Jobs/Appointments

Sunmonu Now Wapic Insurance Chairman as Aig-Imoukhuede Retires

By Dipo Olowookere

Former bank chief, Mr Aigboje Aig-Imoukhuede, has retired as Chairman of Wapic Insurance Plc with effect from Monday, April 27, 2020.

To succeed him is Mr Mutiu Sunmonu, whose appointment was approved by the board and management of the company.

“I am excited to take on this new role and build on the tremendous achievements of Aigboje Aig-Imoukhuede.

“I am going to work with management and employees to actualise the aspirations espoused in the second phase of our company’s growth plan, most especially creating value for shareholders,” Mr Sunmonu said.

Also, the board approved the appointment of Mr Bababode Osunkoya as Chairman of its subsidiary, Wapic Life Assurance Ltd.

Mr Osunkoya, while commenting on his appointment, stated that “under Mr Aig-Imoukhuede’s leadership, Wapic Life Assurance Ltd has not only raised the capital to meet the N8 billion minimum capital requirement, it is now one of Nigeria’s top Group-Life underwriters.”

Mr Osunkoya, who joined the Wapic Assurance board in January 2013, also stated that, “It is a great time for me to assume the role of Chairman as we are well positioned to becoming the leading life underwriters in the industry.”

Business Post reports that Mr Aig-Imoukhuede retired from the position after 8 years of diligent and committed service to both organisations.

He was appointed to champion the transformation of Wapic Insurance Plc and its subsidiaries Wapic Life Assurance Plc and Wapic Insurance (Ghana) Limited following the company’s successful execution of a merger between Wapic Insurance Plc and Intercontinental Properties Limited in November 2011.

Over the past 8 years, Wapic Insurance Plc and its subsidiary Wapic Life Assurance Ltd have grown remarkably from an industry position of 18 to 8, and transformed into a frontline insurance company in sub-Saharan Africa.

According to the companies, “this board-leadership transition heralds the second phase of our growth plan, which is focused on extending our culture of distinction in service excellence, innovation, technology, sustainability practices and operational efficiency.”

The companies added that, “During the first transformation phase under Aig-Imoukhuede’s exemplary leadership, Wapic Insurance and Wapic Life Assurance implemented a number of transformational initiatives that stabilised and returned the 62-year old company to profitability and enabled Wapic to take its place amongst Nigeria’s top 10 underwriting companies”.

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

Jobs/Appointments

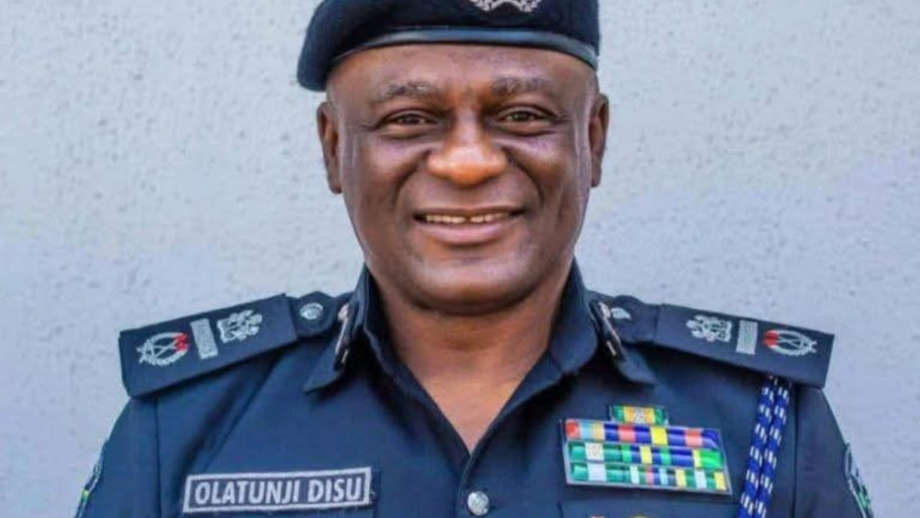

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

Jobs/Appointments

Tunji Disu to Become New IGP as Egbetokun Quits

By Adedapo Adesanya

Mr Tunji Disu, an Assistant Inspector General of Police (AIG), has reportedly replaced Mr Kayode Egbetokun as the new Inspector General of Police (IGP).

Mr Egbetokun resigned from the position on Tuesday after he was said to have held a meeting with President Bola Tinubu on Monday night at the Presidential Villa in Abuja.

President Tinubu appointed Mr Egebtokun as the 22nd IGP on June 19, 2023, with his appointment confirmed by the Nigeria Police Council on October 31, 2023.

Appointed as IGP at the age of 58, Mr Egbetokun was due for retirement on September 4, 2024, upon reaching the mandatory age of 60, but his tenure was extended by the President, creating controversies, which trailed him until his exit from the force today.

Although the police authorities are yet to comment on the matter or issue an official statement about his resignation, the move came amid reports suggesting that Mr Egbetokun has left the position.

Mr Egbetokun’s tenure was marred by a series of controversies; he recently initiated multiple charges against activist Mr Omoyele Sowore and his publication, SaharaReporters, after Mr Sowore publicly described him as an “illegal IGP.”

The dispute escalated into protracted legal battles, with the Federal High Court issuing injunctions restricting further publications relating to the former police chief and members of his family. Critics interpreted these court actions as attempts to stifle dissent and weaken press freedom.

His replacement, Mr Disu, was posted to oversee the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos, some days ago.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn