Economy

Details of How to Purchase/Subscribe FGN Savings Bond

By Dipo Olowookere

The FGN savings bond was created by the federal government a few years ago to meet the investment demands of low-income earners in the country.

Before the introduction of the financial asset, Nigerians had the opportunity to invest in treasury bills for as low as N10,000, but the Central Bank of Nigeria (CBN), which sells T-bills on behalf the Debt Management Office (DMO), raised the minimum subscription for the bills to N50 million.

This development made nearly it impossible for low-income earners to invest in government securities and the sovereign bonds available also required high minimum subscription to partake in them.

This made the debt office to design the FGN savings bond to attract retail investors, who wish to earn steady revenue by lending money to the government to carry out some critical infrastructure in the country. The minimum subscription for this was pegged at N5,000.

Since its introduction, investors have been embracing the papers and in the first week of every month, the DMO auctions the bonds in two different maturities; 2-year and 3-year.

For the month of December 2020, the offer opened on Monday, December 7 and will close on Friday, December 11.

However, not many people know how to go about purchasing this bond targeted at retail investors with a maximum subscription of N50 million. This is what this article hopes to help readers with.

To buy the FGN savings bond, an investor needs to open a stockbroker’s account and this should be with the notable names. In fact, not all brokerage firms are accredited to sell the notes.

Opening a stockbroker’s account is cheap and can be done for as low as N10,000. You can read about the favourite brokerage companies among Nigerian investors HERE.

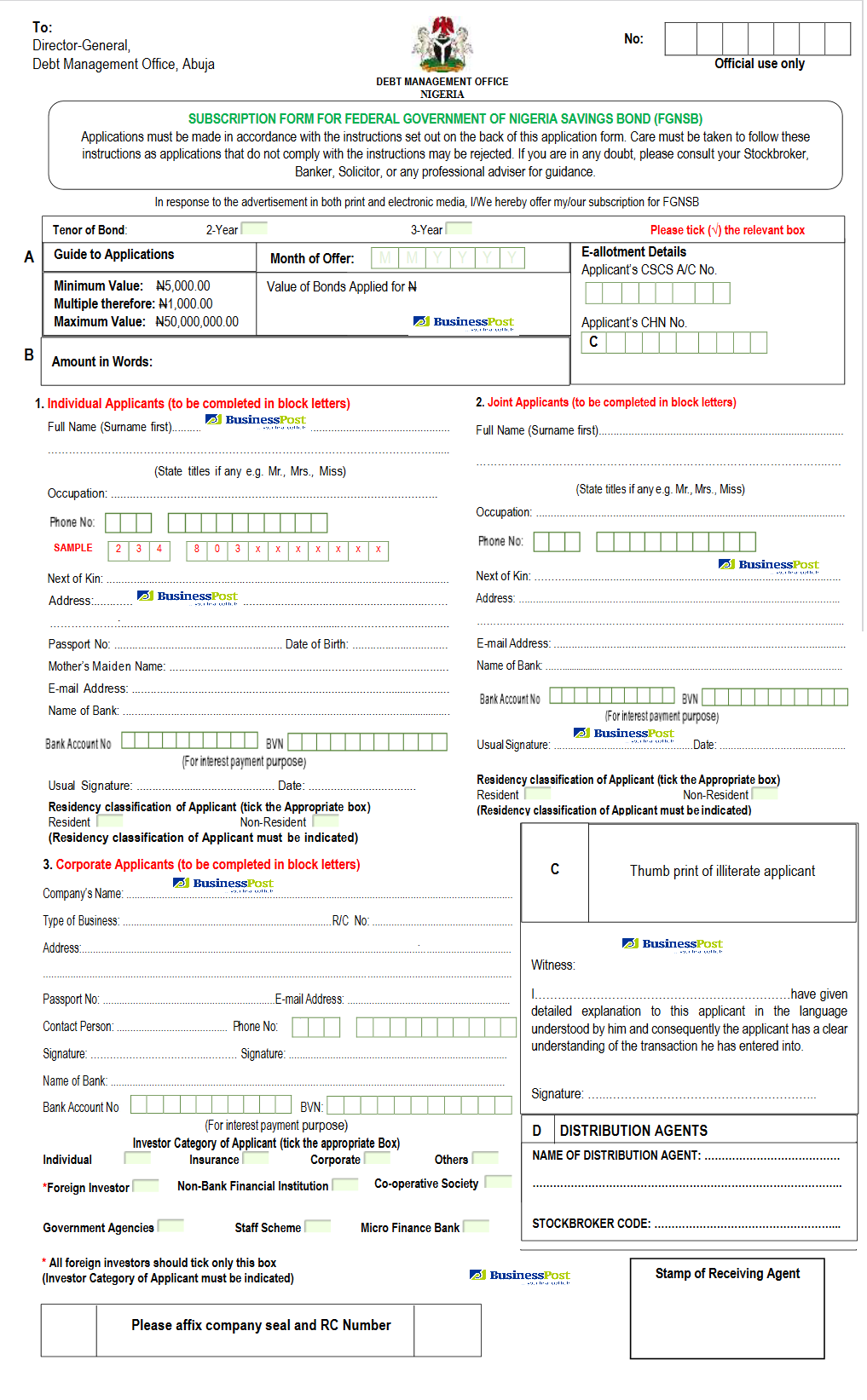

After you have opened the account, you are good to go. You just have to request for the FGN savings subscription form, where you will be required to supply some details like your biodata, account details, including the BVN, which is a must for every financial transaction done in Nigeria.

A sample of the subscription form is in this article for guidance.

After all the information is supplied, the next stage is to make payment to the stockbroker’s account and the payment details, proof of payment, sent to the broker for confirmation. This can be done via an email or the chatbox if the company has one.

These are all the things needed to buy the FGN savings bond.

It is important to state that interests paid on the investment vary almost every month. For this month, the DMO is offering the 2-year paper at 1.32 per cent and the 3-year at 1.82 per cent per annum. The interest, which is also called the coupon, is paid four times a year.

On Wednesday, December 16, 2020, the federal government will credit the CSCS accounts of subscribers with the volume of bonds bought.

In the event you intend to sell your FGN savings bond before maturity to use the funds for emergencies, there is always an opening for that because the bonds are traded at the secondary market on the Nigerian Stock Exchange (NSE).

Do you require any additional information, please feel free to use the comment box, I will be readily available to respond to your questions.

Economy

Petrol Supply up 55.4% as Daily Consumption Reaches 52.1 million Litres

By Adedapo Adesanya

The supply of Premium Motor Spirit (PMS), also known as petrol, increased by 55.4 per cent on a month-on-month basis to 71.5 million litres per day in November 2025 from 46 million litres per day in October.

This was contained in the November 2025 fact sheet of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) on Monday.

The data showed that the nation’s consumption also increased by 44.5 per cent or 37.4 million litres to 52.1 million litres per day in November 2025, against 28.9 million litres in October.

The significant increase in petrol supply last month was on account of the imports by the Nigerian National Petroleum Company (NNPC) Limited into the Nigerian market from both the domestic and the international market.

Domestic refineries supplied in the period stood at 17.1 million litres per day, while the average daily consumption of PMS for the month was 52.9 million litres per day.

The NMDPRA noted that no production activities were recorded in all the state-owned refineries, which included Port Harcourt, Warri, and Kaduna refineries, in the period, as the refineries remained shut down.

According to the report, the imports were aimed at building inventory and further guaranteeing supply during the peak demand period.

Other reasons for the increase, according to the NMDPRA, were due to “low supply recorded in September and October 2025, below the national demand threshold; the need for boosting national stock level to meet the peak demand period of end of year festivities, and twelve vessels programmed to discharge into October, which spilled into November.”

On gas, the average daily gas supply climbed to 4.684 billion standard cubic feet per day in November 2025, from the 3.94 bscf/d average processing level recorded in October.

The Nigeria LNG Trains 1-6 also maintained a stable processing output of 3.5 bscf/d in November 2025, but utilisation improved slightly to 73.7 per cent compared with 71.68 per cent in October.

The increase, according to the report, was driven by higher plant utilisation across processing hubs and steady export volumes from the Nigeria LNG plant in Bonny.

“As of November 2025, Nigeria’s major gas processing facilities recorded improved output and utilisation levels, with the Nigeria LNG Trains 1-6 processing 3.50 billion standard cubic feet per day at a utilisation rate of 73.70 per cent.

“Gbaran Ubie Gas Plant processed 1.250 bscf per day, operating at 71.21 per cent utilisation, while the MPNU Bonny River Terminal recorded a throughput of 0.690 bscf per day during the period. Processing activities at the Escravos Gas Plant stood at 0.680 bscf per day, representing a 62 per cent utilisation rate, whereas the Soku Gas Plant emerged as the top performer, processing 0.600 bscf per day at 96.84 per cent utilisation,” it stated.

Economy

Secure Electronic Technology Suspends Share Reconstruction as Investors Pull Out

By Aduragbemi Omiyale

The proposed share reconstruction of a local gaming firm, Secure Electronic Technology (SET), has been suspended.

The Lagos-based company decided to shelve the exercise after negotiations with potential investors crumbled like a house of cards.

Secure Electronic Technology was earlier in talks with some foreign investors interested in the organisation.

Plans were underway to restructure the shares of the company, which are listed on the Nigerian Exchange (NGX) Limited.

However, things did not go as planned as the potential investors pulled out, leaving the board to consider others ways to move the firm forward.

Confirming this development, the company secretary, Ms Irene Attoe, in a statement, said the board would explore other means to keep the company running to deliver value to shareholders.

“This is to notify the NGX and the investing public that a meeting of the board of SET held on Tuesday, December 16, 2025, as scheduled, to consider the status of the proposed share reconstruction and recapitalisation as approved by the members at the Extraordinary General Meeting (EGM) held on April 16, 2025.

“After due deliberations, the board wishes to announce that the proposed share reconstruction will not take place as anticipated due to the inability of the parties to reach a convergence on the best and mutually viable terms.

“Thus, following an impasse in the negotiations, and the investors’ withdrawal from the transaction, the board has, in the interest of all members, decided to accept these outcomes and move ahead in the overall interest of the business.

“The board is committed to driving the strategic objectives of SEC and to seeking viable opportunities for sustainable growth of the company,” the disclosure stated.

Business Post reports that the share price of SET crashed by 3.85 per cent on Tuesday on Customs Street on Tuesday to 75 Kobo. Its 52-week high remains N1.33 and its one-year low is 45 Kobo. Today, investors transacted 39,331,958 units.

Economy

Clea to Streamline Cross-Border Payments for African Importers

By Adedapo Adesanya

Clea, a blockchain-powered platform that allows African importers to pay international suppliers in USD while settling locally, has officially launched.

During its pilot phase, Clea processed more than $4 million in cross-border transactions, demonstrating strong early demand from businesses navigating the complexities of global trade.

Clea addresses persistent challenges that African importers have long struggled with, including limited FX access, unpredictable exchange rates, high bank charges, fraudulent intermediaries, and payment delays that slow or halt shipments. The continent also faces a trade-finance gap estimated at over $120 billion annually, limiting importers’ ability to access the FX and financial infrastructure needed for timely international payments by offering fast, transparent, and direct USD settlements, completed without intermediaries or banking bottlenecks.

Founded by Mr Sheriff Adedokun, Mr Iyiola Osuagwu, and Mr Sidney Egwuatu, Clea was created from the team’s own experiences dealing with unreliable international payments. The platform currently serves Nigerian importers trading with suppliers in the United States, China, and the UAE, with plans to expand into additional trade corridors.

The platform will allow local payments in Naira with instant access to Dollars as well as instant, same-day, or next-day settlement options and transparent, traceable transactions that reduce fraud risk.

Speaking on the launch, Mr Adedokun said, “Importers face unnecessary stress when payments are delayed or rejected. Clea eliminates that uncertainty by offering reliable, secure, and traceable payments completed in the importer’s own name, strengthening supplier confidence from day one.”

Mr Osuagwu, co-founder & CTO, added, “Our goal is to make global trade feel as seamless as a local transfer. By connecting local currencies to global transactions through blockchain technology, we are removing long-standing barriers that have limited African importers for years.”

According to a statement shared with Business Post, Clea is already working with shipping operators who refer merchants to the platform and is also engaging trade associations and logistics networks in key import hubs. The company remains fully bootstrapped but is open to strategic investors aligned with its mission to build a trusted global payment network for African businesses.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn