Economy

FAAC Shares N780.9bn to FG, States, Local Councils

By Adedapo Adesanya

The Federation Accounts Allocation Committee (FAAC) has shared N780.9 billion to the three tiers of government for March 2020.

This is coming at a time the country is battling with revenue generation streams, especially from crude oil sales as prices have continued to trade lower due to the COVID-19 pandemic.

A statement from the Office of the Accountant-General of the Federation announced the disbursement at the end of the virtual FAAC meeting with the representatives of the federal, states and local governments, along with Federal Capital Territory counterparts on Wednesday.

The monthly FAAC meeting for April 2020, where the sharing of the March 2020 revenues was discussed, was held through virtual conferencing in line with the physical distancing directive by the Nigeria Center for Disease Control (NCDC).

According to the statement, the N780.9 billion shared comprised Statutory Revenue, Value Added Tax (VAT), and Exchange Gain.

It was also revealed the balance in the Excess Crude Account (ECA) grew a little to $72.2 million.

The gross statutory revenue for the month of March 2020 was put at N597.7 billion. This was higher than the N466.1 billion received in February 2020 by N131.6 billion.

The statement revealed that Value Added Tax (VAT) yielded gross revenue of N120.3 billion in March 2020 as against N99.6 billion in February 2020, resulting in an increase of N20.7 billion while N62.928 billion was available from Exchange Gain in the month under review.

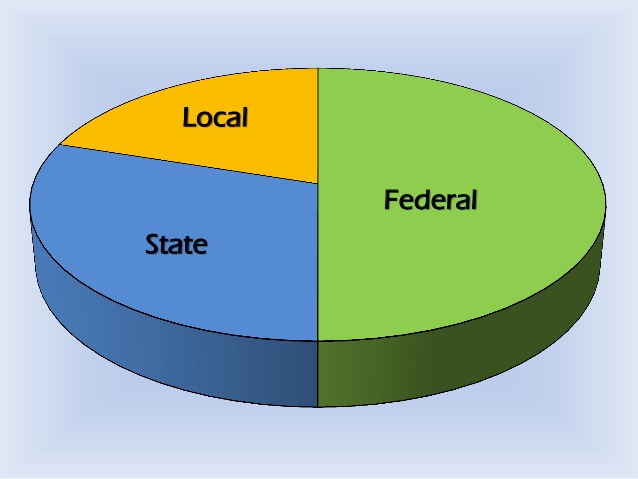

Giving a breakdown of the figures, from the total revenue of N780.9 billion, the Federal Government (FG) received N264.3 billion, the 36 State Governments received N181.5 billion, while the 774 Local Government Councils received N135.9 billion.

The nine oil producing states; Delta, Akwa-Ibom, Bayelsa, Rivers, Edo, Ondo, Imo, and Lagos received a total of N38.8 billion as 13 percent derivation revenue.

The cost of revenue collection by Revenue Agencies and allocation to North-East Development Commission (NEDC) was N160.4 billion.

It was also disclosed that the Federal Government received N217.8 billion from the gross statutory revenue of N597.7 billion, while the State Governments received N110.5 billion and the Local Governments received N85.2 billion.

Also, from the same purse, the sum of N32.3 billion was given to the relevant states as 13 percent derivation revenue and N151.9 billion as cost of revenue collection by Revenue Agencies and allocation to NEDC.

From the N120.3 billion revenue made from VAT, the FG received N16.8 billion, the 36 states and the FCT got N55.9 billion, while LGAs were allocated N39.1 billion, while the cost of collection by Revenue Agencies and allocation to NEDC was N8.4 billion.

The statement disclosed that from the N62.9 billion Exchange Gain, the Federal Government received N29.8 billion, the states received N15.1 billion while the Local Governments received N11.6 billion and the oil producing states received N6.5 billion.

It was also disclosed that in the month of March 2020, Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Import and Excise Duties, Oil and Gas Royalties and Value Added Tax (VAT) all recorded substantial increases which resulted in the large volume of money shared.

Economy

NASD Exchange Moves Higher by 0.77%

By Adedapo Adesanya

For the third consecutive trading session, the NASD Over-the-Counter (OTC) Securities Exchange ended in the green territory, rising further by 0.77 per cent on Thursday, February 5.

Two price gainers helped the bourse to rally during the session, with the market capitalisation up by N16.87 billion to N2.197 trillion from N2.180 trillion and the NASD Unlisted Security Index (NSI) up by 3.18 points to 3,672 points from the 3,644.48 points in the midweek session.

The advancers’ group was led by Central Securities Clearing System (CSCS), which added N3.70 to sell at N48.67 per share versus the previous day’s N44.97 per share, and Afriland Properties Plc expanded by N1.01 to N15.01 per unit from N14.01 per unit.

It was observed that the alternative stock exchange recorded two price losers led by Geo-Fluids Plc, which further lost 51 Kobo to sell at N4.75 per share versus Wednesday’s closing price of N5.26 per share, and Industrial and General Insurance (IGI) declined by 6 Kobo to 59 Kobo per unit from 65 Kobo per unit.

During the session, the volume of securities transacted by investors slid by 51.9 per cent to 1.2 million units from 2.5 million units, the value of securities went down by 32.0 per cent to N12.0 million from N17.7 million, and the number of deals increased by 27.8 per cent to 23 deals from 18 deals.

At the close of trades, CSCS Plc was the most traded stock by value on a year-to-date basis with 16.2 million units exchanged for N659.9 million, followed by FrieslandCampina Wamco Nigeria Plc with 1.7 million units traded for N117.8 million, and Geo-Fluids Plc with 12.3 million units valued at N79.1 million.

CSCS Plc remained the most active stock by volume on a year-to-date basis with 16.2 million units sold for N659.9 million, trailed by Mass Telecom Innovation Plc with 13.6 million units valued at N5.5 million, and Geo-Fluids Plc with 12.3 million units worth N79.1 million.

Economy

NGX Index Crosses 170,000 Points as Investors Sustains Buying Pressure

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited recorded another milestone after it further closed higher by 1.18 per cent on Thursday amid renewed confidence in the market.

The All-Share Index (ASI) crossed the 170,000-point threshold during the session as it added 1,975.18 points to the preceding day’s 168,030.18 points to settle at 170,005.36 points.

Also yesterday, the market capitalisation of Customs Street was up by 1,268 trillion to N109.129 trillion from the N107.861 it ended a day earlier.

The growth recorded during the session was powered 55 equities, which outweighed the losses recorded by 19 other equities.

Guinea Insurance expanded by 10.00 per cent to N1.43, Seplat Energy grew by 10.00 per cent to N7,370.00, RT Briscoe increased by 9.95 per cent to N11.49, Neimeth chalked up 9.90 per cent to close at N11.10, and Zichis rose by 9.89 per cent to N6.11.

At the other side, Deap Capital lost 9.62 per cent to trade at N6.20, Universal Insurance slipped by 9.43 per cent to N1.44, Haldane McCall declined by 9.09 per cent to N4.00, Red Star Express went down by 9.04 per cent to N15.60, and UPDC depreciated by 7.02 per cent to N5.30.

Business Post reports that the energy index was up by 4.68 per cent, the industrial goods improved by 0.79 per cent, the banking space grew by 0.64 per cent, and the consumer goods sector soared by 0.11 per cent, while the insurance counter lost 0.31 per cent.

Yesterday, market participants traded 713.0 million stocks valued at N22.3 billion in 46,104 deals versus the 694.8 million stocks worth N20.6 billion transacted in 42,095 deals on Wednesday, showing a spike in the trading volume, value, and number of deals by 2.62 per cent, 8.25 per cent, and 9.52 per cent, respectively.

Access Holdings sold 106.6 million shares valued at N2.5 billion, Chams transacted 44.5 million equities worth N201.3 million, Champion Breweries traded 44.5 million stocks for N774.3 million, Universal Insurance exchanged 34.8 million shares worth N53.6 million, and Deap Capital sold 22.7 million equities valued at N141.9 million.

Economy

Naira Depreciates to N1,366 Per Dollar at Official Market

By Adedapo Adesanya

The Naira weakened against the US Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEX) on Thursday, February 5, by N7.78 or 0.57 per cent to N1,366.06/$1 from the N1,358.28/$1 it was traded on Wednesday, according to data from the Central Bank of Nigeria (CBN).

The Nigerian currency also depreciated against the Euro in the same market segment yesterday by N5.92 to close at N1,611.95/€1 versus the preceding session’s closing price of N1,606.03/€1, but appreciated further against the Pound Sterling by N8.05 to N1,855.38/£1 from the previous day’s value of N1,863.43/£1.

The domestic currency’s exchange rate for international transactions on the GTBank Naira card was further strengthened after an N8 price appreciation on the greenback to settle at N1,375/$1 compared with the N1,383/$1 it was exchanged at midweek, and at the black market, it maintained stability at N1,450/$1.

The loss suffered by the Nigerian Naira in the official market appears to be an isolated event, as Nigeria’s gross external reserves rose to $46.80 billion as of February 4, 2026, from $46.70 billion a day earlier, underscoring improved capacity to meet foreign obligations and support market confidence.

The local currency has been able to find a solid path despite no indications of any intervention from the apex bank in recent week strengthening the case of price discovery.

As for the digital currency market, Bitcoin (BTC) tumbled more than 13 per cent over the past 24 hours, selling at $63,075.23, its steepest one-day decline since the FTX-driven crash in November 2022.

The sell-off extended beyond crypto, with silver plunging 15 per cent and gold sliding more than 2 per cent. US stocks also fell.

The latest downturn comes as investor confidence in crypto’s utility as a store of value, inflation hedge, and digital currency falters.

Ripple (XRP) plunged by 23.4 per cent to $1.15, Dogecoin (DOGE) went down by 14.2 per cent to $0.0879, Cardano (ADA) declined by 13.4 per cent to $0.2459, Binance Coin (BNB) slumped by 13.2 per cent to $606.83, Solana (SOL) dipped by 13.1 per cent to $78.70, Ethereum (ETH) crashed by 13.0 per cent to $1,841.67, and Litecoin (LTC) lost 13.1 per cent to trade at $50.70, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) were at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn