By Dipo Olowookere

Nigerian billionaire businessman, Mr Cletus Ibeto, is planning to expand his cement business, Ibeto Cement Company Limited, to the global market.

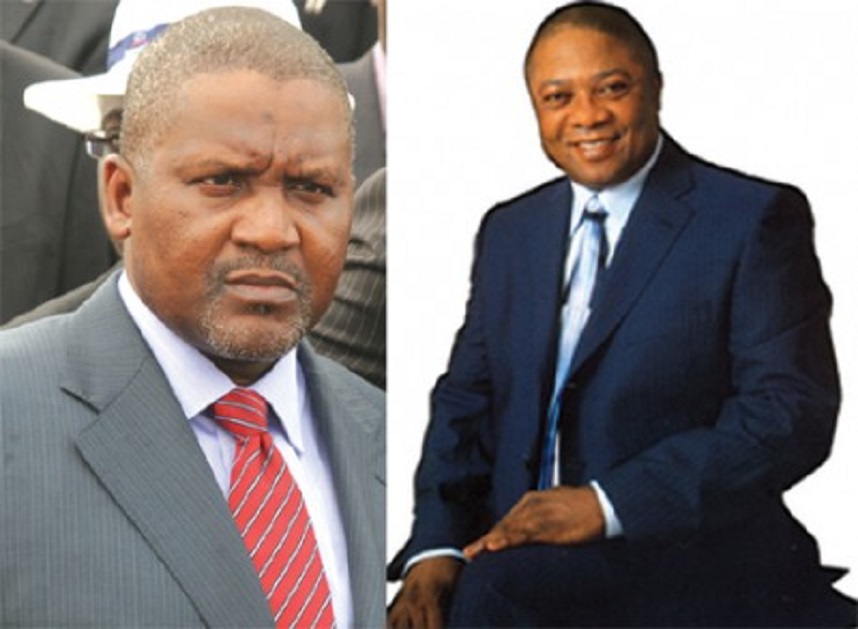

Ibeto Cement, which was pushed out of the Nigerian market by Dangote Cement, is planning to seal a $850 million financing deal with an American private equity firm, Milost Global Incorporated.

A statement issued on Thursday by Milost Global and obtained by Business Post revealed that Mr Ibeto has already executed a binding Milost Equity Subscription Agreement (MESA) with Milost Global for the $850 million deal.

It was gathered that the amount comprises $500 million in equity and $350 million in debt.

In addition, Ibeto, according to the statement, has started the process of going public a reverse merger in the United States as efforts to become a publicly traded company.

“On Friday May 25, the Nigerian Dollar Billionaire Chief Cletus Ibeto will personally consummate the acquisition of a publicly traded company the he will used to reverse the assets of his cement business in America, the final acquisition and definitive agreements have already been executed,” Milost Global said in the statement.

It was disclosed that the public listing will allow Ibeto Cement to raise enough capital in the US public markets outside the Milost financing as well and put the company in the forefront of the cement industry in Africa as Mr Ibeto plans to grow the company beyond west Africa through the acquisition of other profitable cement businesses outside Nigeria within the next 12 months, which would be done at the back for the development of the two new plants.

Commenting on the new development, Mr Ibeto said, “Our key strategic objective in the vast and extensive development of the cement business in Nigeria and the West African sub-region is to make cement affordable to all Nigerians and tiers of government in such a way that they should be able to develop modest homes for themselves and their families inclusive of road infrastructure.

“As far as I am concerned and with the knowledge I have and what I know in this business, the cement business is an investors’ haven especially in Nigeria and a much more profitable business than even crude oil where a lot of people think is the best place to invest.

“This probably explains why the few people in the business have deliberately created very strong barriers to entry into the industry for prospective investors.

“It is therefore my honest belief that this reverse merger will enable us to accomplish this objective. In the end and, in line with our strategic intent and objective, we are geared to be a world-class cement company in terms of quality, affordability, innovation, service, environment, safety, and corporate governance and also to be a part of building the country’s needed infrastructure all of which certainly guarantees good returns on investment for the stakeholders.”

On his part, the Senior Partner & CIO of Milost Global, Mr Solly S. Asibey, stated that, “International equity, coupled with the diversification of our investment portfolio is key to our strategy for growth in emerging markets. Excellence, innovation, unparalleled strategy, industry knowledge, favourable IRR and strong leadership epitomises the partnership between Milost and Chief Cletus Ibeto.

“This is a great investment opportunity for Milost, and the financial engineering behind the structuring of the transaction will catapult Ibeto Cement to exceptional heights.”

Also commenting, Managing Partner & CEO of Milost Global, Mr Kim Freeman, said that, “Ibeto Cement is an important investment for Milost in Nigeria and indeed Africa. We expect this transaction to provide a template for our other investments in Africa which will continue to enhance the value of the companies we invest in as well as value for our investors.”

Business Post gathered that the transaction was solely advised by Palewater Advisory Group.

Will This Brew Another Cement War in the Industry?

This news will likely start another round of cement war between old rivals; Ibeto Cement and Dangote Cement, which currently trades on the floor of the Nigerian Stock Exchange (NSE).

However, one question observers will ask is if Ibeto can dislodge Dangote Cement from the cement business first in Nigeria and then in Africa?

This is because Dangote Cement controls about 65 percent of the market share, leaving the rest to Lafarge Africa and others.

Let’s hear your view on this.