Economy

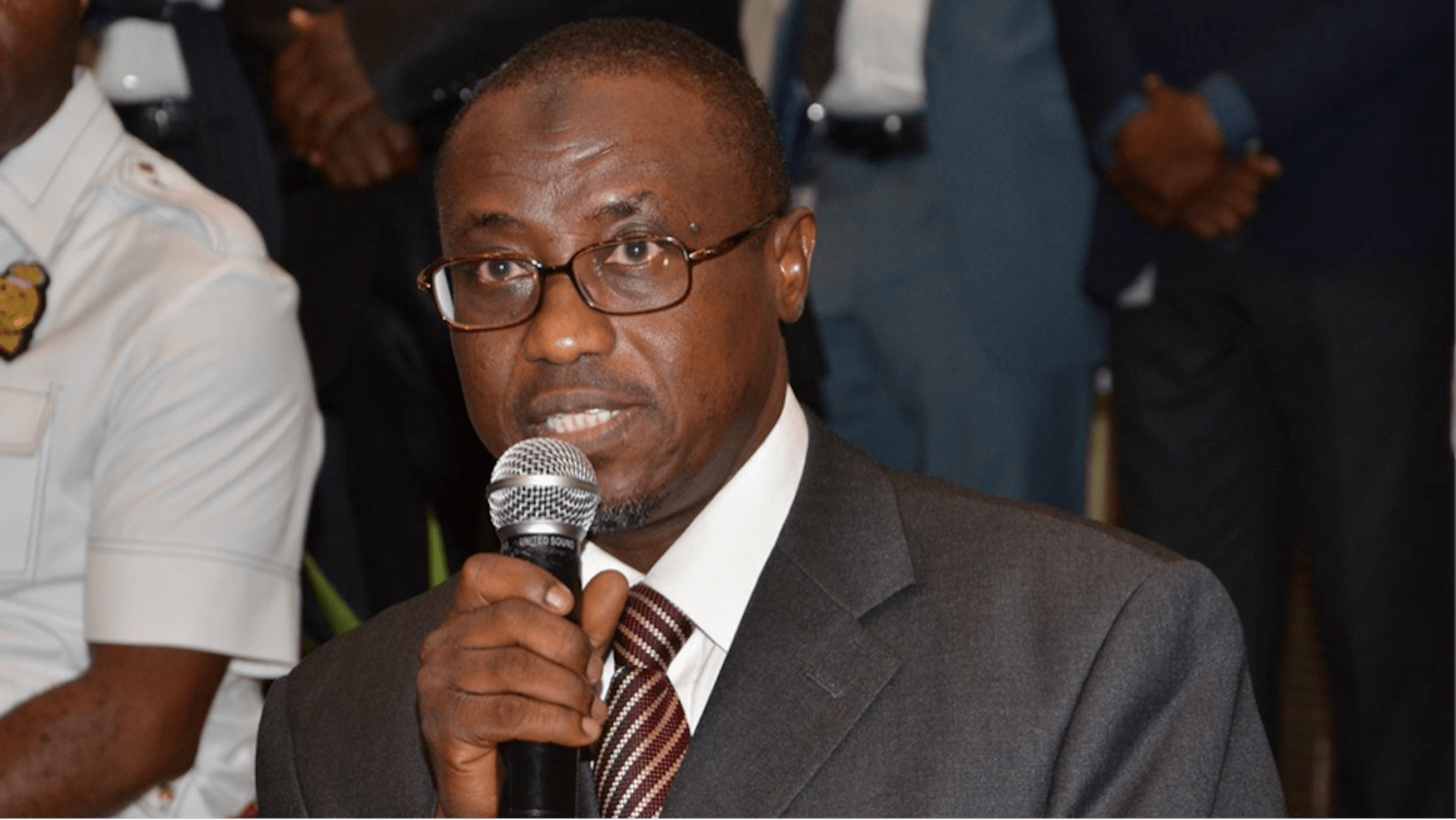

Baru Tasks Mechanical Engineers on Economic Diversification

By Dipo Olowookere

Group Managing Director of the Nigerian National Petroleum Corporation, Dr. Maikanti Kacalla Baru, has charged engineering practitioners in the country to provide viable solutions towards fast-tracking Nigeria’s quest to diversify the economy.

Dr Baru gave the charge while speaking at the 30th Conference & Annual General Meeting of the Nigerian Institution of Mechanical Engineers (NiMechE), shortly after he was conferred with the Institution’s Fellowship in Kaduna today.

“Mechanical Engineers are expected to play a major role in Nigeria’s quest for diversification and industrialization. In the near future, you are expected to provide the necessary tools and equipment for agriculture and transportation system which would drive Nigeria’s industrialization,” Baru said.

Describing engineering as a branch of knowledge which provides the foundation for industrialization and growth in both advanced and developing countries, Mr Baru stressed that alternative energy sources were other areas that should interest engineers.

“Another area where engineers could venture in is Renewable Energy where you can provide ethanol to compete with the fossil oil as fuel for our vehicles towards ensuring a cleaner environment,” he stated.

According to Mr Baru, Mechanical Engineers could also impact the economy positively by getting involved in the design and manufacturing of highly efficient cooling and heating systems, pumps and their drivers.

He noted that in the Oil and Gas industry, engineering remains the bedrock of NNPC’s day-to-day operations both on the onshore and offshore environment.

“Today, our Mechanical Engineers are at the forefront of innovation, design, construction, operations and maintenance of our critical equipment across the oil and gas value-chain,” he stressed.

He expressed NNPC’s commitment to forge strong partnerships with professional bodies such as NiMechE to enable the Corporation deliver on its mandate of moving the nation’s economy forward.

While conferring the Fellowship on the GMD, the National Chairman of NiMechE, Engr. Ugochukwu Nzurumike said Dr. Baru’s worthy contributions to Nigerian Oil and Gas Industry could not have gone unrecognized.

“Today, we celebrate someone who has not only added value to the mechanical engineering profession in the country, but has also moved Nigerian oil and gas industry forward,” he said.

Earlier in his remarks, President of the Nigerian Society of Engineers (NSE), Engr. Otis Anyaeji, said for Nigeria to achieve its industrialization potentials, mechanical engineers must drive the wheels.

Established in 1990, the NiMechE is a division of the NSE charged with developing the professional capacity of mechanical engineers across the country.

The theme of the 30th International Conference/AGM was “Mechanical Engineering in the Diversification of Nigerian Economy.”

Economy

Oyedele Links Nigeria’s Stock Market Surge to Fiscal Reforms

By Adedapo Adesanya

The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Mr Taiwo Oyedele, has linked the surge in the nation’s stock market to ongoing fiscal reforms aimed at strengthening investor confidence and stabilising the economy.

Speaking at the 3rd PUU Capital Market Colloquium on Monday in Abuja, Mr Oyedele described the ongoing reforms as one of the most consequential fiscal resets in Nigeria’s modern history, noting that they are designed to build trust in the economy, stimulate inclusive growth, and foster a more investment-friendly environment.

According to him, the impact of these reforms is already visible on the trading floor of the Nigerian Exchange (NGX) Limited. As of mid-February 2026, the All-Share Index recorded a 25.3 per cent return within the first seven weeks of the year, while market capitalisation crossed the psychological N100 trillion mark in January before reaching an all-time high of over N125 trillion by February 20.

On January 13, 2026, the index reached an all-time high of 165,837.33 points, extending a rally that had already delivered a 51.2 per cent return in 2025, the strongest performance in nearly two decades.

Mr Oyedele linked the strong performance to structural reforms that had improved transparency, enhanced foreign exchange liquidity, and provided greater predictability in tax administration.

“The results of these policies are already evident on the trading floor. As of mid-February 2026, the Nigerian Stock Exchange (NGX) showed exceptional performance with the All-Share Index (ASI) recording a robust 25.3 per cent return in just the first seven weeks of the year, with market capitalisation crossing the psychological N100 trillion mark in January, and reaching an all-time high of over N125 trillion by 20 February 2026.

“Confidence continues to grow from both foreign and domestic investors, driven by the structural reforms and strong performance in key sectors like energy, industrial and financial services,” he said.

He explained that historically, Nigeria’s tax system had been fragmented and costly to comply with, discouraging investment and limiting efficient capital allocation.

“To address this, the new tax framework provides a unified, transparent and predictable environment where businesses can plan effectively, and investors can price risk appropriately,” he said.

He outlined several provisions in the new tax laws aimed at deepening the capital market. These include a full Capital Gains Tax exemption on proceeds reinvested in Nigerian shares within the same year, higher tax-exempt thresholds for small and retail investors, and a legal framework to reduce corporate income tax from 30 per cent to 25 per cent.

Other measures include the removal and reduction of certain transaction taxes, such as stamp duties on share transfers and withholding tax on bonus shares, as well as provisions that protect foreign investors from being taxed on naira gains without accounting for foreign exchange losses.

He emphasised that the ultimate goal is not merely to celebrate rising market indices but to translate financial market growth into tangible economic development, including financing for infrastructure, factories, innovation and job creation.

Economy

Unlisted Securities Shed 0.21% on Profit-taking

By Adedapo Adesanya

It was a bad day for the NASD Over-the-Counter (OTC) Securities Exchange on Monday, February 23, after it slumped 0.21 per cent at the close of business.

This pullback was influenced by profit-taking by investors in four securities, which overpowered the gains recorded by six others.

According to data, Central Securities Clearing System (CSCS) Plc dipped N3.79 to sell at N67.21 per unit compared with the previous N71.00 per unit, UBN Property Plc lost 13 Kobo to close at N1.98 per share versus N2.11 per share, Resourcery Plc fell 3 Kobo to 36 Kobo per unit from 39 Kobo per unit, and Geo-Fluids Plc depreciated 1 Kobo to close at N3.31 per share versus N3.32 per share.

As a result, the bourse’s market capitalisation went down by N5.04 billion to N2.384 trillion from N2.389 trillion, and the NASD Unlisted Security Index (NSI) decreased by 8.42 points to 3,985.90 points from 3,994.32 points.

Business Post reports that NIPCO Plc rose N23.00 to N253.00 per unit from N230.00 per unit, MRS Oil Plc added N14.50 to close at N214.50 per share versus N200.00 per share, FrieslandCampina Wamco Nigeria Plc grew by N1.85 to N93.40 per unit from N91.55 per unit, NASD Plc soared 40 Kobo to N51.28 per share from N50.88 per share, First Trust Mortgage Bank Plc advanced by 12 Kobo to N1.32 per unit from N1.20 per unit, and Food Concepts Plc improved by 6 Kobo to N3.76 per share from N3.70 per share.

As for the trading data, the volume of securities jumped 99.7 per cent to 7.3 million units from 3.7 million units, but the value depleted by 26.8 per cent to N61.8 million from N84.5 million, and the number of deals slipped 7.1 per cent to 39 deals from 42 deals.

At the close of trades, CSCS Plc was the most active stock by value (year-to-date) with 32.9 million units sold for N1.9 billion, followed by Geo-Fluids Plc with 120.6 million units valued at N473.4 million, and Resourcery Plc with 1.05 billion units exchanged for N408.7 million.

Resourcery Plc closed the session as the most active stock by volume (year-to-date) with 1.05 billion units worth N408.7 million, followed by Geo-Fluids Plc with 120.6 million units valued at N473.4 million, and CSCS Plc with 32.9 million units traded for N1.9 billion.

Economy

Customs Street Opens Week Bullish After 0.66% Surge

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited ended the first trading session of the week on a positive note after it chalked up 0.66 per cent on Monday.

The gains recorded yesterday were boosted by the 3.42 per cent rise by the insurance sector, the 1.44 per cent surge by the banking index, and the 1.30 per cent leap by the industrial goods counter. They offset the 0.20 per cent loss posted by the energy sector and a 0.11 per cent decline suffered by the consumer goods industry.

Consequently, the All-Share Index (ASI) closed higher by 1,273.78 points to 196,263.55 points from 194,989.77 points, and the market capitalisation appreciated by N805 billion to N125.969 trillion from N125.164 trillion.

Business Post observed that investor sentiment turned bearish during the session after Customs Street ended with 34 price losers and 33 price gainers, representing a negative market breadth index.

Fortis Global Insurance gained 10.00 per cent to trade at 66 Kobo, Okomu Oil expanded by 10.00 per cent to N1,605.60, Fidson rose by 9.90 per cent to N95.50, NPF Microfinance Bank rose by 9.89 per cent to N6.89, and Infinity Trust Mortgage Bank jumped 9.84 per cent to N17.30.

On the flip side, The Initiates weakened by 10.00 per cent to N17.55, Deap Capital deflated by 9.97 per cent to N6.86, LivingTrust Mortgage Bank went down by 9.92 per cent to N5.90, Multiverse lost 9.92 per cent to close at N22.70 per cent, and Ellah Lakes shrank by 9.77 per cent to N11.55.

Yesterday, market participants traded 1.3 billion shares worth N31.5 billion in 95,091 compared with the 820.5 million shares valued at N28.3 billion in 63,507 deals last Friday, indicating an increase in the trading volume, value, and number of deals by 58.44 per cent, 11.31 per cent, and 49.73 per cent apiece.

Japaul ended the session as the busiest stock after selling 474.0 million units worth N2.0 billion, Chams traded 51.5 million units for N221.3 million, Jaiz Bank exchanged 48.3 million units for N566.9 million, Secure Electronic Technology transacted 46.3 million units worth N68.8 million, and Mutual Benefits sold 42.5 million units valued at N242.5 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn