Economy

Value of Naira Weakens to N361/$1 at Interbank Segment

By Adedapo Adesanya

The Naira value of the Naira to the Dollar was weakened by 17.59 percent on Friday at the official window of the Central Bank of Nigeria (CBN) also known as the interbank segment of the foreign exchange market to to N361/$1 on Friday, March 20, 2020.

The depreciation of the local currency to N361/$1 on the official CBN window from N307/$1 confirmed fears earlier nursed that the Naira would be devalued.

On Friday, Business Post reported that there were suggestions, citing people familiar with the market, that the CBN may have devalued by 15 percent.

The devaluation storm also blew to the black market, where the Naira depreciated by N5 against the American currency to close at N380/$1 on Friday in contrast to N375/$1 it was traded on Thursday.

At the same segment, the local currency appreciated by N5 against the British pound sterling, quoting at N475/£1 compared to N480/£1 published the day before. And against the Euro, the local currency remained flat at N414/€1.

At the Association of Bureaux De Change Operators of Nigeria (ABCON), Business Post gathered that the Naira gained N11 on the dollar at the Abuja market to close at N363/$1 compared with N374/$1 that it traded previously. The domestic currency, however, depreciated by N4 against the British Pound to close at N483/£1 compared with N479/€1 on Thursday and dropped N3 against the Euro to N413/€1 from N410/€1.

In Lagos, the local currency closed flat against the greenback at N376/$1, but appreciated by N5 against the pound, trading at N475/£1 compared with N485/£1 recorded on Thursday and against the Euro, it was strengthened by N8 to N406 from N414/£1.

At the Port Harcourt BDC market, the domestic currency closed flat against the American Dollar at N372/$1, just as it also remained unchanged against the Pound and the Euro at N486/£1 and N415/€1 respectively.

At the Kano BDC market, the Nigerian currency remained unchanged against the Dollar, Pound Sterling and Euro at N374/$1, N480/£1 and N417/€1 respectively.

At the Investors and Exporters (I&E) segment of the forex market on Friday, the Naira depreciated by 0.45 percent or N1.65 against the greenback to close at N372/$1 in contrast to N370.35/$1 it previously traded at the same window.

During the session, transactions recorded at the I$E segment was 0.9 percent or $4.70 million lower than the previous session. On Friday, transactions worth $501.03 million occurred at the market compared with $505.73 million of the previous session.

Economy

Nigerian Senate to Pass 2026 Budget March 17

By Adedapo Adesanya

The Senate, through its Committee on Appropriations, has fixed March 17, 2026, as the tentative date for the final consideration and passage of the N58.472 trillion 2026 Appropriation Bill.

This was made known after a special session on Friday, where February 2 to 13, 2026, was approved for the consideration of budget estimates at the committee level.

The committee equally fixed Monday, February 9, 2026, for a public hearing on the budget proposal.

Chairman of the committee, Mr Solomon Olamilekan Adeola, further disclosed that Thursday, March 5, 2026, has been scheduled for an interactive session between members of the committee and key economic managers of the federal government, including the Ministers of Finance and Coordinating Minister of the Economy, Mr Wale Edun, as well as the Minister of Budget and National Planning, Mr Atiku Bagudu.

According to him, February 16 to 23, 2026, has been earmarked for the submission of reports on budget defence by various standing committee chairmen, ahead of the presentation of the Appropriations Committee’s report to the Senate on March 17.

He disclosed that while the Senate leadership initially preferred the budget to be passed by March 12, 2026, he successfully appealed for an additional week to allow for more thorough scrutiny.

To aid detailed examination of the estimates, Senator Adeola said hard copies of the 2026 budget have been printed and distributed to chairmen and members of the Senate’s standing committees.

On December 19, 2025, President Bola Tinubu presented a budget proposal of N58.47 trillion for the 2026 fiscal year titled Budget of Consolidation, Renewed Resilience and Shared Prosperity to a joint session of the National Assembly.

The budget has a capital recurrent (non‑debt) expenditure standing at N15.25 trillion, and the capital expenditure at N26.08 trillion, while the crude oil benchmark was pegged at $64.85 per barrel.

Mr Tinubu said the expected total revenue for the year is N34.33 trillion, and the proposal is anchored on a crude oil production of 1.84 million barrels per day, and an exchange rate of N1,400 to the US Dollar.

In terms of sectoral allocation, defence and security took the lion’s share with N5.41 trillion, followed by infrastructure at N3.56 trillion, education received N3.52 trillion, while health received N2.48 trillion.

Economy

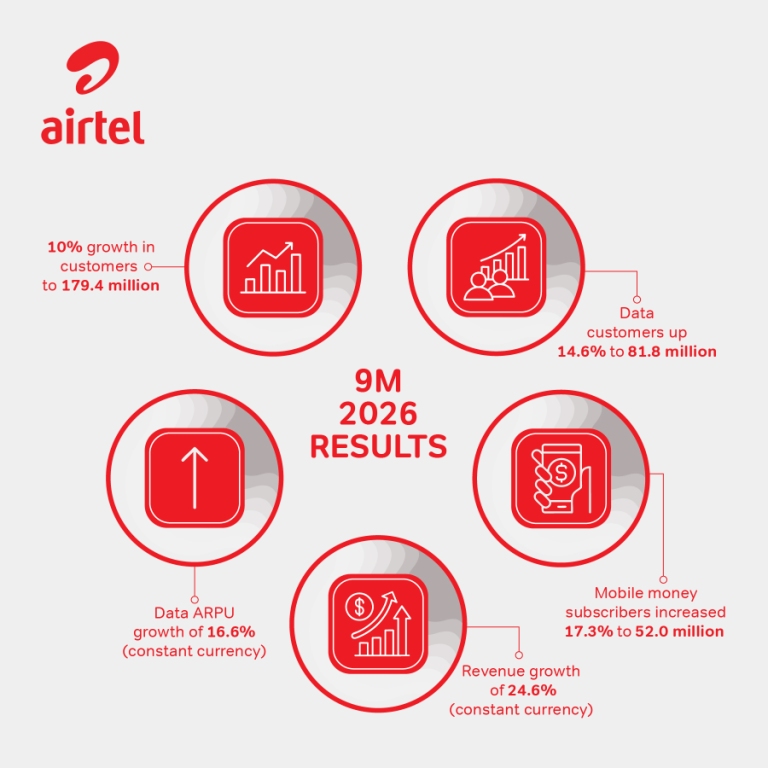

Airtel Africa Grows Earnings to $4.7bn in Nine Months

By Aduragbemi Omiyale

About $4.7 billion was generated by Airtel Africa Plc in nine-month period ended December 31, 2025, details of the company’s financial statements revealed.

The telco disclosed that in the period under review, mobile services revenue grew by 23.3 per cent in constant currency, as data revenues, the largest contributor to group revenues, increased by 36.5 per cent, with voice revenues growing by 13.5 per cent.

In the same vein, EBITDA grew by 35.9 per cent in reported currency to $2.3 billion, with EBITDA margins expanding further to 48.9 per cent from 46.2 per cent in the prior period.

The third quarter of the fiscal year witnessed a further sequential increase in EBITDA margins to 49.6 per cent, driving EBITDA growth of 31.0 per cent in constant currency and 40.8 per cent in reported currency.

The financial results showed that profit after tax of $586 million improved from $248 million in the prior period. Higher profit after tax in the current period was driven by higher operating profit and derivative and foreign exchange gains of $99 million versus the $153 million derivative and foreign exchange losses in the prior period.

Commenting, the chief executive of Airtel Africa, Mr Sunil Taldar, said, “These results highlight the strength of our strategy, with strong operating and financial trends across the business. During the quarter, we accelerated investment to enhance coverage and data capacity while also expanding our fibre network.

“Coupling this investment with innovative partnerships, strengthens our customer proposition and positions us to capture the considerable growth opportunity across our markets.

“Digitisation, technology innovation and embedding AI in our processes will also optimise the customer experience with increased digital offerings and closer integration of GSM and Airtel Money services allowing us to unlock the strong demand across our markets. Smartphone adoption continues to increase with penetration of 48.1 per cent, and we are seeing solid progress in the development of our home broadband business, reflecting the need for reliable, high-speed connectivity across our markets.

“Our push to enhance financial inclusion across the continent continues to gain momentum with our Mobile Money customer base expanding to 52 million, surpassing the 50 million milestone. Annualised total processed value of over $210 billion in Q3’26 underscores the depth of our merchants, agents and partner ecosystem, and remains a key player in driving improved access to financial services across Africa. We remain on track for the listing of Airtel Money in the first half of 2026.

“Disciplined execution on cost efficiency, alongside accelerating revenue growth has enabled another sequential improvement in our quarterly EBITDA margin to 49.6 per cent, – underpinning constant currency EBITDA growth of 31 per cent – and we remain focussed on driving further incremental margin improvements.

“Our strategic priorities remain clear: to keep investing in best in class connectivity, accelerate financial inclusion through our mobile money platform and deliver a great customer experience. These results reinforce our confidence in the long term potential of our markets and our ability to create value for all our stakeholders.”

Economy

Interest Rates May Remain Elevated Despite Inflation Cooling—PwC

By Adedapo Adesanya

According to PricewaterhouseCoopers (PwC), Nigeria’s benchmark interest rate is likely to remain elevated in 2026 even as inflation shows signs of easing.

Speaking at the PwC–BusinessDay Executive Roundtable on Nigeria’s 2026 budget and economic outlook in Lagos on Thursday, the Chief Economist and Head of Strategy at PwC, Mr Olusegun Zaccheaus, said expectations of aggressive interest rate cuts might be premature even with the core factor – inflation – seen cooling.

“Interest rates may remain elevated despite inflation cooling for most of 2025,” Mr Zaccheaus said. “Perhaps not by the 500 basis points some hope for, due to the need to manage liquidity.”

The Central Bank of Nigeria (CBN) had more than doubled its policy rate from 2022 levels in a bid to rein in inflationary pressures, before implementing a 50 basis-point cut in September that brought the monetary policy rate to 27 per cent.

The move followed a sharp moderation in inflation from its late-2024 peak. Inflation slowed to 15.15 per cent in December 2025, while the economy expanded by 3.98 per cent in the third quarter, its strongest quarterly growth in years.

At the last Monetary Policy Committee (MPC) meeting of the CBN in November 2025 voted to keep the interest steady.

The PwC official warned that warned that underlying risks, including exchange-rate volatility, fiscal pressures and global uncertainty, continue to complicate the outlook.

Mr Zaccheaus said that a major challenge for the apex bank will be to control the volume of money circulating in the economy.

He advised that liquidity management remains critical as excess cash can quickly undermine dis-inflation efforts particularly as the 2027 election cycle is around the corner.

He said that Nigeria typically experiences rapid growth in money supply ahead of election cycles, driven by increased government spending and political activity, adding that without careful coordination, such expansions risk fueling inflation and weakening investor confidence.

“The responsibility of the central bank is to ensure liquidity does not grow in a way that has a negative macroeconomic impact,” Mr Zaccheaus said.

He noted that a stable currency environment would support improved capital allocation and investment planning.

“FX stability is crucial,” Mr Zaccheaus said. “It gives investors confidence and allows businesses to plan. But that stability depends on disciplined policy execution.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn