Economy

Senate Holds Talks on Banks’ High Interest Rates

By Dipo Olowookere

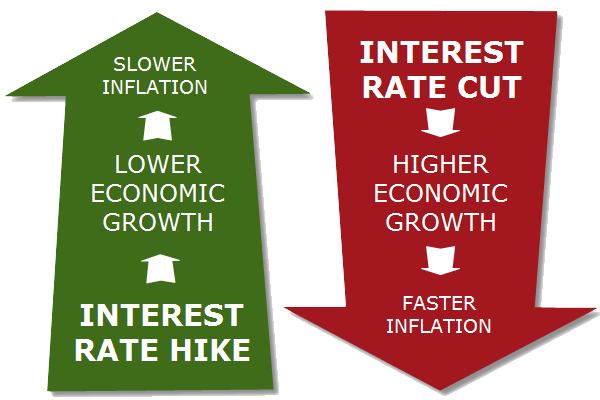

The high interest rate being charged by commercial banks in the country has caught the attention of the Senate and this would be discussed during plenary this week.

Senate President, Mr Bukola Saraki, told reporters on Saturday in Ilorin, Kwara State that he and his colleagues will look into the matter with a view to prevailing on the lenders to cut the rate.

Mr Saraki noted that the high interest rates being charged by commercial banks on loans to customers could have adverse effect on the country’s economy, particularly for entrepreneurs who need borrowed funds to stay afloat and contribute to the Gross Domestic Product (GDP).

The Senate President said during the talks, the Senate would take a decision on the interest rates being charged by commercial banks as he said the prevailing rates were too high and discouraging to genuine industrialists and entrepreneurs who need to accommodate the cost of money alongside other costs to fix prices of goods and services.

“If we genuinely want to stimulate local manufacturing and development of the small and medium enterprises so as to generate employment and help our national economy to recover from recession, then people must be able to borrow money at reasonable interest rates. It is difficult for manufacturers to survive while borrowing at about 28 percent,” he said.

Speaking on the journey thus far, after being at the helm of the Senate and the National Assembly as a whole for the past two years, the Senate President said: “I am comfortable with the support that I have received from my colleagues. One thing that makes the 8th Senate different is that we take initiative.

“For example, a bill like the PIGB would have been easier to pass as an executive bill—however, based on how united we are and focused on the greater good, the passage of the PIGB goes to show Nigerians the competencies of the Senators of the 8th National Assembly.”

Mr Saraki said the 8th Senate has scored many firsts since its inception and that it has fulfilled its mandate through the passage of several critical economic reform bills, opening of the National Assembly’s budget, and its investigations that have helped in the fight against corruption.

“We are a focused Senate. We are also a people-oriented Senate. We are a Senate of many firsts, if you look at the passage of the Petroleum Industry Governance Bill, the opening of the National Assembly Budget, the passage of Bills like the Ports and Harbors Reform Bill and the Credit Bureau Scheme, you will see that we take governance very seriously.

“Over time, through our work like the Treasury Single Account (TSA) investigation; the NEITI Report investigation; and the North East Humanitarian Response investigation, we have shown that this is a Senate that does not sweep things under the carpet. We are working to pass Bills, enshrine transparency, and do things that matter to everyday Nigerians”, the Senate President said, “This is because we know what families across the nation are going through and we are working to try to create more opportunities for them.”

Mr Saraki also said, “Over the last two years, our focus has been on the economy, the economy, and the economy. You will soon see how the ‘Made in Nigeria’ amendment to the Public Procurement Act will open more opportunities for Nigerians.

“Additionally, starting with the implementation of the 2017 budget, the Senate will be defending Nigerian businesses by letting them know that if they find any government ministry, department or agency that is not patronizing ‘Made in Nigeria’ as a first option, they should let us know, and we will take appropriate action.”

When asked why the Senate decided to pass the governance aspect of the Petroleum Industry Bill first, the Senate President said: “One of my first meetings after becoming the Senate President was a meeting with consultants and stakeholders to find out why the Petroleum Industry Bill had always failed to pass in the past.

“When the reason became clear, we decided to take the first part of the Bill that has to do with governance, transparency and accountability in order to make the system more efficient for the country.

“By doing this, we have sent a message to international investors who have been previously unsure about what laws govern our petroleum industry that the country is truly ready for more investment in this sector.”

Speaking on the recent passage of the Nigerian Football Federation Bill by the 8th Senate, the Senate President described it as “A very important Bill that will transform the administration of football in the country. It is very personal to me because as a club owner, I am happy that this Bill will make the administration of football to be in-line with international best practices.”

Economy

Police, Capital Market Regulators Partner for Nigeria’s Economic Growth

By Aduragbemi Omiyale

The Nigeria Police Force (NPF) has promised to work with the Securities and Exchange Commission (SEC) and the Nigerian Exchange (NGX) Group Plc for the prevention of financial crime, and the reinforcement of trust and confidence in Nigeria’s capital market.

The Inspector General of Police, Mr Kayode Egbetokun, gave this assurance on Wednesday at the closing gong ceremony in his honour at the NGX in Lagos.

The police chief said, “A transparent and well-regulated capital market is vital to Nigeria’s economic growth. The Nigeria Police Force remains committed to working with regulators and market operators to prevent financial crime, protect investors, and uphold the integrity of our financial system.”

Earlier in his welcome address, the chairman of NGX Group, Mr Umaru Kwairanga, commended the leadership of the police in supporting market integrity.

“Market integrity is a shared responsibility. By honouring the Inspector-General of Police, we are reinforcing the importance of institutional alignment in protecting investors and preserving trust in our financial system.

“Strong collaboration between regulators, enforcement agencies, and market infrastructure institutions is essential to building a resilient and credible market that supports economic growth,” he stated.

The Director-General of SEC, Mr Emomotimi Agama, while speaking, emphasized the importance of coordinated enforcement, noting: “Investor protection is at the core of market regulation, and today’s engagement highlights how critical collaboration with law enforcement is to achieving that mandate. This partnership strengthens our enforcement capacity, enhances deterrence against illegal investment activities, and reinforces confidence in the Nigerian capital market.”

As for the chairman of NGX Limited, Mr Ahonsi Unuigbe, “A transparent and orderly market can only thrive where rules are respected and misconduct is addressed decisively. The presence of the Nigeria Police Force in this collective effort sends a strong signal that safeguarding the market is a national priority.”

Similarly, the chief executive of NGX Group, Mr Temi Popoola, stressed the importance of aligning innovation with oversight, pointing out that, “Technology and market growth must be supported by strong enforcement and investor protection frameworks. Our collaboration with the SEC and the Nigeria Police Force reflects a unified approach to preserving the credibility of Nigeria’s capital market.”

Economy

NASD OTC Exchange Closes Green by 0.09%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange rallied by 0.09 per cent on Wednesday, February 4, amid renewed appetite for unlisted stocks.

This lifted the NASD Unlisted Security Index (NSI) by 3.18 points to 3,641.30 points from the previous session’s 3,641.30 points and raised the market capitalisation by N1.9 billion to N2.180 trillion from the N2.178 trillion quoted on Tuesday.

The bourse recorded three price gainers and four price losers at the midweek session.

The advancers were led by Air Liquide Plc, which went up by N2.04 rise to end at N22.53 per share versus the previous session’s N20.49 per share, Central Securities Clearing System (CSCS) added 97 Kobo to sell at N44.97 per unit versus N44.00 per unit, and Acorn Petroleum Plc appreciated by 2 Kobo to N1.37 per share from N1.35 per share.

On the flip side, Geo-Fluids Plc lost 55 Kobo to sell at N6.26 per unit versus N6.81 per unit, Nipco Plc depreciated by 48 Kobo to trade at N259.00 per share versus N259.48 per share, FrieslandCampina Wamco Nigeria Plc declined by 40 Kobo to N63.10 per unit from N63.50 per unit, and Industrial and General Insurance (IGI) depleted by 1 Kobo to 65 Kobo per share from 66 Kobo per share.

Yesterday, the volume of trades slid by 64.5 per cent to 2.5 million units from 7.0 million units, the value of transaction decreased by 53.2 per cent to N17.7 million from N37.9 million, and the number of deals went down by 47.1 per cent to 18 deals from 34 deals.

CSCS Plc remained the most traded stock by value on a year-to-date basis with 16.0 million units valued at N652.6 million, followed by FrieslandCampina Wamco Nigeria Plc with 1.7 million units exchanged for N111.2 million, and Geo-Fluids Plc with 11.7 million units traded for N76.1 million.

CSCS Plc was also the most active stock by volume on a year-to-date basis with 16.0 million units sold for N652.6 million, trailed by Mass Telecom Innovation Plc with 13.3 million units worth N5.3 million, and Geo-Fluids Plc with 11.7 million units valued at N76.1 million.

Economy

Naira Rallies to N1,358/$1 at Official Market, N1,450/$1 at Parallel Market

By Adedapo Adesanya

The Naira rallied at the different segments of the foreign exchange (FX) market on Wednesday as supply continues to outweigh demand, giving it an edge against the United States Dollar.

In the parallel market, the Nigerian Naira improved its value on the greenback yesterday by N5 to quote at N1,450/$1 compared with the previous day’s N1,455/$1, and at the GTBank FX desk, it gained N3 to trade at N1,383/$1, in contrast to Tuesday’s exchange rate of N1,386/$1.

In the the Nigerian Autonomous Foreign Exchange Market (NAFEX), which is also the official market, the Naira firmed up against the Dollar at midweek by N14.63 or 1.1 per cent to settle at N1,358.28/$1 versus the preceding session’s N1,372.91/$1.

Against the Pound Sterling, the domestic currency appreciated on Wednesday by N14.16 to N1,863.43/£1 from the previous day’s N1,877.59/£1, and gained N13.73 on the Euro to end at N1,606.03/€1 versus the N1,619.76/€1 it was exchanged a day earlier.

The strengthening of the Naira value has been driven by the injection of forex into the financial markets by foreign investors seeking attractive investments in the emerging markets, helping to boost Nigeria’s external reserves, which provide the Central Bank of Nigeria (CBN) with the capacity to support the local currency.

As of February 4, 2026, the reserves reached $46.59 billion.

The local currency has been able to find a solid path despite no indications of any intervention from the apex bank in recent week, strengthening the case of price discovery.

Policy moves by the CBN is also offering a backbone for the FX market as it considers some strategic reforms through a policy known as the Single Regulatory Window.

In its 2025 Fintech Report, the central bank said this scheme will significantly reduce time-to-market for new digital financial products by streamlining licensing and supervisory processes across multiple agencies.

Meanwhile, the cryptocurrency market was in red amid a broad sell-off in global technology stocks, with reports showing that liquidity was notably thin, amplifying price moves and contributing to forced liquidations. The decline followed a sharp sell-off in global technology stocks overnight, where concerns over the pace of artificial intelligence adoption and rising capital spending by major firms weighed heavily on valuations.

Bitcoin (BTC) lost 7.9 per cent to sell at $70,534.94, Ripple (XRP) declined by 11.2 per cent to $1.42, Binance Coin (BNB) slumped by 9.4 per cent to $689.70, Ethereum (ETH) crashed by 8.9 per cent to $2,072.46, and Solana (SOL) dipped by 8.7 per cent to $89.86.

In addition, Dogecoin (DOGE) depreciated by 6.9 per cent to $0.1008, Cardano (ADA) slipped by 6.8 per cent to $0.2792, Litecoin (LTC) dropped 5.1 per cent to trade at $57.56, and US Dollar Tether (USDT) went down by 0.1 per cent to $0.9980, while the US Dollar Coin (USDC) closed flat at $1.00.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn