By Dipo Olowookere

In the first quarter of 2018, treasury bills worth 1.3 trillion would be put up for sale by the Central Bank of Nigeria (CBN).

This information was revealed by the apex bank yesterday when it released calendar for the treasury bills auction exercise for Q1 of next year.

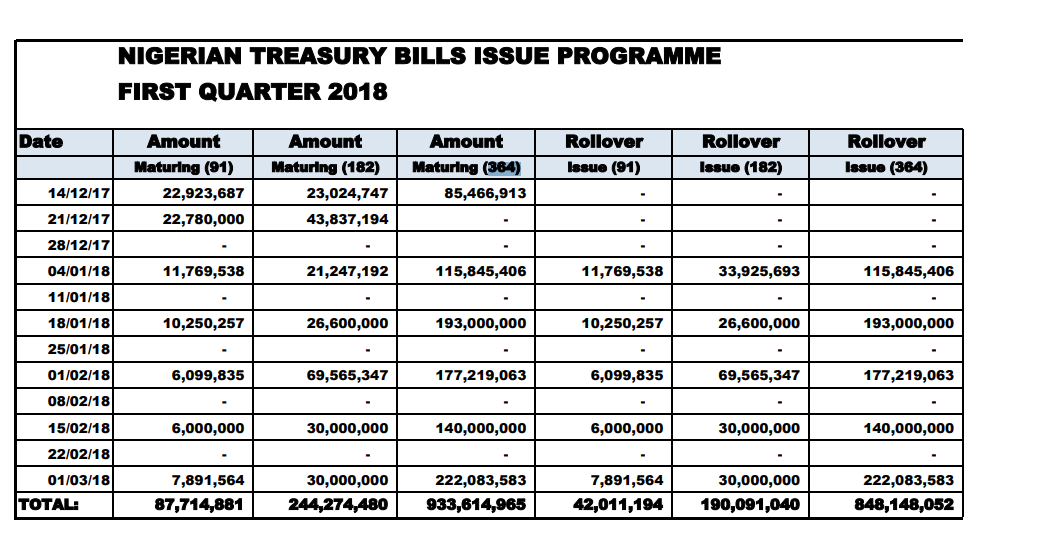

According to the details released by the central bank, the 91-day bills worth N87.7 billion would be auctioned during the period.

For the 182-day maturing bills, the chief lender hopes to raise N244.3 billion, while N933.6 billion worth of 364-day bills would be auctioned by the CBN.

Treasury bills are short-term debt instruments issued by the Federal Government through the Central Bank to provide short term funding for the government. They are sold at a discount and redeemed at par.

To buy treasury bills from the primary market, investors have to approach their banks requesting for a form.

Twice a month, the CBN issues treasury bills to help the government fund its budget deficit, support commercial lenders in managing liquidity and curb inflation.