Banking

Access Bank to Issue American Express Cards in Nigeria

By Adedapo Adesanya

Access Bank has unveiled two new consumer credit cards: the Access Bank American Express Gold Card and the Metal Platinum Card, making these the first American Express cards to be issued in Nigeria and West Africa.

By launching these cards, Access Bank says it will be able to increase its offering to its retail and private bank customers, with benefits including the Membership Rewards loyalty programme and a wide range of travel and lifestyle benefits.

Recall that in 2019, Access Bank signed an agreement with American Express to start acquiring merchants, enabling businesses across the country to accept payments from international American Express Cards.

Now, in a statement seen by Business Post, the bank is ready to issue the first American Express credit cards in West Africa. The Gold and Platinum Cards showcase the international American Express card design, featuring the ‘Centurion’ icon.

Similar products are also issued outside of Nigeria by American Express or third parties licensed by American Express and provide cardmembers with extensive rewards and benefits.

Speaking on this, Mr Herbert Wigwe, Group Managing Director, Access Holdings, said the cards will be available by request and invitation, and customers who have signified interest will begin to enjoy the usage from Tuesday, June 13, 2023.

He said, “We are a bank of many firsts. We do have a wide network, and with this partnership, AMEX will have 60 million customers supporting this partnership. It is a massive endorsement for us to work with AMEX in this partnership.

On his part, Mr Roosevelt Ogbonna, Managing Director and CEO of Access Bank, said: “The launch of American Express Cards in Nigeria is another milestone in the continued development of a vibrant and fast-growing payments industry. Customers want more than transactions – they want real value.

“With American Express, we can provide valuable card benefits, strong loyalty rewards, and a real reason to use electronic payments instead of cash. By diversifying our services to facilitate payments, we can connect more consumers to the SMEs and retail businesses across the country who we know are the engine of economic growth.”

Mrs Chizoma Okoli, Deputy Managing Director, Retail South, Access Bank, said the unveiling of the credit cards is a testament to the bank’s leadership role in the country.

“We are always at the forefront in the banking sector here in Nigeria, and this is our newest innovation as we lead others. You can see these AMEX cards anywhere in Nigeria except here at Access. I know our customers who are going to reap the benefits will be proud of us”.

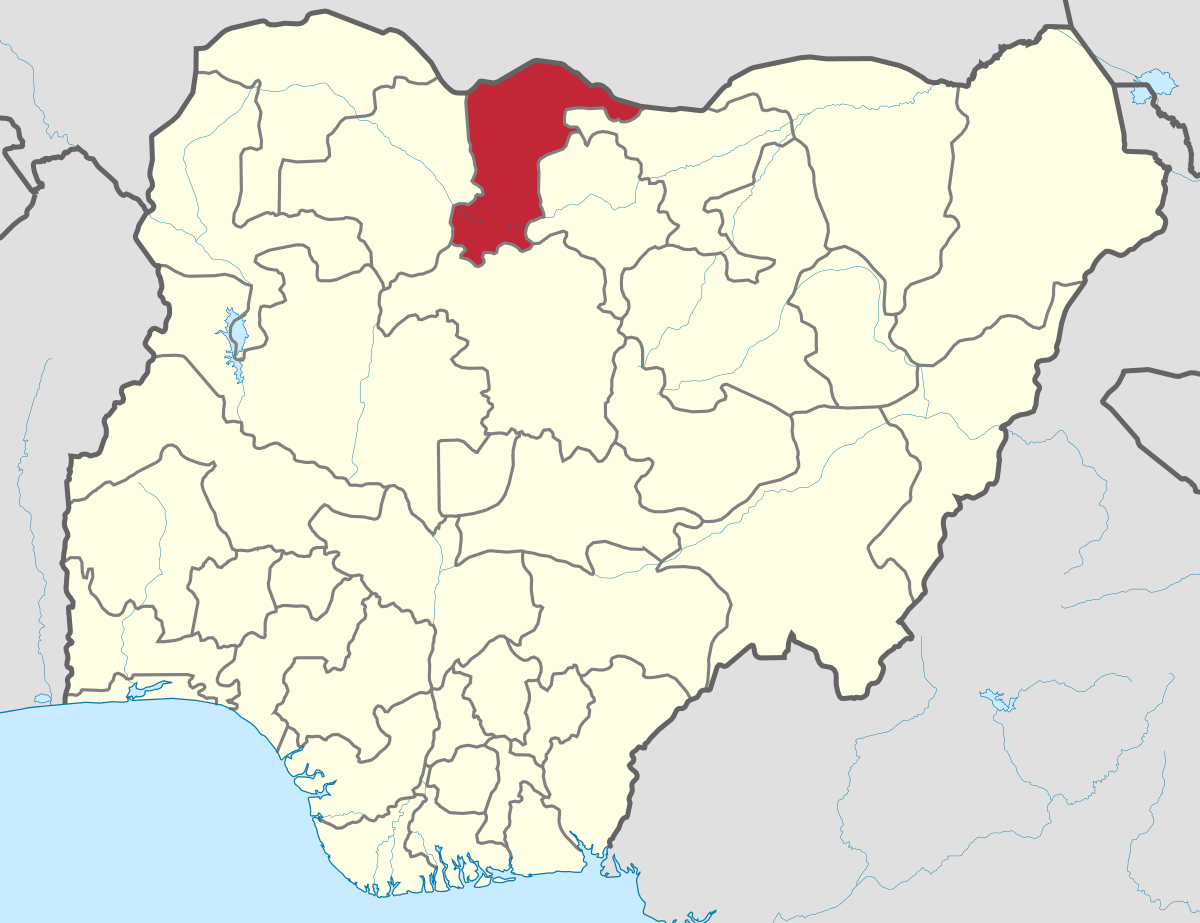

Adding to this, Mr Victor Etiokwu, Deputy Managing Director, Retail North, said the partnership with American Express is not the first and won’t be the last.

“In the payment world, it is important to have varieties, and as a financial sector supermarket, we have varieties of lovely items for the benefit of our customers. AMEX is a unique brand, and we have always wanted to have them on our portfolio and we are glad this has become a reality. We will continue to collaborate with AMEX.

Mr Mohammed Badi, the President of Global Network Services at American Express, explained, “By granting Access Bank a license to launch the first-ever American Express Cards in Nigeria, American Express’s presence in Africa is becoming even more vibrant. The Access Bank American Express Gold Card and the metal Platinum Card enhance the credit card experience in Nigeria with special benefits, access, and service – for Cardmembers both in Nigeria and when travelling overseas.”

Alongside dual-currency functionality (NGN/USD) and international acceptance, the American Express cards include airport lounge access, car rental perks, membership rewards, loyalty points, as well as insurance and protections.

On top of these features, the Platinum Card also offers expanded airport lounge benefits, with complimentary access to more than 1,400 lounges through the American Express Global Lounge Collection.

There are also hotel perks and upgrades through The Hotel Collection and Fine Hotels + Resorts, special status access in the Hilton Honours, Radisson Rewards, and Marriott Bonvoy rewards programmes.

Other benefits include complimentary access to hotel membership programmes, with Tablet Plus membership and Mr & Mrs Smith Gold status, 24/7 travel and lifestyle concierge services.

Banking

Court Orders Final Forfeiture of N81m Stolen from Sterling Bank to FG

By Modupe Gbadeyanka

A Federal High Court sitting in Ikoyi, Lagos, has ordered the final forfeiture of N81.1 million to the Federal Government of Nigeria in favour of Sterling Bank.

The money was part of the N2.5 billion stolen by some customers of Sterling Bank and transferred to their own use as well as to the use of some third-party beneficiaries, owing to a system glitch experienced by the bank.

On October 2, 2025, the court granted an interim forfeiture order of the fund and also directed the publication of the same in a national newspaper for any interested party to show cause why the money should not be finally forfeited to the federal government.

When no one came forward to claim the money, Justice Yelim Bogoro on Monday, March 9, 2026, ordered the final forfeiture of the funds.

The matter was brought before the court by the Economic and Financial Crimes Commission (EFCC) after a petition from the financial institution on July 18, 2022.

The anti-graft agency, in its investigations, traced the stolen funds to various accounts, including that of a customer, Sulaiman Kehinde Ojora, who was one of the major beneficiaries of the monumental fraud.

Investigation further revealed that Sulaiman Kehinde Ojora fraudulently concealed the sum of N43.0 million in the account of his friend, Taiwo Oluwaseyi Alawode (Account No. 1233126860), domiciled in Access Bank, and the sum of N122.2 million in the account of his wife, Aminat Olatanwa Ojora (Account No. 0072889319), domiciled in Sterling Bank.

Banking

Parallex Bank Meets CBN’s N50bn Minimum Capital Requirement

By Adedapo Adesanya

Parallex Bank Limited said it has completed the recapitalisation requirement of the Central Bank of Nigeria, surpassing the N50 billion minimum capital threshold for regional commercial banks ahead of the March 31, 2026, deadline.

The feat reinforces the bank’s position as a financially resilient and strategically forward-looking institution within Nigeria’s evolving banking landscape while positioning it for accelerated growth.

The development now places Parallex Bank among financial institutions that have complied with the apex bank’s directive aimed at strengthening the capital base of deposit money banks, improving financial system stability, and enhancing the sector’s capacity to support economic growth.

Speaking on the development, Mr Olufemi Bakre, the managing director of the lender, said the milestone underscores the belief that excellence, when consistently pursued, delivers sustainable results.

He added that the strengthened capital position will enable Parallex Bank to expand its lending capacity, deepen financial inclusion, and continue delivering innovative, customer-focused financial solutions across various segments of the economy.

“With this strengthened capital position, Parallex Bank is better equipped to expand lending, deepen financial inclusion and continue delivering innovative, customer-focused banking solutions across the retail, SME and corporate segments of the economy,” he said.

The recapitalisation exercise, announced in March 2024 by the CBN, is expected to strengthen the resilience of Nigeria’s banking sector and enhance its capacity to support economic growth.

Mr Bakre commended the bank’s stakeholders, particularly the Board of Directors, for their strategic guidance, oversight, and timely support, which he said were instrumental in ensuring that the recapitalisation requirement was met within the stipulated timeframe.

According to him, the Board’s commitment to strong governance and long-term value creation provided the foundation for disciplined capital planning and effective execution across the institution.

Banking

Zedvance Eyes Disbursement of N250bn to Commercial Businesses in 2026

By Modupe Gbadeyanka

A leading provider of consumer and business financing solutions in Nigeria, Zedvance Finance Limited, intends to increase its lending to commercial entities in the country by 160 per cent in 2026.

Last year, it provided N96 billion loans to support enterprises across key sectors of the economy, including oil and gas, automotive, logistics, renewable energy, fintech, e-commerce, trade distribution value chains, agri-businesses and others.

This year, Zedvance, a subsidiary of Zedcrest Group, plans to push this amount higher to N250 billion across key economic sectors, including off-grid power, smart devices and home equipment, vehicle dealerships and mobility platforms, agribusiness and manufacturing, consumer and industrial goods distribution and hospitality.

This expansion reinforces its mission to accelerate enterprise growth by providing faster and broader access to credit across Africa.

“We are proud of our accomplishments so far, especially the impact we’ve made in sectors that are critical to economic development,” said the Managing Director of Zedcrest Group, Mr Adedayo Amzat.

“Through solar and asset on-lending, we have helped to expand energy access and improve income opportunities for gig workers by financing mobility asset platforms across Nigeria.

“Because our customers are at the heart of our business, we were intentional about designing our flagship product, Liquidity Solutions, to allow businesses to unlock faster credit delivery across all high-growth sectors. This has proven impactful as we continue to witness our clients record great successes,” Mr Amzat further said.

Leveraging its 11-year legacy, Zedvance’s Commercial Solutions business, launched in 2025, has in just one year become a major driver of credit expansion, achieving one of the highest loan disbursement rates among financial institutions, empowering thousands of local enterprises and boosting economic growth.

Through offerings such as working capital, invoice/PO financing, equipment and trade finance, and ecosystem-based solutions, Zedvance enables access to liquidity for buy-now-pay-later providers, asset acquisition, and cross-border credit lines for imports & exports, aiding business expansion and strengthening operational resilience in a dynamic economic environment.

On his part, the acting executive director for Commercial Solutions, Mr Ayooluwa Oladimeji, said Zedvance leverages technology, product innovation, deep sector expertise and risk-moderated structures to deploy diverse funding solutions, including multi-currency credit lines, BNPL facilities, and equipment financing across automotive, renewable energy, manufacturing, fintech, and trade distribution sectors.

“In 2025 alone, Zedvance Commercial Solutions business recorded tremendous growth, driven by strong partnerships and a rapidly expanding portfolio. We are proud to have supported a range of businesses, including Shekel Mobility, Tradegrid, Sapphire, CredPal and other ecosystem partners.

“Beyond these successes, our focus remains on strengthening credit access across Africa’s commercial ecosystems to enable businesses to scale with confidence and resilience,” he said.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn