Economy

Afreximbank to Use Oil Traders to Fund $3bn Nigerian Crude Swap Loan

By Adedapo Adesanya

The African Export-Import Bank (Afreximbank) is planning to use oil traders to fund a $3 billion loan to the Nigerian National Petroleum Company (NNPC) Limited, which is aimed at stabilising the weakening Naira.

According to a Reuters report, the Cairo-based bank has made contact with traders to gauge their interest in lending their support to the oil-backed loan to Nigeria’s national oil company.

The sources who spoke to the publication also disclosed that Afreximbank has made an attempt to come up with the terms that they will present to trading houses.

“There is a lot of interest, but they need to see the conditions,” a senior oil executive with knowledge of the negotiations told Reuters’ sources.

The executive added that increasing oil prices above $90 a barrel would help increase interest, but he asked that his name not be used because he is not permitted to speak publicly on the matter.

Business Post had reported that the local currency appreciated to N755 per Dollar at the official foreign exchange (FX) market while at the unregulated market like the Peer-2-Peer (P2P) market, the Naira sold for N1,020/$1.

Nigeria’s huge FX backlog is limiting the availability of Dollars on the official market, forcing businesses and individuals to seek them on the black market.

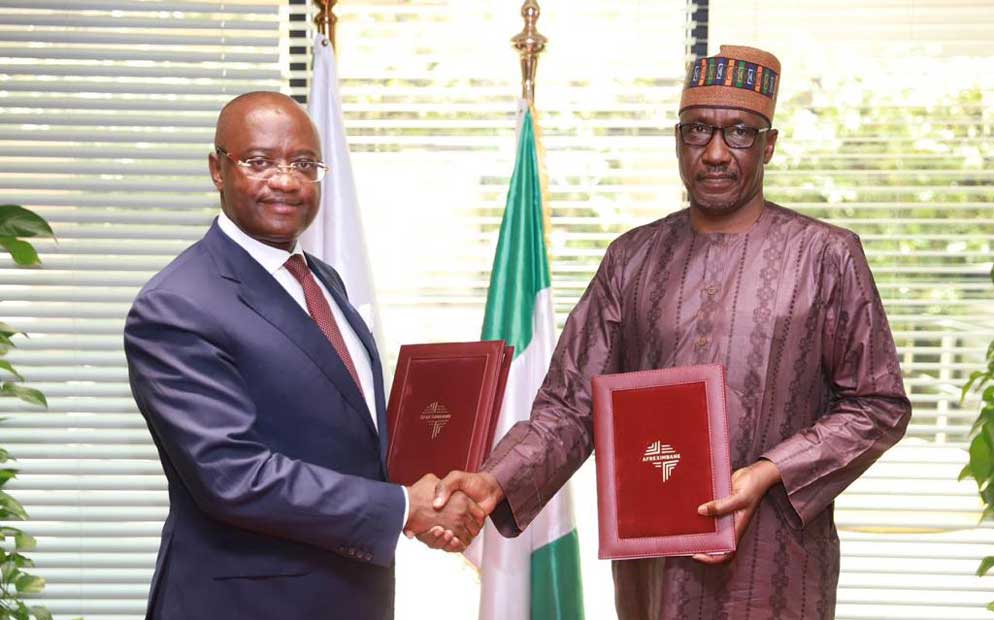

Recall that in August, NNPC said that it had secured an emergency $3 billion crude oil repayment loan, which is aimed at stabilising the Naira.

NNPC Limited, in a statement, said it secured the crude-for-cash funding from Afreximbank headquarters in Cairo, Egypt.

The oil-for-cash loan is meant to be used to support the Naira as it continues its free fall and stabilises the FX market.

This is the fourth transaction being consummated between NNPC and Afreximbank over the last 3 years to further consolidate the mutual relationship between the two entities. Nigeria and NNPC Limited are shareholders in Afreximbank, with the sole purpose of enhancing investments and growing prosperity in Africa.

Economy

NGX Lifts Suspension on Fortis Global Insurance

By Aduragbemi Omiyale

The suspension placed on trading in the shares of Fortis Global Insurance Plc has been lifted by the Nigerian Exchange (NGX) Limited after six years.

The embargo arose from the company’s violation of Rule 3.1: Rules for Filing of Accounts and Treatment of Default Filing (Default Filing Rules).

The underwriting firm, formerly known as Standard Alliance Insurance Plc, was suspended by the exchange on July 2, 2019, after the board failed to file the necessary financial statements.

Rule 3.1 provides that if an issuer fails to file the relevant accounts by the expiration of the cure period, the exchange will: a) send to the issuer a second filing deficiency notification within two business days after the end of the cure period, b) suspend trading in the issuer’s securities, and c) notify the Securities and Exchange Commission (SEC) and the market within 24 hours of the suspension.

A notice from the bourse last week disclosed that the company has now filed all outstanding financial statements due to the NGX, and in view of this, the embargo has been lifted pursuant to Rule 3.3 of the Default Filing Rules.

This section states that, “The suspension of trading in the issuer’s securities shall be lifted upon submission of the relevant accounts, provided the exchange is satisfied that the accounts comply with all applicable rules of the exchange.

“The exchange shall thereafter also announce through the medium by which the public and the SEC were initially notified of the suspension, that the suspension has been lifted.”

The bourse informed trading license holders and the investing public “that the suspension placed on trading on the shares of Fortis Global Insurance was lifted on Wednesday, February 4, 2026.”

Economy

Investors Transact 3.860 billion Stocks Worth N128.581bn in Five Days

By Dipo Olowookere

Last week, on the floor of the Nigerian Exchange (NGX) Limited, investors transacted 3.860 billion stocks worth N128.581 billion in 240,463 deals versus the 3.087 billion stocks valued at N81.505 billion traded in 222,185 deals in the preceding week.

In the five-day trading week, financial equities led the activity chart with 2.188 billion units valued at N50.459 billion in 94,005 deals, contributing 56.68 per cent and 39.24 per cent to the total trading volume and value, respectively.

Services stocks followed with 466.771 million units worth N4.495 billion in 18,526 deals, and ICT shares sold 377.800 million units for N9.049 billion in 25,653 deals.

Chams, Access Holdings, and Universal Insurance were the most active in the week with 664.942 million units valued at N6.801 billion in 15,161 deals, contributing 17.23 per cent and 5.29 per cent to the total trading volume and value apiece.

Business Post reports that 71 equities appreciated during the week versus 44 equities in the previous week, as 35 stocks depreciated compared with 49 stocks a week earlier, while 42 shares closed flat versus 55 shares in the preceding week.

RT Briscoe was the biggest price gainer with a price appreciation of 60.69 per cent to close at N12.63, Zichis gained 60.38 per cent to trade at N6.72, Abbey Mortgage Bank chalked up 59.04 per cent to settle at N14.95, Union Dicon expanded by 49.14 per cent to N13.05, and Austin Laz grew by 38.46 per cent to N5.40.

Conversely, Deap Capital was the biggest price loser after giving up 27.37 per cent to quote at N6.82, Union Homes REIT lost 26.99 per cent to finish at N69.25, Red Star Express declined by 17.55 per cent to N17.15, UPDC REIT shrank by 12.29 per cent to N7.85, and Cornerstone Insurance tumbled by 12.24 per cent to N5.45.

From the above data, the week was under buying pressure, which raised the All-Share Index (ASI) and the market capitalisation by 3.84 per cent to 171,727.49 points and N110.235 trillion, respectively.

Similarly, all other indices finished higher with the exception of the insurance index, which depreciated by 2.33 per cent due to sell-offs.

Economy

Dangote Cement Assures African Consumers Sufficient Supply With 90MT Yearly

By Aduragbemi Omiyale

Leading cement maker, Dangote Cement Plc, has reaffirmed its commitment to making Africa fully self‑sufficient in cement production by raising its output to 90 million metric tonnes per annum by 2030 from the current 52 million metric tonnes per annum.

The chief executive of the firm, Mr Arvind Pathak, during a strategic briefing on the company’s expansion drive, disclosed that efforts are being made to accelerate investments across African markets to close supply gaps and support the continent’s infrastructural ambitions.

According to him, the organisation is strengthening the continent’s industrial backbone and reducing reliance on imported construction materials, stressing that, “Our vision is clear — to ensure Africa produces enough cement to meet its own needs…Through continuous expansion, operational excellence, and a strong distribution network, we are positioning Dangote Cement to power growth across the continent. We are not just building a business; we are building Africa’s future.”

“Through our collective determination, we have eliminated Nigeria’s dependence on imported cement and transformed the country into a net exporter of cement to several neighbouring nations,” Mr Pathak added.

Dangote Cement currently operates in multiple African countries, with integrated plants, grinding facilities, and distribution hubs strategically located to serve diverse markets.

The company’s ongoing projects include plant upgrades, capacity expansions, and the introduction of advanced energy‑efficient technologies designed to reduce operational costs and carbon footprint.

Reinforcing the company’s long-term vision, its founder, Mr Aliko Dangote, described self-sufficiency as both an economic imperative and a continental responsibility.

“Africa has no reason to depend on cement imports. We have the raw materials, the talent, and the determination. Our goal at Dangote Cement is to unlock Africa’s potential by ensuring that every nation on this continent can access affordable, high‑quality cement produced within Africa. This is how we build prosperity, job opportunities, and sustainable development,” the businessman stated.

Mr Dangote added that the company’s investments reflect its passion for unlocking continental competitiveness and fostering industrialisation across Africa.

With major infrastructural projects rising across African cities — from highways and bridges to housing developments — the demand for cement continues to grow. Dangote Cement’s renewed push toward continental self‑sufficiency is expected to address supply challenges, stabilise prices, and enhance construction reliability in the years ahead.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn