Banking

Nigerian Banks Have Porous Online Banking Security—Hacker

By Dipo Olowookere

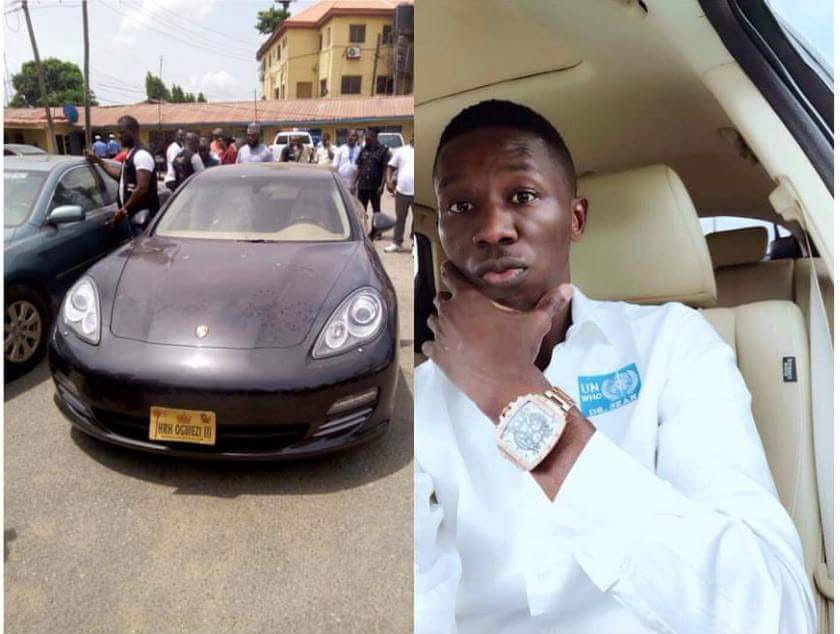

A Nigerian hacker arrested by the Lagos State Police Command, Mr Michael Williams, has disclosed that financial institutions operating in the country have porous online banking system.

Mr Williams, a 28-year-old medical doctor turned hacker, made this disclosure on Monday when he was paraded before the media by the Commissioner of Police, Mr Edgal Imohimi.

He was arrested for purchasing a N28 million Porsche car from a dealer with fake bank alert.

“In Nigeria, you can sit and hack any account but abroad, it is only through the Swiss account because the money is much.

“Nigerian bank don’t have professional hackers to secure them online. They are not secured so I can easily hack into their account.

“When you are online, you can do whatever you want to do. I don’t have an account because you can easily be caught so I just do credit cards. You get old credit card,” the suspect told newsmen yesterday.

Speaking on how he got into hacking banks, Mr Williams said, “I was pushed out of work so I got a visa to travel to Canada. I worked at Tolu Medical Centre and EKO hospital.

“It is just that in Nigeria, when they see you are good at something, they just look for a way to push you out.

“I travelled to Canada to get a job to do or something to do. When I got to Canada, I was living with an Israel guy who had an accommodation there. He taught me all I need to know in hacking. It is about software made easy online. So when you are a hacker, you buy the software online, it is very easy.

“I get money online and not from individuals in Nigeria. It is a free world online. I came back to Nigeria because our banks are not secured. You can easily hack accounts online.

“Creating a credit card, you get old credit card online, create them wait for a day monitor your emails and wait for when transactions are coming in on the Swiss code transaction. I don’t have an idea of how much I have made.

“Anybody making $1 million or $2 million transaction or $1 billion, you can divert it online and then secure your securities and thereafter fund it on your credit card.

“After funding it on your credit card, you can use it to buy any kind of powerful software you want and anything buyable online.

“You monitor celebrities, movie producer and actresses in the USA. John Travolta an actor based in USA he does transfers every week. I hacked into his Swiss code account. Banks in Nigeria are not like banks abroad.”

Speaking on how the suspect, who hails from Delta State, was apprehended, the police chief said, his office received complaints from people about Mr Williams.

According to him, the accused person had visited a car dealer known as Abidogun Adewale to buy a Porsche SUV worth N28 million with a fake bank alert.

“After he had bought the vehicle, he thereafter requested for the seller’s bank account number and made it look like he had paid him via the fake alert to his phone using HTTP tunnel. com.

“The suspect drove the car away unknown to the seller that he had been scammed.

“Adewale had only discovered when he went to the bank to obtain his bank statement weeks after. However, based on his complaint, a manhunt was launched on the fleeing suspect. The command availed detectives of the Federal Special Anti-Robbery Squad all necessary Intelligence asset which led to the arrest of the suspect in Lekki Lagos.

“This suspect was interrogated and he confessed to committing the crime. He also led detectives to Asaba, Delta State where the stolen Porsche car was recovered. He also led detectives to Owerri, Imo State where two Camry Saloon cars he stole in a similar fashion were recovered. The modus operandi of the suspect who has a good mastery of cyber environment is that he creates a credit card, through cyber ghost 12. When the credit card matures, it is then funded through a hacked Swiss account.

“Any transaction anybody is doing through Swiss account the suspect manipulates such and wires the fund to his contrived credit card. This is possible with the aid of cyber ghost 12 HTTP/tunnel.azinytv4/vpn (virtual private network).

“He further stated that through the credit card, one can buy software he needs to work and protect his job so that he cannot be traced. Such software is known as von and word cyber protector for example Dare Devil. It also enables you to do deductions and transactions per dollar from every individual domiciliary account, shutting of CCTV camera on Dare Devil and break the 256 codes on word CCTV.china.north Korea.code, untouchable.tracker.com. This enables him to shut down any working system of his interest on yt. com an Internet sophistication for example YouTube/Facebook to make them unworkable for 67 minutes. Although he is not a computer scientist, he claimed to be a professional hacker.”

Meanwhile, the Commissioner of Police said the suspect would be charged to court soon.

Banking

Allawee, Mastercard Unveil Credit Card for Civil Servants, NYSC Members

By Adedapo Adesanya

A Nigerian digital lending fintech, Allawee, has collaborated with Mastercard to launch a credit-building card designed to enhance financial access for federal civil servants and National Youth Service Corps (NYSC) members.

This product, facilitated by a secure Mastercard platform and issued in collaboration with Providus Bank, and Remita, provides instant access to credit and financial flexibility to over 720,000 federal civil servants and NYSC members all through the Allawee app.

Despite Nigeria’s significant economic potential, over 70 per cent of bank account holders lack access to credit, according to the National Bureau of Statistics (NBS).

The Allawee credit card promises to address this gap, offering a solution that caters to the unique financial needs of Nigerians.

Nigeria as a market is dominated by debit and prepaid cards, so this initiative aims to promote responsible credit usage, combines seamless digital onboarding, user-friendly features, and responsible credit management tools in one platform.

Launched in December 2024, the Allawee credit card supports the Nigerian government’s objective of increasing credit availability to 50 per cent of working Nigerians by 2030. The card offers a secure and seamless way to access credit while helping users build a credit profile, aligning with Mastercard’s mission to drive financial inclusion.

“We are thrilled to collaborate with Allawee on this innovative credit solution, which aligns perfectly with Mastercard’s commitment to bring one billion people into the digital economy by 2025.

“The Allawee credit card provides instant access to credit while also empowering civil servants and NYSC members in Nigerian to build their creditworthiness, further advancing financial inclusion across the country,” said Mrs Folasade Femi-Lawal, Country Manager and Area Business Head for West Africa at Mastercard.

Users can download the Allawee credit card, apply for a loan, receive approval, and start transacting immediately. Once approved, the credit is disbursed directly onto a co-branded card, giving users full control over their funds. The card allows for flexible usage across POS terminals, ATMs, and online transactions, enabling greater financial freedom.

“We launched this card to help Nigerians gain access to instant, affordable credit while building their credit history. Whether it’s handling daily purchases or taking care of life’s emergencies, our customers now have an easy way to cover expenses.

“With Mastercard, we are giving them the convenience to spend their credit at millions of retail locations in Nigeria and around the world, both online and in-store,” said Mr Ikenna Enenwali, CEO of Allawee.

The Allawee credit card offers instant credit access through a fast, secure, and fully digital application process, with wide acceptance at Mastercard online and physical retail locations globally. Customers benefit from flexible repayment options, choosing their credit limits (up to ₦1,000,000) and repaying in installments over four months.

Banking

N200bn Debt: Telcos Get NCC Nod to Disconnect USSD Codes of Wema Bank, Jaiz Bank, Others

By Adedapo Adesanya

The Nigerian Communications Commission (NCC) has authorised telecommunications companies to disconnect the Unstructured Supplementary Service Data (USSD) codes assigned to nine financial institutions over a N200 billion debt.

The directive signed by NCC’s Director of Public Affairs, Mr Reuben Muoka, on Tuesday and obtained by Channels Television, noted that the affected banks are to pay the outstanding debts by January 27, 2025, or risk losing access to their USSD codes.

According to the NCC public notice, nine out of 18 financial institutions had not complied with regulatory directives.

The affected financial institutions include Fidelity Bank Plc, First City Monument Bank, Jaiz Bank Plc, Polaris Bank Limited, Sterling Bank Limited, United Bank for Africa Plc, Unity Bank Plc, Wema Bank Plc, and Zenith Bank Plc.

It said while other banks have cleared their debts, the total amount initially owed by the financial institutions was reported to exceed N200 billion.

According to the NCC, some of the invoices have remained unpaid since 2020, and has been a source of tussle for years.

“By the information made available to the commission as at close of business on Tuesday, 14th January 2025, of a total of 18 financial institutions, the nine institutions listed below have failed to comply significantly with the directives in the Second Joint Circular of the Central Bank of Nigeria and the commission dated December 20, 2024, for the settlement of outstanding invoices due to MNOS, some since 2020,” a part of the notice read.

The affected USSD codes include *770#, *919#, and *822#, among others, could be reassigned to other applicants if the debts remain unresolved.

The regulator noted that banks’ failure to comply with the CBN-NCC joint circular also means that they are unable to meet the good standing requirements for the renewal of the USSD codes assigned to them by the commission.

It added, “In fulfilment of its consumer protection mandate, the commission wishes to inform consumers that they may be unable to access the USSD platform of the affected financial institutions from January 27, 2025.”

The NCC emphasised that the financial institutions had been duly notified of the need for immediate compliance and warned that consumers may face service disruptions if the issues remain unresolved.

Banking

N200bn Debt: Telcos Get NCC Nod to Disconnect USSD Codes of Wema Bank, Jaiz Bank, Others

By Adedapo Adesanya

The Nigerian Communications Commission (NCC) has authorised telecommunications companies to disconnect the Unstructured Supplementary Service Data (USSD) codes assigned to nine financial institutions over a N200 billion debt.

The directive signed by NCC’s Director of Public Affairs, Mr Reuben Muoka, on Tuesday and obtained by Channels Television, noted that the affected banks are to pay the outstanding debts by January 27, 2025, or risk losing access to their USSD codes.

According to the NCC public notice, nine out of 18 financial institutions had not complied with regulatory directives.

The affected financial institutions include Fidelity Bank Plc, First City Monument Bank, Jaiz Bank Plc, Polaris Bank Limited, Sterling Bank Limited, United Bank for Africa Plc, Unity Bank Plc, Wema Bank Plc, and Zenith Bank Plc.

It said while other banks have cleared their debts, the total amount initially owed by the financial institutions was reported to exceed N200 billion.

According to the NCC, some of the invoices have remained unpaid since 2020, and has been a source of tussle for years.

“By the information made available to the commission as at close of business on Tuesday, 14th January 2025, of a total of 18 financial institutions, the nine institutions listed below have failed to comply significantly with the directives in the Second Joint Circular of the Central Bank of Nigeria and the commission dated December 20, 2024, for the settlement of outstanding invoices due to MNOS, some since 2020,” a part of the notice read.

The affected USSD codes include *770#, *919#, and *822#, among others, could be reassigned to other applicants if the debts remain unresolved.

The regulator noted that banks’ failure to comply with the CBN-NCC joint circular also means that they are unable to meet the good standing requirements for the renewal of the USSD codes assigned to them by the commission.

It added, “In fulfilment of its consumer protection mandate, the commission wishes to inform consumers that they may be unable to access the USSD platform of the affected financial institutions from January 27, 2025.”

The NCC emphasised that the financial institutions had been duly notified of the need for immediate compliance and warned that consumers may face service disruptions if the issues remain unresolved.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN