Economy

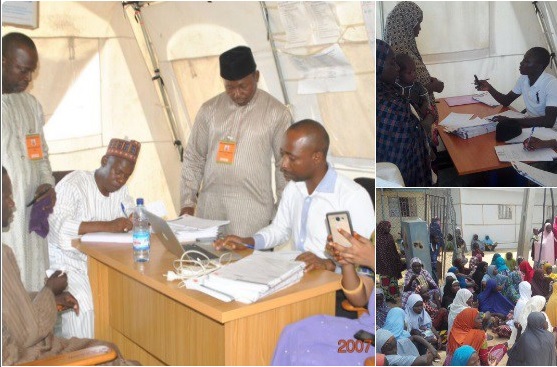

How We Selected Beneficiaries of N5000 Monthly Stipends—FG

By Modupe Gbadeyanka

Details are emerging on how the Federal Government determined the beneficiaries of the Conditional Cash Transfer who are now receiving the N5000 monthly stipends across the nine pilot states.

According to the Senior Special Assistant on Media & Publicity in the Office of the Vice President, Mr Laolu Akande, the nine States are Bauchi, Borno, Cross Rivers, Ekiti, Kwara, Kogi, Niger, Osun and Oyo.

Mr Akande clarified that reference to Ogun, instead of Osun-among the pilot states- in his last press statement on the issue was a typo.

In his press update on the progress of the Buhari administration’s Social Investment Programmes, SIP, over the weekend, Mr Akande explained how the Community-Based Targeting, CBT model of the World Bank was used two years ago to identify most of the beneficiaries in the pilot States, as the World Bank is also an active agent in the entire process. But he added that the data collected belongs to Nigeria.

According to Mr Akande, ” there is no way anyone can describe the selection of the beneficiaries of the CCT as partisan as the beneficiaries from eight of the nine pilot States were picked even before this administration came into office.”

“First, the officials at Federal level, working with the State officials, identify the poorest Local Government Areas, using an existing poverty map for the State, then the LG officials identify the poorest communities in the LGAs and we send our teams there.

The first thing our team does after selection of the LGAs is to select members of the NOA, the LGA and community officials to form the CBT team. Then we train the selected officials on how to conduct Focus Group discussions at community level. These focus groups comprise of women, men, youth, as the community determines.

After training them, the CBT teams now go to each of their communities to sensitize the leaders, including traditional rulers, on the CBT process and the necessity for objectivity and openness in the process. At that meeting, they firm up a date to convene a community meeting at a designated location within the community.

On the set date, discussions are held in the local languages, using terminologies that resonate in that community. The CBT team will explain to the community the purpose of the gathering, i.e. to determine the parameters of poverty upon which persons can be described as poor and vulnerable within the context of that community.

The CBT teams will then engage each group (men, women and youth) in the conversation around the criteria and parameters for determining the poorest people. The groups would then be encouraged to identify those households that fall within the criteria that the community itself determines, and told that the information is required for government’s planning purposes.

(Various poverty criteria have been thrown up so far. In some cases, people have said it’s the number of times they eat, it’s the number of times the fumes of firewood go up from the house, the size of farmland or type of crops grown, etc.)

Then the groups resume in plenary and report back the criteria and parameters discussed.

The CBT team would then compile the criteria and parameters and ask each group to return to their break-out sessions and now begin to identify the households in the community that have been identified as fitting the criteria and parameters.

Once that is done at the groups, everybody comes together again with names compiled by each group. Now, when the same name is featured in at least two of the three groups, it is deemed qualified to be listed on the Social Register.

At this stage, we now enumerate the members of the household and open a bank account for each of the caregivers by capturing the biometric data of households identified as among the poorest and vulnerable.”

According to Mr Akande, in 8 of the nine pilot states, this process had taken place at least 2 years ago under a programme supported by the World Bank under an Agreement entered into directly with the state governments, on the YESSO project. The ninth state is Borno, which was added because of the IDP situation, with the list of the beneficiaries that has been verified by SEMA.

“This is an entirely fair and transparent process and short of mischief, there is no way you can describe this process as partisan. The President is President of the entire country and the SIPs are for all Nigerians as the case may be.”

In addition to the nine pilot states, and with the release of funds for the programmes, the CBT model has now commenced in other States.

The states have been updated on the requirements for the engagement by the Federal team and once the lists from States are enumerated, their details are uploaded onto a server at the Nigeria Inter-Bank Settlement System (NIBSS), which hosts the electronic platform that validates all the payments of the FG for the SIPs.

Banks have been informed that payments must be at community level, so those banks engaged for the pilot stage have in turn engaged several payment agents, to ensure cash-out to the beneficiaries in their places of residence which are distant to the bank locations.

Economy

Nigeria’s Economy Expands 4.07% in Q4 2025

By Adedapo Adesanya

Nigeria’s economy, measured by gross domestic product (GDP), grew by 4.07 per cent (year-on-year) in real terms in the fourth quarter (Q4) of 2025.

The National Bureau of Statistics (NBS) announced the development in its latest GDP report for Q4 2025 on Friday.

The latest figure represents an improvement over the 3.76 per cent growth recorded in the corresponding period of 2024, signalling sustained recovery across key sectors of the economy. The growth rate was faster than the third quarter’s 3.98 per cent.

The report confirmed that Nigeria’s oil sector grew 6.79 per cent year-on-year and the non-oil part of the economy expanded by 3.99 per cent.

Nigeria’s average daily oil production stood at 1.58 million barrels per day in the final three months of 2025. That was lower than the third quarter’s output of 1.64 million barrels per day but higher than the 1.54 million barrels per day in the fourth quarter of 2024.

Breakdown of the data showed that the agriculture sector grew by 4.00 per cent in the fourth quarter of 2025. This marks a significant increase compared to the 2.54 per cent growth recorded in the same quarter of 2024, reflecting improved output and resilience in the sector.

The industry sector also recorded a stronger performance during the period under review. It grew by 3.88 per cent year-on-year, up from 2.49 per cent posted in the fourth quarter of 2024. The improvement suggests enhanced activity in manufacturing, construction, and related industrial sub-sectors.

The services sector maintained its position as a major growth driver, expanding by 4.15 per cent in Q4 2025. However, this was slightly lower than the 4.75 per cent growth recorded in the corresponding quarter of the previous year.

Overall, the 4.07 per cent GDP growth in the final quarter of 2025 underscores broad-based expansion across agriculture, industry, and services, despite a marginal moderation in services growth.

The Q4 performance provides further evidence of strengthening economic momentum, with improvements recorded in both agriculture and industry compared to the previous year.

Economy

Flour Mills Supports 2026 Paris International Agricultural Show

By Modupe Gbadeyanka

For the second time, Flour Mills of Nigeria Plc is sponsoring the Paris International Agricultural Show (PIAS) as part of its strategies to fortify its ties with France.

The 2026 PIAS kicked off on February 21 and will end on March 1, with about 607,503 visitors, nearly 4,000 animals, and over 1,000 exhibitors in attendance last year, and this year’s programme has already shown signs of being bigger and better.

The theme for this year’s event is Generations Solution. It is to foster knowledge transfer from younger generations and structure processes through which knowledge can be harnessed to drive technological advancement within the global agricultural sector.

In his address on the inaugural day of the Nigerian Pavilion on February 23, the Managing Director for FMN Agro and Director of Strategic Engagement/Stakeholder Relations, Mr Sadiq Usman, said, “At FMN, our mission is Feeding and Enriching Lives Every Day.

“This is a mandate we have fulfilled through decades of economic shifts, rooted in a culture of deep resilience and constant innovation. We support this pavilion because FMN recognises that the next frontier of global Agribusiness lies in high-level technical exchange.

“We thank the France-Nigeria Business Council (FNBC), the organisers of the PIAS, and our fellow members of the Nigerian Pavilion – Dangote, BUA, Zenith, Access, and our partners at Creativo El Matador and Soilless Farm Lab— we are exceedingly pleased to work to showcase the true face of Nigerian commerce.”

Speaking on the invaluable nature of the relationship between Nigeria and France, and the FMN’s commitment to process and product innovation, Mr John G. Coumantaros, stated, “The France – Nigeria relationship is a valuable partnership built on a shared value agenda that fosters remarkable Intercontinental trade growth.

“Also, as an organisation with over six decades of transformational footprint in Nigeria and progressively across the African Continent, FMN has been unwaveringly committed to product and process innovation.

“Therefore, our continuous partnership with France for the success of the Paris International Agricultural Show further buttresses the thriving relationship between both countries.”

PIAS is one of the most widely attended agricultural shows, with thousands of people from across the world in attendance.

Economy

NEITI Backs Tinubu’s Executive Order 9 on Oil Revenue Remittances

By Adedapo Adesanya

Despite reservations from some quarters, the Nigeria Extractive Industries Transparency Initiative (NEITI) has praised President Bola Tinubu’s Executive Order 9, which mandates direct remittances of all government revenues from tax oil, profit oil, profit gas, and royalty oil under Production Sharing Contracts, profit sharing, and risk service contracts straight to the Federation Account.

Issued on February 13, 2026, the order aims to safeguard oil and gas revenues, curb wasteful spending, and eliminate leakages by requiring operators to pay all entitlements directly into the federation account.

NEITI executive secretary, Musa Sarkin Adar, called it “a bold step in ongoing fiscal reforms to improve financial transparency, strengthen accountability, and mobilise resources for citizens’ development,” noting that the directive aligns with Section 162 of Nigeria’s Constitution.

He noted that for 20 years, NEITI has pushed for all government revenues to flow into the Federation Account transparently, calling the move a win.

For instance, in its 2017 report titled Unremitted Funds, Economic Recovery and Oil Sector Reform, NEITI revealed that over $20 billion in due remittances had not reached the government, fueling fiscal woes and prompting high-level reforms.

Mr Adar described the order as a key milestone in Nigeria’s EITI implementation and urged amendments to align it with these reforms.

He affirmed NEITI’s role in the Petroleum Industry Act (PIA) and pledged close collaboration with stakeholders, anti-corruption bodies, and partners to sustain transparent management of Nigeria’s mineral resources.

Meanwhile, others like the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) have kicked against the order, saying it poses a serious threat to the stability of the oil and gas industry, calling it a “direct attack” on the PIA.

Speaking at the union’s National Executive Council (NEC) meeting in Abuja on Tuesday, PENGASSAN President, Mr Festus Osifo, said provisions of the order, particularly the directive to remit 30 per cent of profit oil from Production Sharing Contracts (PSCs) directly to the Federation Account, could destabilise operations at the Nigerian National Petroleum Company (NNPC) Limited.

Mr Osifo firmly dispelled rumours of imminent protests by the union, despite widespread claims that the controversial executive order threatens the livelihoods of 10,000 senior staff workers at NNPC.

He noted, however, that the union had begun engagements with government officials, including the Presidential Implementation Committee, and expressed optimism that common ground would be reached.

Mr Osifo, who also serves as President of the Trade Union Congress (TUC), expressed concerns that diverting the 30 per cent profit oil allocation to the Federation Account Allocation Committee (FAAC), without clearly defining how the statutory management fee would be refunded to NNPC, could affect the salaries of hundreds of PENGASSAN members.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn