Media OutReach

Best Mart 360 Announces Annual Results, Recorded Significant Growth in Both Revenue and Net Profit

Proposed a Final Dividend of HK10.0 cents per share

Highlights:

- Revenue increased by 8.2% to approximately HK$2,805.1 million.

- Gross profit increased by 10.6% to approximately HK$1,028.0 million.

- Operating profit recorded approximately HK$315.2 million.

- Profit attributable to owners of the Company increased by 5.3% to approximately HK$247.5 million.

- As at 31 December 2024, the Group operated a total of 176 chain retail stores, including 170 retail stores in Hong Kong and 6 retail stores in Macau.

- Basic earnings per share was approximately HK24.8 cents. The Board recommended the payment of final dividend of HK10.0 cents per share.

Financial Highlights:

|

HK$’000 |

Year ended

31 Dec 2024 |

Year ended

31 Dec 2023* |

Change |

| Revenue | 2,805,146 | 2,592,129 | +8.2% |

| Gross profit | 1,027,997 | 929,812 | +10.6% |

| Gross profit margin | 36.6% | 35.9% | +0.7 ppts |

| Profit attributable to owners of the Company |

247,522 |

234,959 |

+5.3% |

*Unaudited figures

HONG KONG SAR – Media OutReach Newswire – 25 March 2025 – Best Mart 360 Holdings Limited (“Best Mart 360” or the “Company”, together with its subsidiaries, the “Group”; stock code: 2360.HK), a leisure food retailer in Hong Kong, announced its results for the year ended 31 December 2024 (“the Financial Year under Review”). As the Company changes the financial year end date from 31 March to 31 December, which is different from the length of the previous reporting period, the audited comparative figures may not be fully comparable.

During the Financial Year under Review, the revenue recorded by the Group amounted to approximately HK$2,805,146,000, representing an increase of approximately 8.2% as compared with the unaudited revenue of approximately HK$2,592,129,000 for the year ended 31 December 2023, primarily driven by the Group’s stable stores expansion strategy

During the Financial Year under Review, gross profit was approximately HK$1,027,997,000, compared to the unaudited gross profit of approximately HK$929,812,000 for the year ended 31 December 2023. The Group’s gross profit margin for the Financial Year under Review was approximately 36.6%, representing an increase of 0.7 percentage points compared with approximately 35.9% for the unaudited gross profit margin for the year ended 31 December 2023.

Profit attributable to owners of the Company for the Financial Year under Review was approximately HK$247,522,000 (year ended 31 December 2023: approximately HK$234,959,000 (unaudited)), a 5.3% year-on-year increment. The Group’s net profit margin before interest and tax for the year ended 31 December 2024 was approximately 11.2%, while the unaudited net profit margin before interest and tax for the same twelve-month period in 2023 was approximately 11.4%. The decrease was mainly due to the rising operating cost.

During the Financial Year under Review, basic earnings per share was approximately HK24.8 cents. The Board recommended the payment of final dividend of HK10.0 cents per share.

BUSINESS REVIEW

15 New Retail Stores & Kept Broadening Presence in Hong Kong’s Residential Areas

As at 31 December 2024, the Group operated a total of 176 chain retail stores (31 December 2023: 167 stores), including 170 chain retail stores (31 December 2023: 159 stores) in Hong Kong and 6 chain retail stores (31 December 2023: 7 stores) in Macau respectively. During the Financial Year under Review, the Group opened 15 new retail stores, and closed 6 stores upon expiration of their respective lease terms in alignment with the Group’s expansion strategy adjustment.

Rental expense (cash basis) for retail stores was approximately HK$269,493,000 for the year ended 31 December 2024, as compared with that of approximately HK$241,986,000 for the year ended 31 December 2023 (unaudited), representing an increase of approximately 11.4%. The ratio of rental expense (cash basis) to sales revenue of retail stores for the year ended 31 December 2024 was approximately 9.6%, which was higher than that of approximately 9.3% for the year ended 31 December 2023 (unaudited).

Kept Optimising Product Mix & Increased Share of Sales from Private Label Products

During the Financial Year under Review, the Group continued its global procurement policy and mission by sourcing broad spectrum of products worldwide that meet and satisfy market trend and demand. To better cater to the needs of the local community, the Group further strengthened the supply of basic foodstuffs such as cereals, noodles, canned food, milk, chilled and frozen food, daily necessities and basic grocery products. In addition, the Group continued to strengthen its private label sales in retail stores, including nuts and dried fruits, organic grains, wet tissues, canned food, biscuits and snacks, etc., providing consumers with more diversified choices.

For the year ended 31 December 2024, the Group offered a total of 3,653 stock keeping units (“SKUs”) of products (for the year ended 31 December 2023: 3,945 SKUs) from suppliers principally from China and overseas markets as well as brand owners or importers in Hong Kong.

For the year ended 31 December 2024, approximately 54.9% of the products were purchased from suppliers and brand owners or importers in Hong Kong (for the year ended 31 December 2023: approximately 54.4%), while imports from Japan, China and Europe accounted for approximately 11.7%, 9.8% and 6.3% of the total purchases respectively (for the year ended 31 December 2023: approximately 13.0%, 6.0% and 8.3% respectively).

As at 31 December 2024, the total amount of inventories of the Group amounted to approximately HK$339,513,000 (31 December 2023: approximately HK$276,691,000), a 22.7% year-on-year increment.

During the Financial Year under Review, the Group continued to actively develop private label products that on one hand allow the Group to capture pricing advantages and exercise higher level of quality control on its products and on the other hand further uplift its brand awareness and strengthen customers’ loyalty. For the Financial Year under Review, sales derived from private label products was approximately HK$477,222,000 (for the year ended 31 December 2023: approximately HK$404,078,000), accounted for approximately 17.0% of the Group’s revenue for the Financial Year under Review (for the year ended 31 December 2023: approximately 15.6%). During the Financial Year under Review, the Group had launched an aggregate of 11 private labels, and the products for sale included nuts and dried fruits, organic grains, wet tissues, canned food, biscuits and snacks, etc.

Expanded the Customer Base & Timely Launched Marketing Activities

To further deepen customer stickiness and expand customers’ coverage, the Group used big data analysis and reformulated its marketing strategy to launch a new three-tier membership scheme and a second-generation mobile app in 2020. The new membership scheme helps to elevate brand positioning and market recognition, and the membership rewards have been fully optimised and enhanced, with more member benefits such as multiple items purchase stamp reward, special offers for selected products and access to latest market information.

Through diversified marketing strategies, the Group aims to internally strengthen the membership core from within and attract new customers through external expansion, so as to effectively and purposefully foster the ties between members and the Group, thereby driving recurring business from members and promoting sustainable growth of the Group’s business.

During the Financial Year under Review, the number of the Group’s members increased from approximately 2,123,365 as at 31 December 2023 to approximately 2,280,418 as at 31 December 2024, representing an increase of approximately 7.4%.

To express our gratitude for our customers’ support, the Group launched various marketing and promotional activities during the Financial Year under Review including the “Best Price” promotional campaign, which provided customers with a series of special offers for selected quality products from time to time to enhance customer loyalty. Meanwhile, the Group continued to advertise through television, newspapers, social media platforms and other media, which successfully obtained repeat customers, attracted new customers and greatly promoted the discussions about the Group in the market.

PROSPECTS

In order to maintain robust operational profitability, the Group will continue to review the regional distribution of its brand stores, and adopt appropriate expansion policies and flexible leasing strategies to look for suitable opportunities to expand the retail network for its major retail brands “Best Mart 360° (優品360° )” and global gourmet brand “FoodVille” in Hong Kong and Macau, with a target of achieving a net increase of 10 retail stores annually under its dual-brand model, catering to the diverse needs of different customer segments for quality food products.

Through global sourcing, the Group remains committed to broadening its product categories and maintaining price competitiveness. The Group will continue to source a diverse range of food products worldwide, intensify efforts to develop its private label products, and proactively explore new products to provide customers with a broader range of choices to meet the needs of various consumer groups.

In addition, the Group has entered into a sales and procurement framework agreement with China Merchants Hoi Tung Trading Company Limited (“CMHT”). In 2025, the Group will expand its product sales to and procurement from CMHT and its subsidiaries, facilitating the introduction of several popular brands from Mainland China. The Board believes that through CMHT’s robust network of food importers and distributors, the Group will strengthen its procurement as well as business-to-business (B2B) operations . In addition, the Group has entered into agreements with China Merchants Bonded Logistics Co., Limited* (招商局保稅物流有限公司) and China Merchants Qian Hai Wan (Shenzhen) Supply Chain Management Co., Ltd.* (招商前海灣(深圳)供應鏈管理有限公司). Since last year, they have provided customs clearance, warehousing and related logistics services as well as land transportation services of goods between Shenzhen and Hong Kong and other ancillary services. These have alleviated the pressure on the Group’s warehouses in Hong Kong and reduce overall goods handling costs.

Mr. Hui Chi Kwan, Chief Executive Officer of the Group, said, “As the number of Hong Kong residents traveling abroad continues to rise, along with a shift in the consumption patterns of visitors to Hong Kong, the local retail sector is expected to require additional time to fully recover. In this challenging business environment, the sustained success of our group relies on the steadfast support of our customers and the dedicated efforts of our employees. Looking ahead, the group will persist in implementing timely and adaptive marketing strategies to effectively respond to the dynamic and unpredictable market conditions.”

Hashtag: #BestMart360 #優品360 #AnnualResults #業績 #全年業績

The issuer is solely responsible for the content of this announcement.

Best Mart 360 Holdings Limited

Best Mart 360 Holdings Limited operates chain retail stores under the brand “Best Mart 360˚”, offering wide selection of imported and pre-packaged leisure foods and other grocery products principally from overseas. It is the Group’s business objective to offer “Best Quality” and “Best Price” products to customers through continuous efforts on global procurement with a mission to provide comfortable shopping environment and pleasurable shopping experience to customers. As at 31 December 2024, the Group operated a total of 176 chain retail stores, spanning all of the 18 districts in Hong Kong and strategic locations with heavy pedestrian flow in Macau. Among the chain retail stores, the global gourmet brand “FoodVille” launched in September 2021 is also included, targeting the medium-to-high-end-market.

Media OutReach

St. George’s University Prepares Future South Korean Physicians for the Growing Global Cancer Care Challenge

Recognizing the importance of addressing workforce shortage in South Korea, St. George’s University (SGU) School of Medicine in Grenada, West Indies, highlights how its medical education approach supports the development of clinical competencies relevant to cancer care across healthcare settings.

These challenges reflect broader global trends, where cancer care increasingly depends on multidisciplinary teams rather than specialty expansion alone. SGU’s curriculum is designed to build a strong foundation in clinical diagnosis, patient communication and multidisciplinary care, which are essential skills for effective oncology and cancer-related care. Through anatomy labs, simulation-based learning, and integrated digital tools, students develop foundational clinical skills in structured, supervised environments designed to reflect real-world medical practice.

The curriculum also integrates traditional cadaveric dissection with modern 3D anatomical modeling. This blend helps students visualize the human body in a holistic way while reinforcing knowledge through their hands-on interaction. SGU’s simulation lab also enables medical students to have their first direct interaction with ill patients in a safe, simulated learning environment.

On top of core medical training, SGU offers early exposure to prevention, diagnosis and patient-centered care to prepare graduates to tackle complex health issues. SGU has developed long-standing relationships with more than 75 established hospitals and clinical centers in the US and UK. These clinical placements provide exposure to diverse patient populations and care environments, including settings where cancer diagnosis and management are part of routine clinical practice.

South Korean SGU alumni are contributing to healthcare systems through roles that intersect with cancer diagnosis, treatment coordination, and long-term patient care. For example, Dr. Julia Hweyryoung Cho, MD 2022 is practicing internal medicine, which plays a crucial role in cancer care. Internal medicine physicians are often involved in the initial diagnosis of cancer, managing complex medical conditions that may arise during treatment and providing long-term comprehensive care and survivorship planning for patients with a history of cancer.

In observance of World Cancer Day 2026, SGU encourages all medical professionals and organizations to collaboratively address global cancer care challenges. This includes recognizing and meeting the cancer healthcare needs of individuals and communities in South Korea.

For more information on the programs and tracks available through SGU School of Medicine, visit SGU’s website.Hashtag: #St.George’sUniversity

The issuer is solely responsible for the content of this announcement.

Media OutReach

Finalists and Semifinalists for $1 Million Seeding The Future Global Food System Challenge Announced

Created and funded by Seeding The Future Foundation and, for the first time, hosted by Welthungerhilfe (WHH), the Challenge attracted a record 1,600+ applications from innovator teams in 112 countries, underscoring growing global momentum for food systems transformation.

Following a multi-stage, rigorous international review process, 36 teams have advanced across three award levels. These include 16 Seed Grant Finalists (competing for 8 awards of USD 25,000), 12 Growth Grant Semifinalists (competing for 3 awards of USD 100,000), and 8 Seeding The Future Grand Prize Semifinalists (competing for 2 awards of USD 250,000).

“Hosting the GFSC reflects Welthungerhilfe’s commitment to accelerating bold, scalable innovations where they are needed most. This year’s diversity of solutions underscores the complexity of food system challenges and the creativity of innovators worldwide.” said Jan Kever, Head of Innovation at Welthungerhilfe

The submitted innovations span diverse themes and approaches, including climate-smart production, nutrient-dense foods, food loss reduction, and inclusive market models, reflecting the complexity and interconnected nature of today’s food systems challenges.

“The Seeding The Future Global Food System Challenge exists to catalyze impactful, bold, and scalable innovations that advance food systems transformation. We are excited to work alongside Welthungerhilfe as a trusted partner and host of the Challenge and are encouraged by the quality and diversity of innovations emerging from this first year of collaboration.” said Bernhard van Lengerich, Founder and CEO of Seeding The Future Foundation

While the number of awards is limited, all semifinalists and finalist applicants plus all applicants with any prior recognition of other innovation competitions can join the STF Global Food System Innovation Database and Network—currently in beta testing with the Food and Agriculture Organization of the United Nations—vastly expanding their visibility and reach across a global audience.

List of 2025 GFSC Seed Grant Finalists, Growth Grant and Seeding The Future Grand Prize Semifinalists

Find details here: welthungerhilfe.org/gfsc-finalists

Seeding The Future Grand Prize Semi-Finalists

- CNF Global, Kenya

- ZTN Technology PLC, Ethiopia

- One Acre Fund, Rwanda

- Sanku, Tanzania

- Nabahya Food Institute (NFI), Democratic Republic of the Congo

- ABALOBI, South Africa

- metaBIX Biotech, Uruguay

- Nurture Posterity International, Uganda

Growth Grant Semi-Finalists

- Baobaby, Togo

- Safi International Technologies Inc., Canada

- Centro Internacional de Mejoramiento de Maíz y Trigo (CIMMYT), Mexico

- Farmlab Yeranda Agrisolution Producer Company Limited, India

- Banco de Alimentos Santa Fe (BASFE), Argentina

- Chartered Consilorum (Pty) Ltd, South Africa

- American University of Beirut, Environment and Sustainable Development Unit (ESDU at AUB), Lebanon

- The Source Plus, Kenya

- Iviani Farm Limited, Kenya

- Rwandese Endogenous Development Association, Rwanda

- NatureLEAD, Madagascar

- Ndaloh Heritage Organisation, Kenya

Seed Grant Finalists

- Inua Damsite CBO, Kenya

- World Neighbors, United States

- Keloks Technologies Ltd, Nigeria

- REBUS Albania, Albania

- Tanzania Conservation and Community Empowerment Initiative (TACCEI), Tanzania

- Intrasect, Switzerland

- VKS AGRITECH, India

- Murmushi People’s Development Foundation, Nigeria

- Levo International, Inc., United States

- Effective Altruism Research Services Ltd, Uganda

- Taita Taveta University, Kenya

- CultivaHub, Democratic Republic of the Congo

- Resource Hub for Development (RHD), Kenya

- FUTURALGA S.COOP.AND, Spain

- West Africa Centre for Crop Improvement, University of Ghana, Ghana

- Sustainable Solutions Kenya, Kenya

Hashtag: #TheFutureGlobalFoodSystemChallenge

The issuer is solely responsible for the content of this announcement.

About Seeding The Future Foundation

STF is a private nonprofit dedicated to ensuring equitable access to safe, nutritious, affordable, and trusted food. It supports innovations that transform food systems and benefit both people and planet. More at Seeding the future.

About Welthungerhilfe

WHH is one of Germany’s largest private aid organizations, striving for a world without hunger since 1962. More at: Welthungerhilfe (WHH)

Media OutReach

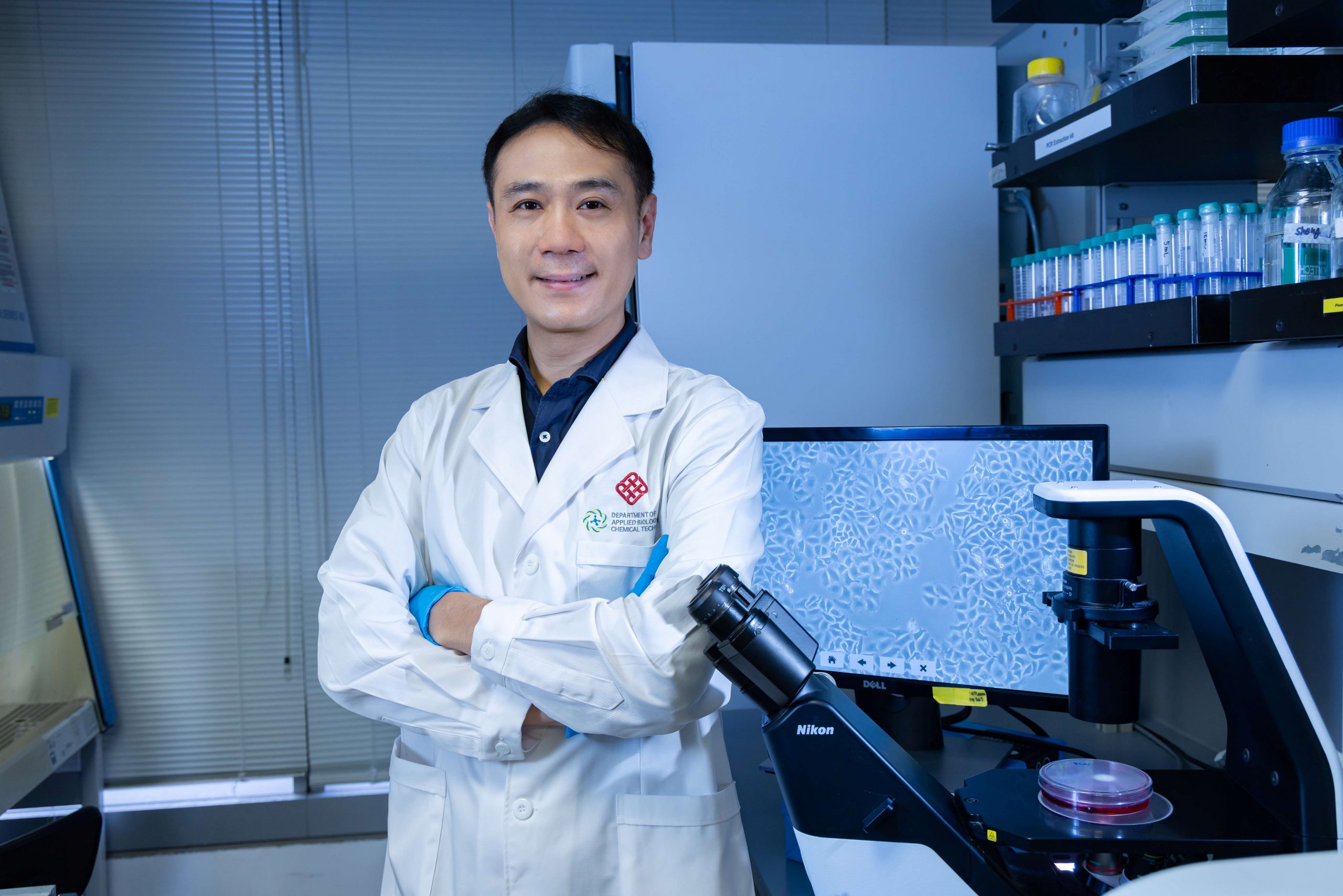

PolyU develops novel antibody targeting fat cell protein, offering new approach to treating metabolism-related liver cancer

Metabolic dysfunction-associated steatotic liver disease (MASLD), commonly known as fatty liver disease, currently affects around a quarter of the global population and is an important risk factor for liver cancer. In affected individuals, fat cells induce insulin resistance and chronic inflammation, leading to excessive fat accumulation in the liver. This ultimately impairs liver function and may progress to liver cancer. Treatment options for MASLD-induced liver cancer remain limited and the effectiveness of current immunotherapies is suboptimal.

A breakthrough study led by Prof. Terence LEE, Associate Head and Professor of the PolyU Department of Applied Biology and Chemical Technology, and his research team has revealed that an adipocyte-derived protein, known as fatty acid-binding protein 4 (FABP4) is a key driver that accelerates tumour growth. Through mass spectrometry, the team confirmed that patients with MASLD-induced liver cancer had markedly elevated FABP4 levels in their serum. Further investigations showed that FABP4 activates a series of pro-proliferative signalling pathways within cells, causing cancer cells to multiply and grow more rapidly.

Prof. Lee’s team has successfully developed a monoclonal antibody that neutralises FABP4. This antibody not only inhibits the growth and proliferation of FABP4-driven cancer stem cells, but also enhances the ability of immune cells to combat cancer.

Prof. Lee said, “This neutralising antibody against FABP4 demonstrates significant potential in inhibiting tumour growth and activating immune cells, providing a complementary approach to current immunotherapy strategies. Our findings highlight that targeting adipocyte-derived FABP4 holds promise for treating MASLD-induced liver cancer.”

Prof. Lee added that gaining deeper insights into how adipocyte-derived FABP4 affects liver cancer cells helps to explicate the disease mechanisms of liver cancer, particularly in obese individuals. Intervening in the relevant signalling pathways could provide effective methods to combat this aggressive malignancy.

Prof. Lee believes that, as this adipocyte-targeted immunotherapy continues to mature, it will bring more treatment options to MASLD patients. He remarked, “If its efficacy can be proven in clinical trials, it could offer new hope to many affected individuals.”

The research is supported by the Innovation and Technology Fund of the Innovation and Technology Commission of the Government of the Hong Kong Special Administrative Region of the People’s Republic of China. PolyU has filed a non-provisional patent for the developed antibody and is continuing to optimise its binding affinity to facilitate future clinical applications.

Hashtag: #PolyU #FattyLiver #Cancer #LiverCancer #理大 #香港理工大学 #肝癌 #癌症 #脂肪肝

The issuer is solely responsible for the content of this announcement.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn