General

Nigerian Investors Accuse Top MLM Leaders of Abetting Omegapro Fraud

By Modupe Gbadeyanka

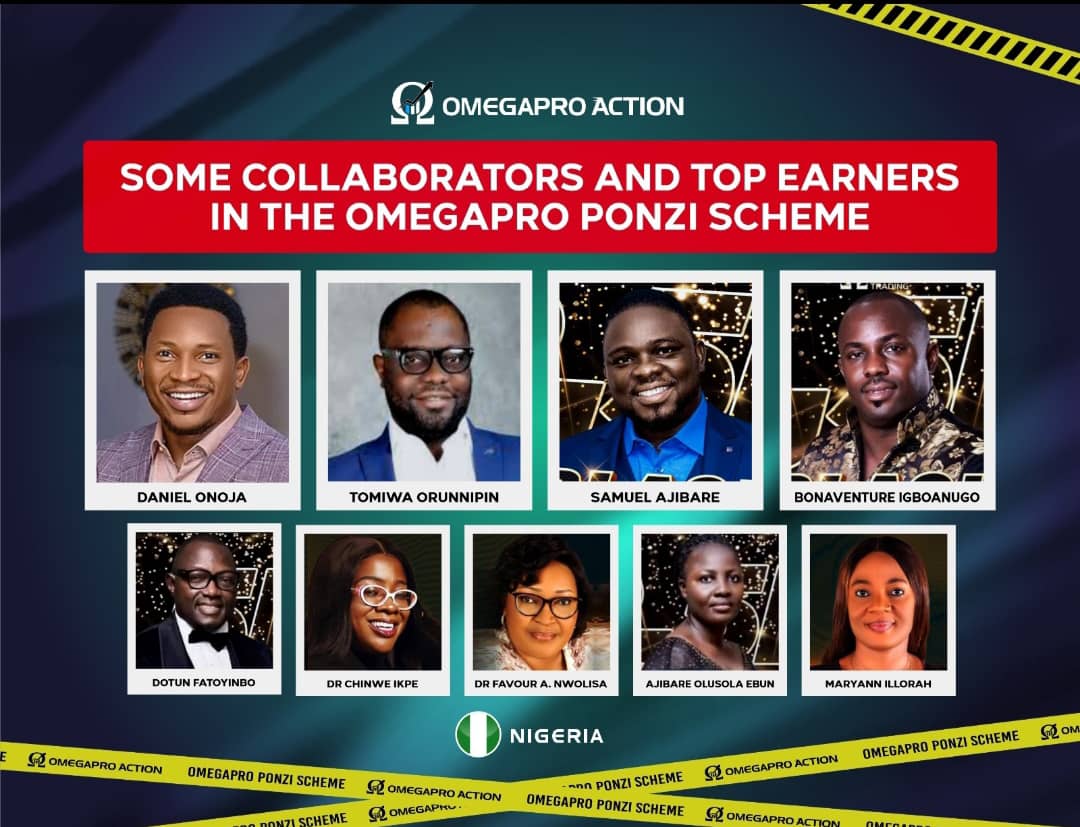

Some top multi-level marketing (MLM) leaders have been accused of supporting a Dubai-based company, Omegapro Forex and Investment Trading Company, to defraud Nigerians.

A statement signed by Dr Ope Banwo, the Coordinating Attorney of Omegapro Action Nigeria Class (OANC), a group formed by affected investors, identified Tomiwa Orunnipin, Samuel Ajibare, Leo Bonaventure and others as those who abetted the foreign firm to dupe its Nigerian victims of over N100 billion.

It was gathered that those affected include widows, retirees, high-net-worth individuals, big business people, and even young people just starting in life.

How The Fraud Was Hatched

Omegapro Forex emerged on the scene, promising Nigerians and investors in general a pathway to financial success.

The investment scheme gained popularity and trust among Nigerians and in the world, as many saw it as a ticket to financial freedom. However, little did they know that it was going to be one of the biggest investment tragedies in Nigeria’s history.

With an intricate web of deception and manipulation, alleged promoters of the scheme, including Daniel Onoja, Tomiwa Orunnipin, Samuel Ajibare, Leo Bonaventure, and several top leader MLM Diamonds, painted the image of a foolproof investment opportunity with high returns and a secure investment environment.

Alleged promoters and agents such as Grace Udenwa Udoye, Wuraola Fadairo Orunupin, Olasebikan Oladapo, Maryann Ilorah, Chinwe Ikpe, Ajibare Olushola Ebunoluwa, Dotun Fatoyinbo, Dr Afoma Nwolisa, and Matthew Ogunmodede, marketed the venture aggressively, touting its legitimacy and potential for lucrative earnings.

At that rate of marketing, investors couldn’t help but take the bait, especially as top agents and promoters in the MLM industry who carried significant influence within their networks also participated in the marketing exercise for Omegapro.

They leveraged their status, persuading thousands of investors to entrust their hard-earned money with Omegapro. Their endorsements created an illusion of credibility that typically lured in unsuspecting Nigerians.

Aside from this, they kept assuring Nigerian investors that rigorous due diligence had been conducted by them on Omegapro’s Dubai-based owners and operations, implying that it was a legitimate and low-risk investment.

This way, investors put in their entire life savings, and pensions, while some even sold their houses and properties to invest in the Omegapro ‘Forex’ trading activities.

For their services, these top promoters allegedly collected a 10 per cent commission from the Omegapro Dubai company as a finders fee from the investment of every unsuspecting investor they referred to the scheme by selling it as a forex trading company.

At the height of what has now been declared a mega scam by investors, several of these top agents and promoters like Daniel Onoja, Tomiwa Orunnipin and Bonaventure Igboanugo allegedly earned over $50,000 weekly as finders’ fee commissions from 1000s of unsuspecting Nigerians whom they kept leading to believe that Omegapro was a legit Forex Trading Company. Cumulatively, they allegedly earned over $2 million each in just a couple of years.

The Dubai company allegedly owned by known Dubai-based scammers such as Andreas Szackas, Dilawar Singh, and Mike Simms with a long history of scamming people went as far as giving the investors a back office that showed that forex trading was going on in the company. These alleged forex trading activities have since been exposed by the USA CFTC as an elaborate scam to lure in people interested in forex trading on a global level.

According to Barrister Banwo, top promoters and agents of the biggest global forex scams in history allegedly used the illegal commissions and proceeds from this Omegapro Ponzi scheme to buy huge mansions in choice places in Nigeria, Canada, the USA, and the United Kingdom leaving investors in pain.

“Daniel Onoja recently celebrated the purchase of a multi-million-dollar house in Canada, while Leo Bonaventure, recently posted videos of the housewarming of his own amazing multi-billion naira estate in Lagos. On his part, Leo Bonaventure recently obtained a micro-banking license,” Banwo said.

While the promoters of the alleged scam smiled at the bank, investors have been crying having realised that the alleged due diligence said to have been conducted was non-existent, and their funds gone.

Interestingly, an investigation has now shown that experts in forex trading had for the past three years been sounding the alarm bells that Omegapro was a scam and a Ponzi scheme.

These experts wrote articles and posted videos about Omegapro, however, these Nigerian top agents and promoters pretended they did not see any of these warning signs as they continued to promote Omegapro as a foolproof investment.

Climax Of The Scam

The pains of Omegapro’s investors began in September 2022, when Omegapro Dubai leaders, their collaborators all over the world, and Nigeria suddenly announced that its system had been hacked, and it stopped releasing payments of matured investments to investors all over the world. A few weeks later, the Dubai owners announced that they were migrating all their investors’ accounts to a new company called Brokers Domain until they could fix the breach in their system. Investors all over the world started getting nervous with some asking tough questions.

Then around April 2022, while over $1 billion of investors’ money in over 70 countries remained frozen, the owners and their top agents and collaborators announced the formation of a new company called Go Global and began aggressively recruiting Omegapro investors to invest in the new company with promises that their investments in Omegapro would soon be released.

Many investors fell for this and started promoting the new Go Global company, while others started seeing the handwriting on the wall.

Finally, in August 2023, the Omegapro owners based in Dubai, and their top promoters and agents announced that they would not be able to pay anyone’s Omegapro investment because the United States CFTC had frozen their accounts over some investigations affecting one of their partners named Mike Simms. However, they could not explain how Omegapro money could have been seized in the USA when they had earlier confirmed that the company does not have any office in the USA and did not have any license to operate direct or financial transactions in the USA.

As suspicions grew, with many investors asking for more details of this shocking announcement, Omegapro leaders abruptly closed its doors, and many of their top Nigerian agents and promoters also went underground, leaving thousands of investors all over the world, including over 250,000 Nigerian investors in despair.

The company’s Dubai-based owners, Dilawar, Singh, and Paulo, and other top agents allegedly made millions of dollars in investments from over 70 countries all over the world, including an estimated N200 billion coming from Nigerian investors.

Amidst reports of a petition to the Economic and Financial Crimes Commission (EFCC), Interpol, and a pending class action lawsuit by affected Nigerian investors in the name of Omegapro Action Nigeria, one is forced to X-ray the involvement of these agents and promoters all over the world, especially those of Omegapro agents in Nigeria who aided and abetted the Dubai company to scam their citizens.

Questions such as were they complicit in the scheme, did they knowingly promote a fraudulent venture, or were they also victims of deception, were they willing accomplices, unwitting victims, should they be made to refund the billions of Naira they received in commissions for luring unsuspecting members of the public into parting with their hard-earned money into this global scam have been asked.

Typically, some maintain that the promoters are guilty of not doing their due diligence while promoting Omegapro thus leading to the loss of thousands of Dollars.

For this sect, the ruling is simple, a refund, at the minimum, the commissions earned from the illegal forex trading scheme is a must.

General

FG Insists Prepaid Meter is Free, Warns Nigerians Against Payment

By Adedapo Adesanya

The federal government has reaffirmed that electricity meters being deployed under the Distribution Sector Recovery Programme (DISREP) are free for customers, warning Nigerians not to pay any money for meter supply or installation.

The Director General of the Bureau of Public Enterprises (BPE), Mr Ayodeji Ariyo Gbeleyi, stated this in Abuja at a joint media briefing on DISREP with the managing directors of Nigeria’s 11 Electricity Distribution Companies (DisCos). DISREP is financed through a $500 million World Bank facility.

The DG said the concessional nature of the funding, which comes at single-digit interest rates, makes it more sustainable than commercial borrowing and supports long-term stability in the power sector.

Under the DISREP IPF, 3.2 million smart meters are being procured and installed nationwide over four years through competitive international and local bidding. According to him, close to 700,000 meters have already been delivered, while about 200,000 have been installed across different DisCos.

The DG said, “With DISREP and other Federal Government interventions, the journey to power sector reliability is underway. DISREP is not just a short-term intervention, but part of a broader and coordinated plan of the Renewed Hope Agenda of President Bola Ahmed Tinubu, GCFR, towards building a financially viable and service-oriented electricity market

“Nigerians deserve a power sector that works, one that delivers reliable electricity, protects consumers, ensures value for money, and supports economic growth.

“Together, we shall achieve that! The supply and installation of these meters for customers is free.

It was also disclosed that the government had already paid the contractors to supply and install the meters. DISREP is integrated with other metering initiatives, including the Presidential Metering Initiative and the Meter Acquisition Fund, to accelerate the closing of Nigeria’s metering gap.

On his part, the Managing Director of Abuja Electricity Distribution Company, Mr Chijioke Okwuokenye, warned customers not to pay for meters.

“These meters are to be deployed and installed freely. Anybody asking you to bring money should be reported,” he said.

MD of Eko Electricity Distribution Company (Eko Disco), Mrs Wola Joseph-Condotti, said the company is working closely with the authorities to weed out bad eggs who extort money from customers for meter procurement and installation.

The programme offers significant benefits to consumers, including the removal of upfront meter purchase and installation costs, accurate billing, the elimination of arbitrary estimated billing, improved service accountability by DisCos, better transparency and dispute resolution, and long-term improvements in supply reliability as the sector becomes more financially viable.

For DisCos, Mr Gbeleyi said DISREP provides access to concessional World Bank financing for metering and network upgrades, reduces Aggregate Technical, Commercial and Collection (ATC&C) losses, improves liquidity and revenue assurance, and strengthens operational performance for long-term investment.

He disclosed that $250 million of the facility is dedicated to Investment Project Financing, which supports bulk procurement of the 3.2 million smart meters, deployment of Meter Data Management Systems, and provision of technical assistance and capacity-building programmes to strengthen DisCos’ operations and processes.

Describing DISREP as a landmark transaction, Mr Gbeleyi said it is the first initiative of its kind in which the government, beyond investing in distribution network infrastructure, is deploying meters at scale to bridge the country’s metering gap. He cited official figures showing that Nigeria currently has about 5.66 million unmetered electricity customers.

“The plan is to quickly close that gap. These meters are for everybody. They are for Nigerians. Priority is on unmetered customers,” he said.

He clarified that while the policy targets unmetered customers, DisCos have been allowed to deploy up to 20 per cent of the meters to replace faulty or technologically obsolete units, following feedback from the field.

General

NSC Revamps PSSP to Solve Complaints, Boost Ease of Doing Business in Ports

By Adedapo Adesanya

The Nigerian Shippers’ Council (NSC) has successfully concluded the review of the Port Service Support Portal (PSSP) application, which is aimed at ensuring seamless handling and efficient resolution of stakeholders’ commercial disputes across the maritime sector.

The Head of NSC-ICT, Mr Benjamin Ivwigheghweta, and his team; the Head of the Complaints Unit, Mr Bashir Ambi and his team; as well as consultants from BrandOne, all collaborated to complete the platform’s final implementation stage.

Mr Ivwigheghweta expressed satisfaction with the successful integration of the revamped PSSP for streamlined dispute resolution. He encouraged the team to fully engage with the new system and to ask questions where necessary, ensuring that every member is well equipped to meet stakeholder needs with precision and efficiency.

On his part, Mr Ambi applauded the deployment of the PSSP as a tool for accelerating grievance resolution, adding that the platform would significantly strengthen the council’s dispute resolution framework by promoting transparency, boosting stakeholder confidence, and generating reliable, data-driven records to support national economic growth.

He further commended the ICT team for its unwavering support-particularly in ensuring extended network availability to support the Unit’s after-hours operations.

Describing the PSSP as a critical modern upgrade for dispute resolution, Mr Ambi revealed that the Council’s operations are now about 90 percent digital. “We rely heavily on electronic platforms to serve our stakeholders,” he said, adding that the ICT Unit has remained the backbone of these efforts by providing consistent support, even over weekends, to ensure uninterrupted online service delivery.

This digital-first approach, he noted, keeps the NSC at the forefront of maritime efficiency.

Following a productive three-hour technical review and interactive question and answer session, the PSSP is now in its final phase.

The next steps include the configuration of individual user access by the ICT Unit and a live demonstration of the platform to Management. Upon completion of these tasks, the council will be ready to go live-ushering in a new era of digital efficiency in port service delivery.

The Port Service Support Portal was officially launched by the former Vice President, Mr Yemi Osinbajo, in June 2016 in Abuja. The launch was held alongside the unveiling of the Port Harmonized Standard Operating Procedures (SOPs). The portal was designed as an online, real-time platform to enhance service delivery, address stakeholder complaints, and curb corruption at Nigerian ports.

General

Tinubu Deploys Army to Kwara, Condemns Terrorist Attack

By Adedapo Adesanya

President Bola Tinubu has deployed an army battalion to Kaiama district in Kwara State after suspected jihadist fighters killed about 170 people in an overnight attack on Tuesday.

The terrorists stormed Woro and Nuku communities in Kaiama Local Council, according to Kwara State lawmaker, Mr Saidu Ahmed.

The violence highlights fears that jihadist factions prevalent in Northern Nigeria are pushing south along the Niger-Kwara axis toward the Kainji forest.

According to a statement from the Presidency, the new military command will spearhead Operation Savannah Shield to checkmate the barbaric terrorists and protect defenceless communities.

He condemned the attack as “cowardly and barbaric,” saying the gunmen targeted villagers who had rejected attempts to impose extremist rule.

“It is commendable that community members, even though Muslims, refused to be conscripted into a belief that promotes violence over peace,” President Tinubu said in the statement.

The President urged collaboration between federal and state agencies to provide succour to members of the community and ensure that those who committed the atrocities do not go scot-free.

President Tinubu prayed for the repose of the souls of the deceased and condoled with those who lost family members as well as the people and government of Kwara State.

Similarly, suspected bandits stormed Doma community in Tafoki Ward, Katsina State, on Tuesday afternoon, killing several residents, injuring many others and setting vehicles and houses ablaze.

There were conflicting figures over the casualty toll, with police putting the number of deaths at 13, while the executive chairman of Faskari Local Council estimated more than 20.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn