Brands/Products

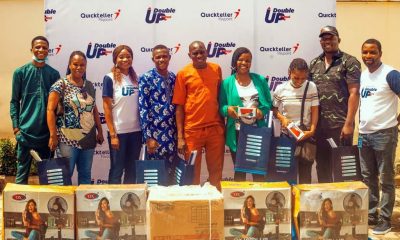

Quickteller Paypoint Double Up Promo Gets First Set of Winners

By Aduragbemi Omiyale

Interswitch Financial Inclusion Services (IFIS) has announced the first set of winners in its Quickteller Paypoint Double Up promo expected to end on March 31, 2022.

The first set of winners was selected from the six geopolitical zones in Nigeria at the first round of a raffle draw held on March 3, 2022, and have all been contacted to receive their prizes, with presentations conducted across the regions.

To ensure that the raffle draw was in strict compliance with regulatory protocols, it was closely monitored by the representatives of the Federal Competition and Consumer Protection Commission (FCCPC), the Lagos State Lottery Board (LSLB), and the National Lottery Regulatory Commission (NLRC).

The Quickteller Paypoint Double Up campaign is aimed at rewarding Quickteller Paypoint agents across the country. The promo will run for eight weeks, having started on February 1.

At the raffle draw about two weeks ago, six agents won television and generator set each; 12 got smartphones, 24 received rechargeable standing fans, 120 got N10,000 wallet funding, while 2,100 agents received N1,000 worth of airtime.

Business Post reports that all the winners were selected based on different categories such as Platinum, Gold, and Silver winners.

The Platinum winner for Lagos was Fatima Abidoye, the Gold winners were Aduku Enejoh and Ashien Queen of Isiewere Solution Enterprises, and the Silver winners were Bamgbe Banwo, Hunye Senami and Florence James.

Speaking on the promo, the Divisional Chief Executive Officer, IFIS, Ms Titilola Shogaolu, reiterated Quickteller Paypoint’s goal of rewarding Paypoint agents who continue to expand the goal of a financially inclusive Nigeria.

She said, “Our overarching goal remains financial inclusion for all Nigerians, democratising financial services and making it easier for even people in the remotest parts to gain access to these services, and making this dream a reality are our valuable Quickteller Paypoint agents.

“This promo serves as an opportunity to reward the work of our agents scattered across the country, who are making sure that Nigerians from all walks of life make easy, safe, and convenient transactions. Again, I implore all active agents to participate in the promo to get rewarded for their effort.”

With the promo still ongoing and open to both new and existing agents, active Quickteller Paypoint agents are encouraged to take part in the reward program. To qualify, agents are to perform a minimum of one transaction monthly.

Brands/Products

Lafarge Africa Rewards Customers, Transporters With Luxury SUVs, Others

By Modupe Gbadeyanka

Customers, transporters, and key stakeholders of Lafarge Africa Plc gathered in Lagos on Saturday, February 21, 2026, for the company’s 2025 Customer & Transporter Awards.

The event was put together to recognise the invaluable contributions of customers and transporters who ensure the company’s products reach every part of the country. The 2025 edition celebrated partners whose dedication, integrity, and resilience have strengthened the company’s market leadership despite evolving economic realities.

The chief executive of Lafarge Africa, Mr Lolu Alade-Akinyemi, thanked the trade partners for their loyalty and commitment to the business.

He noted that Lafarge Africa’s growth story would be incomplete without its partners’ market insights, trust, and consistent support. He emphasised that the company would continue to push boundaries in quality, innovation, and high performance, inspired by the strength of its partnerships.

“We are here to honour partnership. We want to thank our customers for partnering with us in 2025. In 2025, we expanded our retail presence and focused on customer experience.

“We strengthened our ready-mix business, launched new products, including Ecoplanet Elephant and Ecocrete, our low-carbon cement and concrete solutions, and walked the talk on innovation, using technology as a competitive advantage. We could not have done this without our customers and partners,” he said.

Also speaking, the Commercial Director of Lafarge Africa, Mr Gbenga Onimowo, described customers and transporters as “trade champions” whose excellence and unwavering belief in the company’s products have sustained the company’s strong position in the market.

“You are a vital part of our business, ensuring our products are visible and accessible across the country. Your contribution merits daily appreciation. Tonight’s expression of thanks is special because it gives us the opportunity to celebrate our wins together, in person.

“While we celebrate tonight’s winners, we acknowledge that every partner here has contributed meaningfully to our success. We believe this recognition will inspire even greater achievements in the year ahead,” he added.

On his part, the Logistics Director for Lafarge Africa, Mr Osaze Aghatise, acknowledged the transporters as the critical bridge between the company and its customers, ensuring efficient distribution and nationwide availability of its innovative building solutions. According to him, the awards serve as both recognition and motivation, encouraging partners to continue raising the bar.

Elder Ubong Bassey Obot of Ubotex Nigeria Limited emerged the National Volume Champion. Igwe Cosmas Ezeumeh Chizoba of C.C. Umeh and Sons Limited and Chief Etim Effiong Okon of Batoframoje Enterprises secured the titles of first and second runners-up, respectively. As the champion, Ubong Obot received a 2026 Toyota Land Cruiser. C.C. Umeh and Sons Limited and Batoframoje Enterprises were awarded a 2026 Toyota Prado and a 2026 Toyota Fortuner, respectively.

Additionally, B.I.G MultiQuest Nigeria Limited was recognised as the National Winner- Best Transporter category and was awarded a 2026 Toyota Hilux. Two customers who emerged as National Growth Champions received 15-kVA generating sets, while 4 regional champions were rewarded with a Toyota RAV 4 each. Other winners received prizes including a Changan CS55, GAC S3, Hyundai Creta cars, 13KVA solar inverters, 80-inch Hisense TVs, and deep freezers, among others.

Brands/Products

Police Bust Factories Destroying Beverage Bottles, Crates in Anambra

By Aduragbemi Omiyale

Some factories used for the destruction of returnable packaging materials, including glass bottles and plastic crates belonging to various beverage manufacturing companies, have been busted by officials of the Nigeria Police Force (NPF) in Anambra State.

The security operatives stormed these sites on Thursday in collaboration with the Beer Sectoral Group (BSG) of the Manufacturers Association of Nigeria (NPF).

The Executive Secretary of BSG, Ms Abiola Laseinde, described the act as criminal and a serious economic sabotage, noting that these assets remain the property of beverage companies that have invested heavily in these sustainable packaging materials to protect the environment.

She warned those involved in the act to desist, as offenders will be held liable and made to face the wrath of the law, as the organisation will continue to work with the police to crack down on illegal disposal, theft, and unauthorised recycling of its returnable packaging materials, notably returnable glass bottles and plastic crates.

Ms Laseinde noted that the owners of these factories were involved in destroying returnable packaging materials for reuse, thereby causing the businesses to lose millions of naira in investments.

She added that the group had engaged relevant security and regulatory authorities through formal petitions and intelligence-sharing, seeking lawful intervention to curb the illegal practices, recover company assets, and dismantle unauthorised recycling operations.

According to her, the group identified multiple locations in the South-East where they crush our bottles and crates for resale as raw materials, stressing that investigations had revealed that significant quantities were being diverted from legitimate channels into informal recycling networks.

The BSG scribe also disclosed that, in several instances, bottles were deliberately broken and crates were intentionally shredded for sale as raw materials, undermining the beverage companies’ circular packaging model.

“The recent raid is the outcome of sustained engagements and intelligence-led investigations, and represents a decisive step by authorities to protect legitimate business operations, uphold environmental standards, and deter further illegal activity,” she said.

Ms Laseinde pointed out that, beyond the asset loss, the activities of these individuals pose significant risks to businesses, including supply chain disruptions, increased operational costs, environmental risks arising from unsafe recycling practices and threats to public safety.

“These Returnable Packaging Materials (RPMs) are company-owned assets designed for multiple reuse cycles and form a critical part of their sustainability, cost-efficiency, and product quality systems. It’s a criminal activity to destroy them,” she stated, urging the public to remain vigilant and report any suspicious activity of this nature to the police or call the consumer care lines of the beverage companies.

Brands/Products

Unilever Partners Google Cloud to Sustain Long-term Competitive Edge

By Aduragbemi Omiyale

One of the leading global brands, Unilever, has sealed a five-year deal with Google Cloud for the deployment of technology, especially Artificial Intelligence (AI) to drive growth and desirability for its brand portfolios like Dove, Vaseline and Hellmann’s.

Business Post reports that the collaboration will focus on three core pillars of agentic commerce and marketing intelligence, an integrated data and cloud foundation, and advanced AI.

According to a statement, both parties will collaborate to build next-generation marketing capabilities across brand discovery, conversion and measurement to ensure that Unilever remains at the forefront of shifts in technology and consumer habits.

In addition, Unilever will transition key enterprise applications and data platforms to Google Cloud, creating a connected environment for scalable AI deployment across the value chain.

Also, this partnership will fast-track Unilever’s adoption of pioneering technologies, combining Unilever’s deep expertise with Google’s AI capabilities to sustain Unilever’s long-term competitive edge within the CPG market.

The Chief Supply Chain and Operations Officer at Unilever, Willem Uijen, said, “Technology has moved to the core of value creation at Unilever. As brands are increasingly discovered and chosen in environments shaped by AI, we must lead this shift.

“This collaboration with Google Cloud sets a new level in how technology can power commerce and growth in the fast-moving consumer goods industry, ensuring Unilever is agile, fit for the future, and equipped to unlock value at every level of the company.”

Also commenting, the EMEA president for Google Cloud, Tara Brady, said, “In partnering with Unilever as it boldly reimagines its business processes, we are not just modernizing legacy systems; we are deploying our advanced models, such as Gemini, to create a system of intelligence that reasons, learns, and acts. This will set a new standard for agility and consumer engagement in the CPG sector.”

It was gathered that Unilever would use Google Cloud’s technologies, such as its enterprise AI platform, Vertex AI, to build new capabilities in brand discovery, measurement and AI-augmented marketing. This will create a new model for how consumer packaged goods (CPG) brands are discovered and shopped, as consumer journeys shift toward more conversational and agentic experiences.

By migrating its integrated data and cloud platform to Google Cloud, Unilever will build an enterprise-wide, AI-first digital backbone to generate demand faster, turn data into actionable insights, and respond to market shifts with greater agility. This foundation will also support the development of agentic workflows—intelligent systems capable of executing complex tasks across Unilever’s business processes.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn