Economy

Atiku Was Never Head of Economic Management Team—Ezekwesili

By Aduragbemi Omiyale

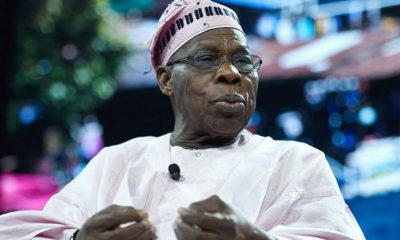

A former Nigerian Minister, Mrs Oby Ezekwesili, has asked former Vice President Atiku Abubakar to stop parading himself as the head of the Economic Management Team of former President Olusegun Obasanjo.

Mr Obasanjo governed the country as a civilian between 1999 and 2007 with Mr Atiku, who intends to become the next Nigerian president this year.

He is contesting the position with the candidate of the ruling All Progressives Congress (APC), the candidate of the Labour Party, Mr Peter Obi, and others.

On Monday, the former VP, through his official Twitter page, said, “As the head of the economic management team, while I was Vice President, I was instrumental in designing a private sector revival strategy and advocated the opening of the economy for private sector investments in several sectors, and we made tremendous progress.”

But the co-convener of the Bring Back Our Girls (BBOG) movement, in response to the tweet, described Mr Atiku’s claim as a lie, saying he never headed the Economic Management Team but the National Economic Council (NEC), which the constitution makes provision for the VP to lead.

“Dear former Vice President Atiku, please ask the handlers of your @Twitter account to stop misleading the public. You were never the Head of the Economic Management Team.

“This absurd lie does you no good at all. Please ask your Team to stop it,” she responded.

She further wrote, “There is a difference between the Economic Management Team set up for the 1st time ever in 2003 by President Obasanjo and the National Economic Council established by the 1999 Constitution as amended; Section 153(1) and Paragraphs 18 & 19 of Part I of the Third Schedule.

“The Presidential Economic Management Team (we called it “The Economic Team” for brevity) was a Technical Team of 12 persons from a range of expertise whom President Obasanjo constituted to drive Nigeria’s Economic Reforms Agenda during his 2nd Term in office 2003-2007.

“In constituting the Economic Team, we designed it @ two levels of Leadership: 1. Political Leadership [headed by] President Olusegun Obasanjo, and the Technical Leadership [headed by] The Minister of Finance, Dr Okonjo-Iweala.

“Our Team also had Thematic Issues Lead, e.g. I was for Good Governance.

“At the Political Leadership level of the Economic Team, the then President, Olusegun Obasanjo, instituted a Weekly Meeting before the Federal Executive Council where he would meet with us his Economic Team to discuss the Economic Reform Agenda. The President was Chair.

“As Chair of the Political Leadership Level of the Economic Team, the then President decided (usually with the counsel of his Economic Team) which sectoral Ministers, or Heads of Agencies, Parastatals and Departments joined this Weekly Wednesday meeting held before FEC meeting.

“As Chair of the Technical Level Leadership, the then Minister of Finance was the Head of our Technocratic Team of 12 persons, which met in her office at the Ministry statutorily weekly and as often as necessary daily as we designed and began implementing the Economic Reforms.

“There is no sincere basis for confusing the work of the Presidential Economic Management Team that I described in the previous tweets with the National Economic Council, provided for in the Constitution and chaired by a Vice President. The functions are not the same at all. None.

“National Economic Council consists of: (a) Vice-President as the Chairman; (b) the Governor of each State of the Federation; and (c) the Governor of the Central Bank of Nigeria established under the Central Bank of Nigeria Decree 1991 or any enactment replacing that Decree.

“Constitutionally, National Economic Council advises the President concerning the economic affairs of the Federation, and in particular on measures necessary for the coordination of the economic planning efforts or economic programmes of the various Governments of the Federation.

“The National Economic Council, which former Vice President Atiku constitutionally chaired and now by Professor Osinbajo, is really an advisory organ that provides an opportunity for the Federal Government and States of the Federation to discuss our Economy for coordination purposes.

“The 1999 Constitution also has the Vice President as the Chairperson of the National Council on Privatization. In that capacity, it is the duty of the Vice President to supervise the work of the Bureau for Public Enterprise BPE on behalf of the President.”

Economy

MTN to Acquire Additional 75% Stake in IHS Holdings for Full Control

By Adedapo Adesanya

MTN Group, Africa’s largest mobile network operator, has entered advanced discussions to buy approximately 75 per cent of shares in IHS Holding Limited (IHS Towers) that it does not already own.

The move would give the South African telco full control of IHS, which is the leading independent tower operator in several of its key markets, providing colocation services and supporting the expansion of mobile networks in regions with growing demand for digital connectivity.

In a cautionary announcement to investors on Thursday, MTN confirmed it is considering a transaction to acquire the remaining stake in the New York Stock Exchange-listed IHS, following recent market speculation.

The potential offer price would be “at a level near the last trading price” of IHS shares on the NYSE as of February 4, 2025, a period when the stock has seen a sharp rise in recent months, reflecting renewed investor confidence in the sector.

No binding agreement has been reached, and MTN emphasised there is no certainty that the deal will proceed.

However, if completed, the transaction could materially impact MTN’s share price, prompting the company to advise shareholders to exercise caution in trading until further updates.

MTN already holds a significant stake in IHS and maintains a deep operational partnership across multiple African markets.

Over the past decade, MTN has sold thousands of passive network sites to IHS through sale-and-leaseback deals, including a major transaction in South Africa in 2022 involving over 5,700 towers.

These arrangements allowed MTN to free up capital from infrastructure while securing long-term tower access via master lease agreements.

A full buyout would represent a dramatic strategic pivot for MTN, effectively bringing tower infrastructure back in-house after years of outsourcing to specialised operators like IHS.

MTN has previously voiced concerns about corporate governance at IHS, adding context to its cautious approach in the announcement.

If the deal falls through, MTN said it would continue exploring options to unlock value from its IHS investment, consistent with its disciplined capital allocation strategy.

The potential acquisition underscores the evolving dynamics in Africa’s telecom infrastructure sector, where operators weigh the benefits of owning versus leasing critical assets amid rising data demands and economic pressures.

Economy

NASD Exchange Moves Higher by 0.77%

By Adedapo Adesanya

For the third consecutive trading session, the NASD Over-the-Counter (OTC) Securities Exchange ended in the green territory, rising further by 0.77 per cent on Thursday, February 5.

Two price gainers helped the bourse to rally during the session, with the market capitalisation up by N16.87 billion to N2.197 trillion from N2.180 trillion and the NASD Unlisted Security Index (NSI) up by 3.18 points to 3,672 points from the 3,644.48 points in the midweek session.

The advancers’ group was led by Central Securities Clearing System (CSCS), which added N3.70 to sell at N48.67 per share versus the previous day’s N44.97 per share, and Afriland Properties Plc expanded by N1.01 to N15.01 per unit from N14.01 per unit.

It was observed that the alternative stock exchange recorded two price losers led by Geo-Fluids Plc, which further lost 51 Kobo to sell at N4.75 per share versus Wednesday’s closing price of N5.26 per share, and Industrial and General Insurance (IGI) declined by 6 Kobo to 59 Kobo per unit from 65 Kobo per unit.

During the session, the volume of securities transacted by investors slid by 51.9 per cent to 1.2 million units from 2.5 million units, the value of securities went down by 32.0 per cent to N12.0 million from N17.7 million, and the number of deals increased by 27.8 per cent to 23 deals from 18 deals.

At the close of trades, CSCS Plc was the most traded stock by value on a year-to-date basis with 16.2 million units exchanged for N659.9 million, followed by FrieslandCampina Wamco Nigeria Plc with 1.7 million units traded for N117.8 million, and Geo-Fluids Plc with 12.3 million units valued at N79.1 million.

CSCS Plc remained the most active stock by volume on a year-to-date basis with 16.2 million units sold for N659.9 million, trailed by Mass Telecom Innovation Plc with 13.6 million units valued at N5.5 million, and Geo-Fluids Plc with 12.3 million units worth N79.1 million.

Economy

NGX Index Crosses 170,000 Points as Investors Sustains Buying Pressure

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited recorded another milestone after it further closed higher by 1.18 per cent on Thursday amid renewed confidence in the market.

The All-Share Index (ASI) crossed the 170,000-point threshold during the session as it added 1,975.18 points to the preceding day’s 168,030.18 points to settle at 170,005.36 points.

Also yesterday, the market capitalisation of Customs Street was up by 1,268 trillion to N109.129 trillion from the N107.861 it ended a day earlier.

The growth recorded during the session was powered 55 equities, which outweighed the losses recorded by 19 other equities.

Guinea Insurance expanded by 10.00 per cent to N1.43, Seplat Energy grew by 10.00 per cent to N7,370.00, RT Briscoe increased by 9.95 per cent to N11.49, Neimeth chalked up 9.90 per cent to close at N11.10, and Zichis rose by 9.89 per cent to N6.11.

At the other side, Deap Capital lost 9.62 per cent to trade at N6.20, Universal Insurance slipped by 9.43 per cent to N1.44, Haldane McCall declined by 9.09 per cent to N4.00, Red Star Express went down by 9.04 per cent to N15.60, and UPDC depreciated by 7.02 per cent to N5.30.

Business Post reports that the energy index was up by 4.68 per cent, the industrial goods improved by 0.79 per cent, the banking space grew by 0.64 per cent, and the consumer goods sector soared by 0.11 per cent, while the insurance counter lost 0.31 per cent.

Yesterday, market participants traded 713.0 million stocks valued at N22.3 billion in 46,104 deals versus the 694.8 million stocks worth N20.6 billion transacted in 42,095 deals on Wednesday, showing a spike in the trading volume, value, and number of deals by 2.62 per cent, 8.25 per cent, and 9.52 per cent, respectively.

Access Holdings sold 106.6 million shares valued at N2.5 billion, Chams transacted 44.5 million equities worth N201.3 million, Champion Breweries traded 44.5 million stocks for N774.3 million, Universal Insurance exchanged 34.8 million shares worth N53.6 million, and Deap Capital sold 22.7 million equities valued at N141.9 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn