Economy

Brent Crosses $63 Threshold on Fresh Trade Deal Optimism

By Adedapo Adesanya

The Brent crude, the global benchmark, traded above $63 per barrel on Friday, November 15, 2019 as oil prices gained following fresh optimism over phase one of a potential US-China trade deal lifting prospects for energy demand.

The deal, which was described by US President Donald Trump as the “phase one” deal, would put in motion settlements to a long lasting trade war that had seen both countries place tariffs on goods.

The Brent, following the latest development surrounding the effect of this on the oil market, traded up at $63.29 per barrel, gaining $1.01 equivalent to 1.62 percent.

On the other hand, the US benchmark, West Texas Intermediate (WTI) Crude, was also up but by 98 Cents or 1.73 percent to trade at $57.75 per barrel yesterday at the market.

The latest development followed good news over the 16 month long trade war as confirmed by US Commerce Secretary Wilbur Ross, who said Friday that the negotiations are now down to the last details.

Business Post understands that any trade deal with China curbs demand worries, and this is very important for oil markets as prices will go up. With this development, both Brent and WTI crude benchmarks recorded a second weekly gain in a row.

Meanwhile, earlier in the day, prices for oil had weakened on the premise of the International Energy Agency (IEA), in its monthly report, raised its forecast for oil output growth for countries outside of the Organization of the Petroleum Exporting Countries.

The Paris-based IEA said it expects non-OPEC supply growth to rise to 2.3 million barrels a day in the year 20202, up from its previous estimate of 2.2 million barrels a day, with the set to continue leading the way.

According to the report, heavy oil market inventories and strong market supply would continue next year and that the United States will lead the way but there will also be significant growth from Brazil, Norway and barrels from a new producer, Guyana.

The report came a day after oil prices fell as the Energy Information Administration reported a 2.2 million-barrel rise in US crude supplies in the week ended November 8 and a weekly increase of 200,000 barrels a day to a record 12.8 million barrels a day in domestic crude production.

Ahead of its December 5-6 meeting to review output cuts in Austria, the Organization of the Petroleum Exporting Countries (OPEC) lowered its own non-OPEC output growth forecast in its monthly report.

Looking at this, oil prices are expected to do well in the coming weeks.

Economy

Flour Mills Supports 2026 Paris International Agricultural Show

By Modupe Gbadeyanka

For the second time, Flour Mills of Nigeria Plc is sponsoring the Paris International Agricultural Show (PIAS) as part of its strategies to fortify its ties with France.

The 2026 PIAS kicked off on February 21 and will end on March 1, with about 607,503 visitors, nearly 4,000 animals, and over 1,000 exhibitors in attendance last year, and this year’s programme has already shown signs of being bigger and better.

The theme for this year’s event is Generations Solution. It is to foster knowledge transfer from younger generations and structure processes through which knowledge can be harnessed to drive technological advancement within the global agricultural sector.

In his address on the inaugural day of the Nigerian Pavilion on February 23, the Managing Director for FMN Agro and Director of Strategic Engagement/Stakeholder Relations, Mr Sadiq Usman, said, “At FMN, our mission is Feeding and Enriching Lives Every Day.

“This is a mandate we have fulfilled through decades of economic shifts, rooted in a culture of deep resilience and constant innovation. We support this pavilion because FMN recognises that the next frontier of global Agribusiness lies in high-level technical exchange.

“We thank the France-Nigeria Business Council (FNBC), the organisers of the PIAS, and our fellow members of the Nigerian Pavilion – Dangote, BUA, Zenith, Access, and our partners at Creativo El Matador and Soilless Farm Lab— we are exceedingly pleased to work to showcase the true face of Nigerian commerce.”

Speaking on the invaluable nature of the relationship between Nigeria and France, and the FMN’s commitment to process and product innovation, Mr John G. Coumantaros, stated, “The France – Nigeria relationship is a valuable partnership built on a shared value agenda that fosters remarkable Intercontinental trade growth.

“Also, as an organisation with over six decades of transformational footprint in Nigeria and progressively across the African Continent, FMN has been unwaveringly committed to product and process innovation.

“Therefore, our continuous partnership with France for the success of the Paris International Agricultural Show further buttresses the thriving relationship between both countries.”

PIAS is one of the most widely attended agricultural shows, with thousands of people from across the world in attendance.

Economy

NEITI Backs Tinubu’s Executive Order 9 on Oil Revenue Remittances

By Adedapo Adesanya

Despite reservations from some quarters, the Nigeria Extractive Industries Transparency Initiative (NEITI) has praised President Bola Tinubu’s Executive Order 9, which mandates direct remittances of all government revenues from tax oil, profit oil, profit gas, and royalty oil under Production Sharing Contracts, profit sharing, and risk service contracts straight to the Federation Account.

Issued on February 13, 2026, the order aims to safeguard oil and gas revenues, curb wasteful spending, and eliminate leakages by requiring operators to pay all entitlements directly into the federation account.

NEITI executive secretary, Musa Sarkin Adar, called it “a bold step in ongoing fiscal reforms to improve financial transparency, strengthen accountability, and mobilise resources for citizens’ development,” noting that the directive aligns with Section 162 of Nigeria’s Constitution.

He noted that for 20 years, NEITI has pushed for all government revenues to flow into the Federation Account transparently, calling the move a win.

For instance, in its 2017 report titled Unremitted Funds, Economic Recovery and Oil Sector Reform, NEITI revealed that over $20 billion in due remittances had not reached the government, fueling fiscal woes and prompting high-level reforms.

Mr Adar described the order as a key milestone in Nigeria’s EITI implementation and urged amendments to align it with these reforms.

He affirmed NEITI’s role in the Petroleum Industry Act (PIA) and pledged close collaboration with stakeholders, anti-corruption bodies, and partners to sustain transparent management of Nigeria’s mineral resources.

Meanwhile, others like the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) have kicked against the order, saying it poses a serious threat to the stability of the oil and gas industry, calling it a “direct attack” on the PIA.

Speaking at the union’s National Executive Council (NEC) meeting in Abuja on Tuesday, PENGASSAN President, Mr Festus Osifo, said provisions of the order, particularly the directive to remit 30 per cent of profit oil from Production Sharing Contracts (PSCs) directly to the Federation Account, could destabilise operations at the Nigerian National Petroleum Company (NNPC) Limited.

Mr Osifo firmly dispelled rumours of imminent protests by the union, despite widespread claims that the controversial executive order threatens the livelihoods of 10,000 senior staff workers at NNPC.

He noted, however, that the union had begun engagements with government officials, including the Presidential Implementation Committee, and expressed optimism that common ground would be reached.

Mr Osifo, who also serves as President of the Trade Union Congress (TUC), expressed concerns that diverting the 30 per cent profit oil allocation to the Federation Account Allocation Committee (FAAC), without clearly defining how the statutory management fee would be refunded to NNPC, could affect the salaries of hundreds of PENGASSAN members.

Economy

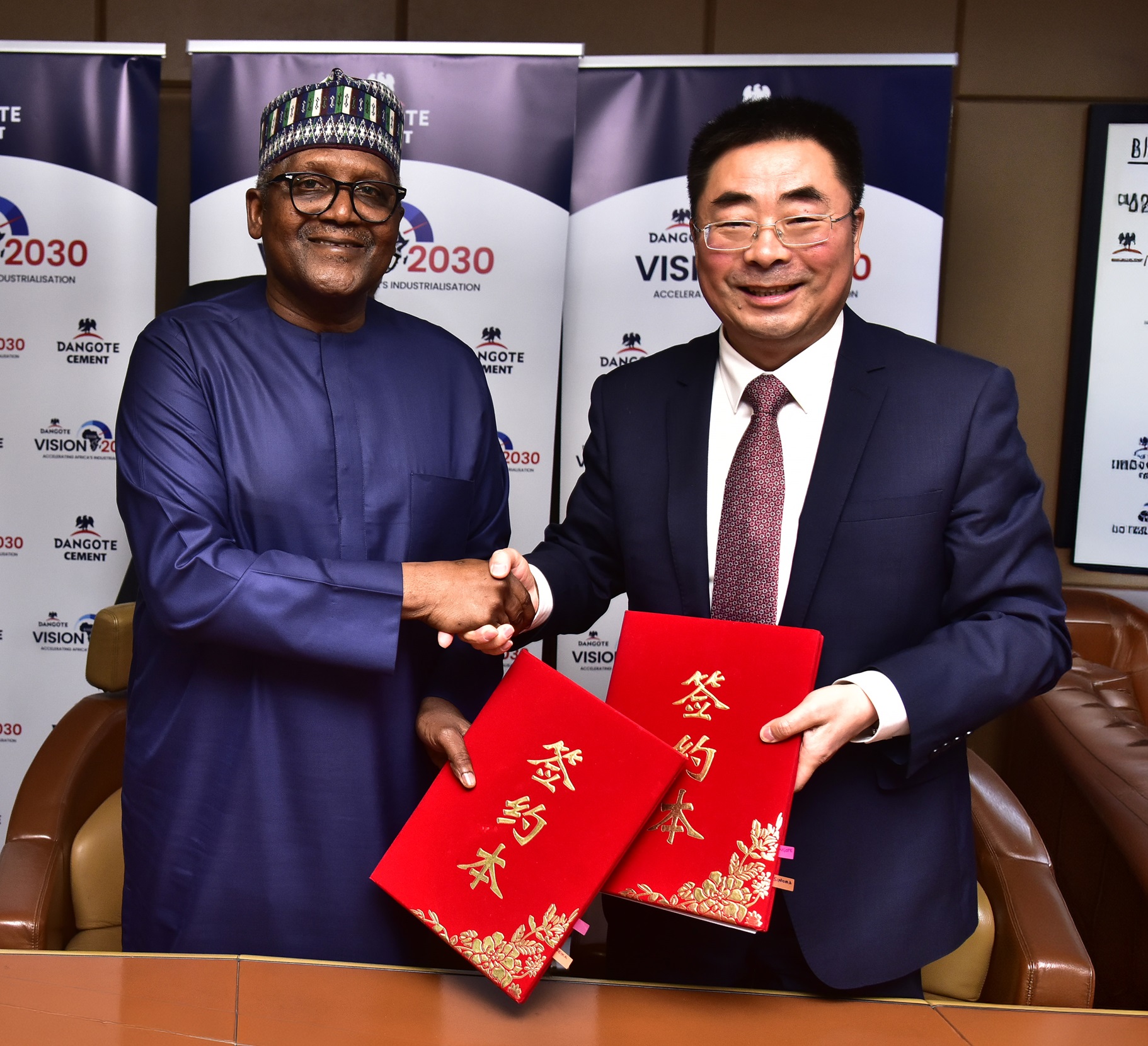

Dangote Cement Deepens Dominance, Export Activities With $1bn Sinoma Deal

By Aduragbemi Omiyale

To strengthen its domestic market dominance, drive its export activities, optimise existing operational assets and enhance production efficiency and capacity expansion, Dangote Cement Plc has sealed $1 billion strategic agreements with Sinoma International Engineering for cement projects across Africa.

The president of Dangote Industries Limited, the parent firm of Dangote Cement, Mr Aliko Dangote, disclosed that the deal reinforces the company’s long-term growth strategy and aligns with the broader aspirations of the Dangote Group’s Vision 2030.

According to him, Sinoma will construct 12 new projects and expand others for the cement organisation across Africa, helping to achieve 80 million tonnes per annum (MTPA) production capacity by 2030, while supporting the group’s overarching target of generating $100 billion in revenue within the same period.

Under the Strategic Framework Agreement, Sinoma will collaborate with Dangote Cement on the delivery of new plants, brownfield expansions, and modernisation initiatives aimed at strengthening operational performance across key markets.

The new projects include a new integrated line in Northern Nigeria with a satellite grinding unit, a new line in Ethiopia and other projects in Zambia/Zimbabwe, Tanzania, Sierra Leone and Cameroon. In Nigeria, Sinoma will also handle different projects in Itori, Apapa, Lekki, Port Harcourt and Onne.

The projects signal Dangote Cement’s sustained commitment to consolidating its leadership position within the African cement industry, while enhancing its competitiveness on the global stage.

Chairman of the Dangote Cement board, Mr Emmanuel Ikazoboh, during the agreement signing event in Lagos, explained that the new projects would enable the company to play a critical role in actualising Dangote Group’s Vision 2030.

The new projects, when completed, will increase Dangote Cement’s capacity and dominant position in Africa’s cement industry.

On his part, the Managing Director of Dangote Cement, Mr Arvind Pathak, said the agreement reflects the company’s determination to grow its investments across African markets to close supply gaps and support the continent’s infrastructural ambitions.

According to him, Dangote Cement is committed to making Africa fully self‑sufficient in cement production, creating more value and linkages, leading to increased economic activities and a reduction in unemployment.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn