Economy

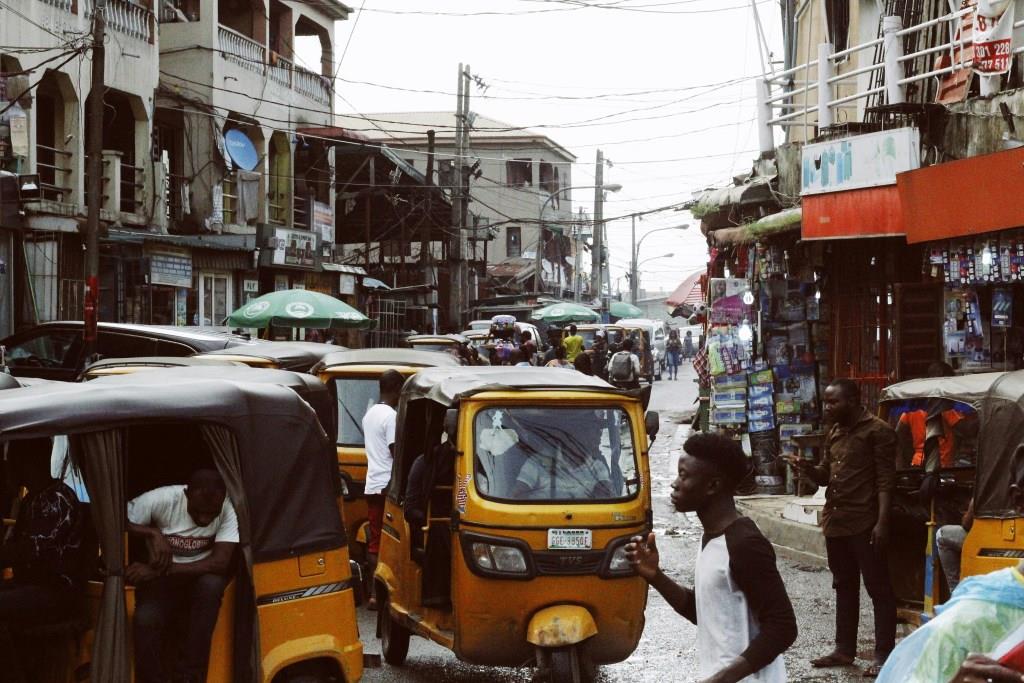

Nigeria Hit with the Worst Fuel Scarcity Yet

Nigeria is the main oil producer in Africa and is currently the continent’s largest crude oil exporter. This status however holds no value for Nigerians who have now been accustomed to fuel scarcity in varying degrees being a constant challenge.

In 2024 alone, the country has been hit with two fuel scarcity crises. The first occurred from April to May when the fuel cost increased by 68.01% on a year-on-year basis from N842. 25 per litre in April 2023 to N1415. 06 per litre in April 2024. The second crisis is ongoing. It has seen the petrol price rise to N1,050 per liter in a matter of days from the average of N770.54 recorded in July 2024. This fuel scarcity is another addition to the ongoing cost of living crisis Africa’s largest economy is experiencing.

Nigeria’s Cost of Living Crisis Continues to Soar

During his inaugural speech on May 29, 2023, President Tinubu announced an end to fuel subsidies in the country, citing that continuing subsidies were unsustainable and a drain on public finances. The president acknowledged in another address on June 12, 2023, that although halting the subsidies added a burden on the people of Nigeria it was crucial to the country’s economic survival. Over a year after this bold move by the government, most Nigerians are struggling to make ends meet sparking protests across the country.

NOIPolls, an independent pollster in West Africa disclosed in 2023 that 63% of adult Nigerians surveyed across the country desire to relocate to other countries. The lack of economic opportunities is the primary motivator for leaving Nigeria. As the “Japa”— a colloquial term for emigration— itch among Nigerians intensifies, the youth who can’t leave have sought to earn an income remotely working for foreign companies, gambling on international online casinos, and working multiple low-level jobs.

The prices of food, cooking gas, medication, and public transport have risen since President Tinubu assumed office in May 2023. This rising cost of living has been a result of the naira’s poor performance against the dollar and the instability of the country’s economy. Nigerians have had to survive through high levels of inflation not experienced before in the country for three decades.

According to the World Food Programme, 26.5 million people across the country are projected to face acute hunger between June and August 2024. This is an almost 40% increase from the 18.6 million Nigerians recorded to have faced food insecurity at the end of 2023. This new fuel scarcity crisis has seen Nigerians make long queues at filling stations to access petrol, led to significant increases in transport fares, and resulted in losses for businesses that rely on fuel to power them.

NNPC Explains Cause of Current Fuel Scarcity

In response to rising concerns about fuel scarcity in the country, the Nigerian National Petroleum Corporation Limited (NNPCL) through Dapo Segun, the Vice President, attributed the ongoing fuel scarcity to the impact of the recent heavy rains, lightning, and thunderstorms across the country. Mr Segun explained that the rains had caused saltation in the Estragos channel making navigation difficult and thus hindering the transportation of petroleum products across the country. Additionally, Seun reported that fuel discharge from both onshore and tankers had been suspended occasionally due to lightning and thunderstorms. These three natural extreme weather conditions have made distributing petroleum products across the country challenging.

As the NNPCL vows to resolve the fuel scarcity crisis soon, Nigerians are looking to two other refineries that were set to begin operations to ease the cost of fuel burden. The Dangote Refinery is expected to begin selling petrol in Nigeria by the end of this August. The chairman of the Dangote Group, Aliko Danknote, who had committed to this milestone is positive that his company will meet the target. Additionally, the Port Harcourt refinery is expected to be operational and supplying petroleum products across the country by September 2024 as assured by the group chief executive officer of the NNPCL, Mele Kyari. This will be the third time the refinery’s operational month has been moved this year following its mechanical completion in December 2023.

The Independent Petroleum Marketers Association of Nigeria (IPMAN), on the other hand, has accused the NNPCL of actively contributing to fuel scarcity by failing to provide petroleum products to its members even after payment. IPMAN disclosed that even though payment to the state oil company was made three months ago members have been forced to purchase petroleum products from private depots whose prices are significantly higher. IPMAN is now calling on the government and other key stakeholders in the oil industry to intervene in the situation to lessen these hardships.

Citizens of Africa’s largest crude oil producer and exporter are now no longer surprised by fuel scarcity in their cities. While many try to find ways to survive under the new economic hardships, others opt to leave the country in search of greener pastures. It is evident that Africa’s largest economy is on the brink of collapsing should the government not turn around the economic situation soon.

Economy

Stock Market Gains N2.367trn as All-Share Index Rises 2.06%

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited appreciated by 2.06 per cent on Friday, amid a rush for local equities due to encouraging earnings of companies for 2025.

Business Post reports that the buying pressure was across the key sectors of Customs Street yesterday, with the banking index growing by 2.49 per cent. The energy industry appreciated by 2.05 per cent, the consumer goods counter grew by 0.78 per cent, the insurance space improved by 0.64 per cent, and the industrial goods sector expanded by 0.44 per cent.

At the close of trades, the market capitalisation went up by N2.367 trillion to N117.027 trillion from N114.660 trillion, and the All-Share Index (ASI) gained 3,687.45 points to close at 182,313.08 points compared with the previous day’s 178,625.63 points.

Cornerstone Insurance, Infinity Trust, and Nestle Nigeria appreciated by 10.00 per cent each to sell at N6.38, N9.90 and N2,662.00, respectively, while Okomu Oil rose by 9.99 per cent to N1,327.00, with RT Briscoe up by 9.97 per cent to N17.42.

Conversely, SAHCO depleted by 10.00 per cent to M135.00, Guinness Nigeria lost 9.97 per cent to trade at N103.00, Omatek shrank by 9.39 per cent to N2.99, NPF Microfinance Bank decreased by 6.51 per cent to N5.60, and eTranzact slipped by 6.33 per cent to N10.80.

A total of 53 stocks ended in the green side and 33 stocks finished in the red side, representing a positive market breadth index and strong investor sentiment.

Data showed that 936.4 million shares valued at N52.7 billion were transacted in 50,068 deals on Friday versus the 698.3 million shares worth N28.438 billion traded in 50,886 deals on Thursday, indicating a rise in the trading volume and value by 34.10 per cent, and 85.56 per cent apiece, and a slip in the number of deals by 1.61 per cent.

First Holdco closed the session as the most active equity with 106.3 million units worth N5.1 billion, Zenith Bank transacted 72.6 million units valued at N5.7 billion, United Capital traded 45.4 million units for N963.2 million, GTCO sold 45.0 million units worth N4.9 billion, and Fidelity Bank exchanged 31.4 million units valued at N639.0 million.

Economy

OTC Securities Exchange Extends Positive Run by 0.86%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange rose further by 0.86 per cent on Friday, February 13, with the market capitalisation growing by N20.27 billion to N2.378 trillion from the previous session’s N2.357 trillion, and the NASD Unlisted Security Index (NSI) rising by 33.87 points to 3,974.77 points from the 3,940.90 points it ended a day earlier.

The improvement recorded by the bourse yesterday was influenced by six price gainers led by Okitipupa Plc, which went up by N18.00 to sell at N260.00 per share compared with the previous day’s N242.00 per share.

Further, Central Securities Clearing System (CSCS) Plc added N3.39 to quote at N80.47 per unit versus N77.08 per unit, IPWA Plc chalked by 31 Kobo to finish at N3.44 per share versus N3.13 per share, Lagos Building Investment Company (LBIC) Plc gained 31 Kobo to settle at N3.41 per unit versus N3.10 per unit, Afriland Properties Plc appreciated by 31 Kobo to N16.51 per share from N16.20 per share, and Food Concepts Plc increased by 8 Kobo to N3.28 per unit from N3.20 per unit.

There were three price losers, led by MRS Oil Plc, which weakened by N10.00 to close at N170.00 per share compared with Thursday’s price of N200.00 per share, FrieslandCampina Wamco Nigeria Plc lost N2.59 to sell for N65.52 per unit compared with the preceding session’s N68.10 per unit, and Geo-Fluids Plc depreciated by 33 Kobo to N3.30 per share from N3.63 per share.

During the session, the volume of securities transacted by the market participants went up by 9.5 per cent to 9.4 million units from 8.6 million units, the value increased by 1,206.5 per cent to N703.6 million from N53.9 million, and the number of deals grew by 7.1 per cent to 45 deals from 42 deals.

CSCS Plc remained the most traded stock by value (year-to-date) with 27.1 million units exchanged for N1.5 billion, followed by Resourcery Plc with 1.05 billion units traded at N408.6 million, and Geo-Fluids Plc with 29.9 million units valued at N152.6 million.

Resourcery Plc ended the day as the most traded stock by volume (year-to-date) with 1.05 billion units sold for N408.6 million, followed by Geo-Fluids Plc with 29.9 million worth N152.6 million, and CSCS Plc with 27.1 million units sold for N1.5 billion.

Economy

Naira Value Further Dips 0.13% to N1,355/$1

By Adedapo Adesanya

The Naira depreciated further against the United States Dollar by N1.76 or 0.13 per cent on Friday in the Nigerian Autonomous Foreign Exchange Market (NAFEX) to close at N1,33.42/$1, in contrast to the N1,353.66/$1 it was exchanged a day earlier.

However, the Naira appreciated against the Pound Sterling in the same market window yesterday by N5.05 to trade at N1,844.59 versus Thursday’s closing price of N1,849.64/£1, and against the Euro, it improved by 75 Kobo to quote at N1,60/€1 versus the previous day’s N1,608.68/€1.

At the GTBank FX desk, the domestic currency lost N6 on the US Dollar on Friday to settle at N1,365/$1 versus the preceding session’s N1,359/$1, and at the parallel market, it chalked up N10 to trade at N1,430/$1 versus the previous day’s N1,430/$1.

The weakening of the Nigerian currency in the official market happened as the Central Bank of Nigeria (CBN) refrained from intervening in the official window.

The FX supply side was eclipsed by growing demand for foreign payments. Exporters’ inflows, non-bank corporate supply, and other market participants’ contributions had enhanced the FX liquidity level.

Pressure came with the entry of all duly licensed Bureau De Change (BDCs) into the official foreign exchange, although there are indications that the move will help the Naira-US Dollar exchange value, as BDC operators have started approaching their banks to understand the operational modalities and framework for accessing Dollars.

As for the cryptocurrency market, benchmarked tokens improved as US interest rate futures on Friday raised odds of rate cuts by the Federal Reserve after a report that showed inflation rose less than expected in January.

Data showed the Consumer Price Index (CPI) rose 0.2 per cent last month after an unrevised 0.3 per cent gain in December, with Solana (SOL) up by 7.9 per cent to $85.17, and Ethereum (ETH) up by 6.5 per cent to trade at $2,059.78.

Further, Cardano (ADA) added 5.3 per cent to close at $0.2758, Ripple (XRP) jumped 5.1 per cent to $1.42, Bitcoin expanded by 4.8 per cent to $69,357.35, Litecoin (LTC) grew by 4.7 per cent to $55.27, Binance Coin (BNB) jumped 4.0 per cent to $621.88, and Dogecoin (DOGE) increased by 3.8 per cent to $0.0965, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn