Health

Confusion as NHIS’s N720b Disappear, Banks, Others Indicted

By Modupe Gbadeyanka

Questions are already being asked over the disappearance of about N720 billion, which was ‘invested’ by the National Health Insurance Scheme (NHIS) in 12 years with no concrete answer being provided.

According to The Nation, not even the NHIS boss, Professor Usman Yusuf, can provide an answer to this question on the lips of authorities, who want to know what happened to the huge amount of money meant for the betterment of Nigerians.

Prof Yusuf, The Nation said, revealed that the “investments” had no approvals of successive Ministers of Health, past boards of the NHIS and the Office of the Accountant-General of the Federation (OAGF).

He said billions were lost to diversion and under-payment of interest.

Banks, former Executive Secretaries, select management staff and interest groups were all neck-deep in the scandal, Yusuf alleged.

According to the NHIS Executive Secretary/Chief Executive Officer, there is no trace yet of the N720billion.

Yusuf opened the lid on the corrupt practices in NHIS in a power-point presentation to the agency’s Governing Council in response to a query by the board.

He said when he discovered the scandal, he engaged forensic accountants to get to the root of the matter.

The Nation had exclusively reported that a team raised by the Federal Government discovered that over N138billion of the NHIS cash was trapped in 17 banks, financial companies and individuals’ pockets from January 2011 to date.

In a memo to the Executive Secretary, the Chairman of the Governing Council of NHIS, Dr. Enyantu lfenne, asked him to “clear these concerns (trapped funds and Forensic Audit) and guide Council on the way forward.”

In his response to the query, the Executive Secretary said the rot in the NHIS was unimaginable.

He said: “Over N720billion of NHIS funds were “invested” over 12 years. No approvals from Minister, Board or Office of the Accountant-General of the Federation (OAGF).

“There was no transparency. In the deals were the Chief Executive Officers, banks and other interest groups. Billions of Naira were lost to diversion and underpayment of interest.

“The Executive Secretaries and select management staff were all neck deep in this.”

The Executive Secretary gave insights into the rot he inherited in NHIS and the dispute over forensic audit of the finances/ investments of the agency.

He added: “When I resumed in August 1, 2016, I could not ascertain the state of the finances of the Scheme. My preliminary findings from the review of financial records were shocking to say the least.

“I was unable to ascertain how much of the Scheme’s funds was with commercial banks, for how long and at what rate of return.

“It was unclear to me how much of the Scheme’s money was still with commercial banks before TSA and how much was transferred to TSA.

“The audited accounts of the Scheme for years ended 31st December 2011 to 2016 were in arrears and had not been signed by the previous CEOs.

“In view of all these anomalies and to bring transparency in the finances of the Scheme on December 21st 2016, I engaged the services of professional accounting firm Messrs. Sofura Professional Services to carry out a forensic review of the Scheme’s accounting system and banking transactions.

“Their scope of work included reconciliation of all NHIS current and investment accounts held with commercial banks, reconciliation of NHIS TSA with the CBN.

“Upon their engagement, I called a meeting of NHIS Management made up of all heads of departments and introduced the firm and its partners and the work they have been engaged to do.

“After the meeting, the firm began its work reviewing documents and interacting with relevant staff. I was briefed regularly by the firm on the progress of the work.

“As part of the work, I wrote letters to commercial banks requesting and mandating them to give them all necessary cooperation relating to their engagement.

“Terms of their engagement were clearly spelt out in their letter of engagement; (I) An annual engagement fee of N2,300,000.00 per annum for retainership and;

“Reimbursable expenses and fees for each specific service undertaken for the Scheme as may be agreed upon by both parties from time to time will be paid on submission of evidence for payment to the Scheme at the end of each assignment.

“I am pleased to report that this is the first time in the 13-year history of the NHIS that a forensic audit has been undertaken in the operation of the Scheme including a review of the records of the Finance & Accounts, Contribution Management, Audit and Procurement Departments.

“Following my resumption from suspension on February 6, 2018, I became aware of the engagement of Aruna Bawa & Co. by the office of the Attorney General of the Federation to carry out an audit and recovery of NHIS funds held by financial institutions, Companies and individuals into the Federal Government’s treasury.

“The information on the basis of which Aruna Bawa & Co. sought to recover NHIS funds is a product of work that I, as the CEO of NHIS, commissioned by engaging Messrs Sofura Professional Services.

“It is noteworthy that Bawa the principal partner of Aruna Bawa & Co. worked for Sofura professional Services on this assignment.

“In the course of the work, I knew Mr Aruna Bawa as a member of the Sofura team.

NHIS has never had any contractual agreement with Mr Bawa or his firm.

“On March 5, 2018, I wrote a letter to the Attorney-General of the Federation (AGF) asking him to cancel the engagement of Aruna Bawa and his firm as it was based on misrepresentation and that NHIS has no contractual agreement with him.

“I visited the NHIS Council Chairman at her home after inauguration of the board and told her about the issue and that I had written a letter to the AGF asking him to cancel Mr Bawa’s engagement.

“The Chairman suggested I should see the AGF and personally brief him which I promptly did.

“I have been receiving letters from banks asking me to confirm if Bawa is representing the Scheme.

“I have written to the AGF asking him to write to him and all the institutions he had introduced him.

”Messrs Sofura Professional Services is the only legitimate firm that the Scheme has a valid contract with and have been working since engagement.

“In fact, I authorized them to meet with the CBN team yesterday to explain their work at the request of the CBN team which they gave me an update on.

”Apparently, Bawa has been going to the Chairman’s house with bags of documents telling her that I and Messrs Sofura Professional Partners have ulterior motives in our quest to recover NHIS funds, hence the Chairman’s “query”.

The NHIS Executive Secretary also explained why he attended the 71st World Health Assembly in Geneva, Switzerland from May 21 to 26.

He said the trip was not a jamboree as being insinuated in some quarters.

He said: “The World Health Assembly is an annual event by Ministers of Health from member nations.

“Nigeria’s delegation included the Minister of State for Health(HMSH) as the leader and heads of Agencies under the Federal Ministry of Health(FMoH).

“The theme of the Assembly this year was Universal Healthcare Coverage (UHC). As a signatory to the Commitment to UHC, Nigeria’s delegation was ably represented by the NHIS which is the lead Agency in Nigeria’s drive to UHC.

“With the commitment of President Muhammadu Buhari’s government to fund the Basic Health Care Provision Fund (BHCPF) for the first time since the passing of the National Health Act, the NHIS will receive N275bn to cover vulnerable Nigerians across all geopolitical zones.

“All our development partners are very excited for our government’s political will.

“The World Bank and Gates Foundation have already committed an initial $20m into the fund.

“NHIS delegation of only five was grossly inadequate considering the multiple presentations on UHC, Healthcare financing, Equity in Health care, Resource mobilization, aggregation of fragmented pools etc.”

The Governing Council of NHIS was yet to take action on the submissions of the Executive Secretary and response to its query as at the time of filing this report.

Source The Nation

Health

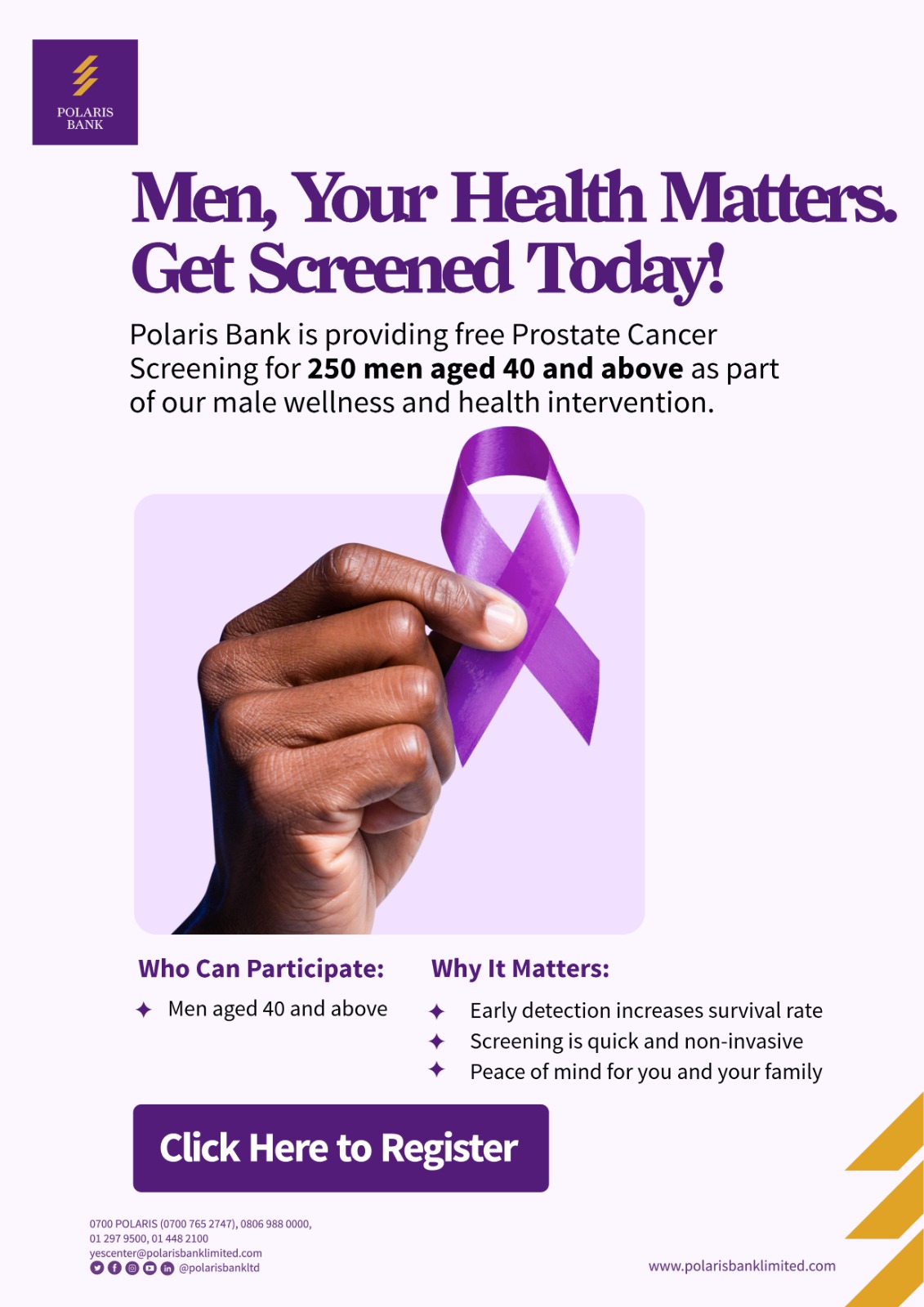

Polaris Bank Sponsors Free Breast, Prostate Cancer Screenings

By Modupe Gbadeyanka

To commemorate World Cancer Day observed on Wednesday, February 4, 2026, Polaris Bank Limited is bankrolling free screenings for breast and prostate cancers across the country.

The financial institution partnered with a non-governmental organization (NGO) known as Care Organization and Public Enlightenment (COPE) for this initiative.

At least 100 women would be screened during the exercise, scheduled for Saturday, February 21, 2026, at the C.O.P.E Centre on 39B, Adeniyi Jones Avenue, Ikeja, Lagos, from 10:00 am to 2:00 pm.

The exercise will be conducted by trained health professionals and volunteers, ensuring participants receive both screening services and educational guidance on cancer prevention, self-examination, and follow-up care.

To participate in the free breast cancer screening programme, the applicants must be women, must be Polaris Bank account holders, and must have registered ahead of the day via bit.ly/BCS2026, with selection based on early and confirmed submissions.

Polaris Bank said the initiative was designed to promote awareness, screening, early detection, and preventive care, reinforcing its belief that access to health services is a critical foundation for individual and economic well-being.

The organization is already supporting an on-going free prostate cancer screening programme for 250 men aged 40 years and above across Nigeria.

The prostate cancer screening is being conducted at the Men’s Clinic, situated at 18, Commercial Avenue, Sabo, Yaba, Lagos, providing accessible, professional medical support for male participants seeking early detection and preventive care for prostate cancer.

Both initiatives (free breast and prostate cancer screenings) directly aligns with the United Nations Sustainable Development Goals, particularly SDG 3 (Good Health and Well-being) through improved access to preventive healthcare and early detection services, SDG 5 (Gender Equality) by prioritizing women’s health and empowerment, and SDG 17 (Partnerships for the Goals) through strategic collaboration with civil society organizations such as C.O.P.E to deliver community-centered impact.

Educational materials, community engagement sessions, and digital awareness campaigns will be deployed to reinforce key messages around early detection, lifestyle choices, and the importance of regular medical check-ups.

The Head of Brand Management and Corporate Communications for Polaris Bank, Mr Rasheed Bolarinwa, emphasised that early detection remains one of the most effective tools in the fight against cancer.

Health

NSIA Gets IFC’s Naira-financing to Scale Oncology, Diagnostic Services

By Adedapo Adesanya

International Finance Corporation (IFC), a subsidiary of the World Bank, and the Nigeria Sovereign Investment Authority (NSIA) have partnered to provide Naira-denominated financing to NSIA Advanced Medical Services Limited (MedServe), a wholly owned healthcare subsidiary of the country’s wealth fund.

Supported by the International Development Association’s Private Sector Window Local Currency Facility, this financing enables MedServe to scale critical healthcare infrastructure while mitigating foreign exchange risks. IFC is a member of the World Bank Group.

The funds will support MedServe’s expansion program to establish diagnostic centers, radiotherapy-enabled cancer care facilities, and cardiac catheterisation laboratories across several Nigerian states.

These centres will feature advanced medical technologies, including CT and MRI imaging, digital pathology labs, linear accelerators, and cardiac catheterisation equipment, thereby enhancing specialised diagnostics and treatment.

MedServe provides sustainable service delivery with pricing that matches local income levels, helping ensure broader access to affordable oncology care for low-income patients.

The initiative will deliver over a dozen modern diagnostic and treatment centers across Nigeria, create 800 direct jobs, and train more than 500 healthcare professionals in oncology and cardiology specialties.

The total project size is $154.1 million, with IFC contributing roughly N14.2 billion ($24.5 million) in long-tenor local currency financing, marking IFC’s first healthcare investment in Nigeria using this structure.

This comes as Nigeria advances its aspirations for Universal Health Coverage. This partnership provides an opportunity to leverage private investment to complement government efforts to expand oncology care and diagnostic services.

IFC’s provision of long-tenor Naira financing addresses a significant market gap and unlocks institutional capital for healthcare infrastructure with strong development upside while MedServe’s co-location strategy with public hospitals maximises capital efficiency and strengthens the public-private ecosystem, establishing a replicable platform for future investment.

“This partnership with IFC represents a significant milestone in NSIA’s commitment to strengthening Nigeria’s healthcare ecosystem through sustainable, locally anchored investment solutions,” said Mr Aminu Umar-Sadiq, managing director & chief executive of NSIA.

He added, “By deploying long-tenor Naira financing, we are addressing critical infrastructure gaps while reducing foreign exchange risk and ensuring that quality diagnostic and cancer care services are accessible to underserved communities. MedServe’s expansion underscores our belief that commercially viable healthcare investments can deliver strong development impact while supporting national health priorities.”

“This ambition is consistent with our broader vision for Africa, one where resilient health systems and inclusive growth reinforce each other to deliver long-term impact across the continent,” said Mr Ethiopis Tafara, IFC Vice President for Africa.

Health

Lagos Steps up Mandatory Health Insurance Drive

By Modupe Gbadeyanka

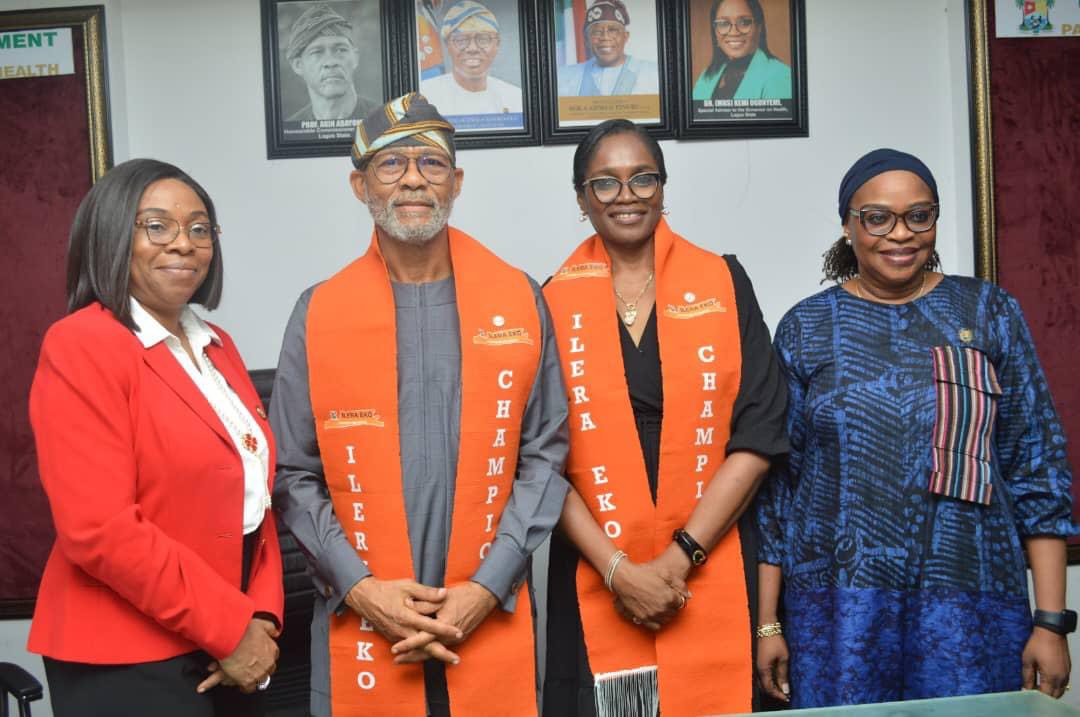

Efforts to entrench mandatory health insurance through the Ilera Eko Social Health Insurance Scheme in Lagos State have been stepped by the state government.

This was done with the formal investiture of the Commissioner for Health, Professor Akin Abayomi, and the Special Adviser to the Governor on Health, Mrs Kemi Ogunyemi, as Enforcement Leads of the Lagos State Health Scheme Executive Order and ILERA EKO Champions.

The Commissioner described the recognition as both symbolic and strategic, noting that Lagos is deliberately shifting residents away from out-of-pocket healthcare spending to insurance-based financing.

“We have been battling with how to increase enrolment in ILERA EKO and change the culture of cash payment for healthcare. Insurance is a social safety net, and this mindset shift is non-negotiable,” he said.

He recalled that Lagos became the first state to domesticate the 2022 National Health Insurance Authority (NHIA) Act through an Executive Order issued in July 2024, making health insurance mandatory. He stressed that the decision reflected the Governor’s strong commitment to healthcare financing reform, adding, “When Mr. Governor personally edits and re-edits a document, it shows how critical that issue is to the future of Lagosians.”

Mr Abayomi also warned against stigmatisation of insured patients, describing negative attitudes towards Ilera Eko enrolees as a major barrier to uptake. “If someone presents an Ilera Eko card and is treated as inferior, uptake will suffer. That must stop,” he said, pledging to prioritise insurance compliance during facility inspections. “The key question I will keep asking is: ‘Where is the Ilera Eko?’”

In her remarks, Mrs Ogunyemi, said the enforcement role goes beyond a title, stressing that the health insurance scheme is now law.

“This is about Universal Health Coverage and equitable access to quality healthcare for everyone in Lagos State,” she said, noting that ILERA EKO aligns with the state’s THEMES Plus Agenda.

She commended the Lagos State Health Management Agency (LASHMA) for aggressive sensitisation efforts across the state, saying constant visibility was necessary to address persistent gaps in public knowledge. “People are still asking, ‘What is Ilera Eko?’ ‘Where do I enrol?’ Those questions tell us the work must continue,” she said.

She urged all directors and health officials to mainstream Ilera Eko promotion in every programme and engagement, emphasising that responsibility for health insurance advocacy does not rest with LASHMA alone. “When people come with medical bills, the first question should be: are you insured?” she said, adding that early enrolment remains critical as premiums rise over time.

Earlier, the Permanent Secretary of LASHMA, Ms Emmanuella Zamba, said the investiture marked a critical step in positioning leadership to drive enforcement of the Executive Order across the public service.

“What we are undertaking is pioneering in Nigeria. All eyes are on Lagos as we demonstrate how mandatory health insurance can work,” she said.

Ms Zamba disclosed that enforcement nominees across Ministries, Departments and Agencies have been trained, with a structure in place to ensure compliance beyond the health sector.

According to her, “This initiative cuts across the entire public service, particularly public-facing MDAs, in line with the provisions of the Executive Order.”

She explained that the formal designation of the Commissioner and the Special Adviser as Enforcement Leaders was meant to strengthen compliance, alongside the Head of Service, while also recognising their consistent advocacy for universal health coverage. “This decoration is to amplify their roles and appreciate the leadership they have shown,” she said.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn