Economy

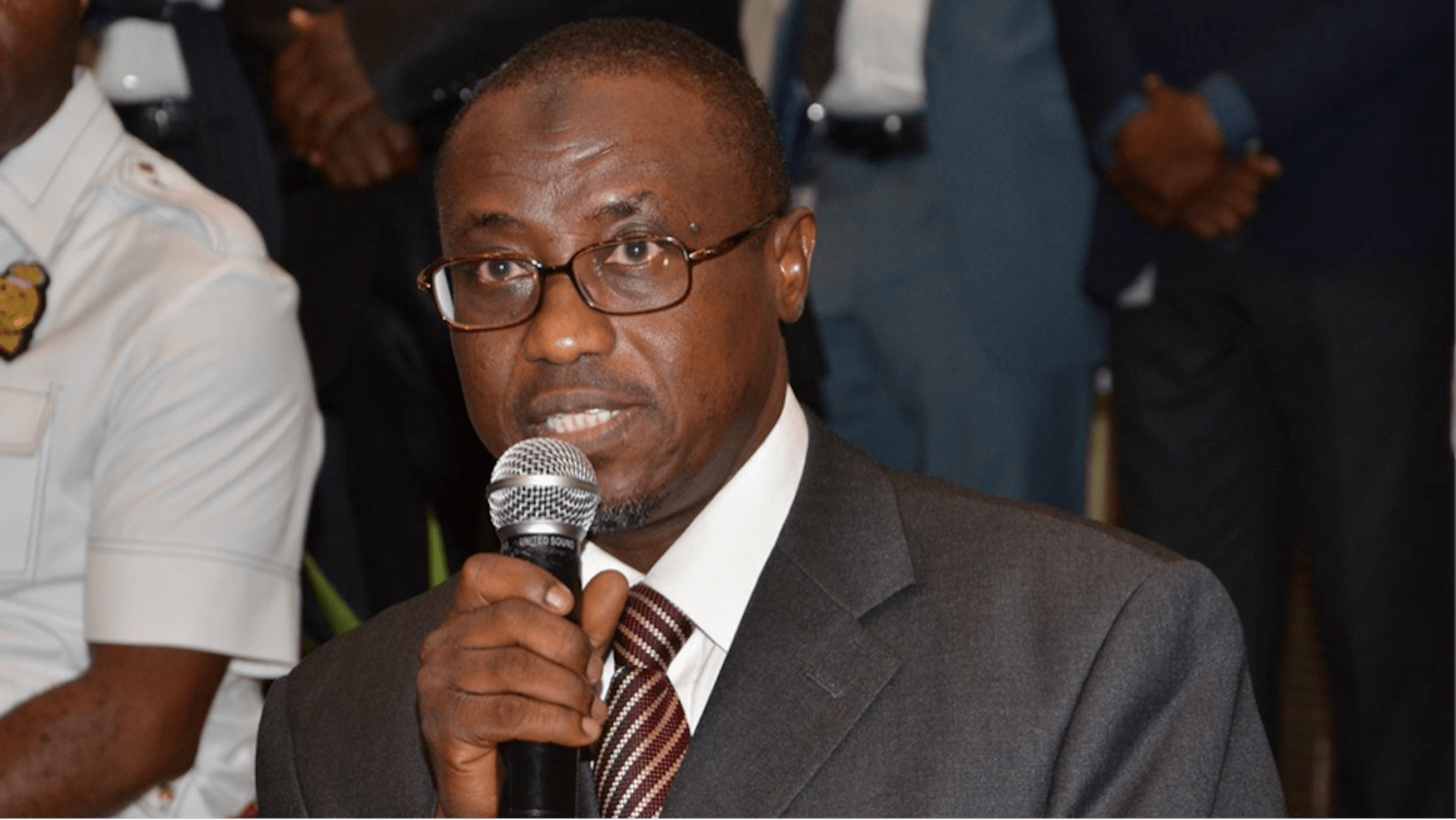

Baru Tasks Mechanical Engineers on Economic Diversification

By Dipo Olowookere

Group Managing Director of the Nigerian National Petroleum Corporation, Dr. Maikanti Kacalla Baru, has charged engineering practitioners in the country to provide viable solutions towards fast-tracking Nigeria’s quest to diversify the economy.

Dr Baru gave the charge while speaking at the 30th Conference & Annual General Meeting of the Nigerian Institution of Mechanical Engineers (NiMechE), shortly after he was conferred with the Institution’s Fellowship in Kaduna today.

“Mechanical Engineers are expected to play a major role in Nigeria’s quest for diversification and industrialization. In the near future, you are expected to provide the necessary tools and equipment for agriculture and transportation system which would drive Nigeria’s industrialization,” Baru said.

Describing engineering as a branch of knowledge which provides the foundation for industrialization and growth in both advanced and developing countries, Mr Baru stressed that alternative energy sources were other areas that should interest engineers.

“Another area where engineers could venture in is Renewable Energy where you can provide ethanol to compete with the fossil oil as fuel for our vehicles towards ensuring a cleaner environment,” he stated.

According to Mr Baru, Mechanical Engineers could also impact the economy positively by getting involved in the design and manufacturing of highly efficient cooling and heating systems, pumps and their drivers.

He noted that in the Oil and Gas industry, engineering remains the bedrock of NNPC’s day-to-day operations both on the onshore and offshore environment.

“Today, our Mechanical Engineers are at the forefront of innovation, design, construction, operations and maintenance of our critical equipment across the oil and gas value-chain,” he stressed.

He expressed NNPC’s commitment to forge strong partnerships with professional bodies such as NiMechE to enable the Corporation deliver on its mandate of moving the nation’s economy forward.

While conferring the Fellowship on the GMD, the National Chairman of NiMechE, Engr. Ugochukwu Nzurumike said Dr. Baru’s worthy contributions to Nigerian Oil and Gas Industry could not have gone unrecognized.

“Today, we celebrate someone who has not only added value to the mechanical engineering profession in the country, but has also moved Nigerian oil and gas industry forward,” he said.

Earlier in his remarks, President of the Nigerian Society of Engineers (NSE), Engr. Otis Anyaeji, said for Nigeria to achieve its industrialization potentials, mechanical engineers must drive the wheels.

Established in 1990, the NiMechE is a division of the NSE charged with developing the professional capacity of mechanical engineers across the country.

The theme of the 30th International Conference/AGM was “Mechanical Engineering in the Diversification of Nigerian Economy.”

Economy

Court Convicts AAC Consulting Over N30.5m Theft from Chevron Contract Staff

By Adedapo Adesanya

A Lagos Special Offences Court has convicted AAC Consulting Limited for stealing over N30.5 million belonging to contract staff of Chevron Nigeria Limited.

The judge, Justice Rahman Oshodi, found the firm guilty of stealing N30,564,635.81, following its prosecution by the Lagos Zonal Directorate 1 of the Economic and Financial Crimes Commission (EFCC).

The conviction followed the company’s guilty plea to an amended one-count charge of stealing, contrary to Section 285(1) of the Criminal Code, Laws of Lagos State, 2011, sealing a long-running fraud case that exposed how outsourced workers’ salaries were diverted by their own payroll handlers.

The case dates back to June 5, 2023, when AAC Consulting Limited and its Managing Director, Anthony Adeoye, were arraigned on a 50-count charge bordering on stealing and issuance of dud cheques. Both defendants initially pleaded not guilty, forcing the EFCC to open full trial.

During proceedings, prosecuting counsel, Mr I.O. Daramola, called two witnesses, while several documents were tendered and admitted as exhibits by the court to establish how the funds meant for Chevron contract staff were allegedly misappropriated.

However, the trial took a dramatic turn after the full repayment of the stolen sum to the petitioner in December 2023.

Following the refund, the defendants changed their plea to “guilty”, prompting the EFCC to amend the charge, dropping the multiple counts and proceeding against the company alone on a single count of stealing.

The amended charge stated that AAC Consulting Limited, “on or about April 27, 2013, at Lagos, dishonestly converted to its own use the aggregate sum of N30,564,635.81, property of contract staff of Chevron Nigeria Limited.”

After reviewing the plea and evidence before the court, Justice Oshodi convicted the company and imposed a N5 million fine, with a stern warning.

The court ordered that the fine must be paid within 14 days, failing which AAC Consulting Limited will be wound up.

The conviction sends a strong message to outsourcing and payroll management firms, particularly those handling funds for multinational oil companies, that refund of stolen money does not erase criminal liability.

For the affected Chevron contract staff, the judgment closes a 13-year chapter of financial abuse, while reinforcing EFCC’s stance that corporate entities will be held accountable for payroll fraud and breach of trust in Nigeria’s corporate and labour ecosystem.

Economy

Nigerian Startups Account for 8% of Africa’s $3.8bn Raise in 2025

By Adedapo Adesanya

Nigeria recorded its lowest funding share since 2019 but the highest number of deals in 2025, according to Africa Investment Report 2025 published by Briter, a market intelligence platform focused on emerging markets.

According to the report, African companies disclosed a total of $3.8 billion in funding in 2025, representing a 32 per cent increase in deal volume and an 8 per cent rise in the number of announced transactions compared to the previous year ($2.8 billion in 2024).

However, Nigeria accounted for only 8 per cent of total funding, trailing behind South Africa (32 per cent), Kenya (29 per cent), and Egypt (15 per cent).

Despite the drop in funding share, Nigeria’s performance reflects a shift toward smaller, early- and growth-stage transactions, rather than mega-deals. The country recorded the highest number of deals on the continent, indicating strong entrepreneurial activity but limited access to large-ticket funding.

According to Briter, among the ‘Big Four’, Nigeria raised around $315 million alone last year from 205 estimated deals compared to South Africa which raised $1.2 billion from 130 deals, Kenya followed with $1.1 billion from around 16o deals, and Egypt came third with $595 million in 115 deals.

Nigeria which used to occupy the top two among this group has faced steep challenges including the 2023 currency devaluation which made it harder for startups to generate Dollar returns.

As a result, Briter explains that fewer mega-rounds happened in Nigeria, making the totals lower. However, it allowed for newer, upcoming startups to raise in 2025.

The report noted that fintech and digital financial services remained the most funded sector by both value and deal count, reinforcing Nigeria’s position as Africa’s fintech hub. However, climate-focused solutions recorded the fastest growth, raising more than three times their 2024 total, with solar energy emerging as the most funded category.

The surge in solar investment reflects growing investor appetite for infrastructure-like clean energy projects offering predictable returns, particularly in countries like Nigeria where power deficits remain a major economic constraint.

Briter noted that Artificial Intelligence (AI) attracted increased attention from investors in 2025, though funding remained largely concentrated in applied use cases such as financial services, logistics, and health tech rather than deep research and development.

In 2025, 63 acquisitions were announced, though only five disclosed transaction values. Notably, half of those involved startups acquiring other startups, pointing to early signs of consolidation within the ecosystem.

The report added that equity financing remained dominant, but debt funding surpassed $1 billion for the first time in a decade, signaling growing confidence in structured finance across African markets. It also noted a rise in capital from non-Western sources, particularly Japan and Gulf Cooperation Council (GCC) countries, as traditional Western investors scaled back.

Despite increased funding activity, Briter pointed out that the gender gap remains stark as less than 10 per cent of total funding went to companies with at least one female founder, highlighting ongoing challenges in inclusive capital access across Africa.

Economy

NASD OTC Exchange Drops 0.44%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange dipped by 0.44 per cent on Tuesday, January 27, with the market capitalisation declining by N9.70 billion to N2.174 trillion from N2.184 trillion, and the NASD Unlisted Security Index (NSI) falling by 16.21 points to 3,634.73 points from 3,650.94 points.

The bourse was under pressure from two securities, which lost weight, overpowering the gains recorded by three securities.

Business Post reports that FrieslandCampina Wamco Nigeria Plc lost N5.70 to sell at N64.00 per share compared with Monday’s price of N69.70 per share and Central Securities Clearing System (CSCS) Plc dropped 17 Kobo to close at N40.50 per unit, in contrast to the preceding day’s N40.67 per unit.

On the flip side, Air Liquide Plc added N1.69 to settle at N18.63 per share versus the previous session’s N16.94 per share, UBN Property Plc appreciated by 20 Kobo to N2.20 per unit from N2.00 per unit, and Industrial and General Insurance (IGI) Plc gained 6 Kobo to trade at 69 Kobo per share versus 63 Kobo per share.

During the session, the volume of securities traded by investors fell further by 80.9 per cent to 1.3 million units from 6.8 million units, the value of securities went down by 57.3 per cent to N57.3 million from N156.7 million, and the total number of deals shrank by 13.6 per cent to 38 deals from 44 deals.

At the close of business, CSCS Plc was the most traded stock by value on a year-to-date basis with 14.4 million units traded for N586.1 million, the second spot was occupied by FrieslandCampina Wamco Nigeria Plc with 1.6 million units worth N107.9 million, and the third spot was taken by MRS Oil Plc with 297,101 units valued at N59.3 million.

CSCS Plc also ended as the most active stock by volume on a year-to-date basis with 14.4 million units valued at N586.1 million, followed by Geo-Fluids Plc with 1.6 million units worth N107.9 million, and Mass Telecom Innovation Plc with 6.4 million units sold for N2.6 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn