Economy

Dangote Insists Kogi State Has no Equity Interest in Obajana Cement

By Aduragbemi Omiyale

The ownership tussles between the Kogi State government and Dangote Group over Obajana Cement Company will not likely end anytime soon.

Dangote Group said it acquired the plant from the state government by following due in 2002 through Dangote Industries Limited. It stressed that the factory and machinery were conceived, designed, procured, built, and paid for solely by DIL, well after it acquired the shares in Obajana Cement Company, noting that the state government has no equity interest in the cement making firm.

The conglomerate asserted that the Kogi State government has no equity interest in Obajana Cement, noting that as a responsible corporate organisation, it has been paying relevant state taxes, levies and charges to the Kogi State government since 2007 when production commenced in the acquired cement plant.

In a statement, Dangote explained that it was responding to the issue to address the concerns and apprehensions of the stakeholders of Dangote Cement Plc (DCP), especially the over 22,000 people it employs directly and more indirectly, as well as thousands of contractors, wholesalers, users of our products, our financiers and shareholders.

“At a time of significant economic challenges that we face as a nation, we believe all must be done to keep our economy running effectively, our people employed, businesses that depend on us thriving and not discourage those who take the risks of needed, lawful and significant investments in our economy. The shutdown of our plant has materially jeopardised the economic well-being of our country without any regard for its significant consequences.

“Whilst reserving our rights to proceed to arbitration in accordance with the extant agreement, we have reported the unlawful invasion by KSG and the consequential adverse effects of same to all the relevant authorities, including the Federal Government of Nigeria who has now intervened in the matter.

“It is hoped that the dispute resolution process we have initiated will quickly resolve the disputes and allow us to focus on our business without distraction and continue our significant contribution to our national economy. It is in this context that we state in brief as follows,” the company added.

According to the statement, “The Obajana Cement Plant is one of the most critical components of economic activity in the nation, being one of the highest taxpayers, and vehicle for one of the largest companies invested in by thousands of Nigerian and foreign investors. Its most important assets are (1) its land, the plant and machinery thereon, and (2) the vast limestone deposit covered by mining leases issued under licence by the Federal Government of Nigeria (FGN).”

The company clarified that the land on which Obajana Cement Plant is built was solely acquired by Dangote Industries Limited (DIL) in 2003. “The land on which the Obajana Cement Plant is built was acquired solely by Dangote Industries Limited (DIL) in 2003, well after it had acquired the shares in Obajana Cement Company in 2002, following the legally binding agreement it entered into with KSG to invest in Kogi State. DIL was issued three Certificates of Occupancy in its name after payment of necessary fees and compensation to landowners.

“The plant and machinery were conceived, designed, procured, built, and paid for solely by DIL, again, well after it acquired the shares in Obajana Cement Company. The limestone and other minerals used by the Obajana Cement Plant, by the provisions of the Nigerian Constitution, belonged to the Federation, with authority only in the FGN and not the State in which the minerals are situated, to grant licences to extract and mine the resources”, the company explained.

“After the agreement with the KSG, DIL applied for and obtained mining leases over the said limestone from FGN at its cost and has complied with the terms of the leases since inception. The Government of Kogi State had no minerals to give, had no assets to give, and only invited DIL, as most responsible governments do, to come into the State and invest in a manner that would create employment, develop the State, and earn it taxes”, the statement added.

In a section of the statement titled, ‘The Incorporation of OCP and the Invitation by KSG’, the company noted that, “In 1992, the Kogi State Government incorporated Obajana Cement PLC (OCP) as a public limited liability company. Sometime in early 2002, about 10 years after the incorporation of the OCP (which still had no assets or operations as of that time), KSG invited Dangote Industries Limited (DIL) to take the opportunity of the significant limestone deposit in the State by establishing a cement plant in the state.

“Following several engagements and assessment of the viability of the proposed opportunity, DIL agreed that it would establish a cement plant in Kogi State and provide the entirety of the substantial capital required for the investment.

“DIL also agreed, following a specific request by KSG, to use the OCP name (albeit only existing on paper as of that time and without any assets or operations) for the time being as the vehicle for this investment. On 30 July 2002, KSG and DIL entered into a binding agreement to document their understanding. The agreement was amended in 2003 and remains binding on, and legally enforceable by, the parties to same,” the statement explained.

On the issue of an Agreement between Dangote and the Kogi State Government, the statement gave a summary. It noted that “it was agreed, inter alia, that: DIL would establish a cement plant with a capacity of 3,500,000 metric tonnes per annum; DIL shall hold 100% of the shareholding in OCP, and source for all the funds required to develop the cement plant; KSG shall have the option to acquire 5% equity shareholding in OCP within 5 years; and KSG shall grant tax relief and exemption from levies and other charges by KSG for a period of seven (7) years from the date of commencement of production.”

“Consistent with the terms of the agreement, DIL sourced 100% of the funds that were used to develop the plant without any contribution from KSG. In line with its rights, ensuring alignment with the Dangote Brand, as part of internal restructuring and for better market recognition, the name of OCP was changed to Dangote Cement Plc in 2010, and a number of other significant cement companies (such as the Benue Cement Company) owned by DIL were merged with OCP to become the enlarged Dangote Cement Plc”, the statement added.

On the issues of ‘Execution of the Agreement: The Plant, Taxes, Shares & Dividends’, the statement noted, “DIL assiduously and at significant cost met all the terms of the agreement between it and KSG in relation to OCP. It built the cement factory, which was much bigger and better than envisaged.

“KSG could not meet its financial obligations of contributing to the funding the plant in any form; neither could KSG fund acquisition of 5% equity shares in OCP when it was asked on a number of occasions to exercise the purchase option.

“KSG also did not meet its obligations to grant a waiver of taxes, charges and levies that it could charge the operations, affairs and activities of OCP. Rather despite being entitled (under the terms of the agreement with KSG) to tax relief and exemption from charges and levies by KSG for a period of seven (7) years from the date of commencement of production, OCP (and now DCP) has paid all due sub-sovereign taxes, levies and charges to KSG since it commenced production in 2007.

“KSG does not have any form of investment or equity stake in OCP, so no dividend or other economic and/or shareholding rights whatsoever could have accrued to it from the operations of the company”, the statement added.

On the issue of the Acquisition of the Plant Site, the statement noted that, “After the agreement between DIL and KSG in 2002, DIL in 2003, applied to KSG for the acquisition of land for the plant site, and this application was granted with the issuance of three Certificates of Occupancy to DIL. DIL, to the knowledge of the Kogi State government, paid substantive compensation to Obajana Farmland Owners located within the two (2) square kilometres plant site.

“Subsequently, in September 2004, DIL, in good faith, applied to the State Governor for the statutory consent for DIL to assign the plant site to OCP being DIL’s investment vehicle. This consent request was granted by the state governor, and the appropriate consent fees were paid by DIL”, it added.

Shedding more light on the company’s engagement with Kogi State Government, the statement explained that, “The investment of DIL in Kogi State through OCP was at the instance of the duly constituted government of Kogi State, done in accordance with the law of the State and all enabling laws in that regard, and the transaction documents were effectively, lawfully and duly executed by the Governor and Attorney General of the State (at the time), after internal approvals were obtained within the government.

“Since the inception of Alhaji Yahaya Bello’s administration in 2016, and regardless that government is a continuum, we have had a series of enquiries about the ownership structure of the Dangote Cement PLC as it relates to the alleged interest of KSG; and had several engagements with the officers of the State government including Governor Yahaya Bello. At all of these engagements, we have provided all the details and information supported by relevant documents required by the Government and the State House of Assembly to confirm our lawful investment.

“For instance, in 2017, we were invited by the Judicial Commission of Inquiry, and we made our submission to the commission with relevant documents to support our position. We are yet to receive any feedback from the Judicial Commission of Inquiry. While still waiting to hear of the report of the Inquiry, we were invited by the State House of Assembly on the same matter earlier this year, and again, we provided evidence in support of our position that KSG does not have any equity or other interest in OCP or DCP.

“On Wednesday, 5 October 2022, hundreds of dangerously armed men, other than law enforcement officers, attacked our cement plant in Obajana, Kogi State, destroyed our property, inflicted grievous injuries on many of our employees, and shut down operations at the plant. KSG has admitted that the armed invaders acted on its instructions and in furtherance of the recent enquiry by the Kogi State House of Assembly in connection with the ownership of the Obajana Cement Plant.

“Curiously, on 6 October 2022, a day after the shutdown of our facility in Obajana on the orders of KSG, Governor Bello addressed the public and announced that a Specialised Technical Committee which was set up as part of the recommendations of the Judicial Commission of Inquiry had just presented its recommendations, which have been accepted by KSG. This statement makes it abundantly clear that the shutdown of DCP’s plant occurred regardless of the Governor’s own confirmation that implementation of the recommendations of the Specialised Technical Committee was still pending”, the statement noted.

Focusing on the current state of play, the company said, “Whilst we do not want to speculate on the motivation for the spurious claims being made by KSG in relation to the ownership of the Company, which have resulted in the unfortunate unlawful forcible closure and damage of our plant, and injury of several people, we condemn in strongest possible terms, the unlawful shutdown of our plant by KSG sponsored armed-thugs, the damage to our property (including the looting of a large sum of money kept in the office), and grievous injury inflicted on our employees by them.

“This disruption of operations at the plant has caused loss of revenue not only to our company and its customers but has also adversely impacted revenue due to both the Federal and State governments. It has also occasioned the loss of jobs for the teeming youths who are daily paid workers that throng our plant for their daily sustenance.

Appealing for overall peace and calm, the statement noted, “We implore all our stakeholders, namely shareholders, customers, suppliers, employees, and the entire community of Obajana and Kogi State at large, to remain calm while we follow the legitimate and lawful process to resolve this matter. We shall keep our stakeholders duly updated whilst we remain confident that the statutory and contractual rights of DIL shall be upheld by these legal processes which we have initiated.”

Economy

Naira Down Again at NAFEX, Trades N1,359/$1

By Adedapo Adesanya

The Naira further weakened against the Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEX) for the fourth straight session this week on Thursday, February 26.

At the official market yesterday, the Nigerian Naira lost N3.71 or 0.27 per cent to trade at N1,359.82/$1 compared with the previous session’s N1,356.11/$1.

In the same vein, the local currency depreciated against the Pound Sterling in the same market window on Thursday by N8.27 to close at N1,843.23/£1 versus Wednesday’s closing price of N1,834.96/£1, and against the Euro, it crashed by N8.30 to quote at N1,606.89/€1, in contrast to the midweek’s closing price of N1,598.59/€1.

But at the GTBank forex desk, the exchange rate of the Naira to the Dollar remained unchanged at N1,367/$1, and also at the parallel market, it maintained stability at N1,365/$1.

The continuation of the decline of the Nigerian currency is attributed to a surge in foreign payments that have outpaced the available Dollars in the FX market.

In a move to address the ongoing shortfall at the official window, the Central Bank of Nigeria (CBN) intervened by selling $100 million to banks and dealers on Tuesday.

However, the FX support failed to reverse the trend, though analysts see no cause for alarm, given that the authority recently mopped up foreign currency to achieve balance and it is still within the expected trading range of N1,350 and N1,450/$1.

As for the cryptocurrency market, major tokens posted losses over the last 24 hours as traders continued to de-risk alongside equities following Nvidia’s earnings-driven pullback, with Ripple (XRP) down by 2.7 per cent to $1.40, and Dogecoin (DOGE) down by 1.6 per cent to $0.0098.

Further, Litecoin (LTC) declined by 1.3 per cent to $55.87, Ethereum (ETH) slipped by 0.9 per cent to $2,036.89, Bitcoin (BTC) tumbled by 0.7 per cent to $67,708.21, Cardano (ADA) slumped by 0.6 per cent to $0.2924, and Solana (SOL) depreciated by 0.4 per cent to $87.22, while Binance Coin (BNB) gained 0.4 per cent to sell for $629.95, with the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closing flat at $1.00 each.

Economy

Crude Oil Falls as Geopolitical Risk Around Iran Clouds Supply Outlook

By Adedapo Adesanya

Crude oil settled lower on Thursday as investors tracked developments in talks between the United States and Iran over the latter’s nuclear programme, weighing potential supply concerns if hostilities escalate.

Brent crude futures lost 10 cents or 0.14 per cent to close at $70.75 a barrel, while the US West Texas Intermediate (WTI) crude futures depreciated by 21 cents or 0.32 per cent to $65.21 a barrel.

The US and Iran held indirect talks in Geneva on Thursday over their long-running nuclear dispute to avert a conflict after US President Donald Trump ordered a military build-up in the region.

Prices had gained earlier in the session after media reports indicated the talks had stalled over US insistence on zero enrichment of uranium by Iran, as well as a demand for the delivery of all 60 per cent-enriched uranium to the US.

However, prices then retreated after the two countries extended talks into next week, reducing the immediate strike potential.

Iran’s Foreign Minister, who confirmed talks will continue next week, said Thursday’s talks were the most serious exchanges with the US yet, saying Iran clearly laid out its demand for lifting sanctions and the process for relief.

His counterpart from Oman, who is handling the talks, said significant progress was made in Thursday’s talks. The Omani minister’s upbeat assessment followed indirect talks between Iranian Foreign Minister and US envoys Steve Witkoff and Jared Kushner in Geneva, with one session in the morning and the second in the afternoon.

He will also hold talks with US Vice President JD Vance and other US officials in Washington on Friday.

The Trump administration has insisted that Iran’s ballistic missile program and its support for armed groups in the region must be part of the negotiations.

The American President said on February 19 that Iran must make a deal in 10 to 15 days, warning that “really bad things” would otherwise happen.

On Tuesday, he briefly laid out his case for a possible attack on Iran in his State of the Union speech, underlining that while he preferred a diplomatic solution, he would not allow Iran to obtain a nuclear weapon.

Meanwhile, the US continues to amass forces in the Middle Eastern region, with the military saying it is prepared to execute orders given by the US President.

Economy

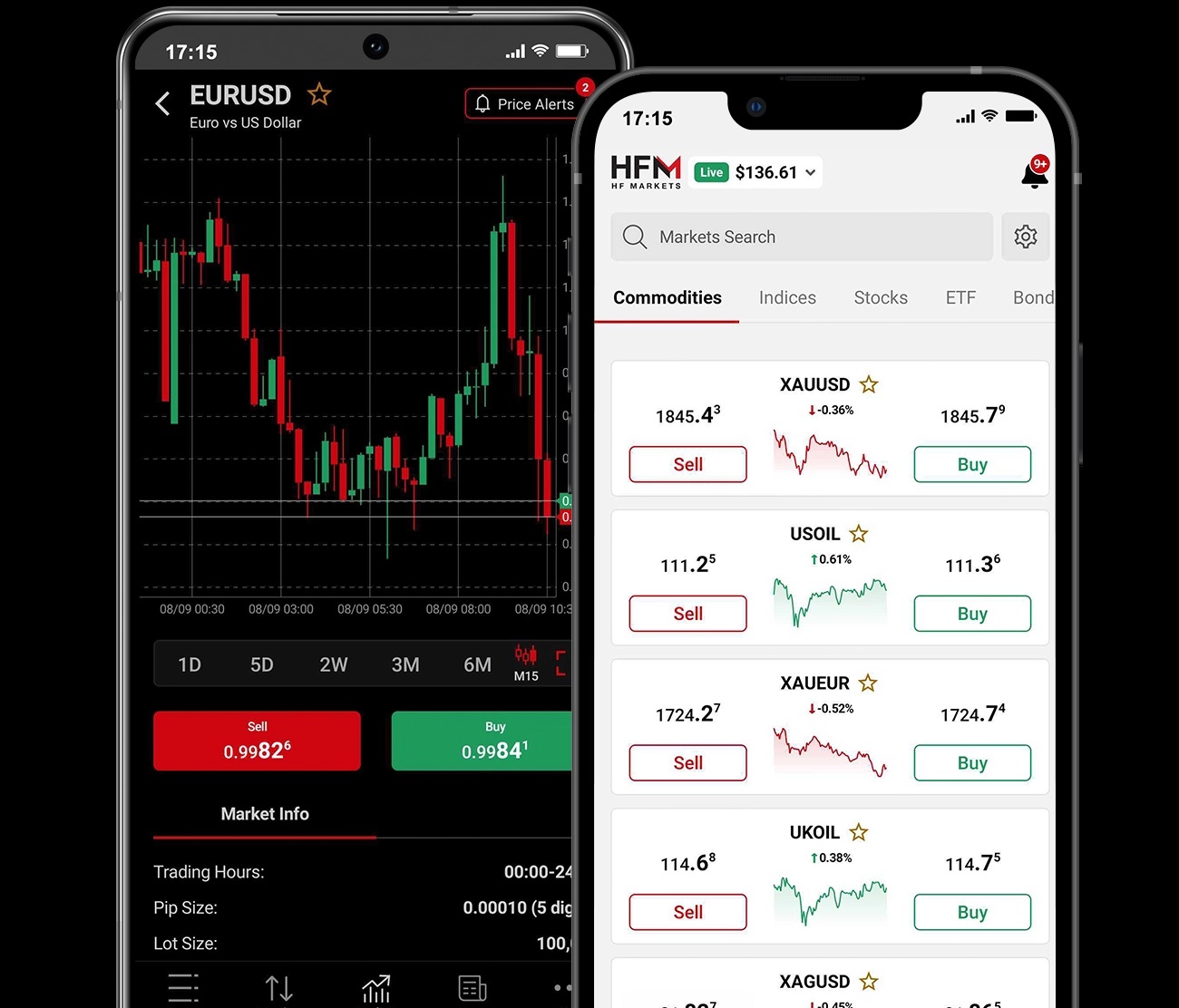

Why Transparency Matters in Your Choice of a Financial Broker

Choosing a Forex broker is essentially picking a partner to hold the wallet. In 2026, the market is flooded with flashy ads promising massive leverage and “zero fees,” but most of that is just noise. Real transparency is becoming a rare commodity. It isn’t just a corporate buzzword; it’s the only way a trader can be sure they aren’t playing against a stacked deck. If a broker’s operations are a black box, the trader is flying blind, which is a guaranteed way to blow an account.

The Scam of “Zero Commissions”

The first place transparency falls apart is in the pricing. Many brokers scream about “zero commissions” to get people through the door, but they aren’t running a charity. If they aren’t charging a flat fee, they are almost certainly hiding their profit in bloated spreads or “slippage.” A trader might hit buy at one price and get filled at a significantly worse one without any explanation. This acts as a silent tax on every trade. A transparent broker doesn’t hide the bill; they provide a live, auditable breakdown of costs so the trader can actually calculate their edge.

The Conflict of Market Making

It is vital to know who is on the other side of the screen. Many brokers act as “Market Makers,” which is a polite way of saying they win when the trader loses. This creates a massive conflict of interest. There is little incentive for a broker to provide fast execution if a client’s profit hurts their own bottom line. A broker with nothing to hide is open about using an ECN or STP model, simply passing orders to the big banks and taking a small, visible fee. If a broker refuses to disclose their execution model, they are likely betting against their own clients.

Regulation as a Safety Net

Transparency is worthless without an actual watchdog. A broker that values its reputation leads with its licenses from heavy-hitters like the FCA or ASIC. They don’t bury their regulatory status in the fine print or hide behind “offshore” jurisdictions with zero oversight. More importantly, they provide proof that client funds are kept in segregated accounts. This ensures that if the broker goes bust, the money doesn’t go to their creditors—it stays with the trader. Without this level of openness, capital is essentially unprotected.

The Withdrawal Litmus Test

The ultimate test of a broker’s transparency is how they handle the exit. There are countless horror stories of traders growing an account only to find that “technical errors” or vague “bonus terms” prevent them from withdrawing their money. A legitimate broker has clear, public rules for getting funds out and doesn’t hide behind a wall of unreturned emails. If a platform makes it difficult to see the exit strategy, it’s a sign that the front door should have stayed closed.

Conclusion

In 2026, honesty is the most valuable feature a broker can offer. It is the foundation that allows a trader to focus on the charts instead of worrying if their stops are being hunted. Finding a partner with clear pricing, honest execution, and real regulation is the first trade that has to be won. Flashy marketing is easy to find, but transparency is what actually keeps a trader in the game for the long haul.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn