Economy

These 18 Companies Will Hold AGMs This Month

By Dipo Olowookere

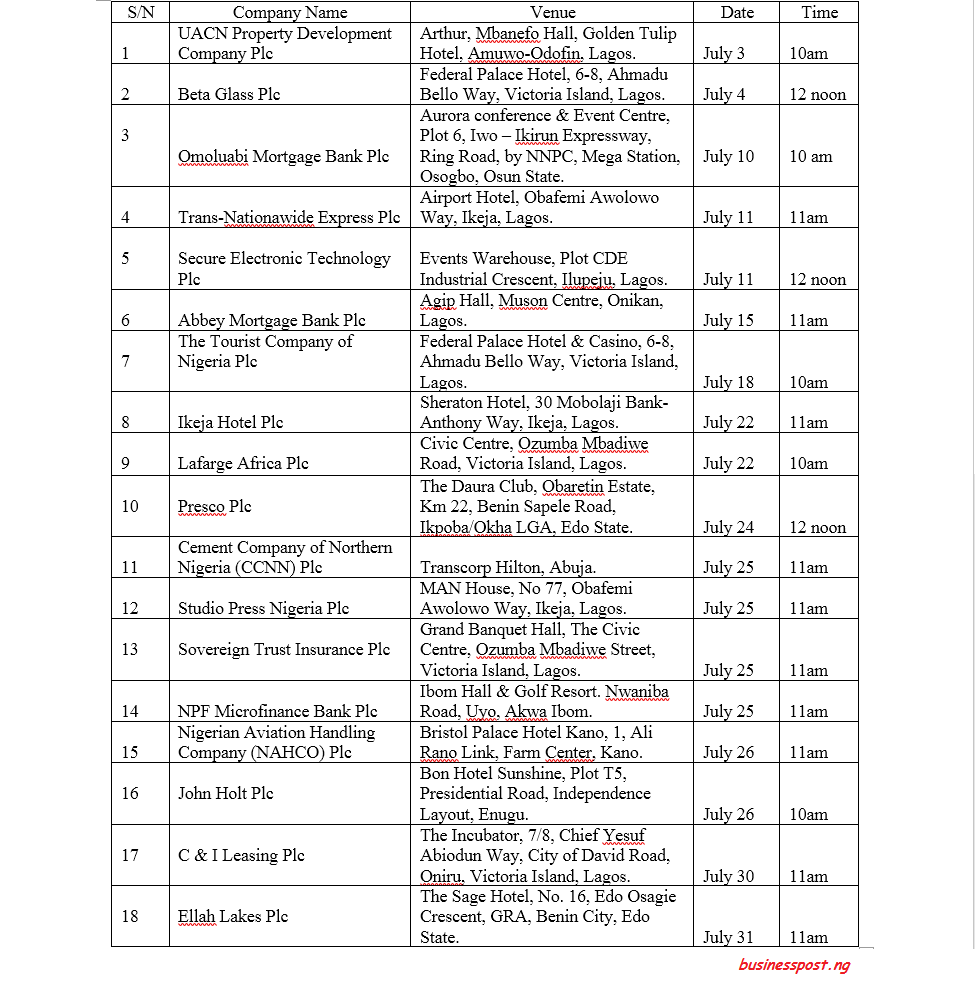

Business Post has compiled a list of companies quoted on the Nigerian Stock Exchange (NSE) having their Annual General Meetings (AGMs) in the month of July 2019, which commenced yesterday. There are 17 AGMs fixed for this month and an Extraordinary Meeting (EGM).

Investors look out for these meetings because for firms which declared dividends, it is at these AGMs the cash payment are approved by shareholders in attendance.

Also, investors use the opportunity to ask questions from the board and management and possibly chip in how things can be improved upon so as to have more dividend payment, which every shareholder is always happy about.

Kicking off the AGM for this month is UACN Property Development Company Plc, which holds its AGM on Wednesday, July 3, 2019 by 10am at Arthur, Mbanefo Hall, Golden Tulip Hotel, Amuwo-Odofin, Lagos.

Beta Glass Plc has fixed its AGM for Thursday, July 4 at the Federal Palace Hotel, 6-8, Ahmadu Bello Way, Victoria Island, Lagos at 12:00 noon.

Omoluabi Mortgage Bank Plc will hold its AGM on Wednesday, July 10 at Aurora Conference & Event Centre, Plot 6, Iwo–Ikirun Expressway, Ring Road, by NNPC, Mega Station, Osogbo, Osun State at 10:00 a.m.

Trans-Nationawide Express Plc fixed its for Thursday, July 11 at Airport Hotel, Obafemi Awolowo Way, Ikeja, Lagos by 11:00 a.m.

Secure Electronic Technology (SET) Plc holds its AGM on Thursday, July 11 at 12 noon at Events Warehouse, Plot CDE Industrial Crescent, Ilupeju, Lagos.

On Monday, July 15, it would be the turn of Abbey Mortgage Bank Plc at Agip Hall, Muson Centre, Onikan, Lagos by 11:00 a.m.

On Thursday, July 18, The Tourist Company of Nigeria Plc will have its AGM at Federal Palace Hotel & Casino, 6-8, Ahmadu Bello Way, Victoria Island, Lagos by 10:00 a.m.

Ikeja Hotel Plc fixed its AGM for Monday, July 22 at Sheraton Hotel, 30 Mobolaji Bank-Anthony Way, Ikeja, Lagos by 11:00 a.m.

On the same day, Lafarge Africa Plc will host its shareholders at an AGM slated for Civic Centre, Ozumba Mbadiwe Road, Victoria Island, Lagos by 10:00 a.m.

On Wednesday, July 24, shareholders of Presco Plc will gather for their AGM at The Daura Club, Obaretin Estate, Km 22, Benin Sapele Road, Ikpoba/Okha LGA, Edo State at 12 noon.

The next day, Thursday, July 25, it would be the turn of Cement Company of Northern Nigeria (CCNN) Plc for its AGM at Transcorp Hilton, Abuja by 11:00 a.m.

Studio Press Nigeria Plc said its AGM will take place the same day at MAN House, No 77, Obafemi Awolowo Way, Ikeja, Lagos by 11:00 a.m.

Another company having its AGM on July 25 is Sovereign Trust Insurance Plc, which holds at the Grand Banquet Hall, The Civic Centre, Ozumba Mbadiwe Street, Victoria Island, Lagos by 11:00 a.m.

Also on the same day is NPF Microfinance Bank Plc, which has fixed its AGM at Ibom Hall & Golf Resort, Nwaniba Road, Uyo, Akwa Ibom by 11:00 a.m.

On Friday, July 26, shareholders of Nigerian Aviation Handling Company (NAHCO) Plc will gather for their AGM at Bristol Palace Hotel Kano, 1, Ali Rano Link, Farm Center, Kano by 11:00 a.m.

On the same day at Bon Hotel Sunshine, Plot T5 Presidential Road, Independence Layout, shareholders of John Holt Plc will begin their AGM by 10:00 a.m.

On Tuesday, July 30, shareholders of C & I Leasing Plc will be at The Incubator, 7/8, Chief Yesuf Abiodun Way, City of David Road, Oniru, Victoria Island, Lagos by 11:00 a.m for their AGM.

Wrapping up the month of July on 31st is Ellah Lakes Plc, which has fixed its EGM on day at The Sage Hotel, No. 16 Edo Osagie Crescent, GRA, Benin City, Edo State by 11:00 a.m.

Economy

Nigerian Stocks Close 1.13% Higher to Remain in Bulls’ Territory

By Dipo Olowookere

The local stock market firmed up by 1.13 per cent on Friday as appetite for Nigerian stocks remained strong.

Investors reacted well to the 2026 budget presentation of President Bola Tinubu to the National Assembly yesterday, especially because of the more realistic crude oil benchmark of $64 per barrel compared with the ambitious $75 per barrel for 2025. This year, prices have been between $60 and $65 per barrel.

Business Post observed profit-taking in the commodity and energy sectors as they respectively shed 0.14 per cent and 0.03 per cent.

But, bargain-hunting in the others sustained the positive run, with the consumer goods index up by 3.82 per cent.

Further, the industrial goods space appreciated by 1.46 per cent, the banking counter improved by 0.08 per cent, and the insurance industry gained 0.04 per cent.

As a result, the All-Share Index (ASI) increased by 1,694.33 points to 152,057.38 points from 150,363.05 points and the market capitalisation chalked up N1.080 trillion to finish at N96.937 trillion compared with Thursday’s closing value of N95.857 trillion.

A total of 34 shares ended on the advancers’ chart, while 24 were on the laggards’ log, representing a positive market breadth index and bullish investor sentiment.

Austin Laz gained 10.00 per cent to close at N2.42, Union Dicon also jumped 10.00 per cent to N6.60, Tantalizers increased by 9.80 per cent to N2.69, Aluminium Extrusion improved by 9.78 per cent to N12.35, and Champion Breweries grew by 9.71 per cent to N16.95.

Conversely, Sovereign Trust Insurance dipped by 7.42 per cent to N3.87, Royal Exchange lost 6.84 per cent to trade at N1.77, Omatek slipped by 6.84 per cent to N1.09, Eunisell depreciated by 5.88 per cent to N80.00, and Eterna dropped 5.63 per cent to close at N28.50.

Yesterday, traders transacted 1.5 billion units worth N21.8 billion in 25,667 deals compared with the 839.8 million units sold for N32.8 billion in 23,211 deals in the preceding session, showing a surge in the trading volume by 76.61 per cent, an uptick in the number of deals by 10.58 per cent, and a shrink in the trading value by 33.54 per cent.

Economy

FrieslandCampina, Two Others Erase N26bn from NASD OTC Bourse

By Adedapo Adesanya

Three stocks stretched the bearish run of the NASD Over-the-Counter (OTC) Securities Exchange by 1.21 per cent on Friday, December 19, with the market capitalisation giving up N26.01 billion to close at N2.121 billion compared with the N2.147 trillion it ended a day earlier, and the NASD Unlisted Security Index (NSI) dropping 43.47 points to 3,546.41 points from 3,589.88 points.

The trio of FrieslandCampina Wamco Nigeria Plc, Central Securities Clearing System (CSCS) Plc, and NASD Plc overpowered the gains printed by four other securities.

FrieslandCampina Wamco Nigeria Plc lost N6.00 to sell at N54.00 per unit versus N60.00 per unit, NASD Plc shrank by N3.50 to N58.50 per share from N55.00 per share, and CSCS Plc depleted by N2.91 to N33.87 per unit from N36.78 per unit.

On the flip side, Air Liquide Plc gained N1.01 to close at N13.00 per share versus N11.99 per share, Golden Capital Plc appreciated by 70 Kobo to N7.68 per unit from N6.98 per unit, Geo-Fluids Plc added 39 Kobo to sell at N5.50 per share versus N5.11 per share, and IPWA Plc rose by 8 Kobo to 85 Kobo per unit from 77 Kobo per unit.

During the trading day, market participants traded 1.9 million securities versus the previous day’s 30.5 million securities showing a decline of 49.3 per cent. The value of trades went down by 64.3 per cent to N80.3 million from N225.1 million, but the number of deals jumped by 32.1 per cent to 37 deals from 28 deals.

Infrastructure Credit Guarantee Company (InfraCredit) Plc finished the session as the most active stock by value on a year-to-date basis with 5.8 billion units valued at N16.4 billion, followed by Okitipupa Plc with 178.9 million units transacted for N9.5 billion, and MRS Oil Plc with 36.1 million units traded for N4.9 billion.

The most active stock by volume on a year-to-date basis was still InfraCredit Plc with 5.8 billion units worth N16.4 billion, trailed by Industrial and General Insurance (IGI) Plc with 1.2 billion units sold for N420.7 million, and Impresit Bakolori Plc with 536.9 million units traded for N524.9 million.

Economy

Naira Crashes to N1,464/$1 at Official Market, N1,485/$1 at Black Market

By Adedapo Adesanya

It was not a good day for the Nigerian Naira at the two major foreign exchange (FX) market on Friday as it suffered a heavy loss against the United States Dollar at the close of transactions.

In the black market segment, the Naira weakened against its American counterpart yesterday by N10 to quote at N1,485/$1, in contrast to the N1,475/$1 it was traded a day earlier, and at the GTBank forex counter, it depreciated by N2 to settle at N1,467/$1 versus Thursday’s closing price of N1,465/$1.

In the Nigerian Autonomous Foreign Exchange Market (NAFEX) window, which is also the official market, the nation’s legal tender crashed against the greenback by N6.65 or 0.46 per cent to close at N1,464.49/$1 compared with the preceding session’s rate of N1,457.84/$1.

In the same vein, the local currency tumbled against the Euro in the spot market by N2.25 to sell for N1,714.63/€1 compared with the previous day’s N1,712.38/€1, but appreciated against the Pound Sterling by 73 Kobo to finish at N1,957.30/£1 compared with the N1,958.03/£1 it was traded in the preceding session.

The market continues to face seasonal pressure even as the Central Bank of Nigeria (CBN) is still conducting FX intervention sales, which have significantly reduced but not remove pressure from the Naira. Also, there seems to be reduced supply from exporters, foreign portfolio investors and non-bank corporate inflows.

President Bola Tinubu on Friday presented the government’s N58.47 trillion budget plan aimed at consolidating economic reforms and boosting growth.

The budget is based on a projected crude oil price of $64.85 a barrel and includes a target oil output of 1.84 million barrels a day. It also projects an exchange rate of N1,400 to the Dollar.

President Tinubu said inflation had plunged to an annual rate of 14.45 per cent in November from 24.23 per cent in March, while foreign reserves had surged to a seven-year high of $47 billion.

Meanwhile, the cryptocurrency market was dominated by the bulls but it continues to face increased pressure after million in liquidations in previous session over accelerating declines, with Dogecoin (DOGE) recovering 4.2 per cent to trade at $0.1309.

Further, Ripple (XRP) appreciated by 3.9 per cent to $1.90, Cardano (ADA) rose by 3.5 per cent to $0.3728, Solana (SOL) jumped by 3.4 per cent to $126.23, Ethereum (ETH) climbed by 2.9 per cent to $2,982.42, Binance Coin (BNB) gained 2.0 per cent to sell for $853.06, Bitcoin (BTC) improved by 1.7 per cent to $88,281.21, and Litecoin (LTC) soared by 1.2 per cent to $76.50, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) traded flat at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn