Economy

Brent Dips to $70 as Triple Whammy Threat Hits Oil Market

By Adedapo Adesanya

The Brent crude recorded its third consecutive loss on Wednesday by going down by $2.23 or 3.1 per cent to sell at $70 per barrel.

The United States crude benchmark, West Texas Intermediate (WTI) was also not left out as it depreciated by $2.61 or 3.7 per cent to settle at $67.95 per barrel.

It was observed that the oil market was dampened by a triple whammy surprise build in crude stockpiles and negative economic reports in the United States as well as worries about the spread of the coronavirus Delta variant.

The market, which was already hurting, was hit harder when the Energy Information Administration (EIA) reported an inventory build of 3.6 million barrels for the week to July 30.

This was higher than what analysts had expected, a 2.9 million barrels draw. At the previous week, the EIA had estimated an inventory draw of 4.1 million barrels.

Earlier, the American Petroleum Institute (API) had estimated a smaller-than-expected draw in crude oil inventories of 879,000 barrels for the week ending July 30.

Apart from this, the market was also faced with worries about soaring COVID as investors focused on the fast-spreading Delta variant which is resurging in China, the US, and many other countries from Europe to Southeast Asia and Australia.

In China, the city of Wuhan, the ground zero for the coronavirus, will test all its 12 million residents which have prompted authorities to impose strict measures to bring the outbreak under control.

In the US, about 40,000 people are currently hospitalized because of COVID-19, according to the Johns Hopkins Coronavirus Resource Center, same as it was this time last year. However, the death rates have dropped due to vaccines and mitigation efforts.

Globally, cases worldwide surpassed 200 million on Wednesday, as the more infectious variant threatens areas with low vaccination rates and strained healthcare systems.

The market was also impacted by a sharp slowdown in US job growth as data showed that private payrolls rose by 330,000 jobs, showing the smallest gain in private payrolls in five months in July and far lower than expected.

The latest scare outweighed concerns about supply from the Middle East, where a tanker was reportedly a target of a hijacking attempt off the coast of the United Arab Emirates.

On Tuesday, sources claimed Iranian-backed forces seized an oil product tanker off the coast of the UAE. This is the second attack on a tanker since Friday in the region, which includes the Strait of Hormuz.

The United Kingdom and the United States blamed Iran for the earlier incident, in which drones crashed into the vessel and killed two sailors.

Economy

SEC Revokes Operating Licence of Kensington Agro Trading Ltd

By Aduragbemi Omiyale

The operating licence of a capital market operator, Kensington Agro Trading Limited, has been revoked by the Securities and Exchange Commission (SEC).

The capital market regulator, in a circular dated February 09, 2026, disclosed that the action “pursuant to the powers of the commission under Section 61(6) of the Investments and Securities Act, 2025, and Rule 34(1) of the SEC Rules and Regulations 2013, as amended.”

The disclosure noted that the revocation of the licence of the company was “with immediate effect.”

The reason for withdrawing the operating licence of Kensington Agro Trading Limited was not stated in the notice.

“The Securities and Exchange Commission hereby notifies the general public of the revocation of the registration of Kensington Agro Trading Limited as a capital market operator (Commodity Broker/Dealer and Collateral Manager) with immediate effect.

“The revocation of the company’s registration is invoked pursuant to the powers of the Commission under Section 61(6) of the Investments and Securities Act, 2025, and Rule 34(1) of the SEC Rules and Regulations 2013, as amended.

“Accordingly, Commodity Exchanges, the investing public, commodity traders, and all Capital Market Stakeholders are advised to discontinue capital market-related dealings with the company,” the circular signed by the management noted.

Economy

CBN Data Shows 25% Drop in Nigeria’s Oil Earnings to N877bn in December

By Adedapo Adesanya

The latest off-cycle data released by the Central Bank of Nigeria (CBN) has revealed that Nigeria’s revenue from the oil and gas industry dipped by 25.04 per cent to N877.176 billion in December 2025, compared with N1.17 trillion received from energy firms in November 2025

In its presentation to the Federation Account Allocation Committee (FAAC) on receipts and expenditures for December 2025, the CBN disclosed that the amount earned from the oil and gas industry in the month under review represented 95.65 per cent of the sector’s budgeted revenue of N917.064 billion for the month.

In comparison, revenue from the petroleum industry in November 2025 accounted for 96.38 per cent of the N1.474 trillion budgeted for the sector in November 2025.

Providing a breakdown of revenue from the industry in December 2025, the CBN stated that the country earned N772.727 million from crude oil sales, dropping by 97.92 per cent from N37.134 billion recorded in November 2025; while the it recorded revenue of N9.019 billion from gas sales, rising by 24.14 per cent from N7.265 billion recorded in November.

Furthermore, the financial sector apex regulator noted that revenue from crude oil royalties dipped by 12.52 per cent to N514.288 billion in the month under review, from N587.865 billion recorded in the previous month; while receipts from miscellaneous oil revenue grew by 97.5 per cent to N2.678 billion in December 2025, from N1.356 billion in the previous month.

It also stated that royalties from gas appreciated by 124.91 per cent to N21.153 billion in December, from N9.405 billion in November 2025; revenue from gas flared penalties stood at N48.858 billion, down by 5.76 per cent from N51.842 billion in November, while revenue from Companies’ Income Tax (CIT) from upstream oil industry operations stood at N73.066 billion, as against N106.106 billion in the previous month.

The CBN further revealed that revenue from Petroleum Profit Tax (PPT) stood at N79.247 billion; rentals – N1.5 billion; while taxes stood at N126.594 billion, compared with N301.471 billion. N775.162 million, and N67.242 billion, respectively, in November 2025.

In addition, the CBN reported that from the country’s oil and gas revenue in December 2025, N18.163 billion was deducted for 13 per cent refund on subsidy, priority projects and Police Trust Fund from 1999 to 2021; while N8.761 billion was deducted by the Nigerian National Petroleum Corporation Limited (NNPCL), in respect of its 13 per cent management fee and frontier exploration fund.

It added that N23.724 billion was deducted and collected by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) in December 2025, being four per cent of the cost of collection; while N46.903 billion was transferred to the Midstream and Downstream Gas Infrastructure Fund from gas flared penalties in the same month.

Economy

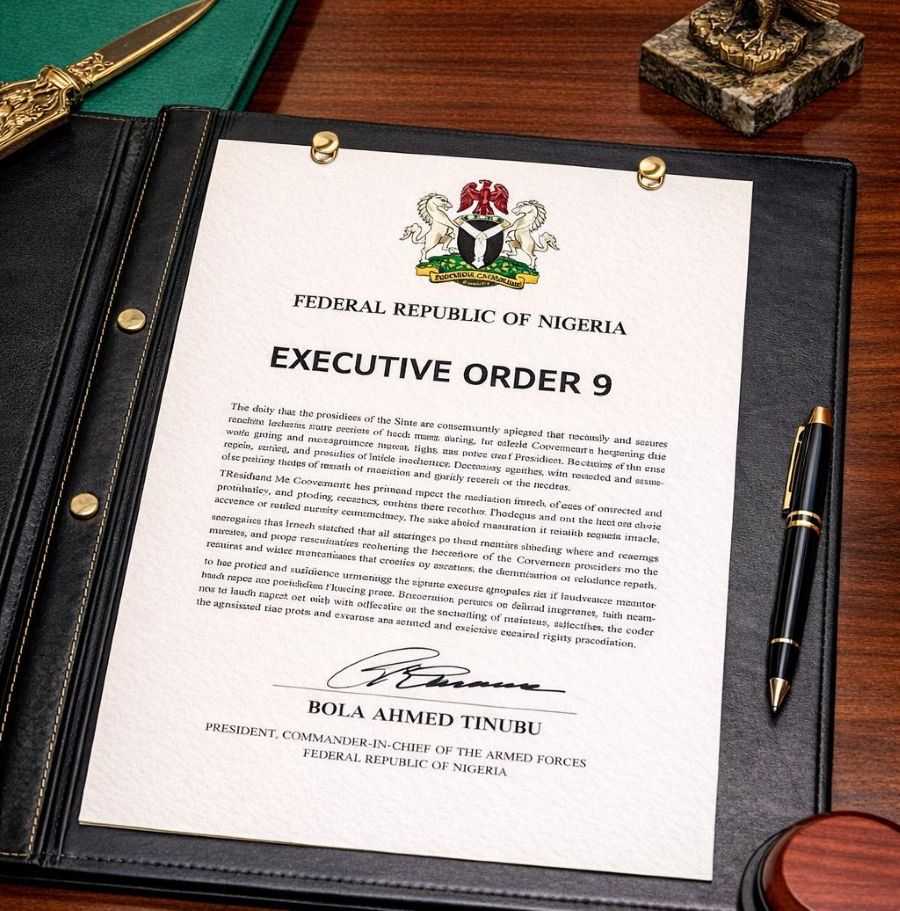

Nigeria Begins Implementation of Executive Order 9 on Oil Earnings

By Aduragbemi Omiyale

On Saturday, February 28, 2026, the Implementation Committee for Executive Order 9 held its inaugural meeting, headed by the Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun.

The panel, at the gathering, reaffirmed the directive of President Bola Tinubu that revenues accruing to the federation from petroleum operations must be handled in a manner that upholds constitutional principles, protects revenues accruable to the nation, and supports the fiscal stability of all three tiers of government.

It approved the establishment of a technical subcommittee to develop the detailed guidelines for the transition to direct remittance within three weeks, and commence a review of the Petroleum Industry Act (PIA) to address structural and fiscal anomalies that weaken Federation revenues.

It was agreed that the subcommittee would be led by the Special Adviser to the President on Energy, and will include the Solicitor-General of the Federation and Permanent Secretary Federal Ministry of Justice, the Chairman of the Nigeria Revenue Service, and the Chairman of the Forum of Commissioners of Finance, representatives of the Minister of State Petroleum Resources, Oil, with secretarial support from the Budget Office of the Federation.

The committee promised to provide coordinated guidance and timely updates as implementation progresses. It commended the cooperation of all stakeholders in advancing the President’s efforts to ensure that Nigeria’s petroleum resources deliver tangible, measurable benefits to citizens across the Federation.

Under the new order, Mr Tinubu directed that NNPC Limited shall cease, with immediate effect, the collection of the 30 per cent management fee and the 30 per cent frontier exploration fund deductions from profit oil and profit gas under Production Sharing Contracts (PSCs).

Additionally, all remittances of gas flare penalties into the Midstream and Downstream Gas Infrastructure Fund (MDGIF) are suspended with immediate effect, in line with the Executive Order.

With respect to Section 2, Sub-section 3 of the Executive Order on direct payments by contractors into the Federation Account, the panel agreed that this transition must be implemented in a manner that respects existing contractual and financing arrangements, and maintains investor confidence.

For this reason, the committee approved a defined transition period for the operationalisation of direct payments by contractors of profit oil, royalty oil, and tax oil into the Federation Account.

Until the Committee issues detailed guidelines, contractors will continue to remit under the current process. During the transition period, the Committee will issue clear, standardised guidance to ensure an orderly changeover.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn