Economy

Agama Advocates Capital Market Integration to Unlock West Africa’s Growth

By Aduragbemi Omiyale

West African countries have been urged to accelerate the integration of their capital markets because it is the only way to mobilise the scale of investment needed to drive the region’s development.

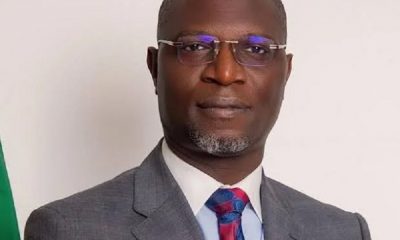

This was the submission of the Director-General of the Securities and Exchange Commission (SEC), Dr Emomotimi Agama, at the Experts Meeting on Validation of the WASRA Charter and Recognition of WASRA as the Regulatory Body for Cross-Border Securities Market in ECOWAS on Thursday in Abuja, Nigeria.

The SEC chief, who is also the WASRA Chairman, said the initiative represents “a watershed moment” in the region’s financial history, noting that West Africa faces urgent developmental challenges ranging from infrastructure deficits and climate adaptation to digital transformation and job creation.

“To meet these challenges, we require capital at scale, and the truth is simple: no single national market can provide it alone. An integrated regional capital market is no longer a luxury; it is a necessity,” he pointed out, lamenting the slow pace of regional integration, warning that “each year of delay is a lost opportunity to mobilise resources for critical projects that can transform our economies.”

Mr Agama also pointed to Africa’s annual infrastructure financing gap of over $100 billion, stressing that West Africa alone requires tens of billions of dollars to modernise transport corridors, upgrade energy systems, and build resilient digital infrastructure.

“Without integrated markets that pool liquidity and broaden investor participation, our governments and private sector will remain constrained, relying on limited fiscal space and expensive borrowing,” he declared.

Drawing lessons from global models, he noted that the European Union and ASEAN achieved significant economic transformation by harmonising rules, fostering investor confidence, and facilitating seamless cross-border funding.

“The creation of a single market enabled European firms to access funding seamlessly across borders, boosting innovation and competitiveness. Closer to home, ASEAN coordinated standards and deepened financial cooperation, strengthening its resilience as a regional bloc,” he disclosed, emphasising that West Africa, with its population of more than 400 million and a combined GDP of about $800 billion, has even greater potential, cautioning that “potential means little without decisive action.”

Mr Agama outlined how integration would bring benefits beyond infrastructure, noting that “in agriculture, integrated markets can mobilise capital for value-chain development, agro-processing, and food security, which are critical priorities for our region”.

“In the digital economy, regional capital can support innovation hubs, fintech scale-ups, and broadband expansion, ensuring that West Africa fully participates in the fourth industrial revolution,” he added.

The DG further stressed that cross-border pools of capital, backed by harmonised regulation, could deliver “transformative impact” across multiple sectors, including youth empowerment and job creation.

Presenting the objectives of the West Africa Securities Regulators Association (WASRA), Agama said the body was established with a clear mandate to anchor market integration, adding that the group will foster integration through joint programmes and common projects, promote mutual assistance across the region, and set common standards for effective regulation.

“Integration is not only about policy declarations; it is about practical collaboration and shared initiatives that deliver results for our markets and our people,” he stressed.

Mr Agama called on policymakers, especially finance ministers within ECOWAS, to champion the WASRA initiative, stating that “The political will of our leaders is the single most important factor in moving from aspiration to reality”.

“WASRA stands ready, in partnership with ECOWAS, WACMIC, and WAMI, to provide the technical leadership required.”

Also speaking at the meeting, the Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, noted that the gathering marked a significant step in the collective “journey toward a harmonized regulatory framework, one that reflects the shared aspirations of ECOWAS member states to deepen capital market integration, enhance cross-border investments, and promote financial stability.”

Mr Edun, represented by the Principal Economist in the Federal Ministry of Finance, Mr Hassan Adamu Jibrin, pointed out that validation of the draft WASRA Charter is not merely a procedural formality, but a critical foundation for institutional coherence, regulatory cooperation, and sustainable market development across our sub-region.

On his part while speaking on behalf of ECOWAS Commission, the acting Director Private Sector, Mr Peter Oluonye, noted that for capital markets integration to gain traction in ECOWAS, there is the need for concerted efforts of all stakeholders at harmonizing rules, practices and regulations, to the standards acceptable to all jurisdictions.

“We are well aware that our member states depend much on external capital flows and direct investment to sustain and deliver on economic development programmes of our governments.

“The region is in dire need to develop critical economic infrastructure projects, requiring huge capital investment and facilitate gross capital formation. The capital market is a major vehicle that should support this aspiration.

“The need to drive our capital markets integration initiative to break down barriers to movement of capital within the region by ensuring a harmonized regulatory space, common market information platforms, interlinked trading systems, cross-border trade and payments settlement, harmonized accounting standards and internationally acceptable governance standards and institutions cannot be over-emphasized at this juncture in our economic integration initiatives,” he stated.

Economy

Decentralised Development Initiatives Key to Unlocking Economic Opportunities—Bagudu

By Dipo Olowookere

The Minister of Budget and Economic Planning, Mr Abubakar Bagudu, has stressed the key role decentralised initiatives play in unlocking economic opportunities across the country.

Speaking in Abuja on Wednesday when he received members of the Crop, Aquaculture, Livestock Farmers and Value Chain Economic Actors Association of Nigeria (CALFAN), the Minister noted that initiatives like the Renewed Hope Ward Development Programme of President Bola Tinubu concentrate development planning at the ward level, which is the lowest administrative unit in Nigeria’s governance structure.

He welcomed the decision of the farmers’ group to collaborate with the federal government to accelerate the programme’s implementation.

Mr Bagudu explained that the project aims to enable communities to identify their development opportunities rather than relying solely on a top-down approach, adding that Nigeria has 8,809 wards, each with unique economic prospects that can be accessed through targeted interventions.

Under the initiative, wards will determine their priority economic opportunities, after which the federal government, state governments, local authorities, and development partners will work together to provide the necessary support.

According to him, Nigeria’s constitutional framework assigns development responsibilities to the three tiers of government, but in practice, these roles have not always been well coordinated, often resulting in duplication, inefficiencies, and interruptions in development initiatives.

“Our belief is that every ward in Nigeria is an acre of diamonds waiting to be uncovered. Each community has its own strengths and potential, and development strategies must reflect these distinctive qualities,” he said.

In his remarks, the president of CALFAN, Mr Aliyu Abdulraheem, outlined the association’s proposal to serve as a field-level implementation partner for the Renewed Hope Ward Development Programme.

He highlighted CALFAN’s extensive grassroots structure, including Ward-Level Extension Service Offices (WESOs) and a digital platform that supports real-time beneficiary identification, community mobilisation, data collection, and monitoring of development activities.

He disclosed that the proposed platform would facilitate economic mapping of rural communities, infrastructure assessments, digital surveys, and real-time data collection to support evidence-based policy decisions and programme monitoring.

The CALFAN boss highlighted the inclusive approach that encompasses the entire agricultural value chain, including farmers, input suppliers, processors, transporters, traders, and service providers.

Unveiled in 2025 by President Tinubu, the Renewed Hope Ward Development Programme aims to reset development planning by boosting economic activities at the ward level through collaboration among the federal, state, and local governments.

Economy

NMDPRA Grants Six Petrol Import Permits to Stabilise Market

By Adedapo Adesanya

The Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) has granted import permits for Premium Motor Spirit (PMS) or petrol to six depot owners and petroleum marketers.

This step comes as the federal government moved to ensure stability and balance in the country’s downstream fuel sector after it was widely reported that the country suspended the issuance of petrol import licenses for a second straight month

The regulator recently issued these permits to six importers, with each authorised to import approximately 30,000 metric tonnes of the fuel into the country to help cushion against the effects of escalating conflict in the Middle East.

This development also occurs against the backdrop of ongoing discussions about supply concentration, with recent data showing that the Dangote Petroleum Refinery supplied roughly 92 per cent of Nigeria’s petrol in February.

At present, the Dangote refinery is the sole facility in Nigeria producing petrol, while most modular refineries primarily focus on diesel output.

The Crude Oil Refineries Association of Nigeria (CORAN) also confirmed that none have been issued so far in March, signalling a shift towards prioritising local output. However, this has since changed, spurred by the latest development.

Industry statistics show that local refining provided an average of about 36.5 million litres per day that month, with imports adding roughly 3 million litres daily, resulting in a total supply of around 39.5 million litres per day.

According to reports, until recently, no petrol import permits had been issued under the current NMDPRA leadership, suggesting that the new approvals signal a deliberate policy shift to preserve supply diversity and adaptability as the domestic market continues to develop.

Nigeria’s average daily petrol consumption fell to 56.9 million litres per day in February 2026, down from 60.2 million litres in January.

In February, the Dangote Refinery supplied 36.5 million litres of petrol and 8 million litres of diesel to the local market, leaving a daily deficit of 20 million litres that was covered by previously imported stock.

According to NMDPRA, these volumes were sufficient, leading to its earlier decision to withhold import licenses.

Economy

State Visit: CPPE, LCCI Urge Tinubu to Pursue Trade Expansion with UK

By Adedapo Adesanya

The Centre for the Promotion of Private Enterprise (CPPE) and the Lagos Chamber of Commerce and Industry (LCCI) have called for trade expansion ahead of President Bola Tinubu’s state visit to the United Kingdom.

In separate communications, the organisations urged President Tinubu to deepen economic ties as he visits the UK on the invitation of the King of England, King Charles III. His state visit to the UK next week will mark Nigeria’s first such visit to the UK in 37 years, when Military President Ibrahim Babangida was head of state.

The chief executive of CPPE, Mr Muda Yusuf, said the planned visit by Mr Tinubu to the UK is significant on multiple fronts.

“At a time of shifting global alliances and economic realignments, the visit presents both opportunity and responsibility.

“It is expected that leading Nigerian business figures will accompany the President, creating a platform for expanding trade flows, deepening investment partnerships, promoting Nigeria as a destination for capital, and strengthening financial-sector linkages.

“The UK remains a major source of portfolio flows, development finance, and private-sector investment into Nigeria. Structured engagements during the visit could unlock opportunities in infrastructure, energy, financial services, technology, manufacturing, and agribusiness,” Mr Yusuf stated.

On her part, the Director General of the LCCI, Mrs Chinyere Almona, noted that the visit represents a historic opportunity to recalibrate Nigeria–UK relations from traditional diplomacy to focused economic diplomacy.

“At a time when Nigeria is implementing bold macroeconomic reforms, this visit should be leveraged to secure concrete commitments on trade expansion, long-term investment, and cooperation on the business environment.

“From the perspective of the Lagos Chamber of Commerce and Industry, the overriding objective should be to translate goodwill into measurable economic outcomes that strengthen Nigeria’s productive base and export capacity,” she said.

According to her, recent data underscore the strategic importance of the UK to Nigeria’s economy, noting that in Q3 2025, Nigeria recorded capital importation of approximately US$6.01 billion, representing a significant year-on-year surge.

“Notably, the United Kingdom emerged as Nigeria’s largest source of capital inflows, accounting for about US$2.94 billion, or nearly half of total inflows during the quarter. These inflows were driven predominantly by portfolio investment, particularly into the financial and banking sectors, reflecting renewed foreign investor confidence following Nigeria’s macroeconomic adjustments.

“On the trade front, total trade in goods and services between Nigeria and the UK stood at approximately £8 billion in the 12 months to mid-2025,” she said.

She said, however, that the relationship remains structurally imbalanced, with UK exports to Nigeria significantly exceeding Nigeria’s exports to the UK.

“Ultimately, the economic agenda of this state visit should be guided by Nigeria’s most pressing challenges: export diversification, inflation-induced cost pressures, infrastructure deficits, and the need for stable long-term capital,” Mrs Almona said in an interview with Nairametrics.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn