Economy

European Stocks Under Pressure on US Inflation Data

By investors Hub

European stocks have come under pressure following the release of the U.S. inflation data after moving to the upside earlier in the session.

While the German DAX Index has fallen by 0.8 percent, the French CAC 40 Index is down by 0.5 percent and the U.K.?s FTSE 100 Index is down by 0.3 percent.

Swiss bank Credit Suisse has jumped after revealing that its fourth quarter net loss narrowed from last year.

Sky Plc and BT Group have also moved higher in London after they agreed to pay 4.464 billion pounds to secure the broadcast rights for the bulk of Premier League football games from the 2019/20 season.

Food group Danone has moved higher on news company intends to sell part of its 21.3 percent stake in Japan-listed Yakult Honsha Co.

Meanwhile, German steelmaker Thyssenkrupp has moved lower after its first quarter profits and revenue came in lower than estimated.

Galliford Try has also come under pressure on equity dilution worries after the construction group and homebuilder announced a 150 million capital raising to help cover the impact of Carillion’s liquidation.

On the data front, the euro area economy grew at a slightly slower pace in the fourth quarter, flash estimate published by Eurostat showed.

GDP climbed 0.6 percent sequentially following the third quarter’s 0.7 percent expansion. The growth came in line with the preliminary flash estimate published on January 30th.

Eurozone industrial production for December rose 0.4 percent month-on-month, beating forecasts for 0.2 percent growth.

Separate reports showed German consumer price index rose 1.6 percent year-on-year in January after a 1.7 percent increase in December, while the German economy grew 0.6 percent sequentially in the fourth quarter, in line with expectations but slightly slower than the 0.7 percent expansion in the third quarter

Economy

Nigeria Splits OPL 245 into Four Blocks for Eni, Shell

By Adedapo Adesanya

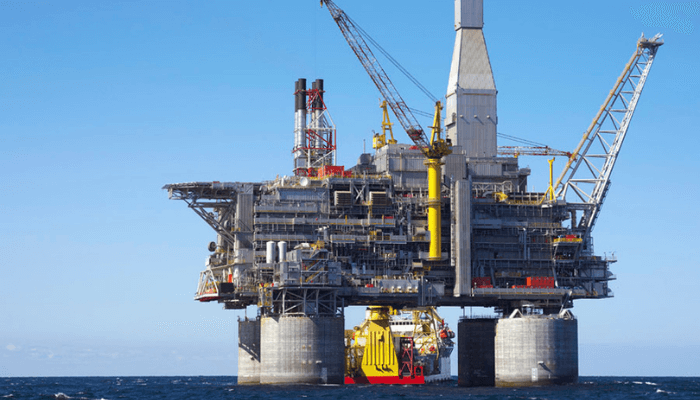

Nigeria has broken up the OPL 245 oil block into four new assets to be operated by Eni and Shell, potentially settling the future of the field at the centre of one of the oil industry’s biggest historic corruption trials.

According to Reuters, the agreement clears the way for the development of OPL 245, one of Nigeria’s biggest deepwater reserves that has remained untapped for almost three decades amid overlapping lawsuits in multiple countries.

The final contracts are expected to be signed starting Monday, the report said, citing a source familiar with the situation.

The Nigerian government had signalled for years that it was keen to find a solution that would bring the block into production. The source wished to remain anonymous as they are not authorised to comment on government policy before an official announcement.

Located in the Niger Delta’s deepwaters, the field has languished since its initial award in 1998 to Malabu Oil and Gas, a shadowy firm controlled by Mr Dan Etete, Nigeria’s oil minister at the time. The block is estimated to hold up to 9 billion barrels of oil equivalent in reserves—enough to rival Nigeria’s entire proven reserves if fully developed.

Mr Etete controversially awarded the lucrative licence to his own company for a nominal $20 million fee, sparking immediate controversy over conflicts of interest.

The saga escalated in 2011 when Malabu sold its rights to a Shell-Eni joint venture for $1.3 billion.

Italian and Nigerian prosecutors alleged that over $1 billion of that sum was siphoned off through bribes to politicians, middlemen, and Mr Etete himself, including hefty payments to then-President Goodluck Jonathan’s associates.

The two European energy giants and some of their former and current executives, including Eni CEO, Mr Claudio Descalzi, faced trial in Italy but all were acquitted in 2021, having denied all wrongdoing.

Shell and Eni have consistently denied wrongdoing, insisting the payments complied with due diligence.

The anti-graft agency, the Economic and Financial Crimes Commission (EFCC), has pursued parallel probes, recovering over $200 million in frozen funds, but progress stalled amid political shifts.

Operations at the Nigerian oil block have been halted for more than a decade by a series of trials and competing legal claims.

In 2023, the federal government withdrew civil claims totalling $1.1 billion against Eni, ending the long battle.

Economy

Dangote Refinery, NNPC Raise Petrol Pump Price by N100

By Modupe Gbadeyanka

The price of Premium Motor Spirit (PMS), otherwise known as petrol, has been increased by at least N100 per litre at the pump.

This followed the recent increase in the price of crude oil in the global market as a result of the bombardment of Iran by the United States and Israel over the weekend.

The air strikes killed the Supreme Leader of Iran, Mr Ayatollah Ali Khamenei, and several others.

Iran has responded by firing missiles at US facilities in some Gulf countries, including Saudi Arabia, Qatar, Kuwait, Bahrain, the UAE, and others.

Crude oil prices rose to about $80 per barrel on the market from about $70 per barrel before the Middle East crisis.

Oil marketers in Nigeria have responded to the tension and have raised the prices of petroleum products.

At most MRS Oil retail stations in Lagos, the new price notice showed an increase of about N100 per litre.

As of Monday, the price of PMS was N837 per litre, but on Tuesday morning, it had changed to N938 per litre, while at NNPC retail stations, it was N930 per litre instead of the previous N830 per litre.

Economy

NASD OTC Exchange Sustains Positive Momentum with 1.41% Rise

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange remained in the positive territory on Monday after it closed higher by 1.41 per cent at the close of business.

During the session, the NASD Unlisted Security Index (NSI) added 57.66 points to close at 4,141.53 points compared with last Friday’s 4,083.87 points, and the market capitalisation added N44.50 billion to settle at N2.477 trillion versus the preceding session’s N2.433 trillion.

Yesterday, the volume of securities went down by 60.7 per cent to 1.8 million units from 4.5 million units, the value of securities decreased by 79.3 per cent to N17.1 million from N82.5 million, and the number of deals dropped 38.6 per cent to finish at 27 deals compared to the preceding session’s 44 deals.

Closing the day as the most traded stock by value on a year-to-date basis was with Central Securities Clearing System (CSCS) Plc with 35.1 million units exchanged for N2.1 billion, trailed by Okitipupa Plc with 6.3 million units traded for N1.1 billion, and Geo-Fluids Plc with the sale of 122.8 million units valued at N480.4 million.

On the flip side, the most traded stock by volume on a year-to-date basis was Resourcery Plc with 1.05 billion units sold for N408.7 million, followed by Geo-Fluids Plc with 122.8 million units valued at N480.4 million, and CSCS Plc with 35.1 million units worth N2.1 billion.

On the first trading day of the week, there were three price gainers and three price losers led by FrieslandCampina Wamco Nigeria Plc, which lost N1.46 to quote at N110.00 per share versus the previous N111.46 per share, Afriland Properties Plc tumbled by 14 Kobo to close at N18.74 per unit versus N18.88 per unit, and Industrial and General Insurance (IGI) depreciated by 5 Kobo to close at 45 Kobo per share versus 50 Kobo per share.

The price gainers were led by MRS Oil Plc, which added N10.00 to trade at N210.00 per unit versus N200.00 per unit, CSCS Plc appreciated by N6.88 to N77.00 per share from N70.12 per share, and First Trust Mortgage Bank Plc gained 16 Kobo to close at N1.75 per unit versus N1.59 per unit.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn