Economy

CBN Issues New FX Futures Contract at N364.65/$ as $515m Settles

By Dipo Olowookere

The year 2018 has shown a steady flow of transactions and activities in the Naira-settled OTC FX Futures market.

The market, which was launched out of the desire to address the need for risk management in the Nigerian FX market, has continued to be an effective hedging product for investors (local and international), businesses and government institutions alike.

On Wednesday, January 30, 2019, the 31st OTC FX Futures contract, NGUS JAN 30 2019, with contract amount of $515.09 million, matured and settled on FMDQ.

The contract, which stopped trading on January 22, 2019, was valued for settlement against the Nigerian Autonomous Foreign Exchange Fixing (NAFEX), the FMDQ reference Spot FX rate published same day.

The associated clearing/settlement activities were effected accordingly, the FMDQ confirmed.

As observed over the last 30 maturities, the Central Bank of Nigeria (CBN) introduced a new contract, NGUS JAN 29 2020 for $1.00 billion at $/N364.65, to replace the matured contract.

The apex bank also refreshed its quotes on the existing 1 to 11-month contracts, which are published daily on FMDQ’s website.

Economy

NNPC/Chevron Awodi-07 Discovery Boosts Nigeria’s Oil Production Hopes

By Adedapo Adesanya

Nigeria’s push to raise crude oil production to an ambitious three million barrels per day has received a fresh boost following the successful Awodi-07 discovery by Chevron Nigeria Limited (CNL).

In a statement on Monday, the Nigerian National Petroleum Company (NNPC) Limited congratulated Chevron Nigeria Limited (CNL), operator of the NNPC Limited/CNL Joint Venture, on the successful completion of the Awodi-07 appraisal and exploration well located in the shallow offshore western Niger Delta.

Drilling activities, which ran from late November to mid-December 2025, were completed safely and in line with regulatory and operational standards. The encouraging results reinforce confidence in the asset’s potential and strengthen the reserve base required to support Nigeria’s long-term production growth ambitions.

“Results from the well are highly encouraging, confirming a significant presence of hydrocarbons across multiple reservoir zones,” the statement signed by Mr Andy Odeh, NNPC’s Communications Officer said.

Commenting on the achievement, the Group Chief Executive Officer of NNPC, Mr Bayo Ojulari, commended Chevron Nigeria Limited for its operational excellence, technical competence, and consistent delivery of value.

“The success of the Awodi-07 well further reinforces the strength of the NNPC Ltd/CNL Joint Venture and our shared commitment to responsibly growing Nigeria’s hydrocarbon reserves. This achievement aligns squarely with our strategic priorities of increasing production, enhancing national energy security, and delivering sustainable value for the Nigerian people,” he said.

Also speaking on the milestone, the Executive Vice President, Upstream, NNPC Ltd, Mr Udy Ntia, described the Awodi-07 results as a clear demonstration of the value of sustained collaboration, technical rigour, and a stable, enabling operating environment.

“This discovery underscores the importance of disciplined exploration programmes, strong partnerships, and the positive impact of the reforms introduced under the Petroleum Industry Act. We look forward to working closely with Chevron Nigeria Limited to mature this opportunity and progress it towards timely development and monetisation,” he added.

The state oil company and and Chevron Nigeria work together under a joint venture agreement to operate several oil and gas fields in Nigeria’s Niger Delta. In this partnership, Chevron owns 40 per cent of the assets, while NNPC Limited holds the remaining share. The arrangement allows both companies to combine resources, expertise, and investment to develop Nigeria’s oil and gas resources more effectively.

Through this collaboration, both aim to increase oil production to about 146,000 barrels per day, which would support government revenue, create jobs, and contribute to the country’s energy supply.

For Nigeria, which has consistently stated its intention to ramp up output to three million barrels per day in the medium term, discoveries such as Awodi-07 are critical. Beyond adding to proven reserves, they provide a pathway to new developments that can offset natural decline from mature fields.

Economy

Market Participants Trade N99.865bn Shares on NGX in Five Days

By Dipo Olowookere

The level of activity on the floor of the Nigerian Exchange (NGX) Limited waned last week after market participants bought and sold 3.748 billion shares worth N99.865 billion in 237,179 deals compared with the 4.607 billion shares valued at N130.636 billion traded in 263,439 deals in the preceding week.

It was observed that the financial services sector recorded a turnover of 1.742 billion stocks worth N44.893 billion executed in 90,589 deals, contributing 46.49 per cent and 44.95 per cent to the total trading volume and value, respectively.

The services industry transacted 707.617 million shares worth N4.379 billion in 18,322 deals, and the ICT space exchanged 303.216 million equities for 5.932 billion in 24,107 deals.

The trio of Secure Electronic Technology, Tantalizers, and Access Holdings accounted for 734.086 million units worth N5.720 billion in 15,726 deals, contributing 19.59 per cent and 5.73 per cent to the total trading volume and value apiece.

Business Post reports that 58 equities appreciated in the week versus 80 equities in the previous week, 40 stocks depreciated compared with the 17 stocks recorded a week earlier, and 50 shares closed flat, same as the preceding week.

Deap Capital led the gainers’ chart after chalking up 60.09 per cent to close at N7.14, SCOA Nigeria appreciated by 59.73 per cent to N23.80, NCR Nigeria expanded by 46.36 per cent to N188.15, Zichis grew by 44.75 per cent to N2.62, and DAAR Communications jumped by 451.67 per cent to N1.53.

Conversely, Eterna led the losers’ log with a decline of 11.92 per cent to trade at N28.45, Secure Electronic Technology lost 10.19 per cent to finish at 97 Kobo, Industrial and Medical Gases declined by 9.95 per cent to N34.85, Aluminium Extrusion slumped by 9.95 per cent to N17.20, and UPDC went down by 8.06 per cent to N5.70.

In the week, which was battered by profit-taking, the All-Share Index (ASI) was down by 0.39 per cent to 165,512.18 points and the market capitalisation depreciated by 0.37 per cent to N105.959 trillion.

Similarly, all other indices finished lower apart from the energy, Lotus ll, growth, and commodity indices, which appreciated by 1.36 per cent, 0.37 per cent, 6.27 per cent and 0.79 per cent, respectively.

Economy

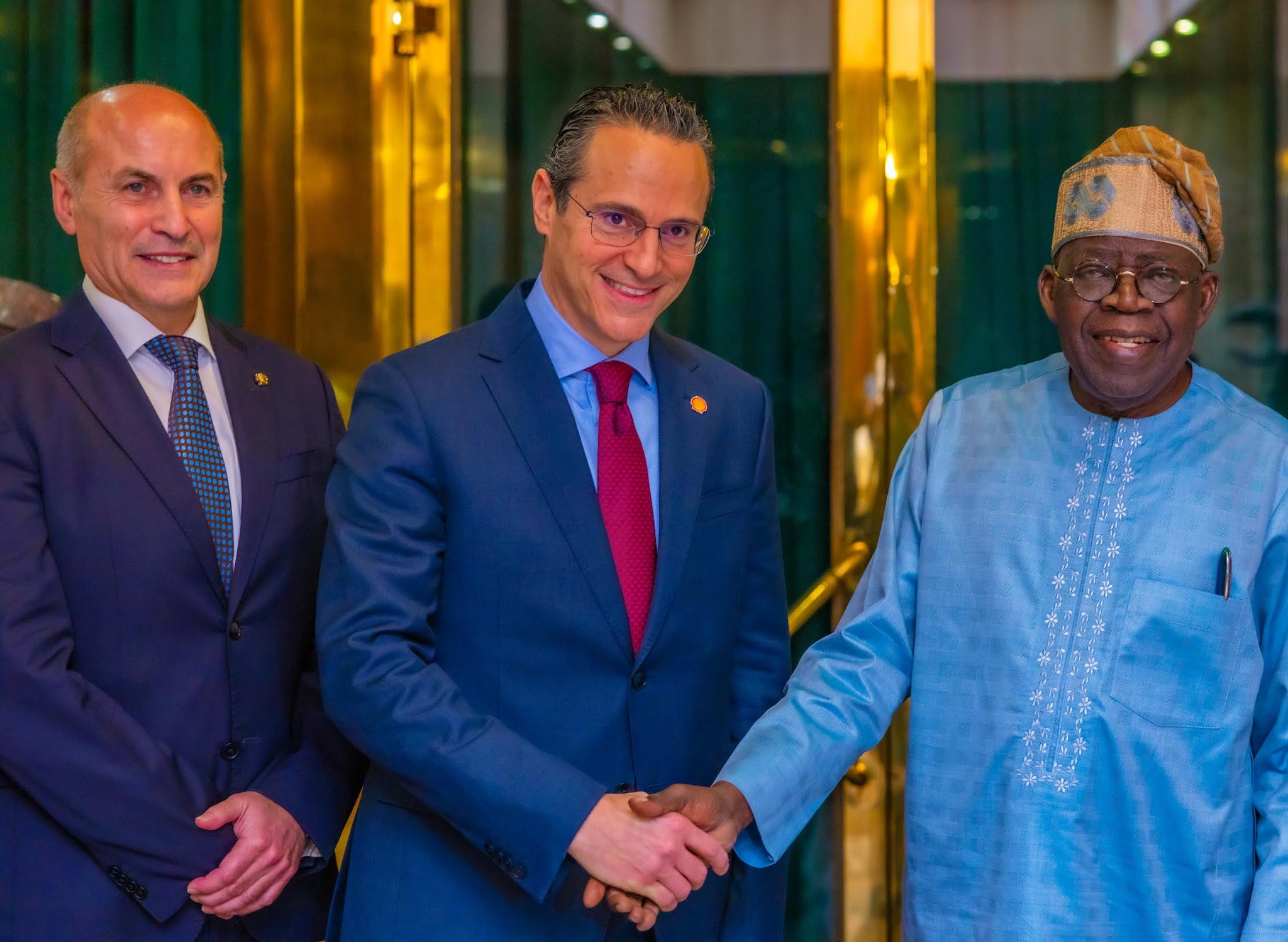

Shell Pledges $20bn Additional Investment in Nigeria

By Adedapo Adesanya

The presidency says the chief executive of Shell Plc, Mr Wael Sawan, has pledged to invest an additional $20 billion in the Nigerian energy sector.

According to a Monday statement signed by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, the Shell chief, during a meeting with President Bola Tinubu at the Presidential Villa, praised the government’s leadership for creating a healthy climate for investments to thrive and restoring investor confidence.

The statement said Shell is deepening and expanding its investments in Nigeria, and is ready, alongside its partners,, primarily because of the robust and bold leadership of the President.

He emphasised that Nigeria, under the Tinubu administration, is one of the countries attracting significant investment from global oil companies.

Highlighting Shell’s recent investments, such as $5 billion in Bonga North, $2 billion in HI, and the gas project to NLNG, Sawan stated that the corporation is committed to long-term investments in the country, underscoring the stable economic environment.

“We have really been in a space where we are very keen to invest in Nigeria. But I would say this has not always been the case. Your leadership and your vision have created an investment climate over the last few years that, I will be very honest with you, propelled us to invest, in particular, also as we compare to other investments around the world,” he said.

“Stability in today’s environment will honestly have a premium for corporates because we are investing not for one administration or five or 10 years, we want to invest for 20, 30, 40 years and in the case of Nigeria, for many, many decades.”

Speaking on the expansion of Shell’s investments in Nigeria, Mr Sawan said the corporation has also deepened its interest in Block OML 118, the Bonga Block.

“Total Energies was selling, so we bought it because we want to deepen further. But that, we think, is not enough. We think there is more to invest here, and we understand the vision that you have for the country. And so we are indeed working on a project, Bonga Southwest, that could, if we reach an FID stage, see us, with our partners, invest around $20 billion in foreign direct investment, half of which will be capital,” he said.

“Your Excellency, to Bonga Southwest, that huge project, I would like to thank you. I want to thank you for the leadership you have shown there to be able to provide the incremental incentives that are now getting us line of sight to an investment in this project with our partners,” the Shell Chief Executive thanked the President.

He also commended the President’s team, describing them as outstanding professionals.

“And that leadership, I would also say, has put many of the people that we are working with, your team, are amongst the best that we are dealing with anywhere in the world,” he concluded.

At the meeting, President Tinubu approved the gazetting of targeted, investment-linked incentives to support the proposed Bonga South West deep offshore oil project by Shell and its partners.

The President also directed his Special Adviser on Energy, Mrs Olu Arowolo-Verheijen, to facilitate the gazette of the incentives in line with Nigeria’s existing legal and fiscal framework.

“My expectation is clear: Bonga South West must reach a Final Investment Decision within the first term of this administration,” President Tinubu added.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn