Economy

That Aso Rock 2017 Budget That Deserves Your Attention

By Saatah Nubari

The first time this budget analysis series ran was for the 2016 budget; and it becomes visible each day that the 1810 page document was a horrid, hurriedly-put, corrupt-conduit-filled piece of executive cluelessness.

Well, since I’m more of a realist than any of the other-ists, I’ll just say that the fact that the world lost an entire tree to the making of the paper it was inked on is a tragedy.

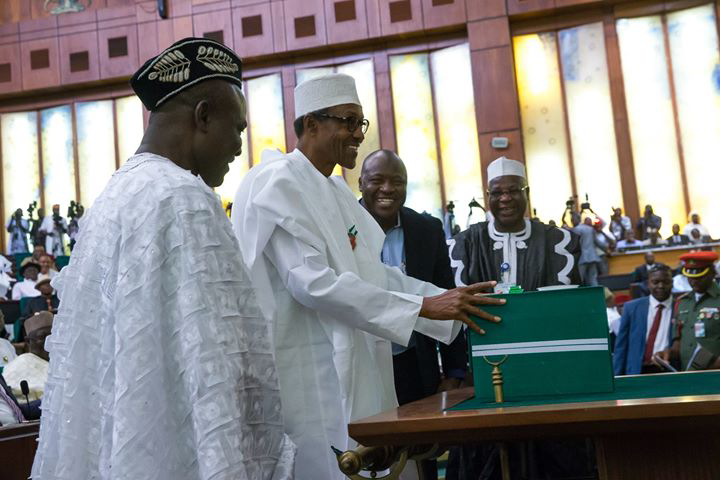

We have been given a sequel; the 2017 budget was presented to the National Assembly by the President in the presence of the ministers who drafted it—and even slept while the presentation was on—and it was called the “Budget of Recovery and Growth.”

If you noticed, it is quite a change from the previous budget of change just like the government’s change mantra.

Here are some quotes from the President’s speech on what when passed, will be arguably the most important document in the country—sorry, just checked and it is 63 paragraphs long so I will just skip to analysing the 2017 budget as we await the implementation report of the 2016 budget.

The 2017 budget is N7.298 trillion. According to the government, this comprises of

- Statutory transfers of N419.02 billion;

- Debt service of N1.66 trillion;

iii. Sinking fund of N177.46 billion to retire certain maturing bonds;

- Non-debt recurrent expenditure of N2.98 trillion; and

- Capital expenditure of N2.24 trillion (including capital in Statutory Transfers).

We will begin with the State House budget, which is N42,917,666,214. This almost doubles what the previous government budgeted for in 2015 which was N23,465,865,117. Out of this, N19,970,000,000 is the total capital budget while the total recurrent budget stands at N22,947,666,214. The total overhead is N10,171,082,268 and that for total personnel is N12,776,583,946.

This is the first piece in the #SaatahBudgetSeries2017, and I will be looking at the budget of the State House (which was referred to as Presidency in previous budgets).

STATE HOUSE

There are 16 agencies under the State House, and they are: State House Headquarters, The Office of the President, The Office of the Vice President, Office of the Chief of Staff to the President, Office of the Chief Security Officer to the President, State House Medical Centre, State House Lagos Liaison Office, Office of the Senior Special Assistant to the President on Sustainable Development Goals (SDGS), National Institute for Policy and Strategic Studies (NIPSS), Bureau of Public Enterprises, National Emergency Management Agency, Economic and Financial Crimes Commission, Bureau of Public Procurement, Nigeria Extractive Industries Transparency Initiative, Nigeria Atomic Energy Commission and its centres, and Office of the Chief Economic Adviser to the President which funny enough the President only appointed in August of this year.

The first piece of poo I was hit with, ironically, was the “Sewage Charges” budget of the State House Headquarters” It was put at N52,827,800; that means N144,733 every day. That’s a lot of poo as far as the eye can see. Compare this with the “Sewage Charge” budget for 2015 which was N4,957,143 and for 2016 which was N6,121,643.

This simply means the poo charge went up by 1050% compared with the 2015 budget, and 850% when compared with the 2016 budget. The N52,827,800 question I want to ask now is what exactly are they shittìng there?

The State House Headquarters budget for “Honorarium/Sitting Allowance” is N556,592,736. Let me remind you that the previous government budgeted N174,471,371 for same item in 2015, while in 2016, this administration jacked it up to N507,518, 861.

The State House Headquarters still continues to budget for “Residential Rent.” This is something I have failed to understand up till now and I wouldn’t mind someone explaining it to me. That aside, the amount budgeted for this “Residential Rent” in 2015 was N22,459,575, while in 2016 it was put at N27,735,643. I don’t know how or why, but in the 2017 budget of “Recovery and Growth,” this same “Residential Rent” went up to N77,545,700. Whoever the Landlord of that State House Headquarters is, in this economy, he must be a very lucky and fortunate chap.

There is an N8,539,200 budget for “Anti-Corruption” and I’m perplexed as to what exactly it is.

The last time there was a budget for “Motor Vehicles” or anything like that was in the 2014 budget by the last administration and it was a total of N132,200,000. This government came in in 2016 and somehow concluded that the State House Headquarters did not have enough “Motor Vehicles,” so they started by budgeting N877,015,000 which was something like a 650% increase from the 2014 budget for the same item.

The State House Headquarters still doesn’t think there are enough “Motor Vehicles,” so in 2017 they have budgeted a total of N197,000,000 for the purchase of “Motor Vehicles” and “Buses.” At this rate, by 2019, this government would’ve succeeded in buying enough “Motor Vehicles” to drive the entire country off the edge.

2016 will end up being one of the darkest years in this country in relation to power supply. So, I do not understand where the State House Headquarters got megawatts from in 2016 that they have now budgeted N319,625,753 for “Electricity Charge” in 2017. Just so you know, the “Electricity Charge” for 2016 was put at N45,332,433.

The 2016 State House Headquarters budget for the “Rehabilitation/Repairs of Residential Buildings” was N642,568,122, while in 2017, I don’t know, but it looks like an enormous asteroid managed to hit and destroy the residential building at the State House Headquarters because what is budgeted for “Rehabilitation/Repairs of Residential Buildings” happens to be N5,625,752,757.

As usual, knowing that we have travelling President, N739,487,784 has been budgeted for “International Travel & Transport.” Last year only the Vice President budgeted for books. This year neither the President nor his Vice budgeted for it. Apparently, they’re tired of reading.

Just like in last year’s budget, the entire capital budget for the National Emergency Management Agency is for the “Construction of Office Building,” all N374,473,456 of it.

The Economic and Financial Crimes Commission has budgeted N5,999,070,468 for the “Construction/Provision of Office Buildings.” In 2016 they spent N58,434,683 on that. If you do the math, that’s an increase of over 10,000% and qualifies as an economic and financial crime.

The Economic and Financial Crimes Commission also budgeted N230,536,000 for “Legal Services.” I don’t know if this is enough, but since they say it is; and as long as none of that amount goes to the case-bumbling, Twitter SAN, Festus Keyamo, no wahala.

In 2016 the EFCC budgeted N93,136,000 for “Motor Vehicles,” but since maybe the corruption they should be fighting has gotten faster, they have upped that to N455,000,000. So if you had a plan of running away from the EFCC, I am sorry, they will have almost half a billion Naira worth of cars to chase you with. It is a car race now you know.

There a line item in the EFCC budget that mentions the “Procurement and Upgrade of Microsoft Product Licences” which N142,237,198 was set aside for. This is as vague as something can get, and when it comes to corruptly enriching yourself, being vague is the best bet.

In 2016 N3,260,000 was budgeted by the EFCC for the “Purchase of Photocopiers” while in the 2017 budget N13,755,000 is the magic number.

N1,100,595,088 has been budgeted for the “Furnishing of the New Head Office” whose construction cost in the 2016 budget was put at N7,912,502,911. Now, guess what. There is a budget for the “Consultancy of the Head Office Project” and N244,727,624 is budgeted for it. I am sorry; you will have to guess what again. Let me not stress you, N4,583,616,838 is budgeted for the “Completion of Ongoing New Head Office Building Construction” which N7,912,502,911 was budgeted for in 2016, bringing the total to N12,496,119,749.

For those of you that numbers scare, that is over N12 billion for the construction of the EFCC new head office. If the budget for the “Furnishing” of same building is taken into consideration, it becomes almost N14 billion. That is the anti-corruption model; build a N14 billion edifice to scare corrupt individuals and firms.

The Bureau of Public Procurement has budgeted N52,957,485 for “Defence Software” and I find myself wondering when they became the Ministry of Defence. But things change, just like this government wants us to believe. I wish them a happy defence.

In the course of going through the 2107 budget, I noticed a significant change. There no longer existed a column to show the state of a project. Previous budgets had the “New” and “Ongoing” tags designated to line items, and it made it easier to understand or rather follow the money. We might not know, but that little omission, which I believe was on purpose, has the ability to make corrupt practices invisible.

The 2017 budget is beginning to look more like a poo-storm, but that shouldn’t be a problem because as you saw from the beginning, they started by budgeting generously for it.

We have come to the end of the first part of my budget analysis; hopefully the second part will have something better to offer us.

Saatah Nubari is on Twitter @Saatah

Economy

Customs Street Chalks up 0.12% on Santa Claus Rally

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited witnessed Santa Claus rally on Wednesday after it closed higher by 0.12 per cent.

Strong demand for Nigerian stocks lifted the All-Share Index (ASI) by 185.70 points during the pre-Christmas trading session to 153,539.83 points from 153,354.13 points.

In the same vein, the market capitalisation expanded at midweek by N118 billion to N97.890 trillion from the preceding day’s N97.772 trillion.

Investor sentiment on Customs Street remained bullish after closing with 36 appreciating equities and 22 depreciating equities, indicating a positive market breadth index.

Guinness Nigeria chalked up 9.98 per cent to trade at N318.60, Austin Laz improved by 9.97 per cent to N3.20, International Breweries expanded by 9.85 per cent to N14.50, Transcorp Hotels rose by 9.83 per cent to N170.90, and Aluminium Extrusion grew by 9.73 per cent to N16.35.

On the flip side, Legend Internet lost 9.26 per cent to close at N4.90, AXA Mansard shrank by 7.14 per cent to N13.00, Jaiz Bank declined by 5.45 per cent to N4.51, MTN Nigeria weakened by 5.21 per cent to N504.00, and NEM Insurance crashed by 4.74 per cent to N24.10.

Yesterday, a total of 1.8 billion shares valued at N30.1 billion exchanged hands in 19,372 deals versus the 677.4 billion shares worth N20.8 billion traded in 27,589 deals in the previous session, implying a slump in the number of deals by 29.78 per cent, and a surge in the trading volume and value by 165.72 per cent and 44.71 per cent apiece.

Abbey Mortgage Bank was the most active equity for the day after it sold 1.1 billion units worth N7.1 billion, Sterling Holdings traded 127.1 million units valued at N895.9 million, Custodian Investment exchanged 115.0 million units for N4.5 billion, First Holdco transacted 40.9 million units valued at N2.2 billion, and Access Holdings traded 38.2 million units worth N783.3 million.

Economy

Yuletide: Rite Foods Reiterates Commitment to Quality, Innovation

By Adedapo Adesanya

Nigerian food and beverage company, Rite Foods Limited, has extended warm Yuletide greetings to Nigerians as families and communities worldwide come together to celebrate the Christmas season and usher in a new year filled with hope and renewed possibilities.

In a statement, Rite Foods encouraged consumers to savour these special occasions with its wide range of quality brands, including the 13 variants of Bigi Carbonated Soft Drinks, premium Bigi Table Water, Sosa Fruit Drink in its refreshing flavours, the Fearless Energy Drink, and its tasty sausage rolls — all produced in a world-class facility with modern technology and global best practices.

Speaking on the season, the Managing Director of Rite Foods Limited, Mr Seleem Adegunwa, said the company remains deeply committed to enriching the lives of consumers beyond refreshment. According to him, the Yuletide period underscores the values of generosity, unity, and gratitude, which resonate strongly with the company’s philosophy.

“Christmas is a season that reminds us of the importance of giving, togetherness, and gratitude. At Rite Foods, we are thankful for the continued trust of Nigerians in our brands. This season strengthens our resolve to consistently deliver quality products that bring joy to everyday moments while contributing positively to society,” Mr Adegunwa stated.

He noted that the company’s steady progress in brand acceptance, operational excellence, and responsible business practices reflects a culture of continuous improvement, innovation, and responsiveness to consumer needs. These efforts, he said, have further strengthened Rite Foods’ position as a proudly Nigerian brand with growing relevance and impact across the country.

Mr Adegunwa reaffirmed that Rite Foods will continue to invest in research and development, efficient production processes, and initiatives that support communities, while maintaining quality standards across its product portfolio.

“As the year comes to a close, Rite Foods Limited wishes Nigerians a joyful Christmas celebration and a prosperous New Year filled with peace, progress, and shared success.”

Economy

Naira Appreciates to N1,443/$1 at Official FX Market

By Adedapo Adesanya

The Naira closed the pre-Christmas trading day positive after it gained N6.61 or 0.46 per cent against the US Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEM) on Wednesday, December 24, trading at N1,443.38/$1 compared with the previous day’s N1,449.99/$1.

Equally, the Naira appreciated against the Pound Sterling in the same market segment by N1.30 to close at N1,949.57/£1 versus Tuesday’s closing price of N1,956.03/£1 and gained N2.94 on the Euro to finish at N1,701.31/€1 compared with the preceding day’s N1,707.65/€1.

At the parallel market, the local currency maintained stability against the greenback yesterday at N1,485/$1 and also traded flat at the GTBank forex counter at N1,465/$1.

Further support came as the Central Bank of Nigeria (CBN) funded international payments with additional $150 million sales to banks and authorised dealers at the official window.

This helped eased pressure on the local currency, reflecting a steep increase in imports. Market participants saw a sequence of exchange rate swings amidst limited FX inflows.

Last week, the apex bank led the pack in terms of FX supply into the market as total inflows fell by about 50 per cent week on week from $1.46 billion in the previous week.

Foreign portfolio investors’ inflows ranked behind exporters and the CBN supply, but there was support from non-bank corporate Dollar volume.

As for the cryptocurrency market, it witnessed a slight recovery as tokens struggled to attract either risk-on enthusiasm or defensive flows.

The inertia follows a sharp reversal earlier in the quarter. A heavy selloff in October pulled Bitcoin and other coins down from record levels, leaving BTC roughly down by 30 per cent since that period and on track for its weakest quarterly performance since the second quarter of 2022. But on Wednesday, its value went up by 0.9 per cent to $87,727.35.

Further, Ripple (XRP) appreciated by 1.7 per cent to $1.87, Cardano (ADA) expanded by 1.2 per cent to $0.3602, Dogecoin (DOGE) grew by 1.1 per cent to $0.1282, Litecoin (LTC) also increased by 1.1 per cent to $76.57, Solana (SOL) soared by 1.0 per cent to $122.31, Binance Coin (BNB) rose by 0.6 per cent to $842.37, and Ethereum (ETH) added 0.3 per cent to finish at $2,938.83, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn