Economy

Crypto Exchanges – How to Choose the Right One

With the prevalence of cryptocurrencies in the digital age, many businesses and investors regularly use the crypto market to build their portfolios and gradually amass a passive income. However, due to the volatility of the market and fluctuations in prices, trading can be risky, as prospectors may lose all their deposited funds with no reward. Crypto exchanges operate as platforms to help you navigate the cryptocurrency market.

Qualities of a Digital Currency Exchange

These facilities make accessing the crypto market more convenient for you. Before exchanges existed, you had to use a command line and type in a command to send crypto coins to your peers. Over time, developers designed user interfaces to make the process easier as cryptocurrency acquired a mass audience of people interested in the cryptoverse and performing related transactions.

Financial Security

Whether you want to buy Bitcoin in Nigeria or another digital coin, you must be cautious of scams and frauds that could mislead you into giving away your personal information. Secure exchanges will offer transparent services and be open about what they contribute and how they use your sensitive information. They will provide a privacy policy describing what details they employ and for what purpose. Secondly, legit services typically have a physical address for their headquarters. You will know the legal ramifications of your expenditures and how to confront issues if you have the address. Otherwise, you will lose money and need to understand where it went.

Reputable Services

The best cryptocurrency exchanges will have positive reviews with testimonies about the offered services. Remember, you need to be able to trust this financial institution before you confide your private data, including identifiable and monetary information, in it. What have other users said about the platform’s security? How is the exchange’s customer service? Reviews should be able to answer your questions about the facility and whether you should invest in it.

Pairs and Transaction Fees

Some platforms offer access to hundreds of pairs, while others provide trading options for only a few. The platform you choose depends on your needs and how diverse you want your portfolio to be.

Remember that most exchanges may incur transaction fees depending on the transaction size, network-related costs, and your account activity. Because crypto transactions occur on the blockchain, blockchain participants require a processing fee for their work on the chain. Some exchanges may charge fees for the transaction, so if you plan to trade daily, consider one with a fair payment.

ChangeNOW As an Effective Service

Founded in 2017, ChangeNOW is a quick and efficient exchange facility. Its headquarters are in Seychelles, and it is operated by proficient blockchain developers. It has over 70,000 trading pairs and 700 coins available with no trading limits. You may perform a high-value transaction at will, and ChangeNOW will process it as swiftly as possible. Typically, its processing speed is between 5 and 20 minutes, but larger blocks take longer to convert.

As a non-custodial exchange service, ChangeNOW has your personal safety and financial protection in mind because it does not require registering to use its services. Instead, you only need a crypto wallet and its payout address to hold your assets. In this way, you do not need to worry about financial theft while using the platform. Its servers do not store identifiable information; you remain anonymous with ChangeNOW.

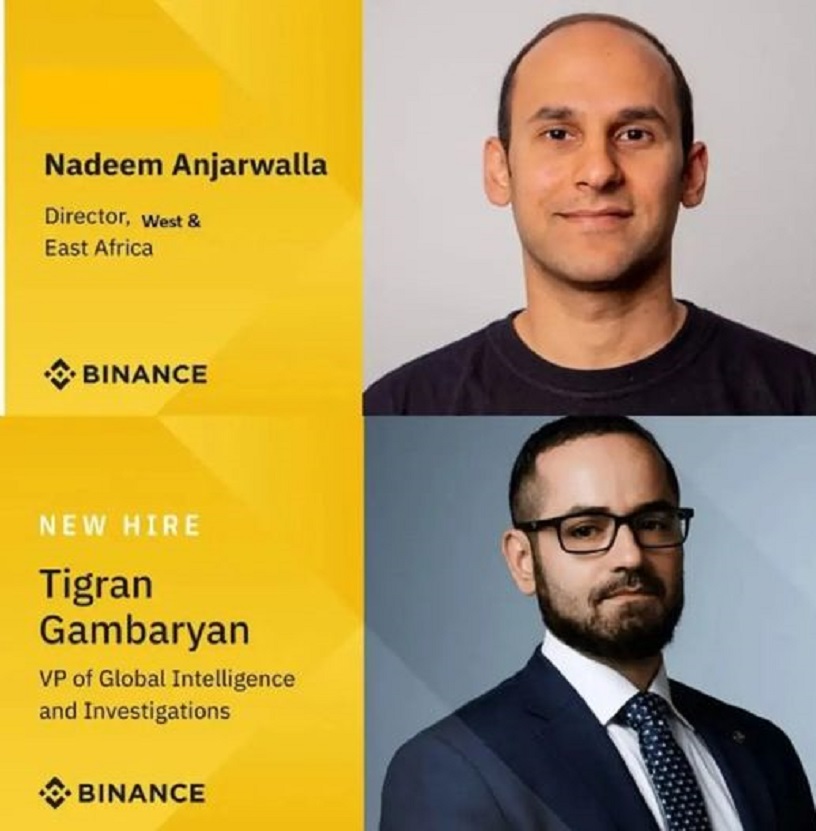

When you are ready to make a crypto trade, ChangeNOW finds and offers the best exchange rate, ensuring you get the best price. Multiple trading platforms like Binance and Kucoin have integrated ChangeNOW to provide these rates. With any swap, the platform only charges network or mining fees; it does not impose service fees.

In addition to swapping cryptocurrency pairs, you can buy crypto through ChangeNOW using fiat currency. The platform uses Simplex, a third party, to handle these transactions so you can utilize Visa, Mastercard, and other card providers to purchase crypto. Keep in mind network fees apply to these transactions depending on the currency.

The Bottom Line

Do your research before officially choosing a platform, and be aware of the associated risks with crypto trading. If hackers compromise a service, your funds may disappear. However, knowing an exchange’s trustworthiness and authenticity can help you decide how secure your digital assets will be.

Economy

Nigeria’s Pension Fund Assets Jump 22% to N27.45trn in 2025

By Adedapo Adesanya

Nigeria’s pension fund assets surged by 22 per cent or N4.94 trillion to N27.45 trillion in 2025 from N22.51 trillion in 2024, according to the latest data from the National Pension Commission (PenCom).

The year-on-year growth underscores the resilience of the Contributory Pension Scheme (CPS), supported by steady employer and employee contributions, improved compliance and stronger investment returns across fixed income and equities.

The achievement capped a year of uninterrupted monthly expansion, reinforcing the sector’s role as one of Nigeria’s most stable pools of long-term domestic capital, despite a challenging macroeconomic environment, an industry analyst said.

Pension assets rose progressively from N22.86 trillion in January 2025 to N23.26 trillion in February and N23.38 trillion in March. By mid-year, assets had climbed to N24.62 trillion, before accelerating in the second half to N25.89 trillion in August, N26.66 trillion in October, N27.05 trillion in November and ultimately N27.45 trillion in December.

On a year-on-year basis, the industry expanded significantly. Total pension assets stood at N22.51 trillion in December 2024. The increase of N4.94 trillion over 12 months translates to approximately 22 per cent growth, reflecting both fresh contributions and investment returns.

The 12-month growth and broader annual expansion are driven by three primary factors: sustained pension contributions, investment income across asset classes, and the expansion of RSA funds.

Mandatory employer and employee contributions under the CPS continued to provide steady inflows, supported by improved compliance among corporate employers, and the expansion of coverage contributed to the accumulation of assets throughout the year.

PFAs benefited from improved yields in fixed income markets and positive performance in domestic equities during parts of the year. Both realised and unrealised gains contributed to the increase in assets under management, while the bulk of the growth came from Retirement Savings Account (RSA) Funds, particularly Funds II and III, which account for the largest share of contributors.

RSA Fund II, the default fund for active contributors below 50 years, grew from N9.24 trillion in December 2024 to N11.52 trillion in December 2025, an increase of N2.28 trillion.

RSA Fund III rose by about N1.10 trillion to N7.02 trillion, while RSA Fund IV, designed for retirees, also recorded significant growth, adding roughly N630 billion during the year.

These three funds collectively represent the core of pension savings within the system and were instrumental in driving the overall asset expansion.

A review of portfolio composition shows that federal government securities remained the dominant investment class, accounting for the largest share of pension assets. Holdings in FGN bonds and treasury bills continued to provide stability and predictable returns.

Corporate debt securities and money market instruments also contributed meaningfully, offering attractive yields amid tight monetary conditions. Meanwhile, domestic equities supported asset growth during market rallies, helping diversify returns.

The balanced allocation across fixed income, equities and other instruments helped cushion portfolios against volatility while sustaining steady growth in total assets.

With assets at N27.45 trillion, the sector continues to deepen its role in long-term domestic capital formation.

Economy

NASD OTC Exchange Drops 0.92%

By Adedapo Adesanya

There was a 0.92 per cent correction at the NASD Over-the-Counter (OTC) Securities Exchange on Tuesday, February 17, pushed by declines in the share prices of 11 Plc and Central Securities Clearing System (CSCS) Plc.

11 Plc lost N28.80 during the session to trade at N263.00 per share compared with the previous day’s N291.80 per share, and CSCS Plc weakened by N4.84 to N75.25 per unit from N80.09 per unit.

Consequently, the NASD Unlisted Security Index (NSI) slid by 36.87 points to 3,964.55 points from 4,001.42 points, and the market capitalisation lost N22.06 billion to end N2.372 trillion compared with Monday’s value of N2.394 trillion.

Business Post reports that there were five price gainers yesterday, which could not lift the market.

They were led by FrieslandCampina Wamco Nigeria Plc, which appreciated by N5.89 to N77.24 per share from N71.35 per share, First Trust Mortgage Bank Plc grew by 8 Kobo to 90 Kobo per unit from 82 Kobo per unit, Geo-Fluids Plc increased by 8 Kobo to N3.58 per share from N3.50 per share, Lagos Building Investment Company (LBIC) Plc gained 7 Kobo to close at N3.48 per unit versus N3.41 per unit, and Acorn Petroleum Plc added 2 Kobo to sell at N1.33 per share compared with the previous day’s N1.31 per share.

During the session, the volume of transactions slid 91.0 per cent to 4.2 million units from 46.2 million units, the value of trades declined 88.4 per cent to N61.9 million from N532.8 million, and the number of deals shrank 2.3 per cent to 43 deals from 44 deals.

CSCS Plc remained the most active stock by value (year-to-date) with 31.9 million units exchanged for N1.9 billion, trailed by Resourcery Plc with 1.05 billion units worth N408.6 million, and Geo-Fluids Plc with 71.8 million units valued at N299.1 million.

The most traded stock by volume (year-to-date) remained Resourcery Plc with 1.05 billion units sold for N408.6 million, followed by Geo-Fluids Plc with 71.8 million transacted for N299.1 million, and CSCS Plc with 31.9 million units traded for N1.9 billion.

Economy

Nigerian Stocks Give up 0.47% to Profit-taking

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited suffered a 0.47 per cent decline on Tuesday a day after hitting all-time highs in its key performance barometers.

This was influenced by profit-taking in Nigerian stocks, as investors cashed out from the gains recorded in the past trading sessions.

According to data, the All-Share Index (ASI) was down by 899.50 points during the session to 189,362.94 points from the preceding session’s 190,262.44 points, and the market capitalisation decreased by N577 billion to N121.553 trillion from the N122.130 trillion achieved a day earlier.

Business Post reports that the sell-offs were intense yesterday as four of the sectors tracked ended in the red.

The consumer goods space improved by 2.54 per cent, but this was not enough to save Customs Street from crumbling when market activity ended at 2:30 pm.

The banking index was down by 3.69 per cent, the insurance space tumbled by 0.57 per cent, the industrial goods counter depleted by 0.50 per cent, and the energy sector dipped 0.06 per cent.

Despite the loss, the market breadth index remained positive after the bourse closed with 44 price gainers and 40 price losers, implying strong investor sentiment.

The trio of Mecure, SAHCO, and Zenith Bank gave up 10.00 per cent each to trade at N93.60, N117.00, and N80.55 apiece, while RT Briscoe depreciated by 9.95 per cent to N14.12, and Tripple G crashed by 9.77 per cent to N6.00.

Conversely, ABC Transport zoomed off by 9.94 per cent to N9.07, Zichis jumped 9.93 per cent to N13.06, Red Star Express appreciated by 9.87 per cent to N29.50, Meyer grew by 9.81 per cent to N22.95, and Japaul increased by 9.78 per cent to N3.03.

As for the activity chart, investors traded 1.2 billion stocks worth N60.2 billion in 86,607 deals compared with the 1.1 billion stocks valued at N64.0 billion transacted in 64,821 deals on Monday, representing a fall in the trading value by 5.94 per cent, and a surge in the trading volume and number of deals by 9.09 per cent and 33.61 per cent apiece.

Access Holdings ended the session as the busiest equity after the sale of 103.5 million units for N2.7 billion, Zenith Bank traded 93.1 million units valued at N8.0 billion, Japaul transacted 73.8 million units for N223.6 million, First Holdco exchanged 54.3 million units worth N2.6 billion, and Secure Electronic Technology sold 45.9 million units valued at N83.3 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn