Banking

Access Bank Grabs Another Karlsruhe Sustainability Award

By Modupe Gbadeyanka

For the second time in a row, Access Bank Plc has been named the ‘Outstanding Business Sustainability Achievement Award 2017’ at the 2017 Karlsruhe Sustainable Finance Awards in Germany.

The award conveners presented the accolade in recognition of Access Bank’s outstanding success in incorporating economic, social and environmental aspects into its corporate strategy and business processes.

This prize also brings global recognition to the Bank’s impressive success in holistically embedding sustainability across all aspects of operations within the financial institution.

Held on July 13, 2017 and attended by CEOs of leading international financial institutions, senior executives of other winning institutions and top German government officials, the award was presented to Access Bank CEO, Mr Herbert Wigwe in Karlsruhe, Germany.

This recognition comes a year after Access Bank made history as the first African bank to receive this prestigious accolade.

The award was received barely a week after Nigeria’s foremost rating agency, Agusto & Co upgraded the Bank’s rating from A+ to AA-

Speaking at the presentation ceremony, Mr Herbert Wigwe, said the award validates the Bank’s continuous efforts and commitment to the Sustainable Development Goals.

“Since we were here last year to receive the 2016, ‘Outstanding Business Sustainability Achievement Award’, Access Bank has continued to champion responsible investing, innovative health initiatives, environmental protection and financial inclusion.

“We are doing this profitably. So, we continue to encourage other institutions to embrace the same principles and practices,” Mr Wigwe said.

“At Access Bank, we believe our operations, loan and project finance must have the barest environmental footprint. Indeed, we believe the net impact of our activities must be positive on the environment.

“As such, we are champions of climate change mitigation and adaptation” he added. He assured that the Bank will be further motivated and maintain profitable growth while embracing sustainability,” he added.

The conveners said the 2017 awards focused on honouring organizations that have made outstanding contributions in the field of sustainable finance, stimulated the interests of financial institutions and other stakeholders in integrating sustainability in their core business strategy.

It also recognises candidates who promote growth of sustainable financial instruments and markets worldwide particularly in the fields of green finance and investments, financial inclusion and social finance, green equity and holistic integration of sustainability in the financial services institutions.

Banking

We’re Committed to Partnerships to Drive Sustainable Growth—Access Bank

By Modupe Gbadeyanka

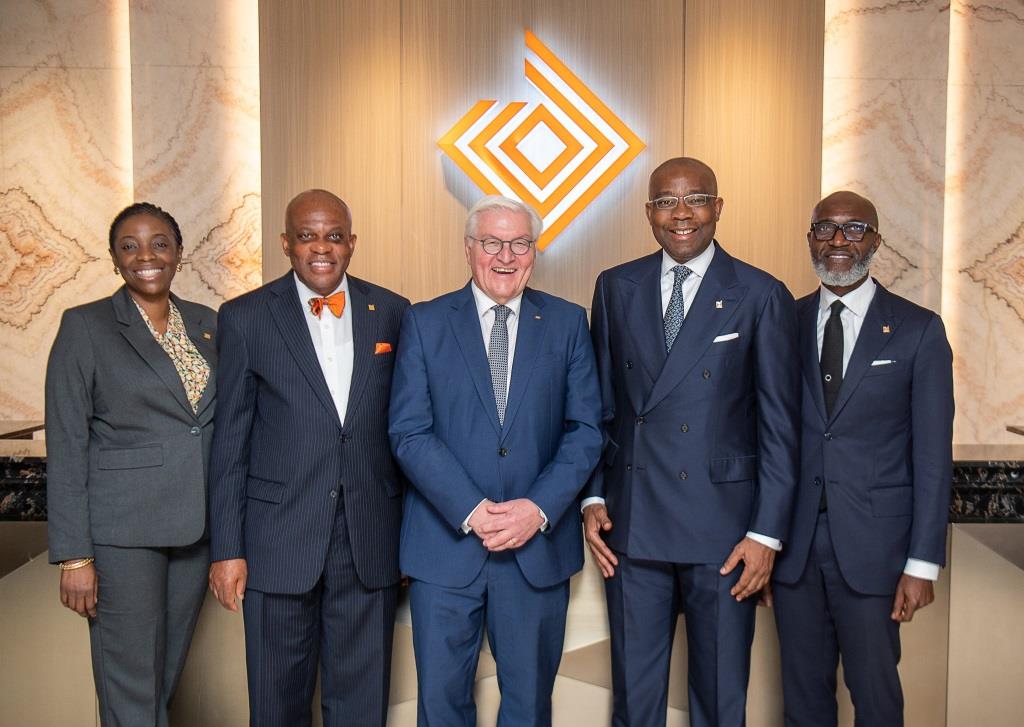

The chief executive of Access Bank Plc, Mr Roosevelt Ogbonna, has expressed the commitment of the company to building partnerships that drive sustainable growth.

Speaking when the lender hosted the President of Germany, Mr Frank-Walter Steinmeier, in Lagos last week, he said the organisation will always leverage its deep expertise in cross-border banking and market integration to the advantage of its customers.

“Nigeria’s position as Germany’s second-largest trading partner in Africa reflects the mutual benefits of this relationship.

“By leveraging our deep expertise in cross-border banking and market integration, Access Bank is committed to building partnerships that drive sustainable growth, innovation, and economic advancement across the continent,” Mr Ogbonna said while addressing stakeholders at a roundtable organised to welcome the German leader.

Last week, Mr Steinmeier made his first official visit to Nigeria and was welcomed by President Bola Tinubu.

President Steinmeier’s visit showcased Germany’s commitment to fostering economic partnerships in the region.

His Lagos agenda featured a landmark visit to Access Bank, as well as engagements with Nigerian startup founders and German-Nigerian business representatives to explore opportunities for trade and investment.

A central feature of the engagement at Access Bank was a business roundtable hosted by Access Bank’s leadership team and its German Desk.

The roundtable brought together German and Nigerian stakeholders, with discussions focused on two key areas: finance and energy, both of which are crucial to bolstering economic growth and innovation in the region.

President Steinmeier also received remarks from Roland Siller, CEO of DEG (German Development Bank), who elaborated on the financial synergies and products DEG provides to German and Nigerian businesses alike.

Access Bank’s German Desk, led by Sebastian Barroso da Fonseca, marked its sixth anniversary this year and has become a cornerstone for German and European businesses operating in Sub-Saharan Africa.

The Desk has provided critical support to over 100 clients, offering end-to-end financial solutions, including local funding facilitation, cash management, and seamless repatriation of funds to corporate headquarters. With operations spanning Nigeria, Angola, Ghana, South Africa, and beyond, the Desk has played an instrumental role in enabling businesses to navigate complex financial landscapes in Africa.

The engagement concluded with a Networking Reception at Access Bank’s headquarters, where delegates and stakeholders had the opportunity to engage and strengthen ties further.

Despite global challenges, Africa remains the fastest-growing economic region, with its GDP rising by 30 per cent over the past decade and average annual growth rates exceeding 5 per cent.

As a key player in the continent’s economic outlook, Nigeria continues to attract interest from global investors, and Germany has emerged as a critical economic partner in this regard.

Access Bank has strategically positioned itself as a gateway for trade and investment, leveraging its growing international footprint across 24 countries in Africa, Europe, and Asia to facilitate cross-border collaboration.

Banking

Ecobank, Afreximbank Simplify Trade, Compliance for African Businesses

By Modupe Gbadeyanka

The duo of the African Export-Import Bank (Afreximbank) and Ecobank Group has joined forces to enable African businesses to benefit from seamless shared services.

Based on the deal, the two organisations will integrate their respective platforms, the Single Market Trade Hub of Ecobank and the MANSA Digital Repository Platform of Afreximbank for smooth trade and compliance.

It was gathered that users of the Single Market Trade Hub would easily leverage MANSA’s comprehensive database for efficient know-thy-customer (KYC) and customer due diligence (CDD) checks while MANSA platform users would, in turn, be able to directly connect to the Single Market Trade Hub to explore trade opportunities to expand their businesses across Africa.

This collaboration will enable Ecobank and Afreximbank to provide a central solution to the key challenge of KYC compliance and access to business across 35 countries in Africa.

The improved interoperability is expected to further streamline cross-border trade and compliance in Africa, fostering greater financial and economic integration on the continent.

The Ecobank Single Market Trade Hub connects registered businesses across Africa on a single platform, helping them benefit from opportunities in the unified market of 1.4 billion people created by the African Continental Free Trade Agreement (AfCFTA).

It serves as a one-stop repository for the AfCFTA by providing small and medium-scale enterprises (SMEs) and corporates with insights about the agreement while its online match-making feature enables importers and exporters to upload their profiles and showcase goods and services they offer, or wish to source, with the aim of finding partners within Africa.

Once a match is found, connections are made via the platform and the transaction can be concluded by leveraging Ecobank’s trade and payment solutions in 35 African markets.

The MANSA Digital Repository Platform is a one-stop-shop for due diligence matters on all African entities.

As a centralised digital repository, MANSA seeks to eliminate information asymmetry and to increase intra-African trade and trade with the rest of the world.

It drives and promotes good governance culture among African SMEs and creates visibility for their businesses while also supporting African entities to expand, diversify and add value to their export products at both the local and international levels.

Entities onboarded unto MANSA are allotted an Africa Entity Identifier (AEI) code which enables them to leverage other Afreximbank products and initiatives.

MANSA is also a key digital solution at the Africa Trade Gateway (ATG) marketplace which houses a suite of digital platforms designed as a single window to enable Afreximbank to better deliver on its mandate, providing critical services to support and promote intra-African trade and the implementation of the AfCFTA.

The platform enables African entities to accelerate their business activities at the ATG marketplace by working with verified information on trusted counterparties.

Banking

CBN Fixes N100,000 as Maximum Daily Cash Withdrawal Via POS

By Modupe Gbadeyanka

As part of measures to promote its cashless policy, the Central Bank of Nigeria (CBN) has directed Point-of-Sale (POS) agents not to pay more than N100,000 as cash to each customer per day.

The banking sector regulator also restricted the POS operators not to pay more than N1.2 million per day as cash to customers, adding that customers may not withdraw more than N500,000 per week as cash.

To ensure accountability, the CBN has mandated that all agency banking transactions must be conducted exclusively through float accounts maintained with the principal institutions.

It also directed that agent banking services be separated from other merchant activities, with agents required to use the approved Agent Code 6010 for transactions.

In a circular dated December 17, 2024, the central bank noted these efforts are to ensure uniform operational standards, combat fraud, and enhance the use of electronic payment systems in agency banking operations.

The CBN ordered that, “All principals of agents are to comply with the following directives immediately,” in the circular signed on behalf of its Director of the Payments System Management Department, Mr Oladimeji Taiwo, and directed at Deposit Money Banks, Microfinance Banks, Mobile Money Operators, and Super-Agents.

“Issuers shall set a cash withdrawal limit (cash-out) per customer (regardless of channel) to N500,000.00 per week; Ensure that all agent banking terminals are set to a daily maximum transaction cash-out limit of N100,000.00 per customer; Ensure that each agent’s daily cumulative cash-out limit shall not exceed N1,200,000.00,” the notice added.

The central bank advised all stakeholders to adhere strictly to the directives to ensure the smooth implementation of the policy and contribute to the advancement of Nigeria’s cashless economy.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN