Economy

CBN May Soon Lift Ban on Crypto Trading

By Adedapo Adesanya

The Central Bank of Nigeria (CBN) may eventually lift the ban it placed on the trading of cryptocurrencies in the country earlier this year.

In February 2021, the apex bank issued a circular to commercial banks, directing them to close all bank accounts linked with crypto trading.

Many Nigerians believed that this action was taken to punish the several youths who partook in the controversial #EndSARS protest in October 2020, which those in government felt was used to embarrass President Muhammadu Buhari.

Many citizens had been making good money from buying and selling digital currency until the CBN came up with the circular that has changed the game.

The development came at a time the Securities and Exchange Commission (SEC) was making efforts to embrace digital assets like others across the globe and look for ways to properly regulate the industry.

On Thursday, at a post-Capital Market Committee (CMC) meeting news briefing, the Director-General of the commission, Mr Lamido Yuguda, hinted that things would soon be resolved.

According to him, the agency was working with the CBN for a better understanding and regulation of cryptocurrencies in the country.

“We are in discussion with CBN for both understanding and better regulating of this market. We will be able to come back to you later to inform you of the outcome of these engagements.

“But because of the lack of access to commercial bank accounts, we had to suspend our own guidelines of September 2020. The implementation of that circular is suspended until these operators are able to have access to Nigerian bank accounts.

“Remember that nobody operates in the Nigerian capital market if that person does not have access to a Nigerian bank account,” he said.

The SEC DG clarified that the commission had always provided support to financial technology companies and had invested so much in developing a framework to support their operations.

He said, “Let me say that the SEC remains very supportive of fintechs. We have invested so much in developing a framework for supporting fintechs in the various areas and fintechs are acting in areas of crowdfunding, investment advice and cryptocurrencies and the like.”

Mr Yuguda, however, accepted that the ban had affected the growth of the fintech market in Nigeria.

He said, “In all other areas, nothing has changed, but in the area of crypto assets, you know that with the recent prohibition by the CBN on access to Nigerian bank accounts by crypto exchanges, that market has been disrupted.

“And the truth of the matter is that while the SEC had issued guidelines in September 2020 aimed at regulating this market, for now for all intents and purposes, because these exchanges do not have access to commercial bank accounts in Nigeria, the market, for now, does not exist.”

Osinbajo supports crypto trading

Recall that shortly after the CBN announced the ban on crypto trading in the country, the Vice President, Mr Yemi Osinbajo, said it was a wrong step. He advised the apex bank to consider regulating the sector rather than prohibit cryptocurrencies because it was the future of money in the world.

Mr Osinbajo had said “we must act with knowledge and not fear” and develop a robust regulatory regime that is thoughtful and knowledge-based.

“I fully appreciate the strong position of the CBN, SEC and some of the anti-corruption agencies on the possible abuses of cryptocurrencies and their other well-articulated concerns. But I believe that their position should be the subject of further reflection.

“There is a role for regulation here. And it is in the place of both our monetary authorities and SEC to provide a robust regulatory regime that addresses these serious concerns without killing the goose that might lay the golden eggs.

“So, it should be thoughtful and knowledge-based regulation, not prohibition. The point I am making is that some of the exciting developments we see the call for prudence and care in adopting them, but we must act with knowledge and not fear,” he added at an event organised by the CBN, the Banker’s Committee and the Vanguard Newspaper.

Economy

NEITI Backs Tinubu’s Executive Order 9 on Oil Revenue Remittances

By Adedapo Adesanya

Despite reservations from some quarters, the Nigeria Extractive Industries Transparency Initiative (NEITI) has praised President Bola Tinubu’s Executive Order 9, which mandates direct remittances of all government revenues from tax oil, profit oil, profit gas, and royalty oil under Production Sharing Contracts, profit sharing, and risk service contracts straight to the Federation Account.

Issued on February 13, 2026, the order aims to safeguard oil and gas revenues, curb wasteful spending, and eliminate leakages by requiring operators to pay all entitlements directly into the federation account.

NEITI executive secretary, Musa Sarkin Adar, called it “a bold step in ongoing fiscal reforms to improve financial transparency, strengthen accountability, and mobilise resources for citizens’ development,” noting that the directive aligns with Section 162 of Nigeria’s Constitution.

He noted that for 20 years, NEITI has pushed for all government revenues to flow into the Federation Account transparently, calling the move a win.

For instance, in its 2017 report titled Unremitted Funds, Economic Recovery and Oil Sector Reform, NEITI revealed that over $20 billion in due remittances had not reached the government, fueling fiscal woes and prompting high-level reforms.

Mr Adar described the order as a key milestone in Nigeria’s EITI implementation and urged amendments to align it with these reforms.

He affirmed NEITI’s role in the Petroleum Industry Act (PIA) and pledged close collaboration with stakeholders, anti-corruption bodies, and partners to sustain transparent management of Nigeria’s mineral resources.

Meanwhile, others like the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) have kicked against the order, saying it poses a serious threat to the stability of the oil and gas industry, calling it a “direct attack” on the PIA.

Speaking at the union’s National Executive Council (NEC) meeting in Abuja on Tuesday, PENGASSAN President, Mr Festus Osifo, said provisions of the order, particularly the directive to remit 30 per cent of profit oil from Production Sharing Contracts (PSCs) directly to the Federation Account, could destabilise operations at the Nigerian National Petroleum Company (NNPC) Limited.

Mr Osifo firmly dispelled rumours of imminent protests by the union, despite widespread claims that the controversial executive order threatens the livelihoods of 10,000 senior staff workers at NNPC.

He noted, however, that the union had begun engagements with government officials, including the Presidential Implementation Committee, and expressed optimism that common ground would be reached.

Mr Osifo, who also serves as President of the Trade Union Congress (TUC), expressed concerns that diverting the 30 per cent profit oil allocation to the Federation Account Allocation Committee (FAAC), without clearly defining how the statutory management fee would be refunded to NNPC, could affect the salaries of hundreds of PENGASSAN members.

Economy

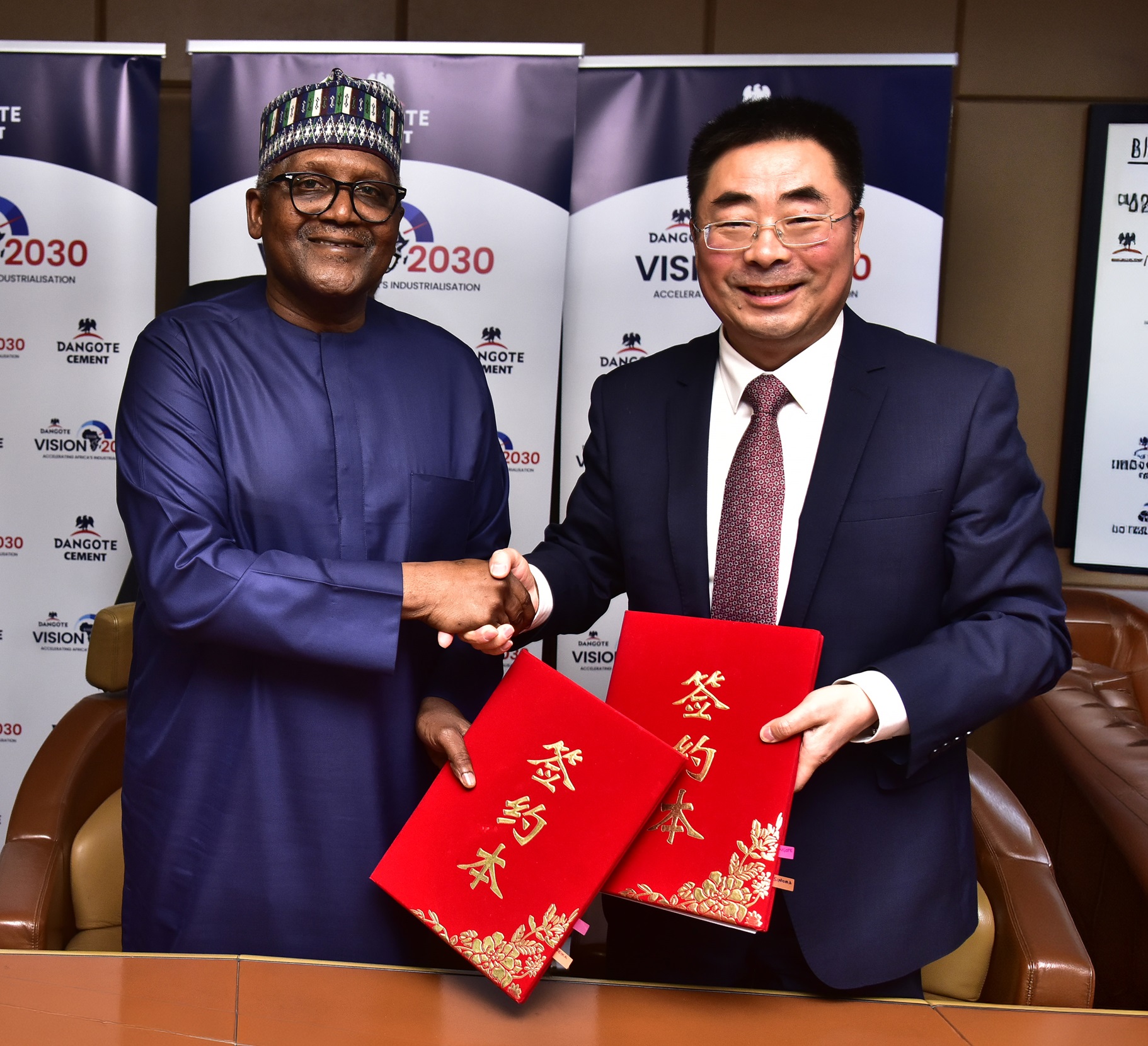

Dangote Cement Deepens Dominance, Export Activities With $1bn Sinoma Deal

By Aduragbemi Omiyale

To strengthen its domestic market dominance, drive its export activities, optimise existing operational assets and enhance production efficiency and capacity expansion, Dangote Cement Plc has sealed $1 billion strategic agreements with Sinoma International Engineering for cement projects across Africa.

The president of Dangote Industries Limited, the parent firm of Dangote Cement, Mr Aliko Dangote, disclosed that the deal reinforces the company’s long-term growth strategy and aligns with the broader aspirations of the Dangote Group’s Vision 2030.

According to him, Sinoma will construct 12 new projects and expand others for the cement organisation across Africa, helping to achieve 80 million tonnes per annum (MTPA) production capacity by 2030, while supporting the group’s overarching target of generating $100 billion in revenue within the same period.

Under the Strategic Framework Agreement, Sinoma will collaborate with Dangote Cement on the delivery of new plants, brownfield expansions, and modernisation initiatives aimed at strengthening operational performance across key markets.

The new projects include a new integrated line in Northern Nigeria with a satellite grinding unit, a new line in Ethiopia and other projects in Zambia/Zimbabwe, Tanzania, Sierra Leone and Cameroon. In Nigeria, Sinoma will also handle different projects in Itori, Apapa, Lekki, Port Harcourt and Onne.

The projects signal Dangote Cement’s sustained commitment to consolidating its leadership position within the African cement industry, while enhancing its competitiveness on the global stage.

Chairman of the Dangote Cement board, Mr Emmanuel Ikazoboh, during the agreement signing event in Lagos, explained that the new projects would enable the company to play a critical role in actualising Dangote Group’s Vision 2030.

The new projects, when completed, will increase Dangote Cement’s capacity and dominant position in Africa’s cement industry.

On his part, the Managing Director of Dangote Cement, Mr Arvind Pathak, said the agreement reflects the company’s determination to grow its investments across African markets to close supply gaps and support the continent’s infrastructural ambitions.

According to him, Dangote Cement is committed to making Africa fully self‑sufficient in cement production, creating more value and linkages, leading to increased economic activities and a reduction in unemployment.

Economy

Lokpobiri Begs Lawmakers to Reschedule Oil Revenue Executive Order Probe

By Adedapo Adesanya

A joint National Assembly probe into President Bola Tinubu’s new oil revenue executive order was stalled on Thursday following a request for more time by the Minister of Petroleum Resources, Mr Heineken Lokpobiri.

The hearing was convened to scrutinise the executive order directing that royalty oil, tax oil, profit oil, profit gas and other revenues due to the Federation under various petroleum contracts be paid directly into the Federation Account.

Mr Lokpobiri told lawmakers that although he attended out of respect for parliament, he had been notified of the hearing only a day earlier and had not obtained all the relevant documents needed to defend the policy adequately.

He appealed for the session to be rescheduled.

Co-chairman of the joint committee and Chairman of the Senate Committee on Gas, Mr Agom Jarigbe, put the request to a voice vote, and lawmakers approved the adjournment.

A new date is expected to be communicated to the minister.

The executive order signed last week also scrapped the 30 per cent Frontier Exploration Fund created under the Petroleum Industry Act (PIA) and discontinued the 30 per cent management fee on profit oil and profit gas previously retained by the Nigerian National Petroleum Company (NNPC) Limited.

Anchored on Sections 5 and 44(3) of the Constitution, the presidency said the directive was aimed at safeguarding oil and gas revenues, curbing excessive deductions and restoring the constitutional entitlements of federal, state and local governments to the

However, the order has sparked criticism within the industry, one of which was from the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN), whose president, Mr Festus Osifo, called for an immediate withdrawal of the order, warning that it could undermine the PIA and erode investor confidence.

Meanwhile, at another session, the Chairman of the Senate Committee on Finance, Senator Mohammed Sani Musa, disclosed that President Tinubu would soon transmit proposals to amend certain provisions of the PIA to align with current economic realities.

He noted that while many expect the executive order to boost revenue automatically, Nigeria has yet to achieve its desired income levels.

He did not specify which sections of the law would be targeted, but suggested that the drive to enhance revenue generation would necessitate legislative adjustments.

The PIA, signed into law in 2021 by the late ex-President Muhammadu Buhari, overhauled the governance, regulatory and fiscal framework of Nigeria’s oil and gas sector, commercialised the NNPC and restructured revenue-sharing arrangements.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn