Economy

Investors Shun NASD Exchange Third Time This Month

By Adedapo Adesanya

Investors appear to be playing it safe again as they shunned trading of stocks at the NASD Over-the-Counter (OTC) Securities Exchange on Monday, April 27, making it the third time this month this is happening.

Business Post, via a telephone chat with the Head of Human Resources and Administration at the bourse, Mrs Chioma Mbagwu, received clarification that there was no trade on Monday.

It appears investors are trying to ‘stay safe’ amid the current COVID-19 pandemic ravaging markets globally, despite notable growths recorded at the NASD so far this month.

Last week, the NASD OTC Security Index (NSI) and market capitalisation closed the trading week positive at 700.73 points and N514.74 billion respectively.

This was majorly pushed by securities depository company, Central Securities Clearing Systems (CSCS) Plc, which pulled a 4.2 percent growth in its stock price from N13 per share to N13.55 per share.

According to data made available at the NASD trading platform, there were no changes to the volume and value of trades at the bourse yesterday.

At the close of business yesterday, insurance firm ARM Life Plc remained the most traded stock by volume (year-to-date) with 7.4 billion units of its shares traded for N4.6 billion traded. Food Concept Plc was in second place with 110 million units traded at N77 million, while Lighthouse Financial Services Plc followed in third place with 48 million units traded at N24 million.

In terms of the most traded equity by value (year-to-date), ARM Life Plc still retained the top spot with 7.4 billion units of its securities transacted for N4.6 billion. Niger Delta Exploration and Production (NDEP) Plc came trailed with 6.5 million units valued at N2.03 billion, while CSCS Plc followed in third spot with 24.2 million units worth N287 million.

Business Post recalls that last Tuesday, April 21, the market recorded no single transaction for the second time this month and just almost a week after, a similar situation occurred.

This first occurrence was on Wednesday April 1, the second day of the federal government imposed lockdown in Lagos, Ogun, and the Federal Capital Territory (FCT).

Economy

Nigeria Now Consolidating Reforms for Economic Stability—Edun

By Adedapo Adesanya

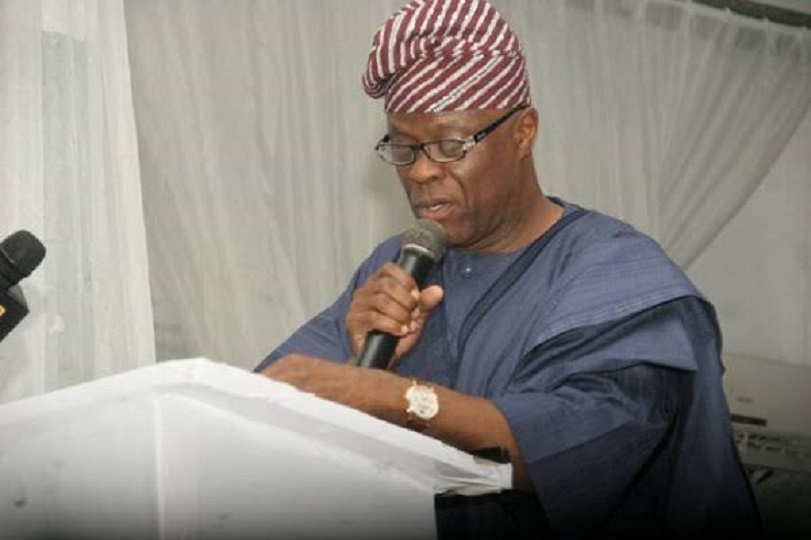

The Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, has stressed that Nigeria was now consolidating its macroeconomic reforms to sustain economic stability in an increasingly volatile global environment.

The Minister spoke at a high-level panel on Fiscal Policy in a Shock – Prone World at the ongoing Al Ula conference for Emerging Market Economies in Riyadh, Saudi Arabia.

“Nigeria’s macroeconomic and fiscal reforms are working. Momentum must be maintained, and the benefits channelled towards long-term growth and resilience,” he stated.

He said the government is also leveraging digital tools to improve revenue assurance, while deepening fiscal and monetary coordination and promoting realistic budgeting practices to ensure durable fiscal discipline.

He noted that despite accounting for a significant share of global growth, population and natural resources, emerging economies remain under-represented in global financial decision-making.

Mr Edun also highlighted the growing strategic importance of Gulf nations in the evolving global economic landscape.

He said countries in the Gulf are increasingly shaping global trade routes, investment flows and sources of capital, making them critical partners for emerging economies such as Nigeria.

The finance minister stressed Nigeria’s commitment to building stronger partnerships that promote a more inclusive and equitable global financial system.

He said Nigeria was positioning itself to engage constructively with global partners to support reforms that unlock growth, stability and shared prosperity.

Mr Edun’s call comes amid mounting global economic pressures. Many emerging economies are grappling with high debt levels, elevated inflation, volatile capital flows and tightening global financial conditions.

Rising interest rates in advanced economies have increased debt-servicing costs, while currency volatility has strained fiscal and external balances across Africa and other developing regions.

Global trade is also facing increased fragmentation due to geopolitical tensions, supply chain disruptions and protectionist tendencies.

These trends have disproportionately affected emerging markets that depend heavily on trade, foreign investment and access to international finance.

For Nigeria, the push for a global economic reset aligns with ongoing domestic reforms aimed at stabilising the macroeconomic environment.

The country has embarked on exchange rate reforms, fiscal consolidation and efforts to attract long-term investment to support growth and job creation.

Mr Edun has repeatedly argued that without reforms to the global financial system, domestic policy efforts in emerging economies risk being undermined by external shocks.

At the Al Ula conference, he reiterated that a more balanced global system would enhance resilience, improve access to finance and support sustainable development.

He said Nigeria would continue to engage in global policy conversations to ensure that emerging economies are not only rule-takers but active shapers of the new global economic order.

Economy

Lagos Lists N230bn Series 4 10-Year Bond on Stock Exchange

By Aduragbemi Omiyale

The N230 billion 10-year bond issued to investors by the Lagos State government has been listed on the Nigerian Exchange (NGX) Limited.

It was the Series 4 of the state government’s N1 trillion Debt and Hybrid Instruments Issuance Programme, which was sold at a coupon rate of 16.25 per cent.

It was offered for sale to bondholders in November 2025, with Chapel Hill Denham Advisory Limited as the leading issuing house and bookrunner.

The joint issuing houses and bookrunners were Asset & Resources Management Limited, Capital Bancorp Plc, Cardinal Stone Partners Limited, Cedrus Capital Limited, Comercio Partners Capital Limited, Cordros Advisory Services Limited, Coronation Merchant Bank Limited, Dynamic Portfolio Limited, FCMB Capital Markets Limited, FCSL Asset Management Company Limited, FirstCap Limited, G.A. Capital Limited, LeadCapital Plc, Light House Capital Limited, Phoenix Global Capital Markets Limited, Quantum Zenith Capital and Investments Limited, Radix Capital Partners Limited, SFS Financial Services Limited, Stanbic IBTC Capital Limited, United Capital Plc, and, Vetiva Advisory Services Limited.

The debt instruments are callable at par after 60 months, on any coupon payment date, subject to the issuer having obtained prior regulatory approvals and upon issuance of the requisite notice to bondholders.

Business Post reports that the bond was sold at a unit price of N1,000, with the interest to be paid to investors on every May 20 and November 20 until maturity.

According to the Governor of Lagos State, Mr Babajide Sanwo-Olu, proceeds from the exercise would be used for critical infrastructure in transportation, housing, the environment, healthcare, education, urban renewal, and the provision of other sustainable infrastructure that would serve the future needs of the state.

The listing of the debt instrument on the stock exchange today, Monday, February 9, 2026, allows investors to trade the bond at the secondary market.

Economy

CBN to Begin 304th MPC Meeting February 23

By Adedapo Adesanya

The Central Bank of Nigeria (CBN) has announced plans to hold its 304th Monetary Policy Committee (MPC) meeting on Monday, February 23 and Tuesday, February 24, 2026.

This information was disclosed in a circular published on the apex bank’s official website on Monday. This will be the first meeting of 2026.

The gathering comes amid sustained efforts by the CBN to rein in inflation, stabilise the foreign exchange market, and strengthen macroeconomic conditions.

At its last MPC meeting in November 2025, the central bank retained the Monetary Policy Rate (MPR) at 27 per cent, maintaining its restrictive posture in a bid to curb inflationary pressures and stabilise the foreign exchange (FX) market.

The MPC is one of the bank’s highest policy-making bodies, responsible for formulating monetary and credit policies aimed at ensuring price stability.

Through key instruments such as the MPR, Cash Reserve Ratio (CRR), and Liquidity Ratio (LR), the committee guides interest rate conditions and overall monetary direction in the economy.

Comprising the CBN Governor, Deputy Governors, Board members, and appointed external members, the committee meets periodically to review critical economic indicators, including inflation, gross domestic product, and exchange rate developments, before taking policy decisions.

The apex bank outlined the timetable and venue in its official notice.

“The 304th meeting of the Monetary Policy Committee (MPC) is scheduled to hold as follows,” the CBN said.

“Day 1: Monday, February 23, 2026 – Time: 10.00 a.m.”

“Day 2: Tuesday, February 24, 2026 – Time: 8.00 a.m.”

According to the circular, the meeting will take place at the MPC Meeting Room on the 11th floor of the CBN Head Office in Abuja.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn