Economy

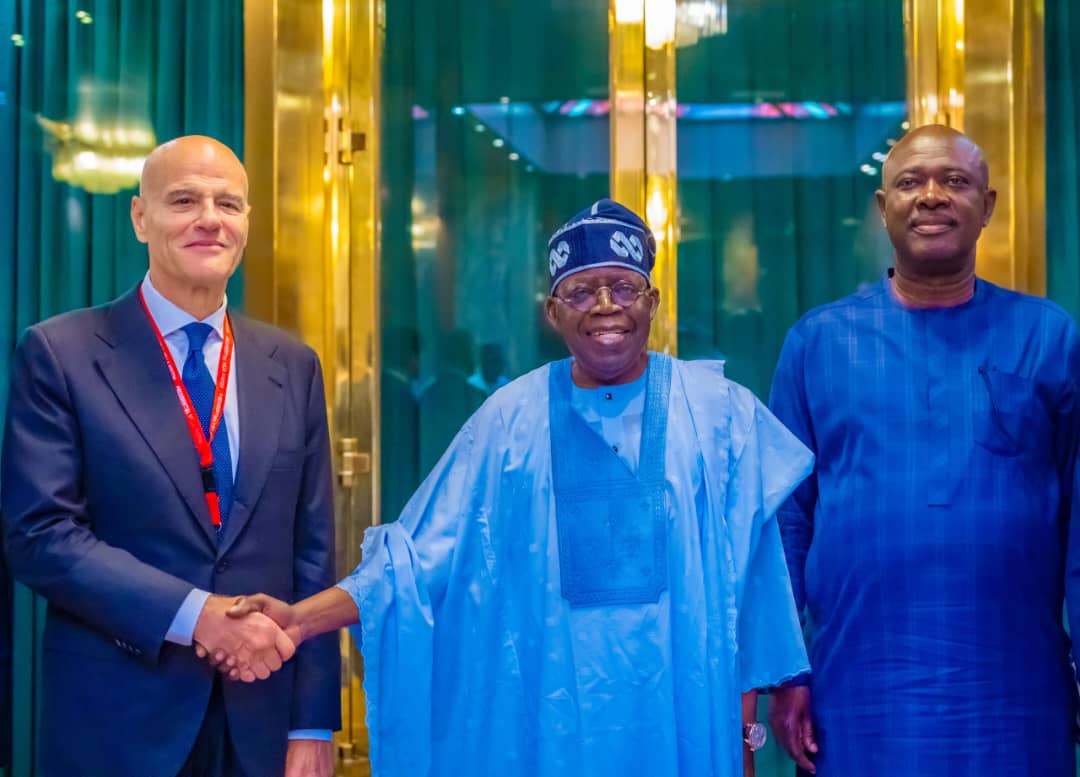

Eni’s Decision to Increase Investment in Nigeria Thrills Tinubu

By Adedapo Adesanya

President Bola Tinubu has commended the decision of an international energy company, Eni, to increase its investment in Nigeria, reiterating his vision of making the nation more globally competitive and an investment destination.

The President said that by exploring the possibilities of innovative thinking, strategic planning, new technology, and research into best practices, his administration’s reforms will reposition the nation’s economy.

Receiving a delegation from Eni led by the chief executive, Mr Claudio Descalzi, at the Presidential Villa, President Tinubu said the vision of his government remains to turn the country into an investment destination, with strategic thinking, planning, and implementation.

“Eni, we welcome your team again. Claudio, welcome back after many years. Nigeria has improved, and I am glad that you noted that we are making changes, not because of anything else but because of a very long-term vision of our investment strategy.

“We have seen conflicting strategies around the world, and we are determined to champion these changes or take ourselves ahead of those changes and make reforms a priority. We cannot grow today’s seed with yesterday’s belief system. We have to continuously be intellectually inquisitive and reform ourselves and our way of doing things.

“And we see the effect of your belief in our partnership, not for exploitation, but for investable development. Africa is not in a begging mode but in an accelerated mode to compete and take its place with the rest of the world,” the President stated.

Mr Tinubu also assured that the reforms would be sustained for the mutual benefit of investors and Nigerians, noting that, “I have seen the need for us to continue to be leaders in this reform and create opportunities for attracting investments because the basket is getting bigger, and the participants are getting larger and more resilient. The fossil fuel problem is there; science and technology are taking over.”

“We will still continue to assure you that we are going to be the global investment destination and I will encourage you, as one of the progressive leaders in the industry, on what our reforms have achieved.

“Please, put a timeline on that investment strategy. It will be a stimulant for the rest of the world when you put a timeline on it,” the President added.

He commended Eni’s confidence in the country for many years and for diversifying into other areas like agriculture, saying, “We are open; we are ready. We are working hard on infrastructural development and to make arable land available for planting, and we are ready to partner you in every aspect of that and in innovative research.”

On his part, Mr Descalzi said the energy company will invest more in the country, particularly in the agricultural sector.

“First of all, there are lots of reasons to thank you. The first is that after nine years, you allowed me to come back to your country. It is quite emotional, especially because you promoted a new era for Nigeria.

“You want us to attract investment, and I think that you are following the right track with your leadership. We want to come back and demonstrate that what somebody in Europe says about Nigeria, that everybody is leaving, is not true. We want to be the champion of this new era.

“We want to stay close to you; to learn and to help you in your endeavour and renew our efforts to create again a new Nigeria for everybody I think that we trust you, and we want everybody in Europe and different countries and everywhere to trust you and your leadership. You know that we work everywhere. And we can be a good ambassador of Nigeria, not just in Europe, but in other countries,” he stated.

Economy

Moniepoint Research Shows Diminishing Role of Cash in Nightlife Payments

By Modupe Gbadeyanka

A new report released by Africa’s leading all-in-one financial ecosystem, Moniepoint Incorporated, has revealed that the use of cash for financial transactions is gradually dying due to security concerns.

The study, which looked into transaction data of over 27,000 clubs, bars, and lounges, showed that bank transfers dominated, followed closely by card payments, with cash actively discouraged. It was observed that transfers outpace card payments by nearly 2 million transactions during peak nighttime hours across its network.

In the research titled The Business of Community Nightlife in Nigeria, findings provided a rare, data-driven look into the country’s informal night economy.

While high-end Detty December venues grabbed headlines with daily revenues of N360 million and table prices reaching N1.2 million, Moniepoint’s study shifted the spotlight to the “community nightlife” where roadside bars, suya spots, and neighbourhood joints form the bedrock of social life for millions of Nigerians.

One of the study’s most operationally significant findings concerns the timing of spending. Nightlife in Nigeria runs late, but economically, the night is decided early.

Transaction volumes begin climbing sharply from 8 pm, peak before midnight, and then decline steadily even as venues remain full. By the time the night is at its longest, purchasing activity has already wound down.

However, for bar operators, this has clear practical implications – the most critical hours for staffing, stocking, vendor payment and cash flow management are the earliest hours of the day between midnight and 6 am.

The report further underscores the sector’s role in employment, noting that local bars typically expand their workforce by 30-50 per cent on peak nights. Conservative estimates suggest that at least 54,000 people are engaged in nightlife labour every night across Nigeria.

It was also observed that the most common transaction narrations from the data sourced – “food”, “pay”, “sent”, “pos”, “cash” – reflect the full breadth of nightlife spending: street food, club entry, lounge tabs, transport, and afterparties. Digital payments have gained huge traction in Nigeria’s social space.

While alcohol remains a key revenue driver, the data shows that food is the quiet stabiliser of Nigeria’s night economy, particularly in local and informal settings. In several neighbourhood venues, bottled water and meals outsell beer and spirits, especially early in the evening.

Lagos leads in sheer concentration of nightlife establishments, with 4,856 bars, clubs, and lounges on the Moniepoint network. FCT follows with 2,515, then Rivers (2,362), Delta (1,930), and Edo (1,574).

Katsina leads the country in nighttime food truck payment value, with vendors pulling in over N130 million in the last 12 months. Kwara State leads in transaction count. Nigeria’s nightlife economy is distributed, not overly elitist.

On the lending side, the report noted that a significant share of loan requests from bar and lounge operators is directed toward renovations, furniture, lighting, and sound systems, showing that investments are intended to attract and retain customers in a competitive sector where ambience plays a decisive role.

Commenting on the report, the chief executive of Moniepoint, Mr Tosin Eniolorunda, said, “Nigeria’s local bars and night-time operators are not peripheral to the economy; they are a critical part of its architecture. We see a substantial and sustained economic sector that employs hundreds of thousands of Nigerians every night and deserves the same attention we give to agriculture, healthcare, and retail.

“Our goal is to make sure every one of those businesses has the tools to grow. From giving credit to finance renovations and sound systems to providing same-day settlement that allows vendors to restock and with tools like Moniebook that power inventory management and reconciliation, Moniepoint is ensuring that this vital artery of the nation’s economy remains viable and empowering.”

Economy

CBN Reduces Interest Rate by 50 Basis Points to 26.50%

By Adedapo Adesanya

The Central Bank of Nigeria (CBN) has cut the interest rate by 50 basis points to 26.50 per cent from 27 per cent.

Nigeria’s apex bank announced this during its two-day 304th Monetary Policy Committee (MPC) meeting, which concluded on Tuesday in Abuja.

This comes after the country’s interest rate cooled in January to 15.10 per cent from 15.15 per cent, according to the National Bureau of Statistics (NBS), strengthening the case for a reduction.

The CBN Governor, Mr Yemi Cardoso, said all members of the MPC unanimously agreed upon the decision.

“The committee decided to reduce the monetary policy rate by 50 basis points to 26.50 per cent,” he said.

Mr Cardoso stated that the liquidity ratio was maintained at 30 per cent, and the standing facilities corridor was adjusted to +50 to -450 basis points around the monetary policy rate.

He said the committee retained the Cash Reserve Ratio (CRR) at 45 per cent for commercial banks and 16 per cent for merchant banks, while the 75 per cent CRR on non-TSA public sector deposits was equally maintained.

The CBN uses the MPR, which works as the benchmark interest rate, to manage inflation, macroeconomic stability, and liquidity.

Last November, the MPC retained the Monetary Policy Rate (MPR) at 27.00 per cent. The last time the apex bank cut interest rates was in September last year, to 27 per cent from 27.50 per cent after a series of easing in inflation.

Market analysts had argued for higher interest cuts due to results seen in the CBN’s inflation targeting framework. Meanwhile, some say the 50 basis points reduction will offer a temporary reprieve as inflation heads for a single-digit target in the coming months.

Economy

Grey to Cut Cross-Border Payment Costs with New USD Offering

By Adedapo Adesanya

A cross-border payments solutions company, Grey has expanded its business banking platform to include US Dollar corporate accounts, bulk international payments, and USDC stablecoin support, all integrated into a single system.

The company is positioning itself as a low-cost, faster alternative to traditional international banking, particularly for businesses in emerging markets as it enables companies to open US Dollar accounts, receive global payments, and send payouts to 170+ countries, including bulk transfers, within minutes.

Grey aims to solve common cross-border payment challenges, particularly the high transfer costs that often range between 6 and 7 per cent of transaction value, prolonged settlement cycles that can stretch across several days, and the limited access many businesses face when trying to open and operate foreign currency accounts. In addition, companies frequently contend with hidden intermediary fees and poor foreign exchange transparency, both of which undermine cost predictability and effective cash flow management.

By integrating USD business accounts and USDC stablecoin functionality into its platform, Grey enhances its value proposition around faster settlement, clearer pricing structures, improved cost efficiency, and broader global accessibility. The expanded capabilities enable businesses to manage international transactions with greater speed, transparency, and operational control.

“Businesses may operate without borders today, but access to reliable global banking remains uneven, particularly for companies in high-growth markets,” said Mr Idorenyin Obong, Co-founder and Chief Executive Officer of Grey. “We’re closing that gap and enabling businesses to move money faster, with greater transparency and control, wherever their clients or partners are based.”

“When payments are delayed, or costs are unpredictable, growth stalls,” added Mr Joseph Femi Aghedo, Chief Operating Officer and Co-founder of Grey. “Grey eliminates those friction points, giving businesses a faster, simpler way to manage payroll, supplier payments, and partner payouts across borders. Adding USD and stablecoin capabilities makes these benefits accessible to even more customers.”

Established in Africa in 2020, Grey has a presence in key markets, including the United States, the United Kingdom, and Europe, and has recently expanded its services and operations into Latin America and Southeast Asia.

Since its inception, the company has consistently enhanced its services to empower digital nomads worldwide, regardless of location. Grey’s offerings include multi-currency accounts, low-cost international money transfers, a virtual USD card, expense management tools, and robust security measures.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn