Economy

How Do Crypto Market Fluctuations Affect The Startups Make Monitoring Tools?

It is evident by research that when investors or business owners start a new business or invest in a part of a business, they conduct thorough research to gather as much information as they can to make the best decision.

The rising adoption rate of cryptocurrency and blockchain technology has started a new trend in the IT sector. More and more startups are getting launched and are offering their services that are in one or more ways associated with the crypto sector.

One such way is offering products and services for monitoring tools. As you know, the crypto market, however, is known for its volatility. Unlike established stock markets, cryptocurrency prices can fluctuate wildly based on various factors, including news events, regulatory changes, and market sentiment.

Monitoring tools are developed to help the crypto market participants with real-time data and insights, enabling them to track price movements, analyze trends, track on-chain activity, and manage risk.

These work like an assistant for traders, investors, and other crypto market participants to make informed decisions and navigate the volatile landscape effectively. But do you know the market fluctuation can also affect the companies or especially the startups that are developing these monitoring tools?

Stay with us to learn about how crypto market volatility impacts startups developing monitoring tools.

The Impact Of Crypto Market Fluctuations On Startups

The market as we see it today has evolved a lot and has become more unpredictable. Transactions are carried out at lightning speed because of the involvement of AI-based tools that do the task for human traders.

But do you know monitoring tools are also powered by AI so that they keep up with the speed? Tools like bitcoin bank breaker are used by traders to gauge the market and stay updated with the price movements. Therefore, market fluctuations also affect the demand for monitoring tools in many ways.

The Demand for Monitoring Tools increases During Volatility

Cryptocurrency market fluctuations are both a blessing and a curse for startups developing monitoring tools. While volatility can present challenges, it also creates a surge in demand for their services. But how is that so?

1 – When prices swing wildly, the need for real-time data and actionable insights becomes paramount. Investors and traders rely heavily on monitoring tools to make informed decisions in a rapidly changing market. Features like live price feeds, order book depth analysis, and charting tools become crucial for navigating volatility.

2 – Market fluctuations heighten the need to track not just prices but also underlying trends and on-chain activity. Monitoring tools that offer comprehensive data analysis, including social media sentiment tracking and whale wallet movements, become invaluable assets for market participants seeking to anticipate price movements and make strategic decisions.

Crypto market volatility acts as a catalyst for the adoption of monitoring tools. As the market becomes more volatile, the demand for these tools to navigate the uncertainty intensifies, presenting a significant growth opportunity for startups in this space.

Funding and Investment Challenges

However, crypto market fluctuations can also pose significant challenges for startups. A major hurdle is the impact on funding and investment.

Downturns in the crypto market can significantly erode investor confidence. Venture capitalists and angel investors have become more cautious, leading to a decrease in available funding for blockchain startups. This can stifle the growth and development of monitoring tool startups, hindering their ability to innovate and expand their offerings.

Securing funding becomes an uphill battle for startups during bearish market cycles. Investors may prioritize established players with proven track records, making it difficult for newcomers to secure the capital needed to compete effectively.

Talent Acquisition and Retention

Furthermore, crypto market fluctuations can have a ripple effect on talent acquisition and retention within the blockchain space.

Volatility can impact salaries and job security within the industry. During downturns, companies may resort to salary freezes or layoffs to stay afloat. This creates uncertainty for talented developers and analysts, potentially discouraging them from joining or staying with monitoring tool startups.

Startups may find it challenging to attract and retain top talent in a volatile market. Established companies with more resources may become more attractive to skilled professionals seeking stability and higher compensation. This can hinder startups’ ability to build strong development teams and maintain a competitive edge.

While crypto market fluctuations create a surge in demand for monitoring tools, they also present funding and talent acquisition challenges that startups need to navigate strategically.

Monitoring Tools Adaptations for Fluctuations

Crypto market fluctuations demand a dynamic approach from monitoring tool startups. But do you know how these tools can adapt to cater to user needs and prosper in a volatile environment?

By Focusing On User Needs During Different Market Conditions

Effective monitoring tools need to adapt their functionalities to cater to the specific needs of traders and investors during both bullish and bearish markets.

In The Bullish Markets

During periods of rising prices, features like technical analysis tools, margin trading support, and portfolio optimization tools have become highly sought after. Monitoring tools can provide users with charting functionalities to identify bullish trends, calculate potential returns, and optimize their portfolios for maximum gain.

In The Bearish Markets

When prices plummet, risk management and sentiment analysis become crucial. Monitoring tools can offer features like stop-loss order automation, volatility alerts, and social sentiment tracking. These features help users mitigate losses, identify potential market bottoms, and make informed decisions during downturns.

With The Help Of Data Aggregation And Advanced Analytics

The effectiveness of any monitoring tool hinges on the quality and comprehensiveness of its data sources. But how can startups improvise their offerings in this critical area?

Monitoring tools need to aggregate data feeds from a variety of reliable sources, including major cryptocurrency exchanges, blockchain explorers, and on-chain analytics platforms. This ensures users have access to the most up-to-date and accurate market information to make informed decisions.

With the vast amount of data generated in the crypto market, leveraging Artificial Intelligence (AI) and Machine Learning (ML) becomes crucial. These technologies can analyze market trends, identify arbitrage opportunities, and predict price movements with greater accuracy. By integrating AI and ML into their tools, startups can empower users with actionable insights that go beyond basic data visualization.

By Emphasizing Security And Transparency

In a volatile market, security and transparency become paramount concerns for users. With rising cyber threats in the crypto space, monitoring tool startups need to prioritize strong security measures.

This includes implementing secure data storage practices, employing encryption protocols, and adhering to industry best practices for user privacy protection. Upholding a strong security posture builds user trust and confidence in the platform.

Startups should offer clear and transparent pricing models for their monitoring tools. Users should be able to easily understand the different pricing tiers and the features associated with each. Furthermore, maintaining clear communication with users is essential.

Regular updates on platform improvements, market insights, and security measures can foster a sense of trust and loyalty among users.

Wrapping Up

The future of monitoring tools in the crypto market remains intertwined with the overall market dynamics. While crypto market fluctuations present challenges, they also highlight the critical role these tools play in navigating a volatile landscape.

As the market matures and user demand evolves, monitoring tools will likely see continued development in areas like AI-powered analytics, advanced risk management features, and an even greater emphasis on data security and user privacy.

Economy

Nigerian Senate to Pass 2026 Budget March 17

By Adedapo Adesanya

The Senate, through its Committee on Appropriations, has fixed March 17, 2026, as the tentative date for the final consideration and passage of the N58.472 trillion 2026 Appropriation Bill.

This was made known after a special session on Friday, where February 2 to 13, 2026, was approved for the consideration of budget estimates at the committee level.

The committee equally fixed Monday, February 9, 2026, for a public hearing on the budget proposal.

Chairman of the committee, Mr Solomon Olamilekan Adeola, further disclosed that Thursday, March 5, 2026, has been scheduled for an interactive session between members of the committee and key economic managers of the federal government, including the Ministers of Finance and Coordinating Minister of the Economy, Mr Wale Edun, as well as the Minister of Budget and National Planning, Mr Atiku Bagudu.

According to him, February 16 to 23, 2026, has been earmarked for the submission of reports on budget defence by various standing committee chairmen, ahead of the presentation of the Appropriations Committee’s report to the Senate on March 17.

He disclosed that while the Senate leadership initially preferred the budget to be passed by March 12, 2026, he successfully appealed for an additional week to allow for more thorough scrutiny.

To aid detailed examination of the estimates, Senator Adeola said hard copies of the 2026 budget have been printed and distributed to chairmen and members of the Senate’s standing committees.

On December 19, 2025, President Bola Tinubu presented a budget proposal of N58.47 trillion for the 2026 fiscal year titled Budget of Consolidation, Renewed Resilience and Shared Prosperity to a joint session of the National Assembly.

The budget has a capital recurrent (non‑debt) expenditure standing at N15.25 trillion, and the capital expenditure at N26.08 trillion, while the crude oil benchmark was pegged at $64.85 per barrel.

Mr Tinubu said the expected total revenue for the year is N34.33 trillion, and the proposal is anchored on a crude oil production of 1.84 million barrels per day, and an exchange rate of N1,400 to the US Dollar.

In terms of sectoral allocation, defence and security took the lion’s share with N5.41 trillion, followed by infrastructure at N3.56 trillion, education received N3.52 trillion, while health received N2.48 trillion.

Economy

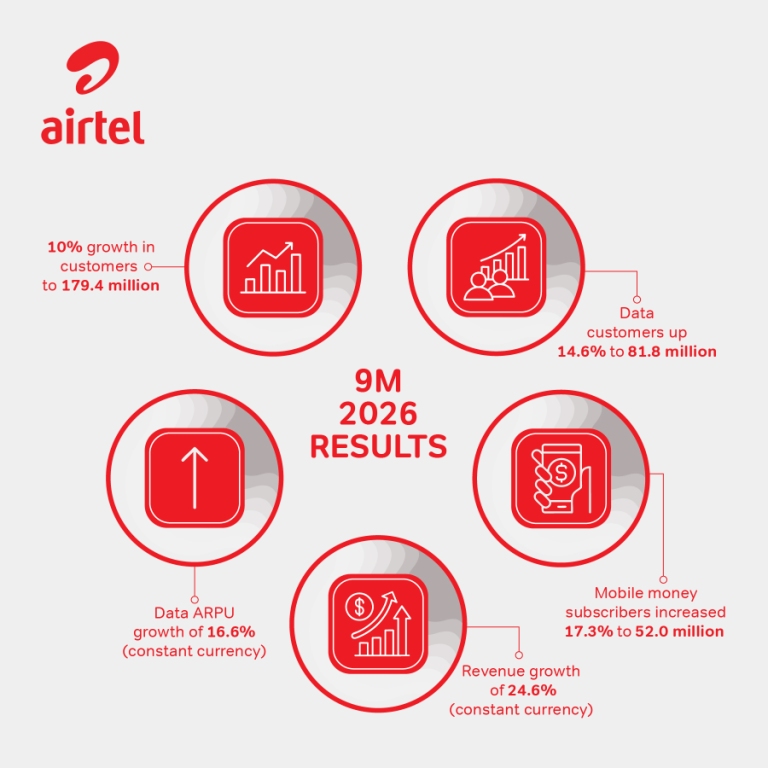

Airtel Africa Grows Earnings to $4.7bn in Nine Months

By Aduragbemi Omiyale

About $4.7 billion was generated by Airtel Africa Plc in nine-month period ended December 31, 2025, details of the company’s financial statements revealed.

The telco disclosed that in the period under review, mobile services revenue grew by 23.3 per cent in constant currency, as data revenues, the largest contributor to group revenues, increased by 36.5 per cent, with voice revenues growing by 13.5 per cent.

In the same vein, EBITDA grew by 35.9 per cent in reported currency to $2.3 billion, with EBITDA margins expanding further to 48.9 per cent from 46.2 per cent in the prior period.

The third quarter of the fiscal year witnessed a further sequential increase in EBITDA margins to 49.6 per cent, driving EBITDA growth of 31.0 per cent in constant currency and 40.8 per cent in reported currency.

The financial results showed that profit after tax of $586 million improved from $248 million in the prior period. Higher profit after tax in the current period was driven by higher operating profit and derivative and foreign exchange gains of $99 million versus the $153 million derivative and foreign exchange losses in the prior period.

Commenting, the chief executive of Airtel Africa, Mr Sunil Taldar, said, “These results highlight the strength of our strategy, with strong operating and financial trends across the business. During the quarter, we accelerated investment to enhance coverage and data capacity while also expanding our fibre network.

“Coupling this investment with innovative partnerships, strengthens our customer proposition and positions us to capture the considerable growth opportunity across our markets.

“Digitisation, technology innovation and embedding AI in our processes will also optimise the customer experience with increased digital offerings and closer integration of GSM and Airtel Money services allowing us to unlock the strong demand across our markets. Smartphone adoption continues to increase with penetration of 48.1 per cent, and we are seeing solid progress in the development of our home broadband business, reflecting the need for reliable, high-speed connectivity across our markets.

“Our push to enhance financial inclusion across the continent continues to gain momentum with our Mobile Money customer base expanding to 52 million, surpassing the 50 million milestone. Annualised total processed value of over $210 billion in Q3’26 underscores the depth of our merchants, agents and partner ecosystem, and remains a key player in driving improved access to financial services across Africa. We remain on track for the listing of Airtel Money in the first half of 2026.

“Disciplined execution on cost efficiency, alongside accelerating revenue growth has enabled another sequential improvement in our quarterly EBITDA margin to 49.6 per cent, – underpinning constant currency EBITDA growth of 31 per cent – and we remain focussed on driving further incremental margin improvements.

“Our strategic priorities remain clear: to keep investing in best in class connectivity, accelerate financial inclusion through our mobile money platform and deliver a great customer experience. These results reinforce our confidence in the long term potential of our markets and our ability to create value for all our stakeholders.”

Economy

Interest Rates May Remain Elevated Despite Inflation Cooling—PwC

By Adedapo Adesanya

According to PricewaterhouseCoopers (PwC), Nigeria’s benchmark interest rate is likely to remain elevated in 2026 even as inflation shows signs of easing.

Speaking at the PwC–BusinessDay Executive Roundtable on Nigeria’s 2026 budget and economic outlook in Lagos on Thursday, the Chief Economist and Head of Strategy at PwC, Mr Olusegun Zaccheaus, said expectations of aggressive interest rate cuts might be premature even with the core factor – inflation – seen cooling.

“Interest rates may remain elevated despite inflation cooling for most of 2025,” Mr Zaccheaus said. “Perhaps not by the 500 basis points some hope for, due to the need to manage liquidity.”

The Central Bank of Nigeria (CBN) had more than doubled its policy rate from 2022 levels in a bid to rein in inflationary pressures, before implementing a 50 basis-point cut in September that brought the monetary policy rate to 27 per cent.

The move followed a sharp moderation in inflation from its late-2024 peak. Inflation slowed to 15.15 per cent in December 2025, while the economy expanded by 3.98 per cent in the third quarter, its strongest quarterly growth in years.

At the last Monetary Policy Committee (MPC) meeting of the CBN in November 2025 voted to keep the interest steady.

The PwC official warned that warned that underlying risks, including exchange-rate volatility, fiscal pressures and global uncertainty, continue to complicate the outlook.

Mr Zaccheaus said that a major challenge for the apex bank will be to control the volume of money circulating in the economy.

He advised that liquidity management remains critical as excess cash can quickly undermine dis-inflation efforts particularly as the 2027 election cycle is around the corner.

He said that Nigeria typically experiences rapid growth in money supply ahead of election cycles, driven by increased government spending and political activity, adding that without careful coordination, such expansions risk fueling inflation and weakening investor confidence.

“The responsibility of the central bank is to ensure liquidity does not grow in a way that has a negative macroeconomic impact,” Mr Zaccheaus said.

He noted that a stable currency environment would support improved capital allocation and investment planning.

“FX stability is crucial,” Mr Zaccheaus said. “It gives investors confidence and allows businesses to plan. But that stability depends on disciplined policy execution.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn