Economy

How Keeping A Small Farm Can Prove To Be A Sustainable Business

In the world today, it is more important than ever to find sustainable ways of living. One way to achieve this is by keeping a small farm. Small farms can provide a variety of sustainable products and services while also preserving the environment. We will explore some of the benefits of keeping a small farm and how it can be a viable business model. So, let’s get started!

Setting Up A Small Farm

Before we dive into the benefits of keeping a small farm, it is important to understand what exactly a small farm is. A small farm is defined as an agricultural enterprise that employs fewer than ten workers (excluding family members). Small farms can be operated as sole proprietorships, partnerships, or corporations. The majority of small farms are family-owned and -operated. On a small farm, you can keep anything from chickens to cows, and some vegetables. Supplies you’ll need on such a farm include chicken feed, coops, fencing, and other basic equipment. Additionally, you will need to obtain the proper permits and licenses before setting up your small farm.

1. Local Production Of Food

One of the main benefits of keeping a small farm is that it allows for the local production of food. As the world population continues to grow, the demand for food will only increase. Small farms can meet this demand by producing food locally. This is important because it cuts down on transportation costs and helps to reduce the carbon footprint of the food that is consumed. Additionally, locally-grown food is typically fresher and tastier than food that has been transported long distances.

2. Preservation Of The Environment

Another benefit of keeping a small farm is that it helps to preserve the environment. Small farms tend to use fewer pesticides and chemical fertilizers than large commercial farms. They also require less land, which means that there is less deforestation. Small farms also tend to have a more diversified crop rotation, which helps to improve soil health. All of these factors help to create a more sustainable and eco-friendly agricultural system.

3. Improved Mental And Physical Health

Keeping a small farm can also have a positive impact on your mental and physical health. Studies have shown that working in nature can reduce stress levels and improve overall well-being. Additionally, working on a small farm can provide you with a moderate amount of exercise, which is beneficial for your physical health. Studies have also shown that people who work on farms have a lower risk of developing dementia.

4. Economic Stimulation

Small farms can also have a positive impact on the economy. When you buy products from a small farm, you are supporting local businesses and farmers. This helps to stimulate the local economy and keep money within the community. Additionally, small farms typically use less energy than large commercial farms. This means that there is less of a demand for fossil fuels, which helps to reduce greenhouse gas emissions.

5. Community Engagement

Finally, keeping a small farm can help to engage the community. Small farms provide an opportunity for people to learn about where their food comes from and how it is produced. They also offer a space for people to come together and connect with nature. On a small farm, you are more likely to develop relationships with your neighbours and other members of the community. Additionally, small farms can be used as a venue for events such as farm-to-table dinners, weddings, and other gatherings.

How To Keep Your Farm Sustainable

Most small farms start as sustainable but soon become unsustainable when they expand and try to produce more. The key to keeping your small farm sustainable is to focus on quality, not quantity. Here are some tips for how to do this:

1. Use Natural Farming Methods

One of the best ways to keep your small farm sustainable is to use natural farming methods. This means avoiding the use of pesticides, chemical fertilizers, and other harmful chemicals. Instead, focus on using organic methods to grow your crops and raise your animals. This will help to preserve the environment and improve the quality of your products.

2. Diversify Your Crop Rotation

Another way to keep your small farm sustainable is to diversify your crop rotation. This means growing a variety of different crops to improve soil health. When you diversify your crop rotation, you will also reduce the risk of crop failure. This will help to ensure that you always have a reliable source of income.

3. Keep Your Animals Healthy

Another important aspect of keeping your small farm sustainable is to keep your animals healthy. This means providing them with a clean and safe environment. It also means feeding them a healthy diet and ensuring that they get enough exercise. By keeping your animals healthy, you will be able to produce high-quality products that are in demand.

4. Invest In Renewable Energy

Finally, one of the best ways to keep your small farm sustainable is to invest in renewable energy. This includes solar panels, wind turbines, and other green energy technologies. By investing in renewable energy, you will be able to reduce your reliance on fossil fuels. This will help to protect the environment and save money in the long run.

Financing Your Farm

Starting a small farm can be a costly endeavour. However, there are several ways to finance your farm. One option is to take out a loan from the government or a private lender. Another option is to seek out grants and other forms of financial assistance. Additionally, you can also crowdfund your farm or sell products to raise money. Also, be sure to look into tax breaks and other incentives that may be available to farmers.

Small farms offer several benefits, both for the environment and for the people who work on them. They are typically more sustainable than large commercial farms and can provide several economic, social, and health benefits. If you are thinking about starting a small farm, be sure to keep these tips in mind to make sure that it is sustainable. And also check out this guide on how to start a successful small farm.

Economy

LIRS Shifts Deadline for Annual Returns Filing to February 7

By Aduragbemi Omiyale

The deadline for filing of employers’ annual tax returns in Lagos State has been extended by one week from February 1 to 7, 2026.

This information was revealed in a statement signed by the Head of Corporate Communications of the Lagos State Internal Revenue Service (LIRS), Mrs Monsurat Amasa-Oyelude.

In the statement issued over the weekend, the chairman of the tax collecting organisation, Mr Ayodele Subair, explained that the statutory deadline for filing of employers’ annual tax returns is January 31, every year, noting that the extension is intended to provide employers with additional time to complete and submit accurate tax returns.

According to him, employers must give priority to the timely filing of their annual returns, noting that compliance should be embedded as a routine business practice.

He also reiterated that electronic filing through the LIRS eTax platform remains the only approved method for submitting annual returns, as manual filings have been completely phased out. Employers are therefore required to file their returns exclusively through the LIRS eTax portal: https://etax.lirs.net.

Describing the platform as secure, user-friendly, and accessible 24/7, Mr Subair advised employers to ensure that the Tax ID (Tax Identification Number) of all employees is correctly captured in their submissions.

Economy

Airtel on Track to List Mobile Money Unit in First Half of 2026—Taldar

By Adedapo Adesanya

The chief executive of Airtel Africa Plc, Mr Sunil Kumar Taldar, has disclosed that the company is still on track to list its mobile money business, Airtel Money, before the end of June 2026.

Recall that Business Post reported in March 2024 that the mobile network operator was considering selling the shares of Airtel Money to the public through the IPO vehicle in a transaction expected to raise about $4 billion.

The firm had been in talks with possible advisors for a planned listing of the shares from the initial public offer on a stock exchange with some options including London, the United Arab Emirates (UAE), or Europe.

However, so far no final decisions have been made regarding the timing, location, or scale of the IPO.

In September 2025, the telco reportedly picked Citigroup Incorporated as advisors for the planned IPO which will see Airtel Money become a standalone entity before it can attain the prestige of trading on a stock exchange.

Mr Taldar, noted that metrics continued to show improvements ahead of the listing with its customer base hitting 52 million, compared to around 44.6 million users it had as of June 2025.

He added that the subsidiary processed over $210 billion in a year, according to the company’s nine-month financial results released on Friday.

“Our push to enhance financial inclusion across the continent continues to gain momentum with our Mobile Money customer base expanding to 52 million, surpassing the 50 million milestone. Annualised total processed value of over $210 billion in Q3’26 underscores the depth of our merchants, agents, and partner ecosystem and remains a key player in driving improved access to financial services across Africa.

“We remain on track for the listing of Airtel Money in the first half of 2026,” Mr Taldar said.

Estimating Airtel Money at $4 billion is higher than its valuation of $2.65 billion in 2021. In 2021, Airtel Money received significant investments, including $200 million from TPG Incorporated at a valuation of $2.65 billion and $100 million from Mastercard. Later that same year, an affiliate of Qatar’s sovereign wealth fund also acquired an undisclosed stake in the unit.

The mobile money sector in Africa is expanding rapidly, driven by a young population increasingly adopting technology for financial services, making the continent a key market for fintech companies.

Economy

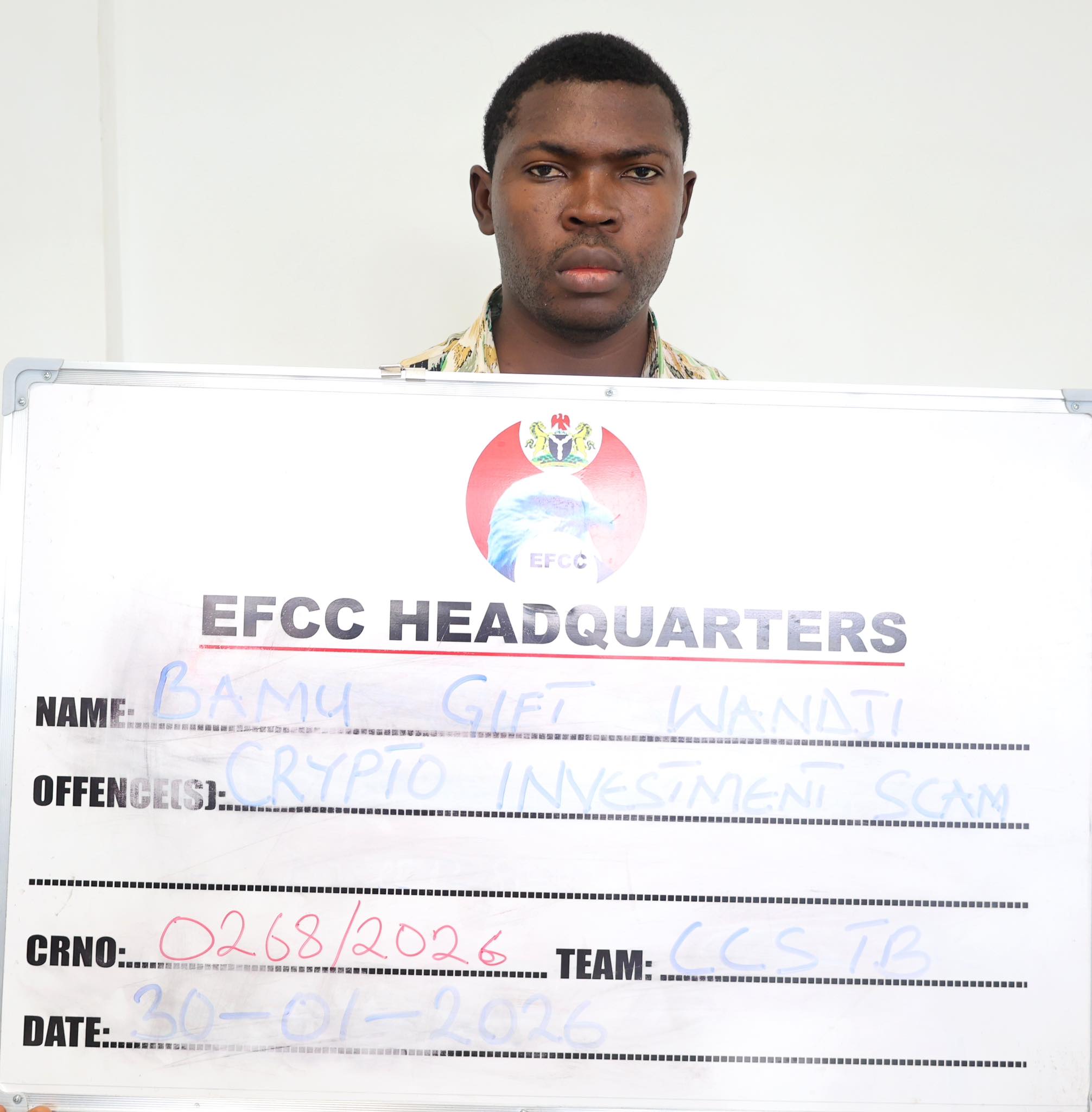

Crypto Investor Bamu Gift Wandji of Polyfarm in EFCC Custody

By Dipo Olowookere

A cryptocurrency investor and owner of Polyfarm, Mr Bamu Gift Wandji, is currently cooling off in the custody of the Economic and Financial Crimes Commission (EFCC).

He was handed over to the anti-money laundering agency by the Nigerian Security and Civil Defence Corps (NSCDC) on Friday, January 30, 2026, after his arrest on Monday, January 12, 2026.

A statement from the EFCC yesterday disclosed that the suspect was apprehended by the NSCDC in Gwagwalada, Abuja for running an investment scheme without the authorisation of the Securities and Exchange Commission (SEC), which is the apex capital market regulator in Nigeria.

It was claimed that Mr Wandji created a fraudulent crypto investment platform called Polyfarm, where he allegedly lured innocent Nigerians to invest in Polygon, a crypto token that attracts high returns.

Investigation further revealed that he also deceived the public that his project, Polyfarm, has its native token called “polyfarm coin” which he sold to the public.

In his bid to promote the scheme, the suspect posted about this on social media platforms, including WhatsApp, X (formally Twitter) and Telegram. He also conducted seminars in some major cities in Nigeria including Kaduna, Lagos, Port Harcourt and Abuja where he described the scheme as a life-changing programme.

Further investigation revealed that in October, 2025, subscribers who could not access their funds were informed by the suspect that the site was attacked by Lazarus group, a cyber attacking group linked to North Korea.

Further investigations showed that Polyfarm is not registered and not licensed with SEC to carry out crypto transactions in Nigeria. Also, no investment happened with subscribers’ funds and that the suspect used funds paid by subscribers to pay others in the name of profit.

Investigation also revealed that native coin, polyfarm coin was never listed on coin market cap and that the suspect sold worthless coins to the general public.

Contrary to the claim of the suspect that his platform was attacked, EFCC’s investigations revealed that the platform was never attacked or hacked by anyone and that the suspect withdrew investors’ funds and utilized the same for his personal gains.

The EFCC, in the statement, disclosed that Mr Wandji would be charged to court upon conclusion of investigations.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn