Economy

FAAC Plans New Revenue Template for NNPC, Shares N715b

By Dipo Olowookere

A new revenue reporting template is being prepared by the Federation Accounts Allocation Committee (FAAC) for the Nigerian National Petroleum Corporation (NNPC) and other members of the revenue sharing committee.

Minister of Finance, Mrs Kemi Adeosun, at a news briefing on Thursday in Abuja, disclosed that the new template would address the key areas of disputes between Governors of the 36 states of the federation and the state-owned oil firm.

According to her, the committee constituted to work on the new template should submit a draft before the next meeting for review.

There had been disputes between the Governors and the NNPC over the amount remitted by the latter.

President Muhammadu Buhari even had to intervene when the states failed to accept what was remitted by the NNPC, causing series of deadlocks in some FAAC meetings.

“We are working with the Department of Petroleum Resources (DPR), the office of Accountant General of the Federation (OAGF), NNPC and all the stakeholders to develop a new template,” Mrs Adeosun told newsmen at the briefing after the FAAC meeting on Thursday.

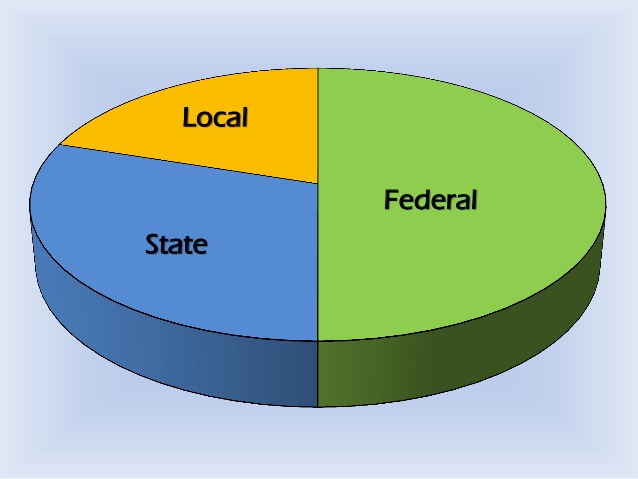

The Minister, who doubles as Chairman of FAAC, also said for the revenue generated in July 2018, FAAC shared the sum of N714.8 billion to the three tiers of government.

The amount comprised statutory revenue of N598 billion, Value Added Tax (VAT) of N79.8 billion, foreign exchange (Forex) equalisation of N25.9 billion and additional withheld funds by the Nigerian National Petroleum Corporation (NNPC) of N12 billion.

She further said from the revenue, federal government received N298.3 billion, states got N183.8 billion, while local governments were given N138.96 billion.

Also from the money, oil producing states received N49.7 billion as 13 percent derivation revenue for the month, while revenue generating agencies and statutory transfers got N44 billion.

She further said the sum of N25 billion was transferred to the excess crude oil revenue account, leaving the balance in the account at about $2.332 billion, while excess petroleum profit tax (PPT) account currently holds about $133 million.

Economy

Naira Further Falls to N1.355/$1 at Official FX Market

By Adedapo Adesanya

The woes of the Nigerian Naira in the Nigerian Autonomous Foreign Exchange Market (NAFEX) further continued on Tuesday, February 24.

During the session, the domestic currency weakened against the United States Dollar by N6.13 or 0.45 per cent to N1,355.37/$1 from the N1,349.24/$1 it was traded in the previous trading day.

The local currency also moved southwards on Tuesday in the same market window against the Pound Sterling after it lost N6.39 to trade at N1,828.26/£1 versus Monday’s closing price of N1,821.87/£1, and against the Euro, it depreciated by N4.94 to close at N1,596.36/€1, in contrast to the preceding session’s N1,591.42/€1.

Similarly, the Naira crashed against the US Dollar at the GTBank FX counter yesterday by N4 to settle at N1,361/$1 versus the N1,357/$1 it was exchanged a day earlier, and at the parallel market, it remained unchanged at N1,365/$1.

The fall of the Naira coincided with the Central Bank of Nigeria (CBN) buying US Dollars from the market to slow down the rapid rise of the nation’s legal tender. Latest information showed that last week, the apex bank bought about $189.80 million to reduce excess Dollar supply and control how fast the Naira was gaining value.

The rationale was to keep foreign investors from pulling their money out of Nigeria’s fixed-income market. If they sell their investments, it could increase demand for US Dollars and lead to more Dollar outflow from the economy.

Meanwhile, Mr Yemi Cardoso, the Governor of the CBN, said Nigeria’s gross external reserves have risen to $50.45 billion – the highest level in 13 years, while speaking after the 304th meeting of the monetary policy committee (MPC) of the CBN held on February 23 and 24.

The committee also reduced interest rates by 50 basis points to 26.50 per cent from 27 per cent after inflation eased in January 2026.

As for the cryptocurrency market, losses on concerns by embattled software businesses that artificial intelligence (AI) tools will destroy their business models continued and overturned some rallies on Tuesday.

Binance Coin (BNB) lost 2.1 per cent to sell for $585.41, Cardano (ADA) dropped 1.8 per cent to trade at $0.2595, Dogecoin (DOGE) went down by 1.5 per cent to $0.0920, Bitcoin (BTC) shrank by 1.2 per cent to $64,098.80, Litecoin (LTC) slipped 1.1 per cent to $51.31, Ripple (XRP) slumped 0.6 per cent to $1.35, and Ethereum (ETH) declined by 0.4 per cent to $1,857.75.

However, Solana (SOL) appreciated by 0.2 per cent to sell at $78.95. while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) traded flat at $1.00 each.

Economy

Oil Slides as Iran Signals Willingness to Seal US Nuclear Deal

By Adedapo Adesanya

Oil depreciated on Tuesday after Iran said it was prepared to take any necessary steps to clinch a deal with the United States ahead of nuclear talks later this week, with Brent futures shedding 72 cents or 1.0 per cent to trade at $70.77 per barrel, and the US West Texas Intermediate (WTI) futures declining by 68 cents or 1.0 per cent to $65.63 a barrel.

Iran, the third-biggest crude producer in the Organisation of the Petroleum Exporting Countries (OPEC), and the US will hold a third round of nuclear talks on Thursday in Geneva, Switzerland.

America wants Iran to give up its nuclear programme, which the country has denied trying to develop an atomic weapon.

Meanwhile, Iran’s deputy foreign minister said on Tuesday that it was ready to take any necessary steps to reach a deal with the US.

However, the US State Department is pulling out non-essential government personnel and their families from its embassy in Beirut, Lebanon, as concerns mount about the risk of a military conflict with Iran.

The US has deployed a vast naval force near the Iranian coast ahead of possible strikes on the Islamic Republic. The American president, on February 19, said he was giving Iran about 10 to 15 days to make a deal.

Also, the US began collecting a temporary new 10 per cent global import tariff on Tuesday, but President Trump’s administration was working to increase it to 15 per cent, a development that has led to confusion after the country’s Supreme Court ruling.

On the supply front, trading houses and buyers of Venezuelan oil have chartered the first very large crude carriers to export from the South American country since a supply deal began between the US and Venezuela. This is set to speed up shipments from March while boosting deliveries to India.

The European Commission will submit a legal proposal to permanently ban Russian oil imports on April 15.

The American Petroleum Institute (API) estimated that crude oil inventories in the United States rose by 11.4 million barrels in the week ending February 20, after falling by 609,000 barrels in the week prior. Official data from the US Energy Information Agency (EIA) will be released later on Wednesday.

Economy

Nigeria to Export New Crude Grade Cawthorne in March

By Adedapo Adesanya

The Nigerian National Petroleum Company (NNPC) Limited is set to commence export of a new light, sweet crude grade known as Cawthorne from March 2026.

According to a report by Reuters, an NNPC spokesperson confirmed the development, describing it as part of efforts to increase output and consolidate Nigeria’s recent recovery in crude oil production.

The move aligns with Nigeria’s broader strategy to boost production after years of constraints caused by pipeline vandalism, crude theft, and unrest in oil-producing regions.

This follows the launch of two other new grades, Obodo in 2025 and Utapate in 2024, Nigeria, whic,h as Africa’s top oil exporter, seeks to strengthen its standing within the Organisation of the Petroleum Exporting Countries and its allies (OPEC+)

Cawthorne crude is scheduled for export in the third week of March and has an API gravity of 36.4, making it similar in quality to Nigeria’s Bonny Light, which is prized for high petrol and diesel yields.

According to Reuters, citing a trading source, the state oil national company issued a tender last week for cargo loading between March 24 and 25.

Analysts at Kpler noted that the new grade is expected to be exported via the Floating Storage and Offloading (FSO) vessel Cawthorne, which has a storage capacity of about 2.2 million barrels. The vessel is designed to enhance transportation and production from Oil Mining Lease (OML) 18 and nearby assets in the Eastern Niger Delta.

Kpler estimates that, based on storage capacity, Cawthorne could increase Nigeria’s crude and condensate output from roughly 1.65 million barrels per day to around 1.7 million barrels per day for the remainder of the year.

Nigeria’s crude oil production recently dropped from the OPEC+ quota of 1.5 million barrels per day, with output at 1.48 million barrels per day recorded in January, according to OPEC data.

Beyond increasing Nigeria’s crude offerings to the international market, the introduction of Cawthorne could also attract buyers seeking specific light, sweet crude qualities, buoy foreign exchange earnings, which would help strengthen government revenue and ease borrowing needs.

New crude grades are typically differentiated by sulfur content, API gravity, and production source, enabling producers to target specific refinery configurations and market segments.

In November 2024, NNPC officially launched the Utapate crude oil blend in the international market, describing it as a milestone for Nigeria’s export profile.

Earlier in July 2024, NNPC and its partner, Sterling Oil Exploration & Energy Production Company (SEEPCO), lifted the first 950,000-barrel cargo of Utapate crude, which was shipped to Spain.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn