. dollar continued to fall, while gold’s price rose towards $3,300 per oz.

- 23 May. Gold prices rose by almost 2%, achieving their best week in six. This was largely due to investors seeking a safe haven as U.S. President Donald Trump renewed tariff threats, recommending a 50% tariff on European Union (EU) imports from 1 June and stating that Apple would face a 25% tariff on iPhones made outside the U.S.

- 29 May. After declining for the previous three trading sessions, XAUUSD rose again after a U.S. appeals court reinstated President Donald Trump’s sweeping tariffs, just a day after most of the tariffs were blocked by a trade court.

‘May was a wild ride for the gold market thanks to America’s erratic trade policies,‘ says Kar Yong Ang, a financial market analyst at Octa broker. ‘Ever since Trump announced his reciprocal tariffs in April, they have been repeatedly delayed, adjusted, challenged, blocked and reinstated, sowing chaos, breeding uncertainty and leaving traders with no clear direction‘.

Indeed, as mentioned previously, the XAUUSD monthly chart shows a significant doji candlestick for May, indicating trader indecision and a potential mid-term reversal. In fact, the short-term trend from 22 April can generally be described as ‘sideways’, as traders are unsure about the bullion’s next big move..However, the broader, long-term trend is still decidedly bullish, as gold’s price remains comfortably above key trendlines and MAs. Overall, chaotic U.S. trade policy, rising fears about the sustainability of the U.S. twin deficits (fiscal and trade), endless geopolitical tensions and political instability, and solid structural demand on the part of central banks helped keep the bullion’s price near all-time highs. In addition, the big technical picture has been positive, resulting in trend buying by investors.

Physical demand for bullion has been a key driver behind the rising price of gold in recent months. Just recently, a Hong Kong Census and Statistics Department (C&SD) report showed that China’s total gold imports via Hong Kong nearly tripled in April, hitting their highest level in more than a year. A total of 58.61 metric tons (mt) of gold was imported via Hong Kong in April, up 178.17% from 21.07 tons in March. And these figures may not even provide a complete picture of Chinese purchases, as gold is also imported via Shanghai and Beijing. Indeed, the People’s Bank of China (PBoC) has been actively adding gold to its reserves for six straight months. According to the World Gold Council, PBoC added 2.2 mt to its gold holdings in April, which now stand at 2,295 mt, 6.8% of total reserve assets. Other countries, notably India and Russia, also continued to stockpile gold. Overall, according to global broker Octa’s estimates, global central banks have added more than 240 tons of gold to their reserves in Q1 2025.

Interestingly, U.S. trade policy also affected physical flows among Western nations. According to Swiss customs data, gold imports to Switzerland from the U.S. jumped to the highest monthly level since at least April 2012 after excluding precious metals from U.S. import tariffs. Reuters reported that Switzerland, the world’s biggest bullion refining and transit hub, and Britain, home to the world’s largest over-the-counter gold trading hub, registered massive outflows to the U.S. over December-March as traders sought to hedge against the possibility of broad U.S. tariffs hitting bullion imports.

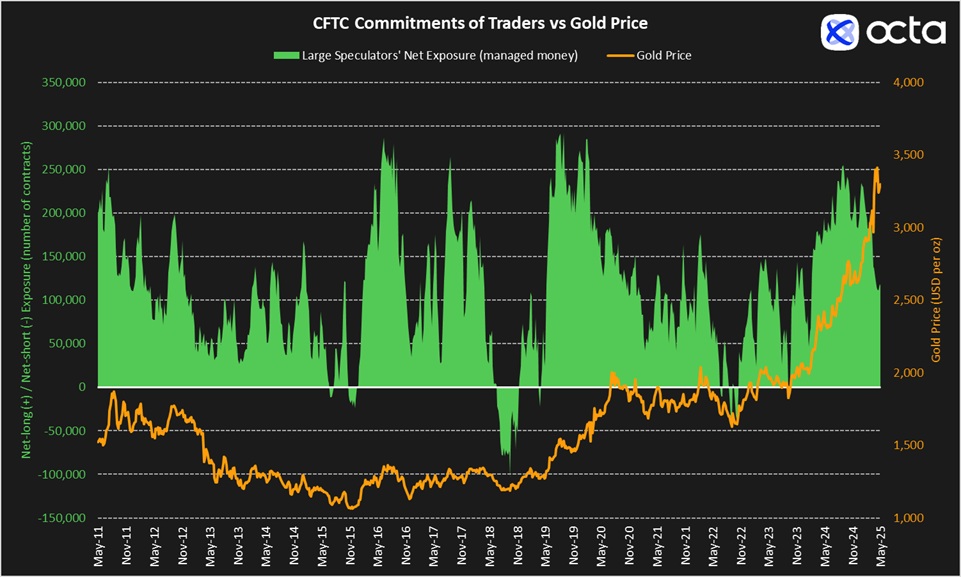

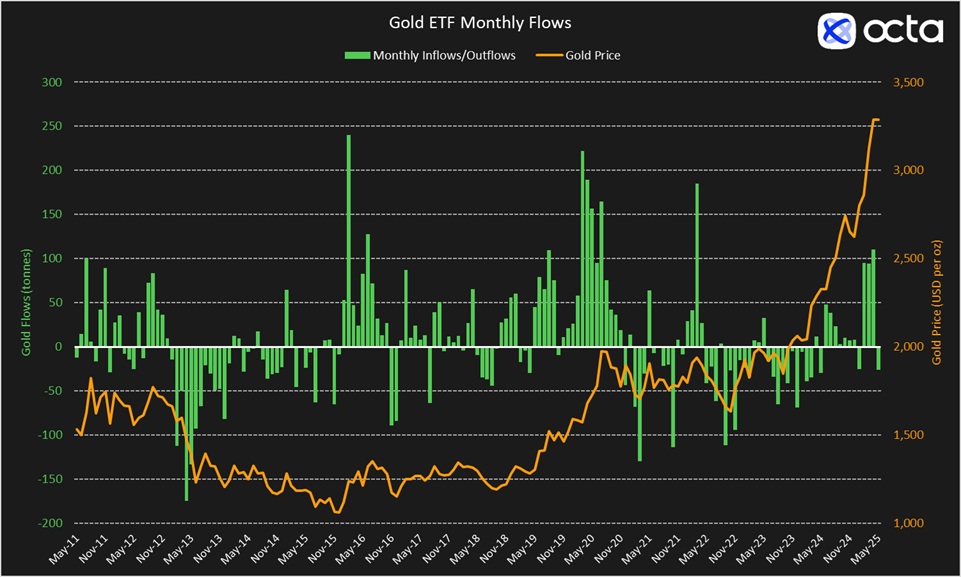

Apart from central banks, global investors have also remained quite bullish on gold. According to the Commodity Futures Trading Commission (CFTC), large speculators (leveraged funds and money managers) were still net-long COMEX gold futures and options as of 27 May, 2025. Long positions totalled 152,034 contracts vs only 34,797 short contracts. Meanwhile, according to LSEG, a financial firm, flows into physically-backed gold exchange-traded funds (ETFs) reached almost 50 mt year-to-date. Most recently, however, speculative bullish interest in gold and ETFs flows have been subsiding.

‘Although large speculators remain net-long, the size of their exposure is substantially smaller compared to what it was back in September 2024, when the uncertainty around the U.S. Presidential elections fuelled bullish bets‘, says Kar Yong Ang, adding that ETFs actually recorded a minor outflow in the first half of May.

Outlook

Fundamentally, the outlook for gold looks bright, but there are important caveats. We have singled out three important factors that will continue to play out in June and the rest of 2025.

Geopolitical uncertainty

Lingering global economic and geopolitical risks continue to play out, with the ongoing trade negotiations between the United States and the rest of the world, particularly China, being the most critical factor affecting the gold market and the global financial system.

The conflicts in the Middle East, such as the Israel-Hamas hostilities, a brief spat between India and Pakistan, and the ongoing conflict between Russia and Ukraine, have destabilised world politics and raised many fears ranging from oil and food supply disruptions to the prospect of a worldwide conflict. Gold, considered a ‘safe-haven’ asset, typically sees increased demand during political uncertainty and instability. While it is extremely difficult to project the resolution of geopolitical conflicts, let alone to forecast the emergence of new ones, peace negotiations in the hottest regions have already commenced. ‘Conflicting parties seem to have at least started to talk. A cease-fire in the Middle East and Eastern Europe is now more likely than it was only a month ago, but a lasting peace may take years to achieve. Either way, any progress in negotiations or even a temporary cessation of hostilities will improve risk sentiment and have a bearish impact on gold,‘ says Kar Yong Ang, global broker Octa analyst.

The looming 8 July tariff deadline imposed by U.S. President Trump further complicates the global political landscape, adding another reason for gold prices to remain elevated. As of today, the United Kingdom is the only country that has signed a new trade deal with the U.S., while trade talks with dozens of other countries have progressed too slowly. Negotiations remain unwieldy, while China and the U.S., the world’s two largest economies, continue to accuse one another of breaching the Geneva trade deal. As long as trade tensions persist, investors will be reluctant to sell gold.

Global monetary policy

Gold is priced in U.S. dollars and is therefore highly sensitive to changes in U.S. interest rates, inflation, and the greenback’s value. As already mentioned, the market is positioned for a dovish Fed. In fact, the latest interest rates swap market data implies roughly 75 basis points (bps) worth of rate cuts by the Fed by the end of December 2025. It is widely expected that other central banks will not fall far behind. For example, after the latest Eurozone inflation figures came out lower than expected, investors now expect the European Central Bank (ECB) to deliver two quarter-point rate cuts by the end of December 2025. Likewise, the Bank of England (BoE) is anticipated to announce at least two rate cuts of 25 bps each before the end of the year. Fundamentally, a less tight (or looser) monetary policy worldwide is a major bullish factor for gold. Because gold has no passive income and does not pay any interest, the opportunity cost of holding it becomes lower when central banks reduce their policy rates. The main risk, of course, is inflation. Should it remain above central banks’ targets or, even worse, start to increase, the Fed and its counterparts will be forced to hold the rates higher for longer.

‘Inflation is a major concern. Tariff-related price increases are yet to be felt, and although U.S. consumer 1-year and 5-year inflation expectations have eased, they remain very high by historical standards. I think some central banks, and maybe even the Fed, will prefer to wait until trade tensions are resolved before committing fully to rate cuts,‘ says Kar Yong Ang.

Physical demand

Physical demand for gold may continue to increase primarily because China, a significant gold consumer, remains an active buyer, but also because global central banks in general are increasingly turning to gold to diversify their reserves away from the U.S. dollar. Specifically, China has seen its national currency, the renminbi (RMB), appreciate more than 2% over the past month. This is not a welcoming development for a country whose economy heavily depends on exports. Thus, Chinese authorities may relax gold import quotas to stop the yuan from appreciating too much. As a result, the physical and investment demand for gold in China may rise in the months ahead. As for India, the demand for gold may temporarily slow due to seasonal factors, but is unlikely to reverse. Indian jewellers may delay making new stock acquisitions as monsoon rains are arriving, while the wedding season is concluding, but that will only have a temporary impact.

Technical picture

Kar Yong Ang, global broker Octa analyst, said: ‘From a technical perspective, XAUUSD looks bullish no matter how you look at it. 3,397, 3,438, and 3,463-3,471 levels are still real targets for bulls. Only a drop below 3,125 will invalidate the underlying bullish trend, and even then XAUUSD is more likely to trend sideways than to go deep down.’

Conclusion

Overall, we continue to see a generally bullish picture for gold, but it may be changing soon. Fundamentally, gold is still a ‘buy’ but no longer a ‘screaming buy’, as we labelled it in our August 2024 Digest. Wall Street analysts predict higher prices. Goldman Sachs recently hiked its 2025 gold forecast to $3,700 per oz, particularly due to strong central bank demand, implying a 10% upside potential from the current levels. At the same time, large speculators have already started to reduce their net-long exposure, while the outlook for the global monetary policy remains uncertain due to tariffs. Investors, in general, may be a bit too optimistic when it comes to rate cuts.

‘As things currently stand, it is still very hard to draw a bearish case for gold, but I do think that the bullish trend is showing first signs of exhaustion and some consolidation is likely to follow‘, said Kar Yong Ang, global broker Octa analyst. Next month will be critical for the gold market as it features seven key rate decisions and will likely be packed with news related to trade negotiations. Traders should be cautious as June news may essentially determine the XAUUSD trend for the next six months.

| 4 June | Bank of Canada meeting |

| 5 June | European Central Bank meeting |

| 6 June | U.S. Nonfarm Payroll |

| 11 June | U.S. Consumer Price Index |

| 15-16 June | Group-7 Summit |

| 17 June | Bank of Japan meeting |

| 18 June | Federal Reserve meeting |

| 19 June | Swiss National Bank meeting |

| 19 June | Bank of England meeting |

| 20 June | People’s Bank of China meeting |

| 23 June | S&P Global Purchasing Managers Indices |

| 24-25 June | North Atlantic Treaty Organization Summit |

| 26-27 June | European Council Summit |

| 27 June | U.S. Personal Consumption Expenditure Price Index |

| 30 June | German Consumer Price Index |

___

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

![]() Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including improving educational infrastructure and funding short-notice relief projects to support local communities.

In Southeast Asia, Octa received the ‘Best Trading Platform Malaysia 2024’ and the ‘Most Reliable Broker Asia 2023’ awards from Brands and Business Magazine and International Global Forex Awards, respectively.

Media OutReach

TAT partners with Lalisa ‘LISA’ Manobal, Amazing Thailand Ambassador, to invite Tourists to discover the Multitude of Feelings upon travelling in Thailand, unveiling the New TVC “Feel All The Feelings”

Reinforcing Thailand’s position as a trusted, high-quality destination through emotion-driven storytelling

BANGKOK, THAILAND –

The film sets to entice tourists to experience and discover the multitude of feelings to be gained from travelling in Thailand, including happiness, serenity, excitement, challenge, and warmth, to establish Thailand as a valuable and unforgettable travel destination.

Ms Thapanee Kiatphaibool, Governor of the TAT, revealed, “This year, the TAT remains committed to reinforcing Thailand’s image through the ‘Trusted Thailand’ strategy to warmly welcome tourists, while continuing its push to establish Thailand as a ‘Quality Leisure Destination.’ This is to build confidence among tourists who want to create valuable, unforgettable memories at every step of their journey. Recently, we launched the ‘Feel All The Feelings’ campaign, building widespread communication and awareness across various channels. We are kicking off the year with a new commercial featuring ‘Lalisa LISA Manobal’ as the Amazing Thailand Ambassador, who will showcase Thailand’s tourist attractions and the feelings evoked on each visit. The campaign aims to ‘enhance quality’ while distributing revenue and tourists to new potential areas. TAT cordially invites all Thais to be ‘good hosts’ and share memorable Thai travel experiences.

TVC ‘Feel All The Feelings‘ by TAT portrays unseen attractions and diverse emotions awaiting tourists to discover and experience in Thailand. The story’s inception was inspired by tourists’ desire to seek a range of experiences that fulfil them emotionally and spiritually, helping them ‘Feel Alive’ again. TAT is confident that Thailand can be the answer and add vivid hues to tourists’ lives, as we are a land of diversity, colour, and vitality, ready to offer an exceptional experience for visitors to feel every emotion, from happiness, serenity, excitement, and challenge, to the warmth of smiles and hospitality, the intriguing mystery of new places, and the wonder of unseen locations. We believe that every area and every journey in Thailand will not only create impressive memories but also deliver ‘feelings’ that greatly enrich the travel experience.”

In this ad, Lalisa ‘LISA’ Manobal, in her role as the Amazing Thailand Ambassador, invites everyone to experience the ‘feelings within Thailand’. LISA is often asked, “What does Thailand feel like?” and she reveals the feelings she experiences while resting and recharging in Thailand in the commercial, through every emotion, every feeling, and every rhythm of Thailand’s beauty, which is unlike anywhere else in the world. The production also features renowned stars and actors such as Win – Metawin Opas–iamkajorn, Gulf – Kanawut Traipipattanapong, and Blue – Pongtiwat Tangwancharoen, who join the journey and convey these feelings together.

The TVC showcases beautiful locations nationwide, starting with the captivating beauty of the Lanna Candle Ceremony (Phang Prateep) at Wat Chedi Luang in Chiang Mai province, followed by a spectacular view of the ‘floating pagodas’ in Lampang province. Viewers can marvel at the sea of mist at Phu Langka in Phayao province. The ads also features attractions in other regions to show that, wherever you are, there is always something to discover. Examples include experiencing the beauty of the first light of dawn at Wat Arun in Bangkok, the splendour of the Red Lotus Sea in Udon Thani province, or experiencing the sound of the cascading waters of

Thi Lo Su Waterfall in Tak province.

Furthermore, the “Feel All the Feelings“ campaign aims is to shift tourists from popular landmarks to hidden-gem destinations, increasing the quality of their spending and the value per trip, in line with the “Value over Volume” strategy.

Join “LISA“ on her journey as the Amazing Thailand Ambassador and discover feelings awaiting tourists in Thailand with the “Feel All The Feelings“ campaign. The “Feel All The Feelings“ TVC is currently available at official Amazing Thailand channels:

Youtube: https://youtu.be/wDMv1KujSGc

X (@AmazingThailand) : https://x.com/AmazingThailand/status/2016507144783487483?s=20

Facebook: https://web.facebook.com/share/v/14RnwfmwTTW/

Instagram: https://www.instagram.com/reel/DUDnoOziPCp/?utm_source=ig_web_copy_link&igsh=MzRlODBiNWFlZA==

TikTok: https://www.tiktok.com/@amazingthailand/video/7600405546558131476

Contact Information

International Public Relations Division

Tourism Authority of Thailand

Tel: +66 (0) 2250 5500 ext. 4545-48

Fax: +66 (0) 2250 0246

E-mail: [email protected]

Website: www.tatnews.org

Media contacts:

- Khianthong Ngernphum (Thonghom) PR Executive, VERVE Public Relations | E-mail: [email protected] | Tel: +66 80 561 9511

- Jirachaya Jaiyen (Linda) Senior PR Executive, VERVE Public Relations | E-mail: [email protected] | Tel: +66 94 876 4938

Hashtag: #AmazingThailand #AmazingThailandAmbassador #AmazingThailandxLISA #FeelAllTheFeelings #FeelAllTheFeelings_TVC

The issuer is solely responsible for the content of this announcement.

Media OutReach

ONYX Hospitality Group named Seventh Best Place to Work in Asia-Pacific for 2025

The Group was also ranked third in Thailand under the international “Best Place to Work in Thailand 2025” certification, reinforcing ONYX’s commitment to sustainable people management and a strong corporate culture.

BANGKOK, THAILAND – Media OuReach Newswire – 30 January 2026 – ONYX Hospitality Group has been recognised as the seventh Best Place to Work in the Asia-Pacific region for 2025, awarded by Best Places to Work, an internationally recognised organisation specialising in workplace assessment and employee experience benchmarking. The recognition reflects the Group’s people-centric workplace practices and a culture that places equal emphasis on employee development and service excellence, and is further reinforced by ONYX’s third-place ranking in Thailand under the “Best Place to Work in Thailand 2025” certification, highlighting the Group’s long-standing focus on sustainable people management and a strong, values-driven corporate culture.

With a diverse portfolio spanning hotels, resorts, serviced apartments, and luxury residences under well-established brands including Amari, OZO, Shama, and Oriental Residence, ONYX Hospitality Group continues to strengthen its position across key strategic markets in the region. As the Group approaches its 60th anniversary in 2026, these accolades further highlight ONYX’s long-standing commitment to building a resilient organisation powered by engaged and capable people.

The “Best Places to Work” certification is an internationally recognised programme that benchmarks organisational excellence in human resource practices and employee engagement. Certification is awarded through a comprehensive evaluation covering employee engagement, employee experience, and the effectiveness of HR policies and practices. In this year’s assessment, ONYX Hospitality Group demonstrated strong performance across multiple dimensions, including a supportive work environment, an open and inclusive corporate culture, and a people development strategy closely aligned with the Group’s regional business direction.

One of the key pillars supporting ONYX’s evolution as a trusted workplace is ONYX Academy, the Group’s comprehensive learning and development institute. ONYX Academy delivers structured programmes spanning foundational skills training, advanced role-specific competency development, and clearly defined career pathways for employees at all levels. By prioritising both future-ready capabilities and practical, applicable skills, the Academy equips team members for sustainable personal and professional growth.

The effectiveness of ONYX Academy has also been recognised at an industry level through multiple honours at the EXA: Employee Experience Awards 2025, including awards for the General Manager Development Programme (GM Track), the NextYou Initiative, the HR Leadership Enhancement Programme, and the Group’s ESG initiatives. These accolades further underscore ONYX Hospitality Group’s long-term and focused commitment to meaningful employee development.

Alongside capability building, ONYX Hospitality Group continues to foster a corporate culture rooted in openness and dynamism, encouraging employees to think creatively, experiment, and contribute new ideas. The Group actively supports agility and adaptability by creating space for diverse voices across the organisation. Employee well-being is also prioritised through the ONYX Cares programme, which holistically supports physical and mental health, relationships, and team engagement—contributing to a work environment that nurtures both individual fulfilment and organisational growth.

Saranya Watanasirisuk, Senior Vice President, Corporate Human Resources, commented: “At ONYX Hospitality Group, we believes that our people are the foundation for delivering exceptional experiences and service. Our success in human resource management is driven by strong leadership support at every level, enabling employees to grow across all dimensions. This commitment spans from recruitment and holistic learning systems to cultivating an environment that encourages creativity, experimentation, and the full expression of individual potential. These efforts have positioned ONYX not only as an employer of choice, but also as an organisation trusted by partners and guests alike.”

Receiving the “Best Place to Work” Certification at both national and regional levels marks another significant milestone for ONYX Hospitality Group. The achievement reinforces its commitment not only to being a regional leader in hospitality management, but also to being an organisation that genuinely values its people.

Looking ahead, ONYX remains dedicated to continuously enhancing the workplace environment and delivering meaningful employee experiences that support long-term growth and sustained competitiveness.

For more information about ONYX Hospitality Group, please visit www.onyx-hospitality.com.

Hashtag: #ONYXHospitalityGroup

![]() https://www.linkedin.com/company/onyx-hospitality-group/

https://www.linkedin.com/company/onyx-hospitality-group/![]() https://www.facebook.com/ONYXHospitalityGroup

https://www.facebook.com/ONYXHospitalityGroup![]() https://www.instagram.com/onyxhospitalitygroup/

https://www.instagram.com/onyxhospitalitygroup/

The issuer is solely responsible for the content of this announcement.

About ONYX Hospitality Group:

ONYX Hospitality Group, a reputable force in Southeast Asia’s hospitality industry, operates a collection of comprehensive yet complementary brands – Amari, OZO, Shama and Oriental Residence – catering to the distinctive needs of discerning business and leisure travellers in Southeast Asia where their expertise lies. In addition to its brand portfolio, ONYX Hospitality Group also operates additional hospitality services across spa and food and beverage. With over five decades of management experience, the company extends its innovative solutions throughout the region, upholding internationally recognised standards and ensuring optimal operational manoeuvrability. By fostering enduring relationships with like-minded business partners, ONYX Hospitality Group delivers unparalleled experiences in a dynamic and competitive market, meeting the ever-evolving demands of travellers.

More information: ![]() www.onyx-hospitality.com

www.onyx-hospitality.com

Media OutReach

SCOPE’s Ultra-Luxury Residential Performance Underscores Strong Investor Confidence in Thailand’s Prime Market

Despite global headwinds including escalating trade disputes, rising commodity prices, and shifting monetary policies, Thailand’s prime residential market remains structurally strong. Bangkok, in particular, continues to attract foreign buyers seeking long-term residential assets that combine lifestyle quality with capital stability. Demand in this segment has been driven less by short-term speculation, and more by purchasers prioritizing quality, identity, and long-term livability.

Commenting on the market outlook, Mr. Yongyutt Chaipromprasith, Chief Executive Officer of SCOPE Company Limited, said: “Thailand offers exceptional value when compared with global cities, not only in pricing but also in quality of life, project standards, and long-term livability. Many international investors view Thai ultra-luxury residences as a safe haven asset, supported by competitive rental yields, lower holding costs, and a lifestyle proposition that few markets can replicate.”

Among its flagship developments, SCOPE Langsuan recorded over 90% sales completion within 2025, reflecting strong demand from discerning buyers. The project’s success highlights a clear shift in buyer behavior: ultra-luxury purchasers are increasingly focused on authenticity, design integrity, and long-term residential value rather than speculative gains.

Central to this appeal is SCOPE’s collaboration with internationally acclaimed designer Thomas Juul-Hansen, whose portfolio includes prominent residential development in New York, notably along the iconic “Millionaire’s Row.” By engaging designers of this caliber, SCOPE reinforces its role as a developer of globally competitive, non-replicable residential projects, rather than locally derivative offerings.

This approach further emphasizes the “value for money” proposition of Thailand’s luxury market. Achieving equivalent design pedigree and spatial quality in global financial capitals would require significantly higher development and acquisition costs.

This philosophy guides every stage of development — from spatial planning and material selection to service design and community environments — ensuring that residences are built to support genuine, long-term living.

From curated common spaces designed as well-being hubs, to personalized residential services and collaborations with world-class architects and designers, SCOPE aims to establish new benchmarks for service-driven, timeless luxury in Thailand’s residential market. This evolution reflects a broader industry shift from competing on physical specifications alone to competing on holistic living experiences.

Looking ahead, Thailand’s ultra-luxury real estate market is transitioning from price-based competition toward differentiation driven by design excellence, development standards, service quality, and long-term livability. This shift strengthens the country’s positioning on the global stage and reinforces ultra-luxury residential assets as stable, long-term investments amid ongoing global uncertainty.

Hashtag: #Scope #Scopecollection

![]() https://scopecollection.com/

https://scopecollection.com/![]() https://www.facebook.com/scopecollection?locale=th_TH

https://www.facebook.com/scopecollection?locale=th_TH![]() https://www.instagram.com/scopecollection/

https://www.instagram.com/scopecollection/

The issuer is solely responsible for the content of this announcement.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn