Media OutReach

Trend Micro Reinvents Proactive Security with Digital Twin Technology

Innovation at the speed of agentic AI, built on NVIDIA AI, provides a data-driven foundation for supercharged decision-making

HONG KONG SAR – Media OutReach Newswire – 6 August 2025 – Trend Micro Incorporated (TYO: 4704; TSE: 4704), a global cybersecurity leader, today unveiled a groundbreaking new cyber resilience model that reinvents how enterprises approach proactive security. Trend’s Digital Twin capabilities will empower enterprises to simulate real-world cyber threats, validate their defenses, and adapt policies in real time across complex and diverse digital environments.

To learn more about how Trend’s Digital Twin technology is reshaping proactive security, visit: https://www.trendmicro.com/en_us/business/ai/digital-twin.html

Bartley Richardson, Senior Engineering Director, Agentic AI at NVIDIA: “In today’s rapidly evolving cybersecurity landscape, organizations need proactive solutions that can anticipate and counter potential threats before they occur. Powered by NVIDIA NIM microservices, Trend’s cybersecurity digital twins bring AI-driven protection to enterprise infrastructure.”

At the core of this model is Trend’s advanced agentic AI and industry-first application of cybersecurity digital twin technology. By creating high-fidelity, continuously updated simulation of an organization’s infrastructure, Trend enables security teams to visualize risk, test scenarios safely, and make rapid, data-driven decisions that improve resilience and reduce business disruptions.

The shift from periodic assessments to continuous, intelligent simulation marks a major evolution in proactive cybersecurity. It allows organizations to stay ahead of adversaries, harden their environments to circumvent cybersecurity threats, and confidently secure mission-critical operations against an ever-changing threat landscape. The technology shifts security practices from static and reactive to dynamic and predictive, enabling measurable improvements across a range of critical use cases.

Stuart Samples, Chief Technology Officer at Northeast Georgia Health System: “Trend’s digital twin approach completely changes our ability to understand risk in real-time. It helps us catch threats we didn’t even know to look for, allowing our team to focus less on firefighting and more on confidently driving innovation.”

Trend’s cybersecurity Digital Twin technology is powered by NVIDIA accelerated computing and NVIDIA AI Enterprise software, including NVIDIA NIM microservices. This enterprise-grade software enables the delivery of agentic AI models, optimized inference, and secure, scalable deployment—combining the simplicity of APIs with the flexibility of self-hosted infrastructure to strengthen cybersecurity outcomes with AI-driven precision.

Trend’s Digital Twin model will help organizations proactively manage risk across their entire infrastructure—from on-prem to cloud, IT to OT, and legacy to next gen AI-powered systems. It comes as governments and industry leaders accelerate AI infrastructure investments. Trend’s approach to digital twins enables customers to make better informed risk decisions and enhance security operations across their organization.

Scenario planning: AI agents simulate threats and tactics within the Digital Twin, long before a real-world incident occurs. This helps to test current mitigation strategies in a continuous cycle, to improve resilience planning for sensitive and complex environments.

Security investments: Decision makers can introduce new tools, policies, or architectural changes to see how they perform in the virtual environment. This results in better informed, data-driven investment decisions.

Business resilience optimization: Digital Twin technology can be used to simulate business-critical failure scenarios to highlight how data flows, how decisions are made, and how disruptions ripple across IT/OT systems and teams. These real-time risk insights boost enterprise security planning capabilities without risking disruption to production systems.

Frank Dickson, Group Vice President, Security & Trust at IDC: “As threats migrate to OT, proactive security is critical. Trend Micro’s Digital Twin technology introduces a new operational model for enterprise cyber security: simulation. Sometimes even probing a production network can result in downtime, often making it extremely difficult to expose vulnerabilities and confirm compensating measures. A continuous cycle of adversary simulation and defensive validation becomes a value tool to ensure that organizations stay ahead of cyber threats, while being sensitive to the fragility of some operational environments.”

The announcement is the latest in a line of innovation-led projects from Trend designed to help network defenders harness AI, close skill gaps, and improve security outcomes.

Most recently, Trend announced it would open source its Trend Cybertron AI model and agent framework in a bid to accelerate the development of autonomous cybersecurity agents.

Its work has also expanded to cover protection for GenAI workloads and advances to sovereign AI infrastructure.

Rachel Jin, Chief Enterprise Platform Officer at Trend: “Enterprises are struggling to defend complex, dynamic infrastructure environments from highly adaptive, AI-powered adversaries. Rapid shifts in threat actor tactics and IT infrastructure mean reactive, point-in-time risk assessments are no longer fit for purpose. Our Digital Twin technology empowers customers to simulate threats and safely validate security controls without touching production systems—to finally close the gap between digital transformation and defensive readiness.”

Hashtag: #trendmicro #trendvisionone #visionone #cybersecurity#digitaltwin

https://www.trendmicro.com

www.TrendMicro.com

Media OutReach

XTransfer Joins Forum Ekonomi Malaysia 2026

Signals Plan to Make Malaysia Regional Compliance Hub

KUALA LUMPUR, MALAYSIA – Media OutReach Newswire – 11 February 2026 – XTransfer, the world’s leading B2B cross-border financial platform, was honoured to be invited to join the Malaysia Economic Forum (Forum Ekonomi Malaysia 2026). Bill Deng, Founder and CEO of XTransfer, shared insights on how Malaysia can accelerate technology application and innovation to help micro, small and medium enterprises (MSMEs) scale exports under the 13th Malaysia Plan (13MP), during FEM 2026’s panel discussion, “Made by Malaysia: Accelerating Technology Applications & Innovation”.

Bill was honoured to join YB Tuan Liew Chin Tong, Deputy Minister of Finance of Malaysia, and Mr Ooi Ching Liang, Senior Director of Engineering at SkyeChip, for a discussion focused on strengthening high-growth, high-value industries, advancing R&D commercialisation, increasing productivity and competitiveness, and supporting MSMEs in global value chains.

Drawing on XTransfer’s work with MSMEs across markets, Bill noted that many Malaysian businesses are “able to export,” but face persistent barriers to scaling exports. The most common issues are trust, compliance, and scale, which often surface as payment delays, repeated documentation requests, FX uncertainty, and working capital pressure as orders grow.

“For B2B SMEs in foreign trade, the biggest constraint isn’t demand. It’s the operational complexity behind cross-border payments, foreign exchange, and compliance,” Bill said. “In particular, AML requirements can be difficult for both traditional banks and SMEs to manage efficiently, creating friction that slows down legitimate trade.”

Bill highlighted a structural shift in global trade flows from a single dominant corridor to non-U.S., intra-Asia, and broader South–South routes. This trend is increasingly clear in real SME transaction patterns. Bill shared, “In 2025, XTransfer’s average collection amount from Asia, Africa, and Latin America grew by 106% year-on-year, with Africa exceeding 270%, Latin America reaching 94%, and ASEAN reaching 82%.” YB Liew noted the trend and thinks it is a direction Malaysia should pursue.

XTransfer also said it plans to establish Malaysia as its regional compliance centre, citing Malaysia’s strong geographic and time-zone advantages, a mature regulatory environment, availability of talent in compliance and risk operations, and cost efficiency. “Malaysia gives us the talent, governance environment, and regional proximity to scale compliance as intra-Asia and emerging-market trade accelerates,” Bill added.

Hashtag: #XTransfer #Malaysia #SMEs #13MP #FEM2026

![]() https://www.xtransfer.com

https://www.xtransfer.com![]() https://www.linkedin.com/company/xtransfer.cn

https://www.linkedin.com/company/xtransfer.cn![]() https://x.com/xtransferglobal

https://x.com/xtransferglobal![]() https://www.facebook.com/XTransferGlobal/

https://www.facebook.com/XTransferGlobal/

The issuer is solely responsible for the content of this announcement.

Media OutReach

CGTN: Little Chinese New Year opens big window to China’s soul

As the lunar calendar turns its final pages, China enters a period of joyful anticipation known as Xiaonian, or Little Chinese New Year. Often celebrated as the Festival of the Kitchen God, it marks the official start of the “busy year” – a traditional term for the intense, joyful period of preparing food, cleaning homes, and shopping for the upcoming Spring Festival.

The Spring Festival is a deeply significant time for family reunion. In 2024, UNESCO inscribed the “Spring Festival, social practices of the Chinese people in celebration of the traditional Chinese New Year” onto the Representative List of the Intangible Cultural Heritage of Humanity.

While daily routines continue to evolve, they remain anchored in rituals that provide a sense of normalcy and meaning. It is perhaps no wonder that in a climate of uncertainty, traditional Chinese lifestyles are finding a new audience beyond the country’s borders, with the Spring Festival chief among those unique traditions that are fast becoming a shared human experience.

Diverse traditions, shared aspirations

In a prelude to the broader celebrations, Xiaonian, observed on February 10 and 11 this year, kickstarts a focused period of preparation. According to ancient lore, families offer Zaotang, or sticky “Kitchen Candy,” to the Kitchen God to ensure he delivers a favorable report on the household’s conduct before he ascends to the heavens. This lighthearted tradition marks the beginning of several symbolic rituals aimed at welcoming a fresh start.

A key element of this transition is donning new clothes. In Chinese culture, the New Year represents a moment when “all things are renewed,” and wearing new garments symbolizes shedding the “dust” or misfortunes of the past to embrace auspicious energy for the year ahead. Alongside this personal renewal, families nationwide engage in “sweeping the dust,” a deep-cleaning ritual to purify the home and prepare it for new blessings.

Whereas these practices are universal, celebratory flavors vary by geography. In the north, families traditionally gather over steaming plates of dumplings, whereas in the south, the menu often features sweet rice cakes (Niangao) and glutinous rice balls (Tangyuan).

As Mao Qiaohui, a researcher at the Institute of Ethnic Literature at the Chinese Academy of Social Sciences, explains, these variations highlight the inclusive nature of Chinese civilization.

“Although folk customs differ between different regions across China, this diversity reflects the cultural pluralism within the Spring Festival tradition,” she notes. “Different regional identities contribute to a shared pursuit of harmony and reunion.”

The vitality of these traditions is also evident in local craftsmanship. In northern regions like Shandong and Henan, artisans are currently making Huamo, decorated steamed buns, featuring horse designs for the upcoming zodiac year. Meanwhile, in Shuozhou, Shanxi Province, intangible heritage inheritors are carving spirited stallions onto traditional gourds. These creations reflect the regional diversity of the festival and a collective desire for progress in the year ahead.

Cultural dialogue: From global stage to daily life

The festive atmosphere is reflected further in preparations for the Spring Festival Gala (Chunwan), produced by China Media Group.

Recent rehearsals show performances meshing traditional Chinese culture with international artistry. One performance piece combines the wooden clog dance of the Hani and Lisu ethnic groups with the rhythmic tap of Spanish Flamenco and Hungarian folk dance. And with global stars like Jackie Chan and Lionel Richie on the bill, the Gala’s stage is set to become a stage for the world to come together.

The reach of the gala has expanded far beyond a domestic audience. Through the “Spring Festival Gala Prelude” events held in the United States, Russia, France, Italy, and several African nations, the program has become a gateway to Chinese New Year customs and cultural exchange.

This interest extends beyond art and into the lives of people worldwide, as seen in the #BecomingChinese trend. This phenomenon features international social media users adopting elements of Chinese daily life – such as keeping a thermos of hot water handy, wearing quilted indoor slippers or practicing mindful movement with Baduanjin exercises.

The festival is no longer a distant event but a gateway to Chinese lifestyle, rooted in ancient wellness wisdom and constantly updated by modern convenience, and the first step to a journey of exploration into a culture that values ritual, safety and hospitality.

Whether through global broadcasts or shared daily habits, the Spring Festival increasingly strengthens a sense of cultural empathy between China and the rest of the world.

For more information, please click here:

Hashtag: #CGTN

The issuer is solely responsible for the content of this announcement.

Media OutReach

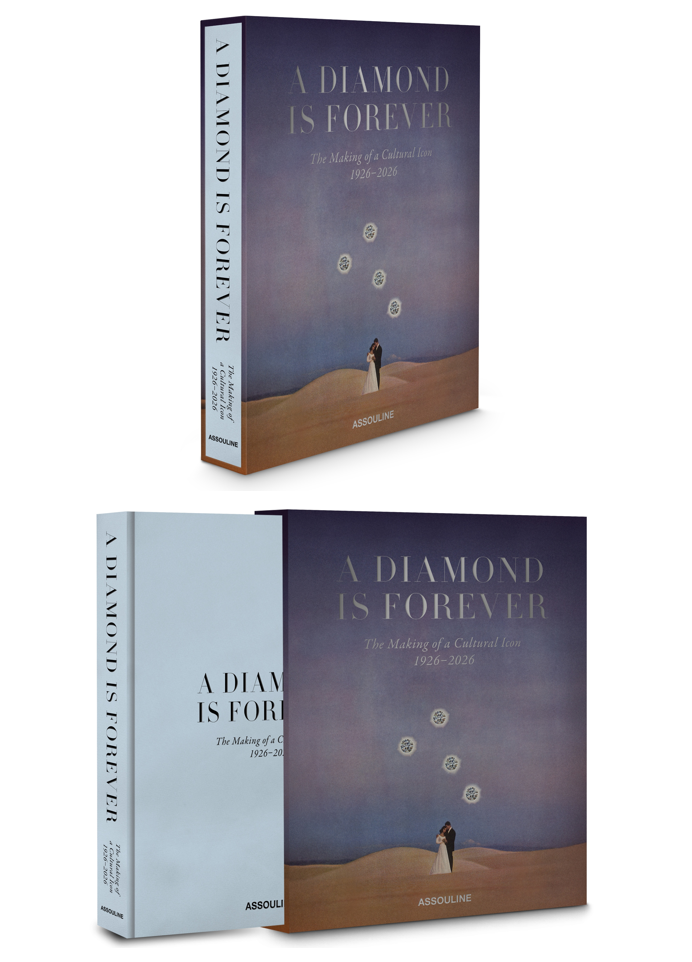

De Beers Group and Assouline Celebrate the Launch of “A Diamond Is Forever: The Making of A Cultural Icon 1926-2026”

Hashtag: #DeBeersGroup #NaturalDiamonds #diamonds #ADiamondIsForever #Assouline

![]() https://www.debeersgroup.com/

https://www.debeersgroup.com/![]() https://www.linkedin.com/company/debeersgroup/posts/?feedView=all

https://www.linkedin.com/company/debeersgroup/posts/?feedView=all![]() https://www.facebook.com/DeBeersGroupOfCompanies

https://www.facebook.com/DeBeersGroupOfCompanies![]() https://www.instagram.com/debeersgroup/

https://www.instagram.com/debeersgroup/

The issuer is solely responsible for the content of this announcement.

About De Beers Group

Established in 1888, De Beers Group is the world’s leading diamond company with expertise in the exploration, mining, marketing and retailing of diamonds. Together with its joint venture partners, De Beers Group employs more than 20,000 people across the diamond pipeline and is the world’s largest diamond producer by value, with diamond mining operations in Botswana, Canada, Namibia and South Africa. Innovation sits at the heart of De Beers Group’s strategy as it develops a portfolio of offers that span the diamond value chain, including its jewellery houses, De Beers Jewellers and Forevermark, and other pioneering solutions such as diamond sourcing and traceability initiatives Tracr and GemFair. De Beers Group also provides leading services and technology to the diamond industry in the form of education and laboratory services via De Beers Institute of Diamonds and a wide range of diamond sorting, detection and classification technology systems via De Beers Group Ignite. De Beers Group is committed to ‘![]() Building Forever,’ a holistic and integrated approach for creating a better future – where safety, human rights and ethical integrity continue to be paramount; where communities thrive and the environment is protected; and where there are equal opportunities for all. De Beers Group is a member of the Anglo American plc group. For further information, visit

Building Forever,’ a holistic and integrated approach for creating a better future – where safety, human rights and ethical integrity continue to be paramount; where communities thrive and the environment is protected; and where there are equal opportunities for all. De Beers Group is a member of the Anglo American plc group. For further information, visit ![]() www.debeersgroup.com.

www.debeersgroup.com.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn