Technology

$125m Loan: Smile Faces Disqualification as 9mobile’s Reserve Bidder

By Modupe Gbadeyanka

There are strong indications that Smile Communications Nigeria Limited’s failure to disclose that its Nigerian shareholders have ongoing and challenging debt to a consortium of banks is threatening its position as the reserve bidder for the sale of 9mobile.

The telco data company has been accused of not only presenting false information in the bidding round but that is now attempting to derail the ongoing sale of the telecoms company by Barclays Africa having lost its attempt to become the preferred bidder.

Unsatisfied with the ongoing bid process, Smile Communications had on May 9, 2018, written the Board of Directors of Emerging Markets Telecommunication Services Limited and Guaranty Trust Bank Plc, representing the 13 local banks, the lenders of the $1.2 billion loan to Etisalat, now known as 9mobile,”raising issues after the fact as it desperately seeks to derail the ongoing bid process for the sale of 9mobile to Teleology”, said a source conversant with the transactions.

Smile has alleged that Teleology, the preferred bidder for the sale of 9mobile does not have the financial capacity to buy 9mobile, and that it has all it takes to reposition 9mobile and make it attractive and competitive again, within 90 days, if given the opportunity to acquire 9mobile. Smile Communications assured that the company would inject fresh millions of dollars from foreign financing outside Nigeria into 9mobile to pay off its indebtedness to the banks and any other group the company is indebted to, and we will still have enough to invest in 9mobile and make it competitive.

Despite its promises and threats, it was discovered that Smile Communication Nigerian partners and shareholders are indebted to banks to the tune of $125 million – a material fact they ought to have disclosed at the beginning.

According to reliable sources, Smile Communications got the loan through a consortium of banks including, Afrexim Bank, and in turn routed the loan through a domestic bank, Diamond Bank resulting in the lenders huge non-performing loans.

The banks are saying that if shareholders of Smile Communications have the money to buy 9mobile, it should have long paid the banks the money it is owing, “asking why they would replace a bad loan with another bad loan”.

Disturbed about the letter written by Smile Communications to the Board of Directors of Emerging Markets Telecommunication Services Limited and Guaranty Trust Bank Plc, the telecoms lawyer, Olaniwun Ajayi wrote Smile Communications on May 14, 2018, warning it to desist from presenting false information about 9mobile sale.

Part of the letter read:…”We would like to refer you to the process letter for phase 111 of the transaction, particularly the second paragraph is Appendix B therefore, which stipulates that the company, the lenders and Barclays Africa reserve the right at the sole discretion and without liability to change, suspend or terminate the procedures set out in the process letter at any time and in any respect, to reject any and all proposals and to terminate negotiations and discussions at any time and for any reason, without being obliged to give prior notice or reasons therefore, with any or all potential purchasers and to negotiate with any party in a manner and to a timetable other than that outlined in the process letter….As you understand, by your continued participation in the process, Smile confirmed its acceptance of the foregoing terms, amongst others, agreeing to be bound thereby, in the circumstance, the basis for the complaints and threats of legal action in your letter is unclear, as are your intentions in this regard.

“Please note that the Company and lenders hereby reserve their rights to pursue all remedies available under all applicable laws,” the lawyer said and advised Smile Communication not to contact the company or the lenders any further on this matter anymore.

Technology

Truecaller, AnyMind Group to Expand Direct Sales Footprint

By Modupe Gbadeyanka

The leading global communications platform, Truecaller, now has a strategic direct sales reseller partnership with AnyMind Group, a Business-Process-as-a-Service company for marketing, e-commerce and digital transformation.

Under this partnership, AnyMind Group will serve as the exclusive intermediary for Truecaller’s advertising inventory across Egypt, UAE, Qatar, Saudi Arabia, Israel, Ghana, Nigeria, Morocco, Malaysia, Singapore and Vietnam.

The scope of the partnership is focused specifically on enabling brands and agencies to leverage Truecaller’s premium ad formats to reach highly engaged, high-intent users through relevant, data-driven advertising solutions.

Through this collaboration, Truecaller will accelerate its direct advertising business across the Middle East & North Africa (MENA) and Southeast Asia (SEA) regions.

With a strong on-ground presence and established relationships with leading advertisers and agencies across MENA and SEA markets, AnyMind Group brings deep regional expertise that will support the scaling of Truecaller’s advertising footprint locally.

The partnership is designed to empower brands with impactful placements on Truecaller’s trusted communications platform, helping drive meaningful engagement with users in these fast-growing digital economies.

“As Truecaller continues to expand its global advertising business, partnerships with strong regional players like AnyMind Group are critical to delivering localised expertise and measurable outcomes for advertisers.

“MENA and Southeast Asia represent high-growth markets with evolving digital maturity, and through this collaboration, we aim to bring brands closer to consumers via trusted and contextual communication experiences on our platform,” the Vice President and Global Head for Truecaller Ads Business, Hemant Arora, said.

Also, the Managing Director for Growth Markets at AnyMind Group, Aditya Aima, said, “We are excited to partner with Truecaller to open its inventory to brands across MENA and Southeast Asia. With Truecaller’s scale and trusted user ecosystem, combined with our market depth and networks, we see strong potential to drive more relevant, high-impact advertising outcomes for advertisers looking to deepen engagement in these dynamic markets.”

Technology

Capillary Technologies Acquires SessionM from Mastercard

By Modupe Gbadeyanka

A software product company established in 2012, Capillary Technologies India Limited, has acquired the customer engagement and loyalty company, SessionM, from Mastercard.

This followed a definitive agreement signed by the global leader in AI-powered customer loyalty and engagement solutions with the renowned digital payments firm.

The acquisition of SessionM is the latest in a series of strategic moves by Capillary, following its successful listing on the Indian Stock Exchange in November 2025.

With SessionM in its portfolio, Capillary reinforces its position as a global leader in enterprise loyalty, offering a leading platform to the world’s most sophisticated enterprise brands.

Mastercard has identified Capillary Technologies—consistently recognised as a Leader in The Forrester Wave as the ideal partner to lead SessionM into its next era of growth.

As part of the agreement, a specialised team within SessionM will transition to Capillary, ensuring that the platform’s deep technical expertise is preserved.

SessionM’s esteemed global customer base—which includes Fortune 500 retailers, airlines, and CPG brands—will continue to receive the same high-calibre support and service they experienced before the acquisition.

“M&A has been a key growth strategy for Capillary over the years, and as a public company, we are delivering on that promise to our shareholders and the market.

“By bringing SessionM into our portfolio, we are not just expanding our footprint across the globe; we are further strengthening our loyalty capabilities to deliver one of the industry’s most comprehensive offerings.

“Our mission remains to provide enterprises across industries with specialised, AI-native loyalty technology solutions,” the chief executive of Capillary Technologies, Aneesh Reddy, commented.

Technology

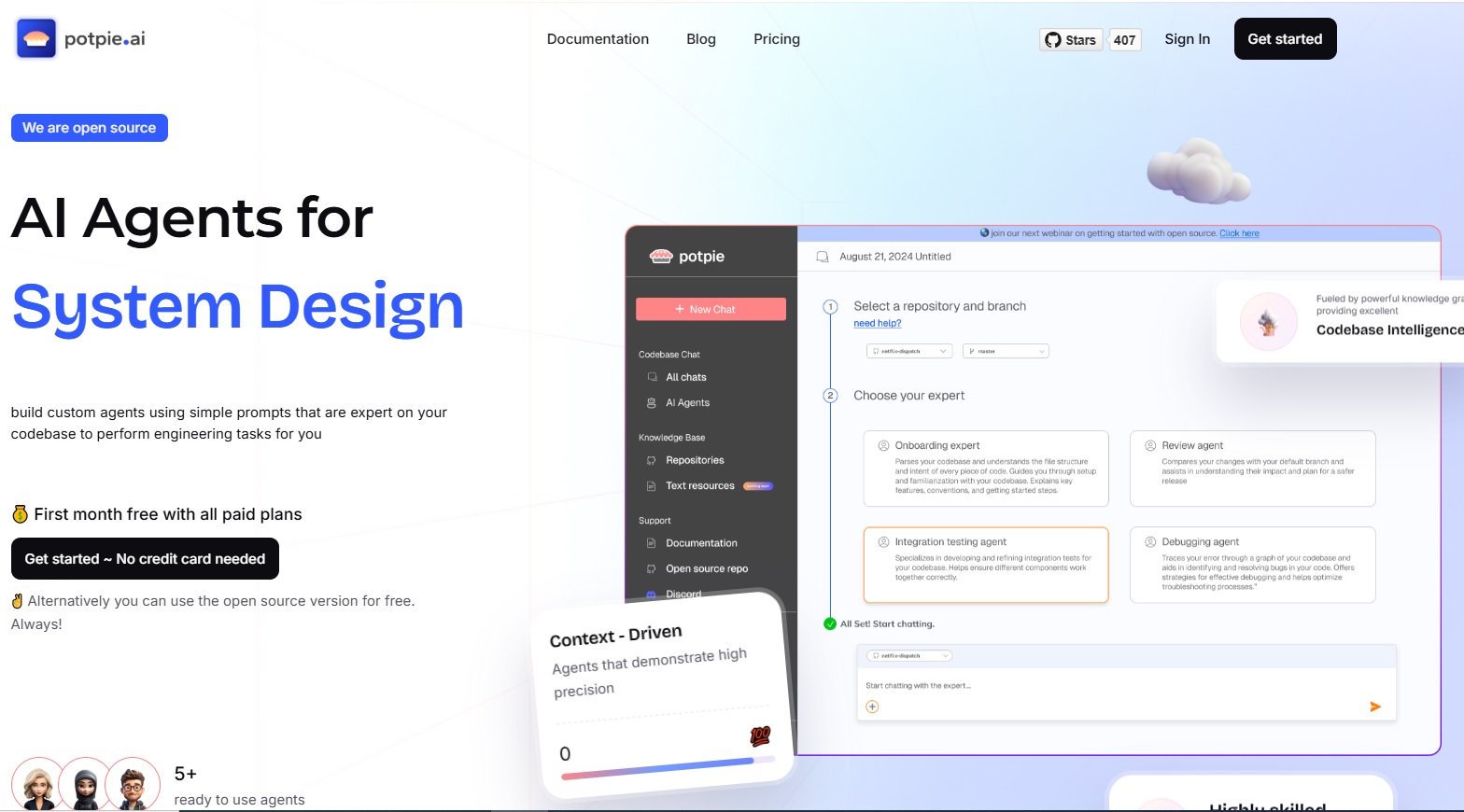

Emergent Ventures, Others Invest $2.2m in Potpie

By Dipo Olowookere

About $2.2 million pre-seed round to help engineering teams unify context across their entire stack and make AI agents genuinely useful in complex software environments has been announced by Potpie.

Potpie was established by Aditi Kothari and Dhiren Mathur, who were determined to unify context across the entire engineering stack and enabling spec driven development.

As generative AI adoption accelerates, most tools focus on surface-level code generation while ignoring the deeper problem of context.

Large language models are powerful, but without access to system-level understanding, tooling history, and architectural intent, they struggle in real production environments.

Traditional approaches rely on senior engineers to manually hold this context together, a model that breaks down at scale and fails when AI agents are introduced.

The platform enables teams to automate high-impact and non-trivial use cases across the software development lifecycle, like debugging cross-service failures, maintaining and writing end-to-end tests, blast radius detection and system design.

It is designed for enterprise companies with large and complex codebases, starting at around one million lines of code and scaling to hundreds of millions.

Rather than acting as another coding assistant, Potpie builds a graphical representation of software systems, infers behaviour and patterns across modules, and creates structured artefacts that allow agents to operate consistently and safely.

A statement made available to Business Post on Monday revealed that the funding support came from Emergent Ventures, All In Capital, DeVC and Point One Capital.

The capital will be used to support early enterprise deployments, expand the engineering team, and continue building Potpie’s core context and agent infrastructure, it was disclosed.

“As AI makes code generation easier, the real challenge shifts to reasoning across massive, interconnected systems. Potpie is our answer to that shift, an ontology-first layer that helps enterprises truly understand and manage their software,” Kothari was quoted as saying in the disclosure.

A Managing Partner at Emergent Ventures, Anupam Rastogi, said, “In large enterprises, the real challenge is not generating code, it is understanding the system deeply enough to change it safely.

“Potpie’s ontology-first architecture, combined with rigorous context curation and spec-driven development, creates a structured model of the entire engineering ecosystem. This allows AI agents to reason across services, dependencies, tickets, and production signals with the clarity of a senior engineer. That is what makes Potpie uniquely capable of solving complex RCA, impact analysis, and high-risk feature work even in codebases exceeding 50 million lines.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn