Economy

How We Selected Beneficiaries of N5000 Monthly Stipends—FG

By Modupe Gbadeyanka

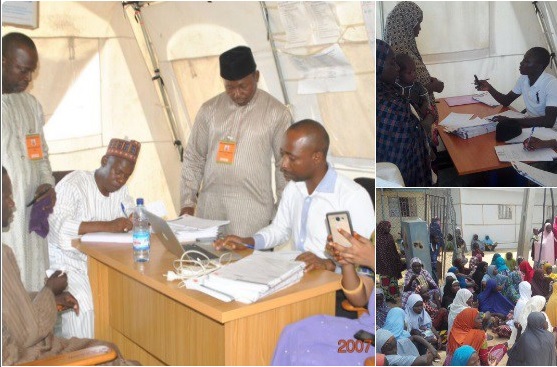

Details are emerging on how the Federal Government determined the beneficiaries of the Conditional Cash Transfer who are now receiving the N5000 monthly stipends across the nine pilot states.

According to the Senior Special Assistant on Media & Publicity in the Office of the Vice President, Mr Laolu Akande, the nine States are Bauchi, Borno, Cross Rivers, Ekiti, Kwara, Kogi, Niger, Osun and Oyo.

Mr Akande clarified that reference to Ogun, instead of Osun-among the pilot states- in his last press statement on the issue was a typo.

In his press update on the progress of the Buhari administration’s Social Investment Programmes, SIP, over the weekend, Mr Akande explained how the Community-Based Targeting, CBT model of the World Bank was used two years ago to identify most of the beneficiaries in the pilot States, as the World Bank is also an active agent in the entire process. But he added that the data collected belongs to Nigeria.

According to Mr Akande, ” there is no way anyone can describe the selection of the beneficiaries of the CCT as partisan as the beneficiaries from eight of the nine pilot States were picked even before this administration came into office.”

“First, the officials at Federal level, working with the State officials, identify the poorest Local Government Areas, using an existing poverty map for the State, then the LG officials identify the poorest communities in the LGAs and we send our teams there.

The first thing our team does after selection of the LGAs is to select members of the NOA, the LGA and community officials to form the CBT team. Then we train the selected officials on how to conduct Focus Group discussions at community level. These focus groups comprise of women, men, youth, as the community determines.

After training them, the CBT teams now go to each of their communities to sensitize the leaders, including traditional rulers, on the CBT process and the necessity for objectivity and openness in the process. At that meeting, they firm up a date to convene a community meeting at a designated location within the community.

On the set date, discussions are held in the local languages, using terminologies that resonate in that community. The CBT team will explain to the community the purpose of the gathering, i.e. to determine the parameters of poverty upon which persons can be described as poor and vulnerable within the context of that community.

The CBT teams will then engage each group (men, women and youth) in the conversation around the criteria and parameters for determining the poorest people. The groups would then be encouraged to identify those households that fall within the criteria that the community itself determines, and told that the information is required for government’s planning purposes.

(Various poverty criteria have been thrown up so far. In some cases, people have said it’s the number of times they eat, it’s the number of times the fumes of firewood go up from the house, the size of farmland or type of crops grown, etc.)

Then the groups resume in plenary and report back the criteria and parameters discussed.

The CBT team would then compile the criteria and parameters and ask each group to return to their break-out sessions and now begin to identify the households in the community that have been identified as fitting the criteria and parameters.

Once that is done at the groups, everybody comes together again with names compiled by each group. Now, when the same name is featured in at least two of the three groups, it is deemed qualified to be listed on the Social Register.

At this stage, we now enumerate the members of the household and open a bank account for each of the caregivers by capturing the biometric data of households identified as among the poorest and vulnerable.”

According to Mr Akande, in 8 of the nine pilot states, this process had taken place at least 2 years ago under a programme supported by the World Bank under an Agreement entered into directly with the state governments, on the YESSO project. The ninth state is Borno, which was added because of the IDP situation, with the list of the beneficiaries that has been verified by SEMA.

“This is an entirely fair and transparent process and short of mischief, there is no way you can describe this process as partisan. The President is President of the entire country and the SIPs are for all Nigerians as the case may be.”

In addition to the nine pilot states, and with the release of funds for the programmes, the CBT model has now commenced in other States.

The states have been updated on the requirements for the engagement by the Federal team and once the lists from States are enumerated, their details are uploaded onto a server at the Nigeria Inter-Bank Settlement System (NIBSS), which hosts the electronic platform that validates all the payments of the FG for the SIPs.

Banks have been informed that payments must be at community level, so those banks engaged for the pilot stage have in turn engaged several payment agents, to ensure cash-out to the beneficiaries in their places of residence which are distant to the bank locations.

Economy

Okitipupa Plc, Two Others Lift Unlisted Securities Market by 0.65%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange recorded a 0.65 per cent gain on Friday, December 13, boosted by three equities admitted on the trading platform.

On the last trading session of the week, Okitipupa Plc appreciated by N2.70 to settle at N29.74 per share versus Thursday’s closing price of N27.04 per share, FrieslandCampina Wamco Nigeria Plc added N2.49 to end the session at N42.85 per unit compared with the previous day’s N40.36 per unit, and Afriland Properties Plc gained 50 Kobo to close at N16.30 per share, in contrast to the preceding session’s N15.80 per share.

Consequently, the market capitalisation added N6.89 billion to settle at N1.062 trillion compared with the preceding day’s N1.055 trillion and the NASD Unlisted Security Index (NSI) gained 19.66 points to wrap the session at 3,032.16 points compared with 3,012.50 points recorded in the previous session.

Yesterday, the volume of securities traded by investors increased by 171.6 per cent to 1.2 million units from the 447,905 units recorded a day earlier, but the value of shares traded by the market participants declined by 19.3 per cent to N2.4 million from the N3.02 million achieved a day earlier, and the number of deals went down by 14.3 per cent to 18 deals from 21 deals.

At the close of business, Geo-Fluids Plc was the most active stock by volume on a year-to-date basis with a turnover of 1.7 billion units worth N3.9 billion, followed by Okitipupa Plc with the sale of 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.3 million units sold for N5.3 million.

In the same vein, Aradel Holdings Plc remained the most active stock by value on a year-to-date basis with the sale of 108.7 million units for N89.2 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with a turnover of 297.3 million units worth N5.3 billion.

Economy

Naira Trades N1,533/$1 at Official Market, N1,650/$1 at Parallel Market

By Adedapo Adesanya

The Naira appreciated further against the United States Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM) by N1.50 or 0.09 per cent to close at N1,533.00/$1 on Friday, December 13 versus the N1,534.50/$1 it was transacted on Thursday.

The local currency has continued to benefit from the Electronic Foreign Exchange Matching System (EFEMS) introduced by the Central Bank of Nigeria (CBN) this month.

The implementation of the forex system comes with diverse implications for all segments of the financial markets that deal with FX, including the rebound in the value of the Naira across markets.

The system instantly reflects data on all FX transactions conducted in the interbank market and approved by the CBN.

Market analysts say the publication of real-time prices and buy-sell orders data from this system has lent support to the Naira in the official market and tackled speculation.

In the official market yesterday, the domestic currency improved its value against the Pound Sterling by N12.58 to wrap the session at N1,942.19/£1 compared with the previous day’s N1,954.77/£1 and against the Euro, it gained N2.44 to close at N1,612.85/€1 versus Thursday’s closing price of N1,610.41/€1.

At the black market, the Nigerian Naira appreciated against the greenback on Friday by N30 to sell for N1,650/$1 compared with the preceding session’s value of N1,680/$1.

Meanwhile, the cryptocurrency market was largely positive as investors banked on recent signals, including fresh support from US President-elect, Mr Donald Trump, as well as interest rate cuts by the European Central Bank (ECB).

Ripple (XRP) added 7.3 per cent to sell at $2.49, Binance Coin (BNB) rose by 3.5 per cent to $728.28, Cardano (ADA) expanded by 2.4 per cent to trade at $1.11, Litecoin (LTC) increased by 2.3 per cent to $122.56, Bitcoin (BTC) gained 1.9 per cent to settle at $101,766.17, Dogecoin (DOGE) jumped by 1.2 per cent to $0.4064, Solana (SOL) soared by 0.7 per cent to $226.15 and Ethereum (ETH) advanced by 0.6 per cent to $3,925.35, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

Economy

Index Gains 0.63% as Value of Nigerian Exchange Crosses N60trn

By Dipo Olowookere

For the fourth consecutive trading session, the Nigerian Exchange (NGX) Limited closed higher on Friday by 0.63 per cent on sustained renewed buying pressure.

Apart from the energy and industrial goods sectors which closed flat, every other sector ended in the green territory, according to data obtained from the bourse.

Business Post reports that the insurance index appreciated by 1.52 per cent, the banking space improved by 0.63 per cent, and the consumer goods counter expanded by 0.46 per cent.

As a result, the All-Share Index (ASI) gained 617.47 points to settle at 99,378.06 points compared with the preceding day’s 98,760.59 points and the market capitalisation went up by 375 billion to close at N60.242 trillion, in contrast to Thursday’s closing value of N59.867 trillion.

The volume of transactions on Customs Street yesterday grew by 11.13 per cent to 544.2 million shares from the 489.7 million shares transacted a day earlier.

The value of transactions increased during the session by 49.30 per cent to N10.6 billion from N7.1 billion and the number of deals went up by 1.93 per cent to 8,464 deals from the 8,304 deals posted in the previous trading session.

The busiest equity for the trading day was Japaul with the sale of 71.7 million units valued at N158.0 million, eTranzact exchanged 70.7 million units worth N477.5 million, Tantalizers sold 57.3 million units for N101.2 million, FCMB traded 33.0 million units worth N297.3 million, and Universal Insurance transacted 27.1 million units valued at N9.6 million.

A total of 36 stocks ended on the gainers’ chart, while 15 stocks finished on the losers’ table, indicating a positive market breadth index and strong investor sentiment.

The trio of Aradel Holdings, Ikeja Hotel and Caverton gained 10.00 per cent each to trade at N550.00, N8.80, and N1.98, respectively, as Africa Prudential rose by 9.87 per cent to N17.25 and Golden Guinea Breweries soared by 9.64 per cent to N8.64.

On the flip side, Austin Laz lost 10.00 per cent to close at N1.62, ABC Transport crashed by 8.00 per cent to N1.15, Royal Exchange slumped by 7.69 per cent to 60 Kobo, Secure Electronic Technology plunged by 5.26 per cent to 54 Kobo, and The Initiates crumbled by 4.26 per cent to N2.25.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN