Media OutReach

Wildfires and Floods Caused Billion-Dollar Economic Loss in Asia Pacific in the first quarter of 2025: Aon Report

- Q1 data follows $74B economic loss in Asia Pacific from natural disasters in 2024

- Earthquake in Myanmar estimated to be the costliest event of the year so far, with only a fraction insured

SINGAPORE – Media OutReach Newswire – 14 May 2025 – Aon plc (NYSE: AON), a leading global professional services firm, published Asia Pacific (APAC) insights from its Q1 Global Catastrophe Recap – April 2025, which analyzes the natural disaster events that occurred worldwide during the first quarter of 2025.

During this period, the APAC region experienced significant wildfire activity, particularly in South Korea and Japan. South Korea faced devastating wildfires that resulted in 31 deaths, 49 injuries and the destruction of over 7,700 structures with losses estimated at approximately $1B.

The earthquake that occurred in March in Myanmar is the costliest event of the year so far. Damage is expected to reach billions of dollars and only a fraction is covered by insurance. The costliest event for APAC insurers was ex-Tropical Cyclone Alfred, with insured losses of approximately AU $1B.

The Q1 data follows Aon’s 2025 Climate and Catastrophe Insight report, which identified global natural disaster and climate trends to quantify the risk and human impact of extreme weather events in 2024, where total economic losses in APAC were $74B, with insurance covering only approximately $4B.

The main driver of economic losses in 2024 was flooding, with a significant contribution from seasonal floods in China. Two major events: the Noto earthquake in Japan and Typhoon Yagi in Southeast Asia and China also accounted for a large proportion of the losses.

Typhoon Yagi was one of the most severe storms to hit Southeast Asia since Typhoon Rammasun in 2014. The storm caused extensive damage across Vietnam, China, Myanmar, the Philippines and Thailand, resulting in significant economic and insured losses. This event highlights the importance of considering both wind and flood risks in typhoon-prone areas.

George Attard, CEO for Reinsurance Solutions for APAC at Aon, said: “The devastating earthquake in Myanmar, which caused at least 5,400 deaths and significant structural and infrastructure loss, underscores the importance of being prepared for catastrophe-related risks. Extreme weather and seismic events remain a powerful force driving the complexity and volatility that businesses and communities face and emphasizes the urgent need for innovative mitigation solutions to address this growing challenge.”

Aon’s 2025 Climate and Catastrophe Insight report highlights several trends with natural catastrophe losses:

- Growing Disaster Losses: Global insurance losses in 2024 were 54 percent above the 21st-century average, covering $145B of the $368B in damages. Even though insured losses far exceeded the average, the protection gap stood at 60 percent, representing a significant financial headwind to communities, businesses and governments. In the APAC region, the protection gap was much higher with 95 percent of the losses not covered. Increases in population density in coastal areas, wealth and overall exposure to natural hazards in high-risk areas continue to be a crucial component of growing disaster losses.

- Earthquake Risks: April 2024 saw a significant earthquake impact in Taiwan, while Japan experienced the Noto Peninsula earthquake on January 1, 2024. This emphasises the need for ongoing vigilance and preparedness for seismic events.

- Exposure Changes: Changes in exposure is a growing challenge for insurers and clients. These changes, rather than climate risks alone, are driving shifts in loss patterns. Typhoon Yagi, for example, accentuated the importance of a regional risk management approach that extends beyond sovereign borders.

- Advances in Flood Modelling: Despite the challenges, advancements in flood modelling have made significant strides in recent years. Advanced tools and data analytics can help businesses and governments understand the complexities of flood risk and prepare for future events.

- Economic Impacts: The exposure of commercial infrastructure to extreme weather has increased, requiring companies and insurers to explore the impact of changing weather patterns on assets. While Typhoon Yagi made a significant impact on economic and insured losses in China, Vietnam and the Philippines, 2024 was a relatively quiet year for natural catastrophes in Asia when compared with the long-term regional trend.

The economic and insured losses in the region also contrast with the global figures, where economic losses from natural disasters in 2024 are estimated at $368B, more than 10 percent above the long-term average since 2000.

With greater resilience and mitigation measures in place, global economies can reduce damage and loss of life. In 2024, 18,100 people lost their lives due to natural hazards, mostly from heatwaves and flooding globally. This was below the 21st-century average of 72,400. The long-term decrease in global fatalities can be attributed to improved warning systems, weather forecasts and evacuation planning, underscoring the value of reliable climate data, insights and analytics.

Significant Asia Events in 2024

| Date | Event | Location | Deaths | Economic Loss (2024 $ B) |

Insured Loss

(2024 $ B) |

| 09/06 -14/07 | South Central China Floods | China | 470 | 15.7 | 0.4 |

| 01/09 – 09/09 | Typhoon Yagi | China, Southeast Asia | 816 | 12.9 | 0.7 |

| 01/01 | Noto Earthquake | Japan | 489 | 18.0 | 1.5 |

| 01/03 – 30/06 | India Heatwaves | India | 733 | NA | NA |

| 20/06 – 30/06 | Karachi Heatwave | Pakistan | 568 | NA | NA |

“Asia is at the forefront of flood modelling,” said Peter Cheesman, head of Risk Capital analytics for APAC at Aon. “Despite this, there remains a need for better tools and collaborations with public and private partnerships to help close the insurance gap. A comprehensive, multi-country strategy, together with advanced modelling and data inputs, are critical in helping risk managers prepare for future events as climate and exposure trends continue to evolve.”

Aon’s 2025 Climate and Catastrophe Insight report can be found here.

Hashtag: #Aon #climaterisks #climate #catastrophe #catastropherisks #flooding

The issuer is solely responsible for the content of this announcement.

About Aon

Aon plc (NYSE: AON) exists to shape decisions for the better — to protect and enrich the lives of people around the world. Through actionable analytic insight, globally integrated Risk Capital and Human Capital expertise, and locally relevant solutions, our colleagues provide clients in over 120 countries with the clarity and confidence to make better risk and people decisions that protect and grow their businesses.

Follow Aon on newsroom and sign up for news alerts here.

Disclaimer

The information contained in this document is solely for information purposes, for general guidance only and is not intended to address the circumstances of any particular individual or entity. Although Aon endeavours to provide accurate and timely information and uses sources that it considers reliable, the firm does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of any content of this document and can accept no liability for any loss incurred in any way by any person who may rely on it. There can be no guarantee that the information contained in this document will remain accurate as on the date it is received or that it will continue to be accurate in the future. No individual or entity should make decisions or act based solely on the information contained herein without appropriate professional advice and targeted research.

Media OutReach

St. George’s University Prepares Future South Korean Physicians for the Growing Global Cancer Care Challenge

Recognizing the importance of addressing workforce shortage in South Korea, St. George’s University (SGU) School of Medicine in Grenada, West Indies, highlights how its medical education approach supports the development of clinical competencies relevant to cancer care across healthcare settings.

These challenges reflect broader global trends, where cancer care increasingly depends on multidisciplinary teams rather than specialty expansion alone. SGU’s curriculum is designed to build a strong foundation in clinical diagnosis, patient communication and multidisciplinary care, which are essential skills for effective oncology and cancer-related care. Through anatomy labs, simulation-based learning, and integrated digital tools, students develop foundational clinical skills in structured, supervised environments designed to reflect real-world medical practice.

The curriculum also integrates traditional cadaveric dissection with modern 3D anatomical modeling. This blend helps students visualize the human body in a holistic way while reinforcing knowledge through their hands-on interaction. SGU’s simulation lab also enables medical students to have their first direct interaction with ill patients in a safe, simulated learning environment.

On top of core medical training, SGU offers early exposure to prevention, diagnosis and patient-centered care to prepare graduates to tackle complex health issues. SGU has developed long-standing relationships with more than 75 established hospitals and clinical centers in the US and UK. These clinical placements provide exposure to diverse patient populations and care environments, including settings where cancer diagnosis and management are part of routine clinical practice.

South Korean SGU alumni are contributing to healthcare systems through roles that intersect with cancer diagnosis, treatment coordination, and long-term patient care. For example, Dr. Julia Hweyryoung Cho, MD 2022 is practicing internal medicine, which plays a crucial role in cancer care. Internal medicine physicians are often involved in the initial diagnosis of cancer, managing complex medical conditions that may arise during treatment and providing long-term comprehensive care and survivorship planning for patients with a history of cancer.

In observance of World Cancer Day 2026, SGU encourages all medical professionals and organizations to collaboratively address global cancer care challenges. This includes recognizing and meeting the cancer healthcare needs of individuals and communities in South Korea.

For more information on the programs and tracks available through SGU School of Medicine, visit SGU’s website.Hashtag: #St.George’sUniversity

The issuer is solely responsible for the content of this announcement.

Media OutReach

Finalists and Semifinalists for $1 Million Seeding The Future Global Food System Challenge Announced

Created and funded by Seeding The Future Foundation and, for the first time, hosted by Welthungerhilfe (WHH), the Challenge attracted a record 1,600+ applications from innovator teams in 112 countries, underscoring growing global momentum for food systems transformation.

Following a multi-stage, rigorous international review process, 36 teams have advanced across three award levels. These include 16 Seed Grant Finalists (competing for 8 awards of USD 25,000), 12 Growth Grant Semifinalists (competing for 3 awards of USD 100,000), and 8 Seeding The Future Grand Prize Semifinalists (competing for 2 awards of USD 250,000).

“Hosting the GFSC reflects Welthungerhilfe’s commitment to accelerating bold, scalable innovations where they are needed most. This year’s diversity of solutions underscores the complexity of food system challenges and the creativity of innovators worldwide.” said Jan Kever, Head of Innovation at Welthungerhilfe

The submitted innovations span diverse themes and approaches, including climate-smart production, nutrient-dense foods, food loss reduction, and inclusive market models, reflecting the complexity and interconnected nature of today’s food systems challenges.

“The Seeding The Future Global Food System Challenge exists to catalyze impactful, bold, and scalable innovations that advance food systems transformation. We are excited to work alongside Welthungerhilfe as a trusted partner and host of the Challenge and are encouraged by the quality and diversity of innovations emerging from this first year of collaboration.” said Bernhard van Lengerich, Founder and CEO of Seeding The Future Foundation

While the number of awards is limited, all semifinalists and finalist applicants plus all applicants with any prior recognition of other innovation competitions can join the STF Global Food System Innovation Database and Network—currently in beta testing with the Food and Agriculture Organization of the United Nations—vastly expanding their visibility and reach across a global audience.

List of 2025 GFSC Seed Grant Finalists, Growth Grant and Seeding The Future Grand Prize Semifinalists

Find details here: welthungerhilfe.org/gfsc-finalists

Seeding The Future Grand Prize Semi-Finalists

- CNF Global, Kenya

- ZTN Technology PLC, Ethiopia

- One Acre Fund, Rwanda

- Sanku, Tanzania

- Nabahya Food Institute (NFI), Democratic Republic of the Congo

- ABALOBI, South Africa

- metaBIX Biotech, Uruguay

- Nurture Posterity International, Uganda

Growth Grant Semi-Finalists

- Baobaby, Togo

- Safi International Technologies Inc., Canada

- Centro Internacional de Mejoramiento de Maíz y Trigo (CIMMYT), Mexico

- Farmlab Yeranda Agrisolution Producer Company Limited, India

- Banco de Alimentos Santa Fe (BASFE), Argentina

- Chartered Consilorum (Pty) Ltd, South Africa

- American University of Beirut, Environment and Sustainable Development Unit (ESDU at AUB), Lebanon

- The Source Plus, Kenya

- Iviani Farm Limited, Kenya

- Rwandese Endogenous Development Association, Rwanda

- NatureLEAD, Madagascar

- Ndaloh Heritage Organisation, Kenya

Seed Grant Finalists

- Inua Damsite CBO, Kenya

- World Neighbors, United States

- Keloks Technologies Ltd, Nigeria

- REBUS Albania, Albania

- Tanzania Conservation and Community Empowerment Initiative (TACCEI), Tanzania

- Intrasect, Switzerland

- VKS AGRITECH, India

- Murmushi People’s Development Foundation, Nigeria

- Levo International, Inc., United States

- Effective Altruism Research Services Ltd, Uganda

- Taita Taveta University, Kenya

- CultivaHub, Democratic Republic of the Congo

- Resource Hub for Development (RHD), Kenya

- FUTURALGA S.COOP.AND, Spain

- West Africa Centre for Crop Improvement, University of Ghana, Ghana

- Sustainable Solutions Kenya, Kenya

Hashtag: #TheFutureGlobalFoodSystemChallenge

The issuer is solely responsible for the content of this announcement.

About Seeding The Future Foundation

STF is a private nonprofit dedicated to ensuring equitable access to safe, nutritious, affordable, and trusted food. It supports innovations that transform food systems and benefit both people and planet. More at Seeding the future.

About Welthungerhilfe

WHH is one of Germany’s largest private aid organizations, striving for a world without hunger since 1962. More at: Welthungerhilfe (WHH)

Media OutReach

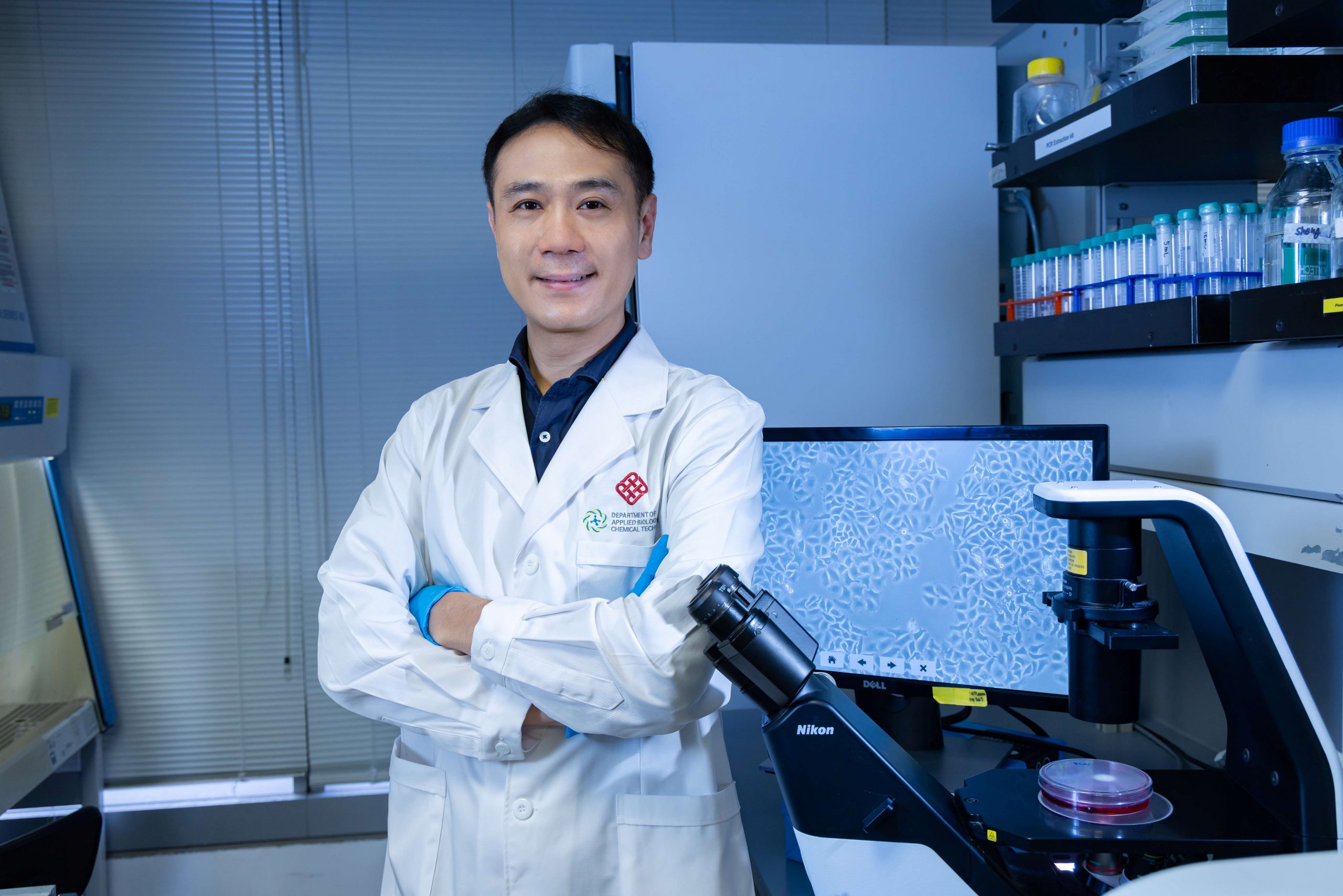

PolyU develops novel antibody targeting fat cell protein, offering new approach to treating metabolism-related liver cancer

Metabolic dysfunction-associated steatotic liver disease (MASLD), commonly known as fatty liver disease, currently affects around a quarter of the global population and is an important risk factor for liver cancer. In affected individuals, fat cells induce insulin resistance and chronic inflammation, leading to excessive fat accumulation in the liver. This ultimately impairs liver function and may progress to liver cancer. Treatment options for MASLD-induced liver cancer remain limited and the effectiveness of current immunotherapies is suboptimal.

A breakthrough study led by Prof. Terence LEE, Associate Head and Professor of the PolyU Department of Applied Biology and Chemical Technology, and his research team has revealed that an adipocyte-derived protein, known as fatty acid-binding protein 4 (FABP4) is a key driver that accelerates tumour growth. Through mass spectrometry, the team confirmed that patients with MASLD-induced liver cancer had markedly elevated FABP4 levels in their serum. Further investigations showed that FABP4 activates a series of pro-proliferative signalling pathways within cells, causing cancer cells to multiply and grow more rapidly.

Prof. Lee’s team has successfully developed a monoclonal antibody that neutralises FABP4. This antibody not only inhibits the growth and proliferation of FABP4-driven cancer stem cells, but also enhances the ability of immune cells to combat cancer.

Prof. Lee said, “This neutralising antibody against FABP4 demonstrates significant potential in inhibiting tumour growth and activating immune cells, providing a complementary approach to current immunotherapy strategies. Our findings highlight that targeting adipocyte-derived FABP4 holds promise for treating MASLD-induced liver cancer.”

Prof. Lee added that gaining deeper insights into how adipocyte-derived FABP4 affects liver cancer cells helps to explicate the disease mechanisms of liver cancer, particularly in obese individuals. Intervening in the relevant signalling pathways could provide effective methods to combat this aggressive malignancy.

Prof. Lee believes that, as this adipocyte-targeted immunotherapy continues to mature, it will bring more treatment options to MASLD patients. He remarked, “If its efficacy can be proven in clinical trials, it could offer new hope to many affected individuals.”

The research is supported by the Innovation and Technology Fund of the Innovation and Technology Commission of the Government of the Hong Kong Special Administrative Region of the People’s Republic of China. PolyU has filed a non-provisional patent for the developed antibody and is continuing to optimise its binding affinity to facilitate future clinical applications.

Hashtag: #PolyU #FattyLiver #Cancer #LiverCancer #理大 #香港理工大学 #肝癌 #癌症 #脂肪肝

The issuer is solely responsible for the content of this announcement.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn