Banking

V Bank Considers Expansion to Ghana, Kenya

By Ahmed Rahma

The co-founder and Executive Director, Institutional Business & Investor Relations of VFD Group Plc, Mr Niyi Adenubi, has said the company is planning to expand the operations of its digital bank, V Bank, to other African countries.

V Bank has been a success in Nigeria, where it started its operations and the owners are already looking at taking the business to Ghana and Kenya, two other key markets on the continent.

Mr Adenubi, while speaking with Eleni Giokos of CNN Marketplace Africa, said talks are already ongoing with authorities of the two nations, noting that this is part of the company’s goal of becoming a pan African investment company.

“We are already looking at Ghana and we have started a conversation in Ghana. We are looking to deploy a small payment bank in Ghana using the V Bank platform.

“From Ghana, we also looking at Kenya- it’s a very exciting market. We definitely have ambition for Africa and if we get lucky in our lifetime, we will go global, but I am quite hopeful that we can land in Africa,” he said.

Mr Adenubi is a trained investment banker with over 10 years of hands-on experience in private equity, venture capitalism and financial advisory.

The entrepreneur started his banking career in his mid-20s in London and at various instances, he has played specific oversight on corporate governance and financial advisory roles to numerous firms both in Nigeria and in the United Kingdom, most notably with the Royal Bank of Scotland and ATOS Consulting.

“In my mid-20s, I was an investment banker in London.

“After about three or four years in investment banking consulting, I started thinking about my country and the continent. I started thinking of how to build businesses and create values in that space.

“My only expertise is investment banking so very quickly I set up an investment management firm called Paragon Partners and since that time we created 10-year strategies to build out initially a financial service holding company now a diversified investment company looking at financial services, power, education, and media – which is VFD Group,” he told Ms Giokos.

Mr Adenubi expressed optimism that his company will gain a market share of 15 to 20 per cent in the Nigerian banking space by next year.

“The initial plan was 15 per cent to 20 per cent of the banking market and either way, we are on track to meet that target even before half year next year.

“Till today, I think we still have about 40 million accounts, out of a population of 200 million,” he said.

Banking

Zenith Bank Deepens Engagement Around Women’s Empowerment, Others

By Modupe Gbadeyanka

Monday, March 9, 2026, has been fixed by Zenith Bank Plc for its annual International Women’s Day seminar in Lagos.

The event is part of activities lined up to commemorate the 2026 International Women’s Day, themed Give to Gain.

The theme prepared for Zenith Bank’s programme is Take it, You Own it, and was designed to deepen meaningful engagement around women’s empowerment, leadership, and sustainable impact.

The workshop will include segments focused on leadership insight, professional empowerment, wellbeing, and collaboration, offering attendees opportunities to engage deeply with thought leadership and practical strategies for advancing equity.

With a carefully curated programme spanning keynote addresses, panel conversations, Q and A sessions, and creative interludes, Zenith Bank’s 2026 International Women’s Day Seminar promises to be a catalyst for meaningful action.

“International Women’s Day is a reminder that progress requires intentionality.

Give to Gain speaks to the responsibility institutions have to create real opportunities, while our theme, Take It, You Own It, challenges women to step forward boldly and lead.

“At Zenith Bank, we are deliberate about building environments where women are supported to grow, thrive, and shape outcomes, not only within our institution but across the communities and industries we serve,” the chief executive of Zenith Bank, Ms Adaora Umeoji, stated.

Over the years, the lender’s International Women’s Day initiatives have brought together women leaders, professionals, entrepreneurs, and emerging talents for dynamic dialogue, inspiration, and shared learning around gender equity, professional growth, and inclusive opportunity.

More than a commemorative gathering, the 2026 seminar is designed as a convergence of influence, insight, and inspiration, bringing together accomplished women and progressive leaders across business, governance, creative industries, technology, and social impact.

Banking

Ecobank Accelerates Growth for Women Entrepreneurs With Enhanced ‘Ellevate’ Programme

By Modupe Gbadeyanka

As part of activities commemorating International Women’s Day 2026, Ecobank Nigeria has improved its multi-award-winning gender financing initiative, Ellevate by Ecobank.

Originally launched to improve access to finance for women-owned, women-led, and women-focused small and medium-sized enterprises (SMEs) within its commercial banking segment, the enhanced Ellevate programme now adopts a broader, more inclusive structure.

The new framework extends across all business segments, positioning Ellevate as a comprehensive ecosystem designed to address the structural financing and growth barriers faced by women entrepreneurs.

The upgraded programme reinforces the bank’s long-term commitment to advancing women-led enterprises in Nigeria and across Ecobank’s pan-African footprint.

Under the expanded structure, beneficiaries will enjoy improved access to credit on competitive terms, including more flexible collateral considerations aimed at easing traditional financing constraints. Beyond lending, the programme integrates digital payment, collections, and cash management solutions to enhance operational efficiency and support scalability.

A core pillar of the enhancement is structured market access. Through the bank’s MyTradeHub online matchmaking platform and e-commerce enablement capabilities, women entrepreneurs will be better positioned to connect with customers and trade partners across Africa, facilitating cross-border expansion and participation in regional value chains.

The initiative also incorporates robust non-financial support mechanisms, including targeted training programmes, leadership development sessions, and knowledge-sharing platforms to strengthen managerial capacity and long-term sustainability.

This is complemented by access to customised wealth management advisory services, integrated insurance solutions, and a loyalty framework offering commercial incentives through select retail and lifestyle partnerships.

“Since its launch in Nigeria in July 2021, Ellevate has delivered meaningful impact for SMEs and women-led businesses.

“This next phase deepens our value proposition and reinforces our resolve to remain the preferred financial partner for women entrepreneurs,” the Managing Director of Ecobank Nigeria, Mr Bolaji Lawal, said.

“African businesswomen deserve world-class banking solutions that drive turnover, profitability, and sustainable growth. Our approach goes beyond financial inclusion to building an enabling ecosystem that enhances competitiveness and long-term resilience,” he added.

He further highlighted that Ecobank Nigeria consistently hosts flagship platforms such as Adire Lagos, Oja Oge, +234Art Fair, the Lagos Pop-Up Museum, SME Bazaar, and the Design & Build Exhibition, which provide prominent opportunities for showcasing and elevating women-owned businesses.

Banking

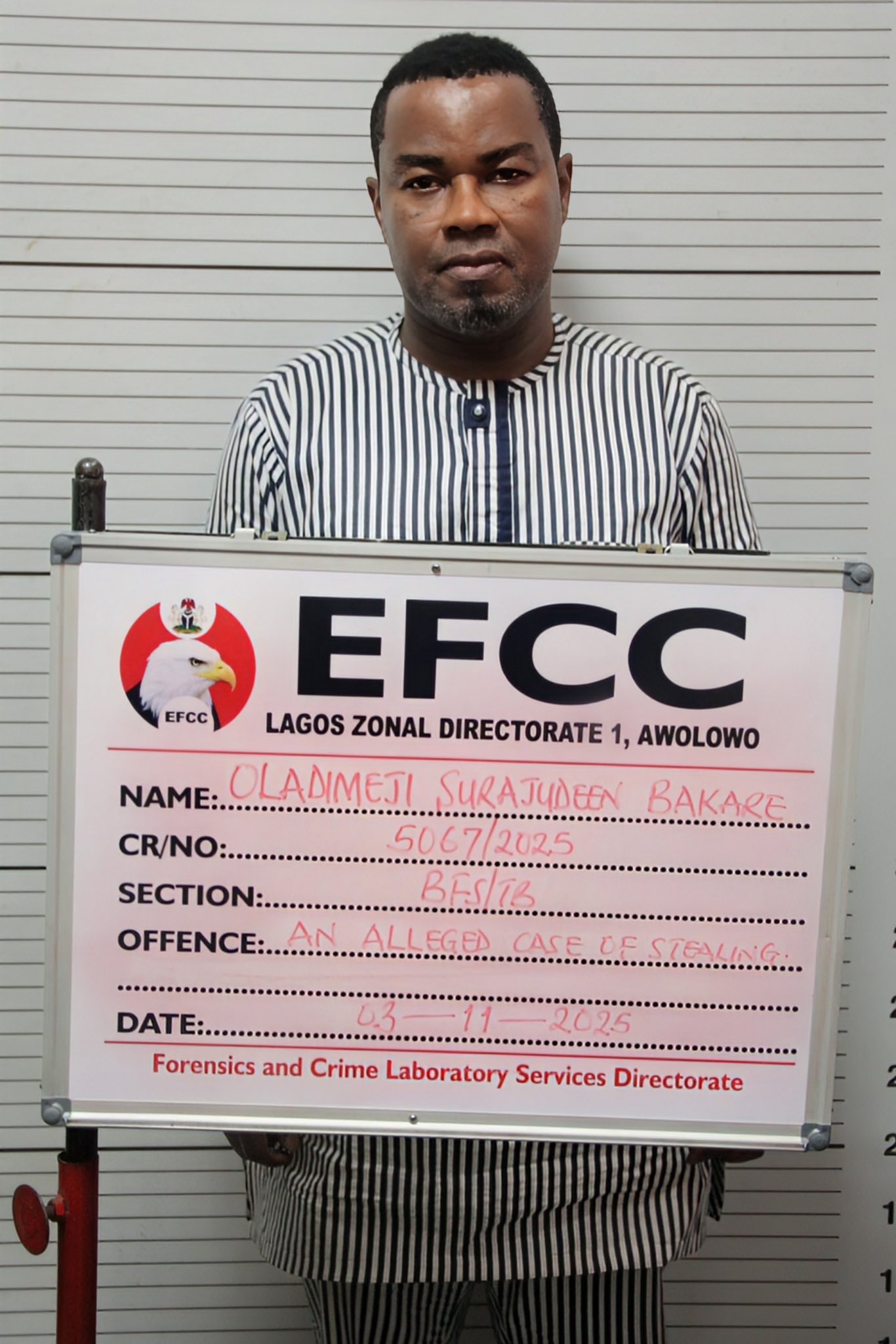

EFCC Arraigns Two FSDH Merchant Bank Employees

By Modupe Gbadeyanka

Two employees of FSDH Merchant Bank Limited, Mr Bakare Oladimeji Surajudeen and Mr James Olukayode Imokwede, have been arraigned by the Economic and Financial Crimes Commission (EFCC).

The suspects were brought before Justice Ismaila Ijelu of the Lagos State High Court sitting in Ikeja on Tuesday, March 3, 2026.

They were accused of stealing and retaining stolen property valued at about $306,667.81 and €50,250.

The EFCC, which received a petition from the lender, said its investigations showed that the suspects processed fraudulent transfers through the SWIFT platform to third parties.

The bank said an internal audit uncovered unauthorised debits totalling $306,667.81 and €50,250, equivalent to N527.4 million from its Letters of Credit (LC) payable accounts.

At the court yesterday, after the defendants pleaded “not guilty” to all 10-count charges preferred against them, the prosecution counsel, H. U. Kofarnaisa, asked for a trial date and also prayed that the defendants be remanded in a correctional facility pending trial.

Counsel to the first and second defendants, Oluwaseun Akintunde and Olajide S. Onasanya, informed the court that bail applications had been filed on behalf of the defendants and also urged the court to grant them bail on liberal terms.

They also prayed that the defendants be remanded in the EFCC custody pending the perfection of their bail conditions.

The prosecution counsel, however, opposed the prayers of the defence seeking the remand of the defendants in the EFCC custody, saying that “the EFCC detention facilities are overstretched.”

After listening to both parties, Justice Ijelu granted the defendants bail in the sum of N2 million each, with two sureties in like sum.

The court ordered that one of the sureties must be a relative who is gainfully employed. The sureties must provide evidence of tax payment in the last three years and must show proof of livelihood, with their residences verified.

The defendants were ordered to deposit their international passports with the court, and must not travel outside the country without the leave of the court.

The judge subsequently remanded the defendants in a correctional facility pending the perfection of their bail conditions, and adjourned the matter till March 25, 2026, for the commencement of trial.

Business Post reports that one of the counts said, “That you, Bakare Oladimeji Surajudeen and James Olukayode Imokwede, sometime in 2021 in Lagos within the jurisdiction of this court, dishonestly took the sum of N527,406,916.66, property of FSDH Merchant Bank Limited.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn