Economy

Nigeria Imports 61,884.3MT of Cooking Gas in One Month

By Adedapo Adesanya

Nigeria imported a total of 61,884.291 metric tonnes (MT) of Liquefied Petroleum Gas (LPG), also known as cooking gas, in March 2022.

This was disclosed by the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) in its latest gas report, which covers the third month of the year.

This indicated that the total gas import rose by 107.61 per cent from the 29,807.591 MT imported in February.

According to the NMDPRA, the totality of Nigeria’s 61,884.291 MT cooking gas import, represented 47.9 per cent of the total cooking gas supplied in the country in the month under review.

In terms of destinations, there were no changes as the United States of America and Argentina topped the suppliers of the commodity to Nigeria. They also topped in the previous month.

Furthermore, NMDPRA noted that five companies — Algasco LPG Services Limited, Prudent Energy and Services Limited, Rainoil Limited, NIPCO and Techno Oil Limited — were responsible for Nigeria’s total cooking gas import in March 2022.

According to the report, in the month under review, Algasco imported 22,389.781 MT of LPG from the US; Prudent Energy imported two consignments of LPG from the US, comprising 4,020.031 MT and 4,177.380 MT, while Rainoil brought in 7,512.035 MT of the commodity from Argentina.

In addition, NIPCO and Techno imported 12,129.213 MT and 11,665.851 MT, respectively, from the USA.

The downstream and midstream regulator, also known as the authority, further stated that a total of 129,291.824 MT of LPG was supplied in Nigeria in March, appreciating by 67.57 per cent from 77,158.292 MT recorded in the previous month.

According to the organisation, of the total cooking gas supplied in March, 67,407.533 MT, representing 52.14 per cent of the total LPG supplied in Nigeria, was sourced locally; in comparison, 47,350.701 MT of the commodity was sourced locally in February 2022.

In the local category, the agency, formerly known as the Petroleum Products Pricing Regulatory Agency (PPPRA), reported that Matrix Energy sourced 8,060.224 MT and 6,056.868 MT of LPG from Bonny River Terminal, which it then supplied to the Nigerian market.

Algasco sourced 6,881.480 MT and 13,444.576 MT of cooking gas from the Nigerian Liquefied Natural Gas (NLNG), Bonny for supply to the local market; NIPCO and 11 Plc supplied 13,426.615 MT, sourced from NLNG, Bonny; while Stockgap also sourced 9,771.583 MT and 9,766.187 MT of LPG from NLNG.

Furthermore, the NMDPRA disclosed that Ashtavinayak Hydrocarbon Limited, Kwale, Delta State, supplied 9,681.650 MT of propane in March 2022; while Nigerian Petroleum Development Company, Oredo, Benin and Greenville Natural Gas Limited, Rumuji, Rivers State supplied 1,893.450 MT and 291.650 MT of propane, respectively.

Economy

NEITI Backs Tinubu’s Executive Order 9 on Oil Revenue Remittances

By Adedapo Adesanya

Despite reservations from some quarters, the Nigeria Extractive Industries Transparency Initiative (NEITI) has praised President Bola Tinubu’s Executive Order 9, which mandates direct remittances of all government revenues from tax oil, profit oil, profit gas, and royalty oil under Production Sharing Contracts, profit sharing, and risk service contracts straight to the Federation Account.

Issued on February 13, 2026, the order aims to safeguard oil and gas revenues, curb wasteful spending, and eliminate leakages by requiring operators to pay all entitlements directly into the federation account.

NEITI executive secretary, Musa Sarkin Adar, called it “a bold step in ongoing fiscal reforms to improve financial transparency, strengthen accountability, and mobilise resources for citizens’ development,” noting that the directive aligns with Section 162 of Nigeria’s Constitution.

He noted that for 20 years, NEITI has pushed for all government revenues to flow into the Federation Account transparently, calling the move a win.

For instance, in its 2017 report titled Unremitted Funds, Economic Recovery and Oil Sector Reform, NEITI revealed that over $20 billion in due remittances had not reached the government, fueling fiscal woes and prompting high-level reforms.

Mr Adar described the order as a key milestone in Nigeria’s EITI implementation and urged amendments to align it with these reforms.

He affirmed NEITI’s role in the Petroleum Industry Act (PIA) and pledged close collaboration with stakeholders, anti-corruption bodies, and partners to sustain transparent management of Nigeria’s mineral resources.

Meanwhile, others like the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) have kicked against the order, saying it poses a serious threat to the stability of the oil and gas industry, calling it a “direct attack” on the PIA.

Speaking at the union’s National Executive Council (NEC) meeting in Abuja on Tuesday, PENGASSAN President, Mr Festus Osifo, said provisions of the order, particularly the directive to remit 30 per cent of profit oil from Production Sharing Contracts (PSCs) directly to the Federation Account, could destabilise operations at the Nigerian National Petroleum Company (NNPC) Limited.

Mr Osifo firmly dispelled rumours of imminent protests by the union, despite widespread claims that the controversial executive order threatens the livelihoods of 10,000 senior staff workers at NNPC.

He noted, however, that the union had begun engagements with government officials, including the Presidential Implementation Committee, and expressed optimism that common ground would be reached.

Mr Osifo, who also serves as President of the Trade Union Congress (TUC), expressed concerns that diverting the 30 per cent profit oil allocation to the Federation Account Allocation Committee (FAAC), without clearly defining how the statutory management fee would be refunded to NNPC, could affect the salaries of hundreds of PENGASSAN members.

Economy

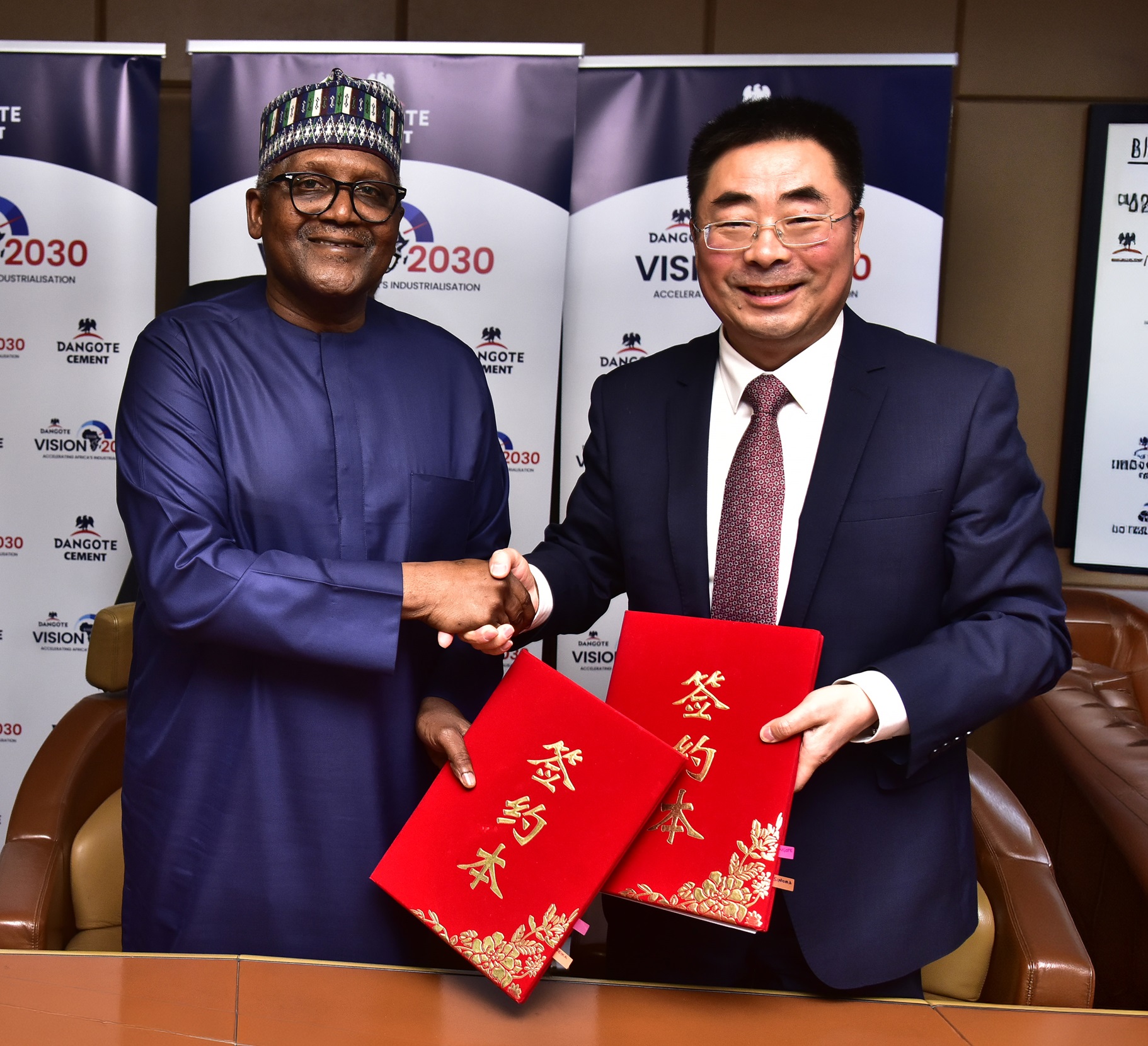

Dangote Cement Deepens Dominance, Export Activities With $1bn Sinoma Deal

By Aduragbemi Omiyale

To strengthen its domestic market dominance, drive its export activities, optimise existing operational assets and enhance production efficiency and capacity expansion, Dangote Cement Plc has sealed $1 billion strategic agreements with Sinoma International Engineering for cement projects across Africa.

The president of Dangote Industries Limited, the parent firm of Dangote Cement, Mr Aliko Dangote, disclosed that the deal reinforces the company’s long-term growth strategy and aligns with the broader aspirations of the Dangote Group’s Vision 2030.

According to him, Sinoma will construct 12 new projects and expand others for the cement organisation across Africa, helping to achieve 80 million tonnes per annum (MTPA) production capacity by 2030, while supporting the group’s overarching target of generating $100 billion in revenue within the same period.

Under the Strategic Framework Agreement, Sinoma will collaborate with Dangote Cement on the delivery of new plants, brownfield expansions, and modernisation initiatives aimed at strengthening operational performance across key markets.

The new projects include a new integrated line in Northern Nigeria with a satellite grinding unit, a new line in Ethiopia and other projects in Zambia/Zimbabwe, Tanzania, Sierra Leone and Cameroon. In Nigeria, Sinoma will also handle different projects in Itori, Apapa, Lekki, Port Harcourt and Onne.

The projects signal Dangote Cement’s sustained commitment to consolidating its leadership position within the African cement industry, while enhancing its competitiveness on the global stage.

Chairman of the Dangote Cement board, Mr Emmanuel Ikazoboh, during the agreement signing event in Lagos, explained that the new projects would enable the company to play a critical role in actualising Dangote Group’s Vision 2030.

The new projects, when completed, will increase Dangote Cement’s capacity and dominant position in Africa’s cement industry.

On his part, the Managing Director of Dangote Cement, Mr Arvind Pathak, said the agreement reflects the company’s determination to grow its investments across African markets to close supply gaps and support the continent’s infrastructural ambitions.

According to him, Dangote Cement is committed to making Africa fully self‑sufficient in cement production, creating more value and linkages, leading to increased economic activities and a reduction in unemployment.

Economy

Lokpobiri Begs Lawmakers to Reschedule Oil Revenue Executive Order Probe

By Adedapo Adesanya

A joint National Assembly probe into President Bola Tinubu’s new oil revenue executive order was stalled on Thursday following a request for more time by the Minister of Petroleum Resources, Mr Heineken Lokpobiri.

The hearing was convened to scrutinise the executive order directing that royalty oil, tax oil, profit oil, profit gas and other revenues due to the Federation under various petroleum contracts be paid directly into the Federation Account.

Mr Lokpobiri told lawmakers that although he attended out of respect for parliament, he had been notified of the hearing only a day earlier and had not obtained all the relevant documents needed to defend the policy adequately.

He appealed for the session to be rescheduled.

Co-chairman of the joint committee and Chairman of the Senate Committee on Gas, Mr Agom Jarigbe, put the request to a voice vote, and lawmakers approved the adjournment.

A new date is expected to be communicated to the minister.

The executive order signed last week also scrapped the 30 per cent Frontier Exploration Fund created under the Petroleum Industry Act (PIA) and discontinued the 30 per cent management fee on profit oil and profit gas previously retained by the Nigerian National Petroleum Company (NNPC) Limited.

Anchored on Sections 5 and 44(3) of the Constitution, the presidency said the directive was aimed at safeguarding oil and gas revenues, curbing excessive deductions and restoring the constitutional entitlements of federal, state and local governments to the

However, the order has sparked criticism within the industry, one of which was from the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN), whose president, Mr Festus Osifo, called for an immediate withdrawal of the order, warning that it could undermine the PIA and erode investor confidence.

Meanwhile, at another session, the Chairman of the Senate Committee on Finance, Senator Mohammed Sani Musa, disclosed that President Tinubu would soon transmit proposals to amend certain provisions of the PIA to align with current economic realities.

He noted that while many expect the executive order to boost revenue automatically, Nigeria has yet to achieve its desired income levels.

He did not specify which sections of the law would be targeted, but suggested that the drive to enhance revenue generation would necessitate legislative adjustments.

The PIA, signed into law in 2021 by the late ex-President Muhammadu Buhari, overhauled the governance, regulatory and fiscal framework of Nigeria’s oil and gas sector, commercialised the NNPC and restructured revenue-sharing arrangements.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn