Media OutReach

Linklogis Releases 2024 Annual Results: Accumulated Transaction Volume Reaching RMB 411.2 Billion, Cash Balance Totaling RMB 5.1 Billion

The company maintains a stable financial position with cash reserve of RMB 5.1 billion. To continuously enhance capital returns to shareholders, the Board of Directors of Linklogis proposes to pay a special dividend of HK$0.03 per share.

Core Business Sustaining Growth, Remarkable Progress in Customer Expansion

In 2024, amidst macroeconomic volatility and ongoing policy support in the supply chain finance technology sector, Linklogis resolutely implemented the dual-wheel development model of ”Strategic Focus + Innovation-Driven”, boosting continued business growth. The total transaction volume processed by its technology solutions reached RMB 411.2 billion, a 28% year-on-year increase. In 2024, the number of anchor enterprise and financial institution customers for Linklogis’ supply chain finance technology solutions increased by 373 to reach a total of 1,108, an increase of 51% from 2023. During 2024, the company has served 377 financial institution customers and partners, including banks, trust companies, insurance asset management companies, securities companies, and fund companies. The overall customer retention rate hit 96%. According to China Insights Consultancy, Linklogis held 21.1% market share, ranking No.1 in the third-party supply chain finance technology solutions providers in China for five consecutive years.

Anchor Cloud and FI Cloud are the key supply chain finance technology solutions of Linklogis, the former including the Multi-tier Transfer Cloud and AMS Cloud, and the latter comprising ABS Cloud and eChain Cloud. In 2024, Anchor Cloud demonstrated strong performance. In the Multi-tier Transfer Cloud segment, the total volume of supply chain asset processed in 2024 amounted to RMB 207.3 billion, representing a year-over-year growth of 52%. The contribution of the Multi-tier Transfer Cloud to the company’s total transaction volume rose to 50%, achieving a customer retention rate of 99%. In the AMS Cloud segment, the total volume of supply chain assets processed reached RMB 75 billion, representing a year-over-year growth of 16%.

In the FI Cloud segment, the total volume of supply chain assets processed by the ABS Cloud in 2024 soared against the market headwind, reaching RMB 54.2 billion, with a 101% year-on-year surge. This remarkable growth was accompanied by notable achievements in product innovations, such as successfully facilitating the issuance of the first Technology Intellectual Property Asset-Backed Note (ABN) in China and assisting Shenzhen Energy Group in issuing the first green asset-backed securities in the Greater Bay Area. In the eChain Cloud segment, the company proactively reduced some low-margin businesses and launched the lightweight one-stop AI Agent for supply chain finance, named “BeeLink AI”, to address the digital transformation needs of financial institutions. The company has formed deep partnership with 18 customers, including Standard Chartered Bank, aiding financial institutions in enhancing operational efficiency.

In 2024, Linklogis strengthened its strategic positioning in core industries such as construction/infrastructure, power equipment, transportation, commerce and retail, successfully achieving business expansion. Linkloigs’ Supply Chain Finance Technology Solutions serve a wide range of anchor enterprises in various sectors and cover all 31 industries listed in the SWS Industry Classification, among which 14 industries contributed more than RMB 5 billion in supply chain asset transactions in 2024. On the anchor enterprise side, the company continued to delve deeply into various regions and industries, focusing on industrial cycle opportunities in “major infrastructure + green energy + advanced manufacturing”, while expanding service networks in key areas such as the Yangtze River Delta, the Beijing-Tianjin-Hebei region, and the Greater Bay Area, transforming more high-quality chain-affiliated ecosystem partners into anchor enterprise customers.

AI Empowering Business Innovation, Driving Intelligent Transformation in the Industry

As a dedicated player in the field of artificial intelligence within China’s supply chain finance technology sector, Linklogis consistently invested into AI technology research and development, as well as application scenarios. This year, based on the LDP-GPT technology, the company innovatively launched the industry’s first lightweight one-stop AI Agent for supply chain finance, named “BeeLink AI”. This platform featured core functions such as multimodal data processing and intelligent review engines, which has been successfully delivered and applied in many financial institutions and won the “Best AI Technology” award from The Asian Banker in 2024. By deepening technical collaboration with DeepSeek large language models, Linklogis aims to further enhance its cognitive engine capabilities, targeting full-process automation in customer management, risk control, and other areas, while significantly reducing operational costs.

In terms of product and scenario innovation, Linklogis has actively accelerated the innovation practice of the “de-anchored” business models for supply chain finance. The company continued to implement data-driven product solutions without clear debtor acknowledgment for comprehensive platform customers, promoting gradual optimization of product portfolios and a steady improvement in revenue quality. During the year, Linklogis partnered with 18 central state-owned enterprises (SOEs) and leading private corporations, including Universal Medical Group, Jiangsu Transportation Holding Group, Yangtze River Industrial Investment Group, Shanghai Urban Construction Group, and Yangtze River Pharmaceutical Group, to implement integrated industry-finance platform projects, further solidifying its leading market position. Additionally, the company is optimizing cross-border cloud services through AI technology. In the overseas market, Linklogis has built full-link logistic financing solutions for logistics service providers of several renowned cross-border e-commerce platforms, significantly improving the efficiency of capital turnover in cross-border trade.

Strategic Acquisitions Expanding Market Reach, Accelerating Global Layout of International Business

Linklogis is unlocking new avenues for growth through strategic acquisitions and globalization strategy. In 2024, the company expanded its business scope and product line by acquiring Shenzhen Bytter Technology Co., Ltd. This transaction will further enrich the company’s product matrix, extending from supply chain financing solutions for upstream and downstream partners of anchor enterprises to group-level capital management solutions. This acquisition will enable Linklogis to provide comprehensive services for upgrading intelligent treasury management platforms, covering from treasury management to supply chain financial system development for central state-owned enterprises (SOEs), large private corporations, and institutional customers, empowering customers to accelerate the establishment of world-class financial management systems.

In the international business segment, the total volume of supply chain assets processed by the Cross-Border Cloud in 2024 reached RMB 20.7 billion, representing a 64% year-over-year growth. Leveraging the dual-engine strategy of “Go Early” and “Go Deep”, Linklogis remains committed to expanding a broad and diverse global partner network, providing cross-border trade financing services for small and medium-sized merchants and helping leading Chinese outbound enterprises expand their global supply chain industry-finance systems. Linklogis announced plans to establish regional operational centers with localized teams in the United States, United Kingdom, and India. These centers will form an integrated operational network with the company’s Asia-Pacific resources at the Singapore international business headquarters, Olea’s industrial ecosystem network in Southeast Asia, and Green Link Digital Bank’s cross-border settlement capabilities. This development marks Linklogis’ advancement into a deeper phase of globalization strategy, comprehensively building a globalized business framework.

Major Milestones in Sustainable Development, Promoting Green Supply Chain Growth

Linklogis actively practices the philosophy of “Technology for Good” and is committed to constructing a new paradigm of digital inclusive finance, centered on the core ESG mission of “technology empowering the development of sustainable supply chain finance”. This year, the assets related to sustainable supply chains processed by Linklogis reached RMB 37.1 billion, representing a significant increase of 93% from last year. The company’s focus areas included renewable energy, rural revitalization, environmental protection, and public health.

Building on the deep integration of ESG principles and industrial digitalization, Linklogis has collaborated with a number of financial institutions since 2022 to jointly explore innovative models of green supply chain finance. This initiative combines AI-driven assessment, environmental pricing mechanisms, and industry-finance collaboration to drive sustainable industrial development. This effort helps thousands and millions of enterprises benefit from digital and technological inclusion, contributing to the development of the real economy and the advancement of the digital economy.

In the ESG field, Linklogis has received widespread industry recognition. The company has received a “Low Risk” rating from the international authoritative ESG rating agency Sustainalytics for three consecutive years. Linklogis was awarded an ESG “A” rating by Wind Information for the first time, ranking 5th among 181 companies in the software services industry assessed. This year, the company was selected for inclusion in the S&P Global’s The Sustainability Yearbook (China Edition) 2024. Linklogis’ ESG solution, “SCeChain” developed in collaboration with Standard Chartered Bank, won the “Best China ESG Solution Award” from The Asset. Linklogis also received the “Excellence in ESG Innovative Practice” and the “Annual ESG Pioneer Award” from Guru Club, as well as the “Most Socially Responsible Public Company” award from Zhitongcaijing, highlighting the company’s outstanding achievements in the field of sustainable development.

Charles Song, the founder, chairman and CEO of Linklogis, said, “In the past year, Linklogis has achieved high-quality growth and innovative breakthroughs. Looking ahead to 2025, Linklogis will focus more on its core business, enhance efficiency, and create new growth curves through the application of AI technology and strategic acquisitions. By focusing on core businesses with long-term revenue sustainability and high profitability potential, Linklogis will optimize resources allocation and implement technology-driven operational efficiency upgrades to return to profitability. Underpinned by stable financial resources, Linklogis will create greater value for its customers, deliver consistent returns to its shareholders, and contribute to the sustainable development of global supply chain finance.”

Hashtag: #Linklogis

The issuer is solely responsible for the content of this announcement.

Media OutReach

Zoho Corporation Surpasses One Million Paying Organisations as Customers

On its 30th Anniversary, Zoho Corporation exceeds milestone of 150 million users

SINGAPORE – Media OutReach Newswire – 5 March 2026 – Zoho Corporation, a global technology company, today marked its 30th anniversary with the announcement of two major company milestones. Zoho Corporation, consisting of Zoho, ManageEngine, Qntrl, and TrainerCentral, is now a trusted technology provider to more than one million paying customers and more than 150 million users globally. Today’s announcement follows significant YoY customer (32%) and revenue (20%) growth in 2025.

Zoho Corporation would foremost like to thank every one of its customers, big and small, whose loyalty and support has had an outsized impact on the company’s foundation, growth, and future success. To honor that commitment, Zoho Corporation is shining a light on a few dedicated customers, whose success it is proud to have helped support.

“‘What made us stick with Zoho for so long is consistency and trust. Zoho continues to invest in its platform with a clear long-term vision, not short-term trends. The products are stable, well integrated, and designed to support real business needs, which allows us to confidently recommend Zoho to our clients year after year,” said Alexon Garcia, Technical Delivery Manager, Devtac, Philippines. “As Zoho turns 30, we would like to thank the people building the products. Your focus on privacy, value, and practical innovation truly sets Zoho apart in the market. It shows that the company is built for the long run and not driven by hype.”

“For almost a decade of using Zoho Desk and Zoho SalesIQ, we have seen a huge improvement in the way we handle tickets and access reports, enabling our team to make faster, data-driven decisions. Over time, Zoho has naturally become an integral part of our daily operations because it is easy to use, reasonably priced, and continues to evolve based on real feedback from its users. A big thank you to the Zoho team for building such a powerful SaaS platform—we look forward to continuing to grow together in the years to come,” said Wildan Zubaidi, VP of Customer Experience, PT Biznet Gio Nusantara, Indonesia.

“During periods of rapid business expansion and operational complexity, particularly when organizations needed to move from fragmented systems to integrated digital platforms, Zoho played a critical role. Solutions such as Zoho CRM, Creator, Analytics, and Finance applications enabled faster decision-making, improved visibility, and operational resilience, especially during times of disruption and digital transformation. These moments reinforced Zoho’s value not just as a software provider, but as a strategic enabler,” said Henry Soo, Founder, DataDevelop Consulting Ltd., Hong Kong.

Recent customers to Zoho Corporation include: In the United States, Rapid Response Monitoring and Synergy Home Care; In India, Mercedes-Benz India, Force Motors, Joyalukkas and Union Bank of India; in the UK/European Union, Flora Food Group, Handl Tyrol and Atout France; in Middle East-Africa, Al-Ahli Saudi FC and Al Qadsiah FC; in LATAM, Grupo Gonher; and in Brazil, Creditas and Editora Globo.

“Being bootstrapped, private, and built entirely in-house makes Zoho an outlier among competitors,” says Sridhar Vembu, Co-founder and Chief Scientist, Zoho Corporation. “But vendors don’t need our help, businesses do, which is why delivering customer value has, for 30 years, been Zoho Corporation’s North Star. Before any innovation, strategy, or guiding principle becomes a product, pivot, or policy, it must first affirm the question, ‘Will this help businesses?’ We are incredibly grateful that companies around the world have responded so positively to our customer-first approach over the past three decades, and will continue to meet the evolving needs of businesses with powerful, scalable, and affordable solutions.”

To learn more about the unique growth stories of Zoho Corporation’s customers over 30 years, visit here.

Hashtag: #ZohoCorporation

https://www.zoho.com![]() https://www.linkedin.com/company/zohoapac

https://www.linkedin.com/company/zohoapac

The issuer is solely responsible for the content of this announcement.

About Zoho Corporation

With 60+ apps in nearly every major business category, Zoho Corporation is one of the world’s most prolific technology companies. Zoho is privately held and profitable with more than 19,000 employees globally with headquarters in Austin, Texas and international headquarters in Chennai, India. Zoho APAC HQ is located in Singapore. For more information, please visit: www.zoho.com/

Zoho respects user privacy and does not have an ad-revenue model in any part of its business, including its free products. The company owns and operates its data centers, ensuring complete oversight of customer data, privacy, and security. More than 150 million users around the world, across hundreds of thousands of companies, rely on Zoho everyday to run their businesses, including Zoho itself. For more information, please visit: https://www.zoho.com/privacy-commitment.html

Media OutReach

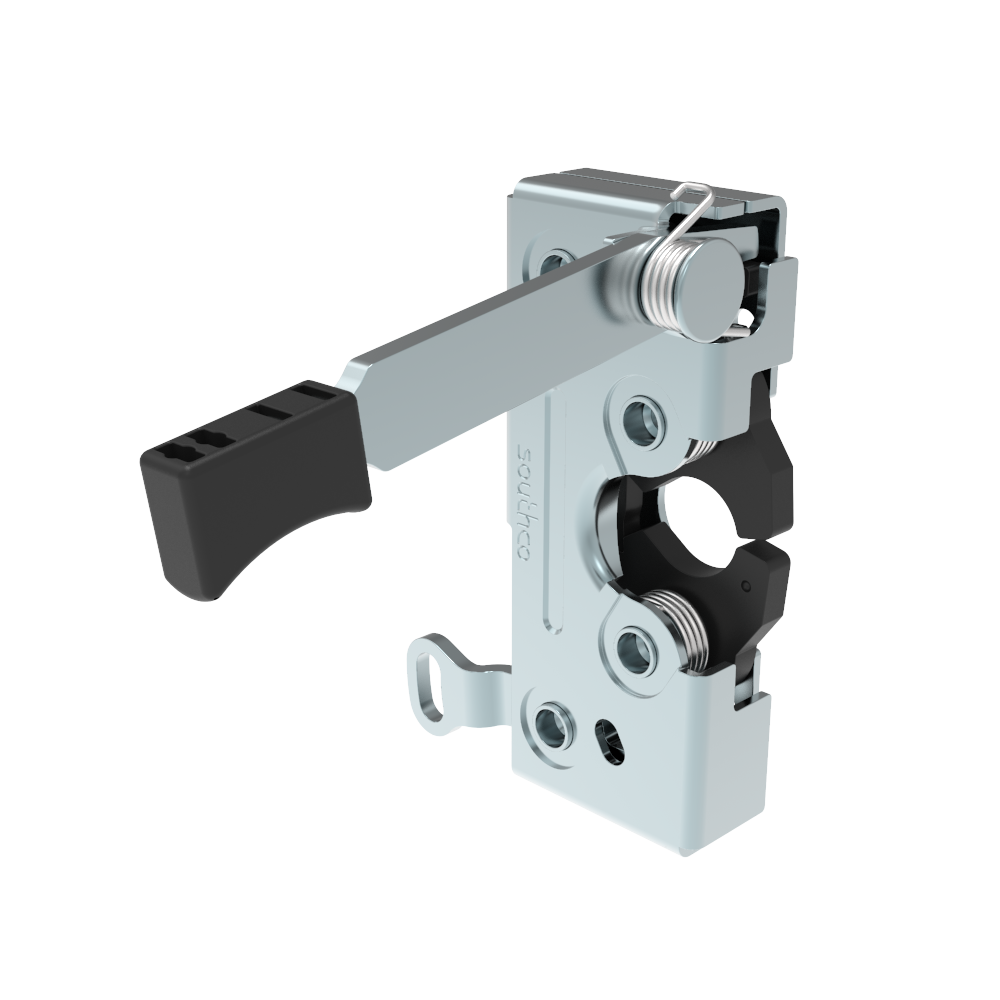

Southco’s New Heavy-Duty Rotary Latch Simplifies Cab Access While Enhancing Operator Safety

The new R4-50 Rotary Latch provides the heavy-duty performance that modern machinery demands, to tackles vibrations, safety-risking accidental releases, and complex access delays in rough environments.

Engineered for demanding conditions, the R4-50 delivers:

- Independent interior and exterior actuation – making it easier and safer to enter and exit equipment cabs.

- A pre-loaded interior hand lever – purpose-built for high-impact environments, reducing noise and vibration while ensuring smoother, more reliable operation.

- Accidental actuation prevention – minimizing unintended movement to keep operators secure and equipment protected.

- Flexible release options – including remote actuator connection via cable or rod, or direct push release, to meet different cab design needs.

Southco’s R4 Rotary Latch series is highly durable, and is available in a variety of configurations that meet customer needs with little to no modification, including compact mechanical and electromechanical designs made of durable materials suitable for any environment. R4-50 Rotary Latches with Dual Triggers are compliant with FMVSS 206 impact standards, IP65 dust and water intrusion standards, EN 45545-3 fire protection standards, as well as applicable vibration standards.

As a heavy-duty upgrade to Southco’s trusted R4 Rotary Latch line, the R4-50 with Dual Triggers combines operator safety, rugged durability, and simplified access in one cost-effective system. The latch is also compatible with Southco AC actuators, offering OEMs a low-investment, high-value option for enhancing their cab entry solutions.

Global Product Manager Cynthia Bart adds, “The new R4-50 Rotary Latch with Dual Triggers offers a complete, highly versatile cab door entry system for use in heavy-duty construction and agricultural vehicles. The latches are compatible with Southco AC Actuators, allowing designers to quickly and affordably upgrade their existing designs.”

For more information about the functionality of R4-50 Rotary Latches, please visit southco.com or email the 24/7 customer service department at in**@*****co.com

Hashtag: #Southco

The issuer is solely responsible for the content of this announcement.

About Southco

Southco, Inc. is the leading global designer and manufacturer of engineered access solutions. From quality and performance to aesthetics and ergonomics, we understand that first impressions are lasting impressions in product design. For over 75 years, Southco has helped the world’s most recognized brands create value for their customers with innovative access solutions designed to enhance the touch points of their products in transportation and industrial applications, medical equipment, data centers and more. With unrivalled engineering resources, innovative products and a dedicated global team, Southco delivers the broadest portfolio of premium access solutions available to equipment designers throughout the world.

Media OutReach

DBS Hong Kong collaborates with Know Your Customer Limited to further improve digital account opening for SMEs

Leveraging Know Your Customer’s cutting-edge digital compliance platform, DBS Hong Kong will gain real-time access to comprehensive business verification data — including instant retrieval of official company documents and automatic identification of complex ultimate beneficial ownership (UBO) networks across more than 140 jurisdictions.

This AI-powered automation addresses the traditionally manual and cumbersome SME onboarding processes by streamlining the end-to-end business KYC process, efficiently verifying corporate structures and ownership, reducing manual effort and accelerating onboarding timelines. The result is significantly enhanced operational efficiency and a faster, more seamless onboarding experience for DBS Hong Kong’s business customers.

[Lareina Wang, Head of SME Banking, DBS Bank Hong Kong] said,

” At DBS Hong Kong, we are dedicated to reimagining the customer onboarding experience through continuous digital innovation. By engaging Know Your Customer, we leverage advanced technology to streamline CDD workflows, delivering faster service to our customers. This collaboration also represents a major advancement in automating SME onboarding processes that have historically been complicated and manual, solidifying SME banking position of DBS in the market of Hong Kong. “

Claus Christensen, CEO and Co-Founder of Know Your Customer, added,

“Our service provided to DBS Hong Kong exemplifies how financial technology can simplify complex onboarding challenges. With our global data coverage and AI-powered automation, we empower DBS Hong Kong to accelerate KYC processes and provide business customers with an unrivalled onboarding journey. Together, we are shaping the future of digital banking.”

In recognition of its visionary digital strategy, DBS Hong Kong was named Asia’s Best Digital Bank in 2025 by Euromoney. The bank also continues to lead digital innovation, evidenced by over 70% of Hong Kong SMEs already integrating or exploring AI and digital technologies as part of their operations, according to its recent SME survey.

This transformative collaboration underscores DBS Hong Kong’s unwavering commitment to innovation and delivering safe and trusted digital onboarding solutions in Asia’s rapidly evolving financial landscape.

Hashtag: #KnowYourCustomer

The issuer is solely responsible for the content of this announcement.

About DBS Bank (Hong Kong) Limited

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank’s “AA-” and “Aa1” credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “![]() World’s Best Bank” by Global Finance, “

World’s Best Bank” by Global Finance, “![]() World’s Best Bank” by Euromoney and “

World’s Best Bank” by Euromoney and “![]() Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “

Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “![]() World’s Best Digital Bank” by Euromoney and the world’s “

World’s Best Digital Bank” by Euromoney and the world’s “![]() Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “

Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “![]() Safest Bank in Asia” award by Global Finance for 17 consecutive years from 2009 to 2025. In 2026, DBS won the “Triple A award – Best Digital Customer Onboarding Experience – Hong Kong”

Safest Bank in Asia” award by Global Finance for 17 consecutive years from 2009 to 2025. In 2026, DBS won the “Triple A award – Best Digital Customer Onboarding Experience – Hong Kong”

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by uplifting lives and livelihoods of those in need. It provides essential needs to the underprivileged, and fosters inclusion by equipping the underserved with financial and digital literacy skills. It also nurtures innovative social enterprises that create positive impact.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit ![]() www.dbs.com.

www.dbs.com.

About Know Your Customer Limited

Know Your Customer Limited is an award-winning RegTech company specialised in next-generation business verification solutions for financial institutions and regulated organisations worldwide. For teams struggling with inefficient client due diligence and onboarding processes, Know Your Customer offers an intuitive digital compliance workspace that combines unmatched real-time registry data, covering over 140 countries, seamless integrations, and AI-powered smart automation. This streamlined approach transforms the compliance function at its core, allowing customers to customise their solutions by selecting only the functionalities they need, all accessible via a robust REST API.

Founded in Hong Kong in 2015, with a local presence in Singapore, Dublin, London, and Shanghai, Know Your Customer has built a global customer base across 11 verticals and 18 jurisdictions. The company also maintains a wide network of technology and data partners, ensuring high-quality entity data and enhanced compliance processes for its customers.

For more information visit ![]() https://knowyourcustomer.comor follow Know Your Customer Limited on

https://knowyourcustomer.comor follow Know Your Customer Limited on ![]() LinkedIn or

LinkedIn or ![]() X.

X.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn