Economy

Stocks Begin 2019 with N135b Loss

By Modupe Gbadeyanka

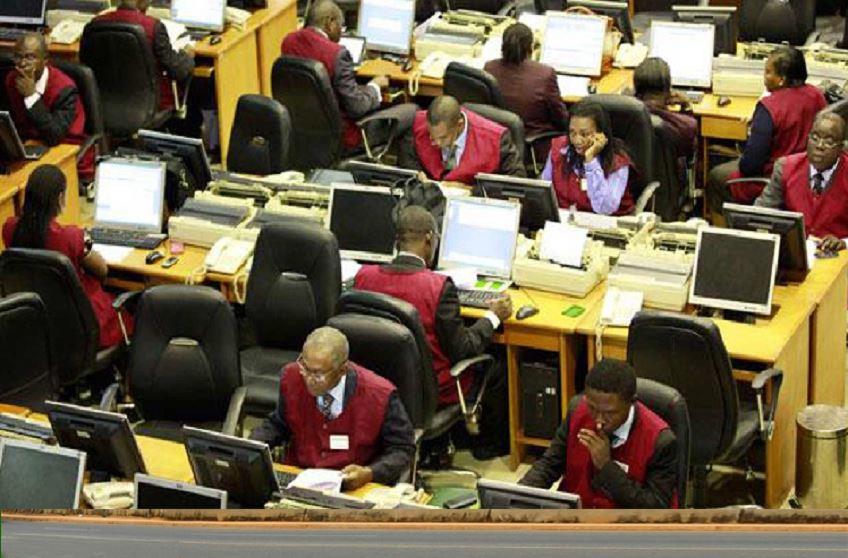

The first trading day of year 2019 on the floor of the Nigerian Stock Exchange (NSE) started on a bearish note on Wednesday, January 02, 2019.

The local bourse suffered a N135 billion as a result of profit taking by investors, leaving the market capitalisation to close at N11.586 trillion and the All-Share Index at 31,070.06 points after a decline of 360.44 points or 1.15 percent.

During the trading day, losses were recorded by high-cap equities led by Nestle Nigeria, which went down by N10 to settle at N1475 per share.

Nigerian Breweries declined by N7.20k to finish at N78.30k per share, Dangote Cement fell by N3.70k to end at N186 per share, Flour Mills depreciated by 90 kobo to close at N22.20k per share, while Forte Oil lost 70 kobo to finish at N28 per share.

On the flip side, Julius Berger topped the gainers’ chart on the first trading day after a price appreciation of N2 to settle at N22.10k per share.

International Breweries grew by N1 to finish at N31.50k per share, while Custodian Investment rose by 45 kobo to end at N6.10k per share.

Vitafoam appreciated by 42 kobo to close at N4.82k per share, while Ecobank went up by 30 kobo to settle at N14.30k per share.

Also at the market yesterday, the volume of shares transacted by investors declined by 76.93 percent from 929.3 million to 214.4 million, while the value reduced by 60.47 percent from N4 billion to N1.6 billion.

Diamond Bank was the most traded stock on Wednesday with a total turnover of 50.7 million units sold for N112 million.

It was followed by Sovereign Trust Insurance, which exchanged 33 million shares worth N6.7 million, and Access Bank, which transacted 20.8 million equities valued at N136.2 million.

Zenith Bank sold 18 million shares for N413.6 million, while FBN Holdings exchanged 11.3 million equities worth N88.6 million.

Economy

Analysts Predict 18% Inflation Rate for January 2026

By Adedapo Adesanya

Analysts have projected that Nigeria’s headline inflation could rise to about 18 per cent in January, defying the downward trend recorded in 2025.

The forecast comes ahead of the first Consumer Price Index (CPI) data release by the National Bureau of Statistics (NBS) of 2026 due on Monday.

Headline inflation closed December at 15.15 per cent year-on-year, while the annual average eased sharply to 23.33 per cent from 33.18 per cent in 2024.

According to analysts at Cowry Research, the recent CPI normalisation has created a lower base for January comparisons, making a temporary uptick in headline inflation likely in January and possibly February. It projects inflation to trend within the 17.8 per cent to 18.7 per cent range in 2026, driven by election-related spending pressures and fading base effects, even as structural reforms support a medium-term disinflation path.

Similarly, analysts at Quest Merchant Bank said the lower base effect could push January inflation to around 18 per cent to 19 per cent. They, however, expect inflation to resume a broadly disinflationary trajectory over the course of the year, supported by softer energy prices, stable exchange rate conditions and easing food costs.

Last year’s deceleration was driven largely by base effects after the stats office normalised its CPI computation methodology. Unlike previous rebasing exercises that used a single month as the base period, the agency calculated the base using the average of all months in 2024. The rebasing also involved reweighting several categories and expanding the inflation basket to 934 items from 740.

In December alone, the NBS published two separate inflation figures for December after the CPI methodology tweaking caused the headline rate to more than double.

Nigeria’s inflation data are closely monitored by the Central Bank of Nigeria (CBN) as it transitions toward an inflation-targeting monetary policy framework.

The CBN has already factored in the CPI rebasing and related computational issues in its three-year inflation forecast.

The apex bank is targeting a slowdown in inflation to around 13 per cent by next year, despite current price pressures and statistical adjustments.

The Monetary Policy Committee (MPC) will meet next week, and today’s inflation report will form the basis for whether there will be a cut or hold in the interest rates.

Economy

Deap Capital, Access Holdings, Zenith Bank Lead Activity Chart

By Dipo Olowookere

The trio of Deap Capital Management & Trust, Access Holdings, and Zenith Bank led the activity chart of the Nigerian Exchange (NGX) Limited last week.

In the five-day trading week, Customs Street posted a total turnover of 4.652 billion shares worth N193.326 billion in 286,751 deals compared with the 3.860 billion shares valued at N128.581 billion traded in 240,463 deals a week earlier.

According to data, financial services equities dominated the activity chart with 2.782 billion units sold for N74.063 billion in 104,325 deals, contributing 59.81 per cent and 38.31 per cent to the total trading volume and value, respectively.

Services stocks recorded the sale of 573.189 million units worth N7.177 billion in 28,784 deals, and consumer goods shares exchanged 317.667 million units valued at N24.027 billion in 33,280 deals.

Deap Capital, Access Holdings, and Zenith Bank accounted for 980.253 million shares worth N30.182 billion in 25,390 deals, contributing 21.07 per cent and 15.61 per cent to the total trading volume and value apiece.

Business Post reports that 79 equities appreciated versus 71 equities in the previous week, as 27 stocks depreciated versus 35 stocks in the previous week, while 42 shares closed flat, the same as the previous week.

Zichis was the best-performing stock after it gained 60.71 per cent to trade at N10.80, Union Dicon appreciated by 60.15 per cent to N20.90, DAAR Communications grew by 55.26 per cent to N2.95, Fortis Global Insurance rose by 50.00 per cent to 39 Kobo, and John Holt grew by 45.21 per cent to N10.60.

On the flip side, Abbey Mortgage Bank lost 26.42 per cent to quote at N11.00, Sovereign Trust Insurance shrank by 17.16 per cent to N2.80, Ecobank declined by 13.29 per cent to N45.00, SAHCO went down by 11.59 per cent to N135.00, and Austin Laz depleted by 11.11 per cent to N4.80.

Last week, the All-Share Index (ASI) and the market capitalisation appreciated by 6.16 per cent to 182,313.08 points and N117.027 trillion, respectively.

In the same vein, all other indices finished higher with the exception of the sovereign bond index, which fell by 0.01 per cent.

Economy

Worries Intensify as Attacks in Nigeria Spread Southwards

By Adedapo Adesanya

Nigeria’s security crisis is spreading southwards as jihadists and armed gangs step up attacks in parts of the country largely untouched by decades of violence.

Over the last few months, there had been an alarming increase in violence, especially in relatively low-conflict areas. The Nigerian government has long been fighting an array of jihadist groups, including Boko Haram and IS-linked factions, but largely in the North-East. However, some new groups are gaining footholds, spreading south.

Earlier this month, 162 people were killed in an attack in Kwara State. The gruesome murder in the central part of the country last week highlighted the fundamental shift in the nature and geography of the insecurity crisis facing Africa’s most populous nation.

The increased attacks come even as President Bola Tinubu declared a security emergency and the United States deployed troops to the nation, as part of cooperation efforts to tackle insecurity.

This weekend, at least 32 people were killed after gunmen launched simultaneous attacks on three separate communities in Niger State, which has the Federal Capital Territory (FCT) to the southeast and Kwara State to its southwest. The communities of Tunga-Makeri, Konkoso, and Pissa, all located in the Borgu area of Niger state, were targeted in early raids on Saturday, February 14.

According to Niger State police spokesman, Mr Wasiu Abiodun, six people died in the assault on Tunga-Makeri, adding that it was not clear how many people had been abducted.

Mr Abiodun said that Konkoso was also attacked, but gave no other details other than that security teams have been sent to the scene and a rescue operation for those who were abducted was under way.

A resident, Mr Abdullahi Adamu, from Konkoso, reportedly said 26 people were killed in the attack there, describing how the attackers were “operating freely without the presence of any security”.

The attack on Tungan Makeri reportedly began on Friday, when over 200 armed men stormed the village, shooting sporadically and setting several houses on fire.

There were also reports that an Air Force aircraft was sighted around Tungan Makeri after the initial attack, a development some residents believe forced the bandits to withdraw from the village.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn