Media OutReach

2025 China corporate payment survey: Longer payment terms helped mitigate increases in payment delays

- Companies generally extended their payment terms, aided in part by third-party risk mitigation tools that may provide some comfort for suppliers to accommodate client needs.

- Longer payment terms have mitigated increases in payment delays, which rose only slightly from 64 days to 65 days.

- However, if payment delays are added to payment terms, the total average waiting time between product delivery and payment collection increased from 133 days in 2023 to 141 days in 2024.

- Among respondents that experienced ultra-long payment delays (ULPDs, above 180 days), almost half reported late payment worth at more than 2% of annual turnover. This proportion was significantly up from 33% in 2023 and implied a rise in non-payment risk.

Junyu Tan, North Asia Economist at Coface, says: “The collection period for Chinese suppliers lengthened in 2024, due to declining corporate revenues, driven by slower volume growth amid sluggish domestic demand but also by price pressures in an ongoing deflationary environment. While suppliers extended payment terms on average, growing caution was evident as fewer companies offered credit sales. Looking ahead to 2025, 52% of our respondents expected the economic outlook to improve as government stimulus efforts may have bolstered confidence among companies. However, this optimism could be overstated, as stimulus measures have been relatively restrained so far, and tariff risks for trade sectors remain a looming challenge. Coface expects China’s GDP growth to stand at 4.3% in 2025.”

Payment delays[1]: Increasing ultra-long payment delays

Companies generally extended payment terms in 2024, aided in part by third-party risk mitigation tools. The average total payment terms increased from 70 days in 2023 to 76 days in 2024. Thanks to these more generous terms, payment delays remained relatively stable, rising only slightly from 64 days to 65 days. However, if payment delays are added to payment terms, the total average waiting time between product delivery and payment collection, known as days sales outstanding (DSO), increased from 133 days in 2023 to 141 days in 2024, indicating an extended collection period from a year ago.

The share of respondents reporting past dues considerably reduced from 62% in 2023 to 44% in 2024. The duration of delays also remained stable. However, when combined with longer payment terms, the average days sales outstanding (DSO) rose from 133 days in 2023 to 141 days in 2024, indicating extended collection periods.

Meanwhile, among respondents that experienced ultra-long payment delays (ULPDs, above 180 days), 50% reported late payment worth more than 2% of annual turnover. This proportion was significantly up from 33% in 2023 and implied a rise in non-payment risk. Based on Coface’s practical experience, 80% of such delays, above 180 days and exceeding 2% of suppliers’ annual turnover, were not able to be collected.

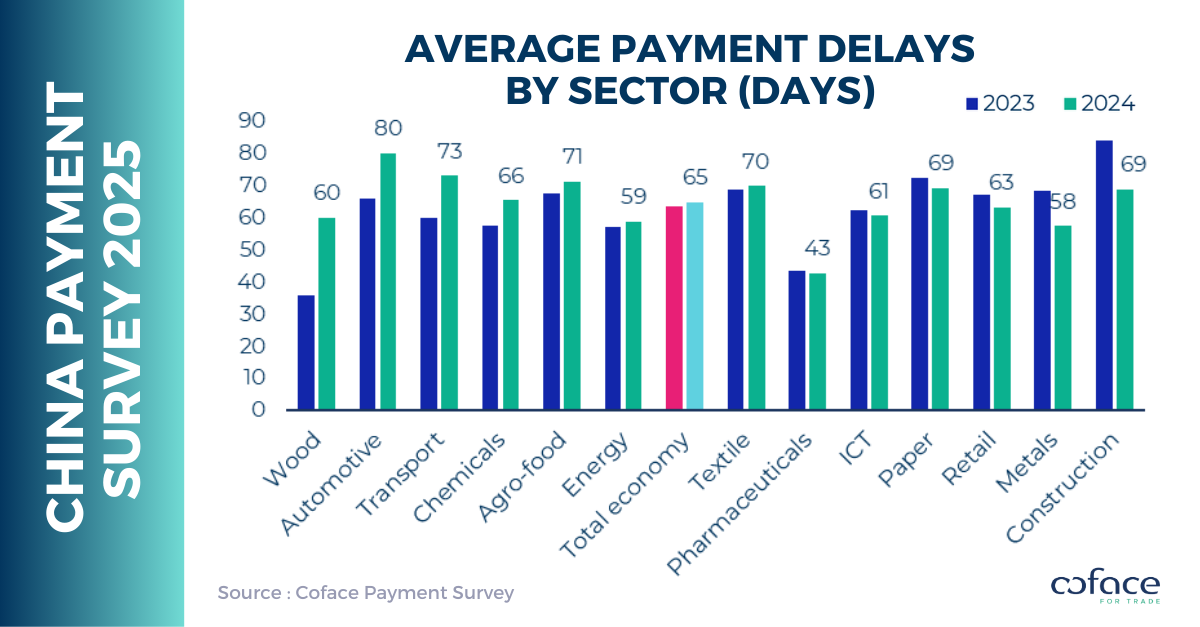

By sector, the wood industry has experienced the most significant extension in payment delays, primarily driven by the prolonged housing market crisis that suppressed furniture demand and led to a significantly longer settlement cycle for the sector. Meanwhile, the automotive sector faced similar challenges. This was largely attributed to the financial burden on car dealers, who were grappling with losses and capital constraints amid an ongoing discount war aimed at reducing inventory. The construction industry continued to have one of the longest DSO in the survey, reflecting persistently tight liquidity conditions for the downstream.

Economic expectations: Competition to remain intense amid persisting overcapacity pressure

Respondents remained optimistic about the economic outlook over the next 12 months, with 52% expecting business conditions to improve in 2025. Pharmaceuticals remained the most optimistic industry (83%), driven by structural demand from an aging population. Metals ranked second in optimism (72%), likely fuelled by hopes for stimulus measures. Yet, this sentiment may be excessive, as muted demand from the housing construction sector may continue to weigh on real demand. Additionally, rising tariffs between the U.S. and China could exacerbate challenges for metals like steel and aluminium that are subject to higher tariffs. Textiles remained the most pessimistic sector, though fewer respondents expected the outlook to worsen compared to last year, as textile firms may find some relief from moderating raw material costs, with prices for cotton and oil expected to trend lower.

Fierce competition remained the top risk facing corporate operations in 2025, highlighting the persistent challenge of China’s excessive production capacity. Slowing demand ranked as the second-largest risk, particularly for export-oriented firms, which could face heightened trade barriers under a second Trump presidency. It remained unclear whether government efforts to stimulate domestic demand would be sufficient to offset the shortfall in external demand. The sustained gap between supply and demand is likely to push Chinese companies to continue engaging in price competition to drive sales, further intensifying market pressures.

Hashtag: #Coface

The issuer is solely responsible for the content of this announcement.

COFACE: FOR TRADE

As a global leading player in trade credit risk management for more than 75 years, Coface helps companies grow and navigate in an uncertain and volatile environment.

Whatever their size, location or sector, Coface provides 100,000 clients across some 200 markets. with a full range of solutions: Trade Credit Insurance, Business Information, Debt Collection, Single Risk insurance, Surety Bonds, Factoring. Every day, Coface leverages its unique expertise and cutting-edge technology to make trade happen, in both domestic and export markets. In 2024, Coface employed ~5 236 people and recorded a turnover of ~€1.84 billion.

For more information, visit ![]() coface.com.hk

coface.com.hk

Media OutReach

SIM Graduates Demonstrate Strong Employment Outcomes in High-Demand Sectors

Findings from the SkillsFuture Singapore (SSG) Private Education Institution (PEI) Graduate Employment Survey 2023/2024 provide valuable insights into the employment landscape for PEI graduates. The survey reported that 74.8% of PEI graduates in the labour force secured employment within six months of graduation. Of this group, 46.4% attained full-time permanent roles, while others engaged in part-time, temporary or freelance employment.

Although overall employment rates reflect a slight softening in the job market, the median gross monthly salary for full-time permanent employment increased to S$3,500, signalling continued demand for qualified talent. Graduates in Information and Digital Technologies achieved the highest median salary at S$4,080, underscoring the strong market appetite for digital and technological skillsets, areas in which SIM’s IT and Computer Science programmes are well aligned.

SIM’s Business graduates also continue to perform competitively across the finance, technology and consulting sectors, leveraging analytical proficiency and global perspectives to contribute to multinational corporations and high-growth enterprises. In parallel, Arts and Social Sciences graduates are building meaningful careers in communications, media and the public service, where creativity, problem-solving and community engagement remain critical.

Graduate Success Pathways

The survey findings are reinforced by the varied experiences of SIM graduates who have progressed into competitive roles across multiple industries. Their journeys demonstrate how diverse learner profiles can achieve successful outcomes when supported by accessible pathways and industry-relevant learning.

Many SIM graduates enter programmes with different educational starting points — from polytechnic diplomas to mid-career transitions — and go on to advance through learning designed to strengthen both academic foundations and practical skills. Graduates have leveraged internationally recognised qualifications offered at SIM to secure positions in multinational organisations, high-growth technology firms, financial institutions, and public service agencies. Others pursue postgraduate education at reputable universities worldwide, building on their undergraduate success.

Students benefit from exposure to real-world environments through internships, applied industry projects and student leadership opportunities, which help build capabilities valued by employers. These experiences contribute to stronger career readiness and more resilient employability outcomes, supporting transitions into fast-moving sectors that are central to Singapore’s economic priorities.

Collectively, these pathways reflect SIM’s ongoing role in enabling talent progression — supporting students in unlocking new opportunities, whether beginning their careers, switching industries or enhancing their professional expertise.

SIM’s Contribution to Workforce Development

The survey findings underline the important contribution of private education pathways within Singapore’s broader talent ecosystem. While autonomous universities continue to report higher employment rates and salary outcomes, SIM remains a key provider of industry-relevant programmes that complement national skills priorities, serving a wide spectrum of learners and supporting their career advancement goals.

The upward salary trend among full-time permanent roles, together with strong performance in technology and business fields, indicates that SIM graduates are well-positioned to participate in sectors driving Singapore’s continued growth.

References:

- Close To 3 in 4 Private Education Institution Graduates in Employment Within 6 Months After Graduation Amidst Overall Lower Hiring Demand – https://www.ssg.gov.sg/newsroom/close-to-3-in-4-private-education-institution-graduates-in-employment-within-6-months-after-graduation-amidst-overall-lower-hiring-demand/

- From Undergrad to Postgrad: Paving the Way to the C-Suite – https://www.sim.edu.sg/articles-inspirations/from-undergrad-to-postgrad-paving-the-way-to-the-c-suite

- How this graduate pivoted her career by pursuing a degree while working full time – https://www.sim.edu.sg/articles-inspirations/how-this-graduate-pivoted-her-career-by-pursuing-a-degree-while-working-full-time

- How 6 internships, 4 hackathons, and CCAs paved the way for Ashley – https://www.sim.edu.sg/articles-inspirations/how-6-internships-4-hackathons-and-ccas-paved-the-way-for-ashley

- The Power of a Second Chance – https://www.sim.edu.sg/articles-inspirations/the-power-of-a-second-chance

Hashtag: #SIMGlobalEducation #SIMGE #GlobalEducation #InternationalDegree #CareerReady #FutureSkills

The issuer is solely responsible for the content of this announcement.

About SIM Global Education

SIM Global Education (SIM GE) is a leading private education institution in Singapore and the region. We offer more than 140 academic programmes ranging from diplomas and graduate diploma programmes to bachelor’s and master’s degree programmes with some of the world’s most reputable universities from Australia, Canada, Europe, United Kingdom, and the United States. SIM GE’s cohort is made up of 16,000 full- and part-time students and adult learners, of which approximately 36% are international students hailing from over 50 countries.

SIM GE’s holistic learning approach and culturally diverse learning environment aim to equip students with knowledge, industry skills and employability competencies, as well as a global perspective to succeed as future leaders in a fast-changing, technologically driven world.

For more information on SIM Global Education, visit sim.edu.sg

Media OutReach

SIM Career Fairs: Connecting Talent with Top Employers

Two Opportunities to Engage Annually

SIM organizes two major career fairs each year, strategically aligned with industry hiring cycles. This biannual format provides flexibility for students seeking internships during their studies or full-time positions upon graduation.

DREAMS Career Fair – Flagship Event

DREAMS is SIM’s premier career fair, featuring over 100 leading companies from sectors such as finance, technology, logistics, and consulting. Participating employers include Big Four accounting firms, major banks, and multinational corporations. The event offers extensive networking opportunities, interactive employer booths, and on-the-spot interviews for internships and graduate roles. This serves as a powerful launchpad for students to secure meaningful career opportunities.

IGNITE Career & Internship Fair – Industry-Specific Networking

IGNITE is SIM’s targeted networking event focused on sectors such as accounting, banking, technology, and logistics. Unlike large-scale fairs, IGNITE facilitates smaller, more personalized interactions with recruiters, enabling students to engage in substantive conversations and build deeper connections. The event includes company talks offering insider insights into niche roles and career pathways, complemented by mentorship and personalized guidance.

From Campus to Corporate

Students at SIM leverage career fairs and employer engagement events to build clearer pathways into the workforce. Many approach these opportunities by researching participating organisations, strengthening their resumes and practising how to communicate their strengths effectively, steps that help them gain direct exposure to recruiters and better understand evolving industry expectations.

While early interaction at career fairs may not immediately result in internships or job offers, they have provided meaningful insights and networking opportunities that later contribute to successful applications. Through repeated engagement and improved preparation, students have been able to secure internships and full-time roles at major firms across different sectors.

These outcomes reflect how structured career development activities at SIM support students in strengthening both their technical and interpersonal competencies, expanding their professional networks and transitioning more confidently into competitive industries.

Beyond Recruitment: A Holistic Employability Ecosystem

SIM’s Career Connect integrates career fairs with sustained employability programming, skills workshops, mentorship initiatives such as Project Protégé, and internship matching via the CareerSense app. This holistic approach ensures students have repeated engagement with employers throughout the year and supports recognition through awards like the SIM EDGE awards, which celebrates the well-rounded development of students.

More than recruitment channels, these fairs exemplify SIM’s commitment to bridging talent, industry needs and employment opportunity. External coverage of DREAMS and IGNITE further validates SIM’s commitment in equipping graduates to thrive in an evolving job market.

References:

- SIM Career Services Career Connect Overview – https://www.sim.edu.sg/degrees-diplomas/life-at-sim/career-services

- How I Landed A Full-Time Job Before Graduating – https://www.sim.edu.sg/articles-inspirations/how-i-landed-a-full-time-job-before-graduating

- External Coverage – DREAMS Career Fair @ SIM (CYS Global Remit) – https://www.cys.com.sg/post/dreams-career-fair-sim-unlocking-opportunities

- IGNITE Career & Internship Fair – SCDF Career Outreach Listing – https://www.scdf.gov.sg/join-us/career-outreach-activities/2024/09/20/career-outreach-activities/sim-career—internship-fair—ignite-2024

Hashtag: #SIMGlobalEducation #SIMGE #GlobalEducation #InternationalDegree #CareerReady #FutureSkills

The issuer is solely responsible for the content of this announcement.

About SIM Global Education

SIM Global Education (SIM GE) is a leading private education institution in Singapore and the region. We offer more than 140 academic programmes ranging from diplomas and graduate diploma programmes to bachelor’s and master’s degree programmes with some of the world’s most reputable universities from Australia, Canada, Europe, United Kingdom, and the United States. SIM GE’s cohort is made up of 16,000 full- and part-time students and adult learners, of which approximately 36% are international students hailing from over 50 countries.

SIM GE’s holistic learning approach and culturally diverse learning environment aim to equip students with knowledge, industry skills and employability competencies, as well as a global perspective to succeed as future leaders in a fast-changing, technologically driven world.

For more information on SIM Global Education, visit sim.edu.sg

Media OutReach

SIM Introduces CareerSense, an AI-Based Career Guidance Platform for Students

CareerSense Matters in Today’s Job Market

The global workforce is evolving rapidly. Automation, digitalisation, and emerging technologies are creating new opportunities while presenting new challenges. Navigating this landscape requires more than academic credentials; it demands self-awareness, adaptability, and strategic planning.

CareerSense addresses these needs by combining artificial intelligence with career development expertise, offering a personalised, data-driven approach to job readiness. It functions as a comprehensive career coach, accessible anytime and anywhere.

Key Features That Set CareerSense Apart

CareerSense offers a comprehensive suite of features designed to empower students throughout their career journey. Its AI-driven VIPS profiling evaluates Values, Interests, Personality, and Skills to deliver personalised career recommendations aligned with individual strengths and aspirations. The smart resume builder provides real-time scoring and improvement tips, while the job-matching algorithm connects students to roles that fit their unique profiles. Through integrated access, students can RSVP for events, schedule advisory sessions, and apply for internships and job listings seamlessly. Additionally, the Employability Index measures job readiness and works alongside skill gap analysis and tailored course recommendations to help students stay competitive in today’s dynamic job market.

The Bigger Picture: Empowering Future-Ready Graduates

The future of work is shaped by constant change, technological disruption, and global connectivity. Employers seek individuals who are adaptable, self-aware, and equipped with relevant skills. CareerSense empowers students to take ownership of their career journey, understand their strengths, identify gaps, and build competencies that matter in the real world.

This initiative reflects SIM’s commitment to lifelong learning and employability, ensuring graduates are not only job-ready but future-ready. In a competitive market, CareerSense positions SIM learners as confident, agile professionals prepared to lead in the digital economy.

References:

- Introducing CareerSense: Your All-in-One Personalised Career Buddy On-The-Go – https://www.sim.edu.sg/articles-inspirations/introducing-careersense-your-all-in-one-personalised-career-buddy-on-the-go

- Career Service – https://www.sim.edu.sg/degrees-diplomas/life-at-sim/career-services

- SIM Career Sense App (Google Play Store) – https://play.google.com/store/apps/details?id=sg.edu.sim.careersense&hl=en-US&pli=1

- SIM Career Sense App (Apple Store) – https://apps.apple.com/sg/app/sim-careersense/id1641839680

- Introducing CareerSense: Your Guide to Career Success After Graduation – https://regional.simge.edu.sg/en/introducing-careersense-your-guide-to-career-success-after-graduation/

Hashtag: #SIMGlobalEducation #SIMGE #GlobalEducation #InternationalDegree #CareerReady #FutureSkills

The issuer is solely responsible for the content of this announcement.

About SIM Global Education

SIM Global Education (SIM GE) is a leading private education institution in Singapore and the region. We offer more than 140 academic programmes ranging from diplomas and graduate diploma programmes to bachelor’s and master’s degree programmes with some of the world’s most reputable universities from Australia, Canada, Europe, United Kingdom, and the United States. SIM GE’s cohort is made up of 16,000 full- and part-time students and adult learners, of which approximately 36% are international students hailing from over 50 countries.

SIM GE’s holistic learning approach and culturally diverse learning environment aim to equip students with knowledge, industry skills and employability competencies, as well as a global perspective to succeed as future leaders in a fast-changing, technologically driven world.

For more information on SIM Global Education, visit sim.edu.sg

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn