Economy

MPC to Hold Rate Steady as Green Shoots of Recovery Emerge

By Meristem Research

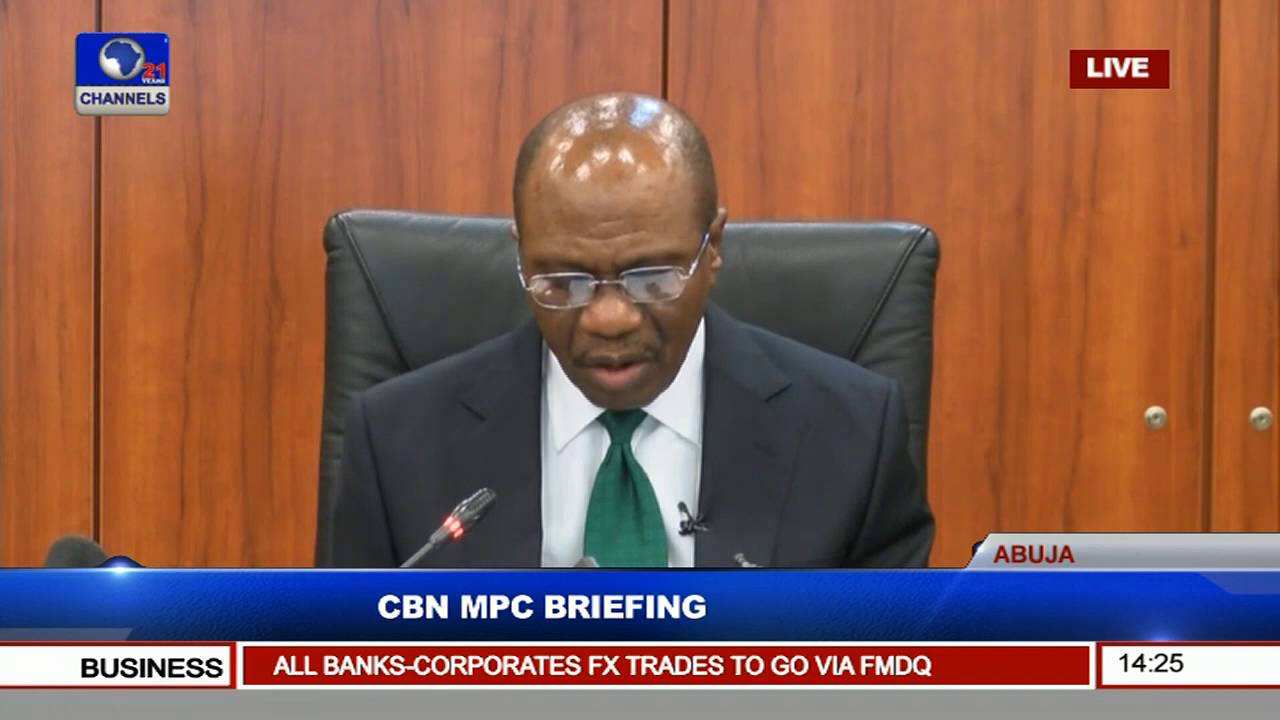

The fifth Monetary Policy Committee meeting is scheduled to hold on the 25th and 26th of September, 2017. The committee is expected to appraise the prevailing state of the Nigerian economy amidst the fragile economic growth, moderating inflation and improvement in FX liquidity, deliberate on these matters and thereafter reach a consensus on the way forward as it relates to achieving the ultimate goal of price stability and economic growth.

This report therefore assesses the state of the domestic economy so far in 2017, highlighting developments in economic indicators as well as financial market performance. Developments in the global economy since the last MPC meeting and their ripple effects on the Nigerian economy will also be evaluated viz a viz our expectations of the MPC’s decision.

With the need to foster economic growth whilst sustaining the current achievements witnessed in the year so far, a rate hike may not be deemed as appropriate. While we opine that the committee may be at crossroads between holding the rate steady and cutting it marginally to allow for some easing in the economy, we believe that ultimately, status quo will be maintained as the economy is still in a fragile growth phase and the MPC may be reluctant to thwart the progress recorded on the FX front by recommending a lower policy rate.

International Economies & Developments

Global Growth Remains on Track

The global economy remains on the path of expansion in line with expectations. The International Monetary Fund (IMF) in its revised July World Economic Outlook Update projected a 3.5% expansion in global growth. Growth in the US economy expanded by 2.6% in Q2:2017 amidst heightened uncertainty on its fiscal policy. In the UK, the economy also grew by 0.3% in the second quarter despite the slow progress recorded in Brexit negotiations. The same positive trend was observed across the EU, where the growth rate of the economy stood at 0.6% for the same period. In Asia, increased activity in the industrial sector drove China’s GDP in the second quarter to expand by 6.9% year on year (YoY). Similarly, Japan shot past expectations, recording a 1.0% growth in GDP.

Elusive Inflation Targets Lead Central Banks to Hold Rates

Inflation rates in most of the advanced economies, however, remained elusive relative to their targets. In the US and UK, inflation pegged at 1.7% and 2.9% respectively, against a target of 2% in both economies. The Fed expects inflation to stabilize around its 2% target in the medium term and consequently took a decision to hold interest rates. The Bank of England, on the other hand, maintained rates in what may be termed as a balancing act between returning inflation to its target and adopting a policy stance which is supportive of economic activity. Similarly, inflation rates in the EU and Japan are 1.5% and 0.5% respectively, which is significantly below their targets of 2%.

While the former considered the unchanged medium term outlook for growth and inflation in its decision to hold rates, the Bank of Japan (BoJ) which anticipates a rise in projected inflation, expects that an improvement in output gap should return inflation towards its target. We note that these stances may change depending on the prevailing economic conditions.

Oil Price Climbs in the Aftermath of Hurricanes Harvey and Irma

Two hurricanes, Harvey and Irma, recently hit Texas and Florida respectively in the US, leaving in its wake, the destruction of major oil refineries and also major obstruction to shale oil production. This has expectedly resulted in the increase in both the price of global crude oil as well as refined petroleum products in the US. We however expect that the price increase will be fleeting, as accumulated crude oil inventories will correct the price movement within weeks.

In a bid to drive inflation towards its target, Central Banks across advanced economies voted in their last meetings to hold interest rates constant. However, we posit that Nigeria’s current interest rate differential, along with the I&E FX window remains supportive of capital inflows and should continue to enhance FX liquidity. We anticipate this will weigh on the committee’s decision to maintain the MPR.

Domestic Economy

Economy gains Momentum advancing by 0.55% YoY in Q2:2017.

Following five (5) consecutive quarters of decline, the economy emerged from recession after recording a 0.55% YoY growth in Gross Domestic product (GDP) in Q2:2017. This was on the back of the reduced militant attacks in the Niger Delta region thus pushing oil production to higher levels, coupled with the relatively high oil prices, stable FX rate and sustained growth in the agricultural and industrial sectors.

Sequel to the revision of the Q1:2017 oil production, the oil sector recorded real growth of 1.64% YoY, after six (6) consecutive quarters of decline. This boosted the contribution to the total real GDP by 0.10% from 8.79% recorded in Q1:2017. Contributing 91.11% to the total real GDP in Q2:2017, the non-oil sector grew by 0.45% YoY on the back of growths recorded in the agricultural (3.01%), financial services (10.45%), utility (8.16%), mining (2.28%), manufacturing (0.64%) and construction (0.13%) sectors.

We expect the oil sector to continue on the growth path following the lifting of the force majeure on the Forcados terminal alongside the continued calm in the Niger Delta, which should trigger production back to previous levels. The successful implementation and execution of the 2017 budget and the Economic Recovery and Growth plan (ERGP) should also spur growth in the non-oil sector. Whilst considering the need to support growth alongside other policy objectives, we expect the MPC to maintain status quo.

Base Effect on Inflation to Wane Off

Following seven months of consecutive decline, inflation rate settled at 16.01% in August (vs. 18.72% in January, 2017). Despite the pressure on food prices during the year, the decline in inflation rate was significantly supported by the base effect alongside the CBN intervention in the foreign exchange market which has helped to stabilize the Naira.

Compared to previous months, the impact of the base effect was significantly moderated in August and should be eliminated going forward. The upside risk to inflation remains our expectation of continued upward pressure on food prices, alongside a possible hike in electricity tariff which should be more pronounced subsequently. We therefore expect the MPC to take into consideration the uncertainties around the sustainability of a downtrend in inflation and as such, we expect that the MPC will maintain status quo and hold the MPR at 14%.

Fiscal Policy

Rising Debt Levels amidst Declining Revenue

On the 5th of September 2017, the Debt Management Office (DMO) declared that the nation’s total debt; both Domestic and Foreign debt stood at NGN19.64tn as at 30th June 2017. Although the government has deployed strategies to boost revenue generation such as the Voluntary Assets and Income Declaration Scheme and community tax sensitization, we still see constrained growth in revenue leading to even higher debt levels. The recent issue of the non-conventional NGN100bn 7-year Ijarah Sukuk substantiates the government’s borrowing drive.

The government has been unable to meet their capital project commitments in the year due to declining revenue. This suggests the need to increase borrowings in the rest of 2017. Hence, we rule out the option to hike MPR, as this would further increase the cost of borrowing. Also, we do not expect a drop in MPR due to the expected expansionary effect from the 2017 budget implementation.

Polity and Insecurity

Sustained Tension as Biafra Agitation Resurfaces.

The lingering agitation for restructuring by the Indigenous People of Biafra (IPOB) has continued to cause strains on the state of peace in the nation, while also leading to a downturn in economic activities in the affected regions. Consequently, this has led to a further decline in the nation’s global peace index by 0.028 to 2.849. In its corruption survey, the National Bureau of statistics has revealed that an estimated total of 82.3million bribes were paid in Nigeria in the past year; ranking corruption as the third most important problem, trailing high cost of living and unemployment. On the back of continued efforts being put in place to tackle corruption, we expect this to be moderated in the near term.

Also, attacks on pipelines have significantly reduced over the months, following the continuous dialogue between the Federal Government and the various Niger Delta groups. This has also been ably supported by the sustained focus on prioritizing the successful execution of the amnesty program. Thus resulting in increased revenue from crude oil sales and steady foreign exchange inflows. We expect the sustenance of this current mood to significantly impact the economy’s growth for the remaining part of the year.

Monetary Policy

Increased Credit to Government

The money supply to the economy (M2) increased by 1.02% between May and July 2017, driven by the 2.53% and 0.71% increase in total demand deposits and short term liquid assets. In contrast, the currency in circulation (CIC) dipped by 6.75% to NGN1.77tn within the same period.

Similarly, the Net Domestic Credit (NDC) improved by 3.88% to NGN27.16tn in July 2017 (vs. NGN26.15tn in May 2017) which was propelled by the 1.10% growth in the credit to private sector (a major driver of NDC), as the credit to government also surged by 18.35%. The increased credit to government can be attributed to the continued attractiveness of yields in the fixed income space.

MPR Vs. MM Rates

Since the last MPC meeting, the OBB and OVN rates have shed 3.84% and 3.83% respectively. Subsequently, average money market rate closed at 11.75%, as at the 18th of September, 2017, representing a decline of 3.84%. Similarly, the Nigerian Inter-Bank Offered Rate (NIBOR) also recorded declines across all tenors as the average NIBOR closed at 17.45%.

In the period under review, system liquidity remained moderate as the CBN continued interventions in the interbank market via OMO, T-bills and FX auctions. Given CBN’s continued intervention in the market, we expect system liquidity and rates to remain at current levels in the near term.

External Reserves and FOREX

Since the last MPC meeting, foreign reserves have advanced by 3.66% from USD30.69bn to USD31.81bn as at the 15th of September, 2017. We believe that this increase was as a result of the improved production volumes coupled with the rise in global oil price in the period. The marked reduction in insurgency in the Niger-Delta region, alongside the resumption of the Forcados line contributed to the increased volume from an average of 1.69mbpd in Q1:2017 to 1.84mbpd in Q2:2017.

Also, since the last MPC meeting, the Naira has remained relatively stable at both markets, trading within the range of NGN305.50 and NGN306.65 at the interbank market and NGN363.00 and NGN370.00 at the parallel market. However, when compared to the 18th of September, 2017, the Naira depreciated marginally by 0.05% and 0.54% at the interbank and parallel markets respectively.

In the period under review, the CBN continued to intervene in the market through the supply of FX to the banks, while the operations of the FX windows continued to ensure liquidity in the market. Barring any significant change in the current stance, we expect the exchange rate to remain stable in the near term.

Fixed Income Yield Environment and Outlook

Activities in the fixed income space have remained bullish since last MPC meeting as average Treasury bills and bonds rate declined by 0.83% and 0.91% to close at 18.38% and 15.53% as at the 18th of September, 2017. In the secondary market for Treasury bills, yields declined on all tenors, save for the 1M tenor which recorded a 1.55% advancement in yield. Similarly, in the Treasury bonds space, yields declined on four (4) bonds, offsetting the advancements recorded on eleven (11) bonds.

On the 9th of August 2017, the Federal Government announced its intention to refinance maturing Treasury bills with USD3bn through external borrowing. We believe that this may cause decline in yields in the Treasury bills space in the near term.

In a bid to expand the available financing options, the Federal Government introduced its first ever Sukuk bond which went on offer on Thursday, the 14th of September, 2017 and will close on the 20th of September, 2017. The Seven-year Ijarah Sukuk worth NGN100bn will be offered at a rental rate of 16.47%.

We note that the committee’s decision to maintain the current policy stance saw foreign Portfolio investments into the economy remain buoyant so far in 2017. Recent data from the CBN showed that FPI inflows was at its highest point of USD466.45mn in July 2017 (vs. USD67.85mn in January 2017). Given that the attraction of foreign investors remains a priority, we expect that the MPC committee would vote to maintain the current monetary stance.

Equities Market Performance and Outlook

The equities market recorded significant activities from the last MPC meeting to date. We attribute this to investors’ positive reaction to the favourable half year financial scorecards released by most listed companies. This pushed the NSEASI to its highest point in the year at 38,198.60 on the 11th of August 2017. However, on the back of the profit taking that ensued afterwards, the Year to Date return settled at 29.76% on the 18th of September, 2017 from 42.14% on 11thAugust and 32.22% on 25th July, 2017.

As we expect the Nigerian economy to continue to improve, we believe that the equities market, which is a leading indicator, will also reflect this positivity. Also, we believe that the MSCI Index weighting rebalancing for Nigeria which is set for November as well as the release of Q3:2017 earnings scorecard, will further drive the market in the near term.

On a Balance of Factors…

At the July MPC meeting, the committee noted stifle private sector investment which can be attributed to the lack of credit flows to the real economy and the waning base effect of inflation amongst others as major headwinds which could spur the need for both expansionary and contractionary policies.

We however posit that in a bid to attain the ultimate goal of price stability, the decisions around abating expected inflationary pressures in the near term will be a key focus at the next MPC meeting. Also, in line with the seeming relative convergence of the interbank and parallel FX market rates, improvements in oil production and price and expected fiscal stimulus, we believe the MPC will not want to negate their decisions which seem to have yielded good fruit.

Consequently, we expect the MPC to make the following decisions:

- Retain the MPR at the current level of 14%

- Retain liquidity ratio at 30%.

- Retain the asymmetric corridor at +200bp/-500bp.

- Retain the CRR at 22.5%.

Economy

Shettima Blames CBN’s FX Intervention for Naira Depreciation

By Adedapo Adesanya

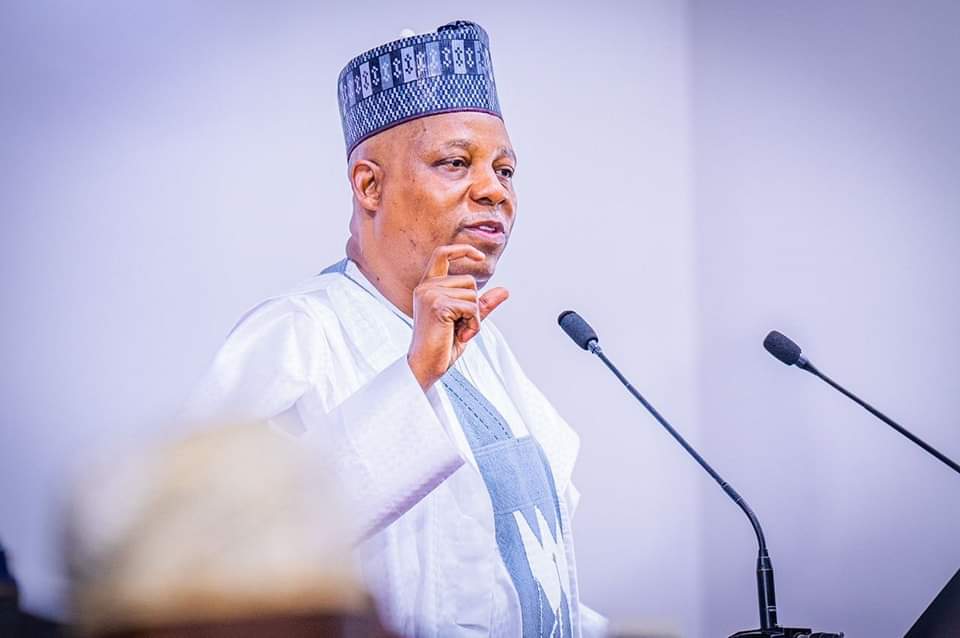

Vice President Kashim Shettima has attributed the Naira’s recent depreciation to the intervention of the Central Bank of Nigeria (CBN) in the foreign exchange (FX) market, stating that the currency could have strengthened to around N1,000 per Dollar within weeks if the apex bank had allowed market forces to prevail.

The local currency has dropped over N8.37 on the Dollar in the last week, as it closed at N1,355.37/$1 on Tuesday at the Nigerian Autonomous Foreign Exchange Market (NAFEM), after it went on a spree late last month and into the early weeks of February.

However, speaking on Tuesday at the Progressive Governors’ Forum (PGF), Renewed Hope Ambassadors Strategic Summit in Abuja, the Nigerian VP said the intervention was to ensure stability.

“In fact, if not for the interventions by the Central Bank of Nigeria yesterday, the 1,000 Naira to a Dollar we are going to attain in weeks, not in months. But for the purpose of market stability, the CBN generously intervened yesterday.

“So, for some of my friends, especially one of our party leaders who takes delight in stockpiling dollars, it is a wake-up call,” the vice president said.

He was alluding to CBN buying US Dollars from the market to slow down the rapid rise of the Naira.

Latest information showed that last week, the apex bank bought about $189.80 million to reduce excess Dollar supply and control how fast the Naira was gaining value.

The move was aimed at preventing foreign portfolio investors from exiting Nigeria’s fixed-income market, as large-scale sell-offs could heighten demand for US Dollars, intensify capital flight, and exert further pressure on the exchange rate.

Amid this, speaking after the 304th meeting of the monetary policy committee (MPC) of the CBN on Tuesday, Governor of the central bank, Mr Yemi Cardoso, said Nigeria’s gross external reserves have risen to $50.45 billion, the highest level in 13 years.

This strengthens the country’s foreign exchange buffers, enhances the apex bank’s capacity to defend the Naira when needed, and boosts investor confidence in the stability of the Nigerian FX market.

Economy

Dangote Refinery Exports 20 million Litres Surplus of PMS

By Aduragbemi Omiyale

Up to 20 million litres in surplus of Premium Motor Spirit (PMS), otherwise known as petrol, is being exported daily by the Dangote Petroleum Refinery and Petrochemicals after supplying about 65 million litres to the domestic market.

Nigeria’s average daily petrol consumption stands at between 50 and 60 million litres, indicating that the refinery’s output exceeds current domestic requirements, marking a decisive break from decades of fuel import dependence and recurrent scarcity.

The president of Dangote Group, Mr Aliko Dangote, speaking in Lagos, while confirming a structured offtake agreement with selected marketers to ensure nationwide distribution and eliminate supply instability, said the structured model was designed to eliminate supply bottlenecks and curb speculative practices that have historically triggered disruptions.

“We have agreed an offtake framework to supply up to 65 million litres daily for the domestic market. Any surplus, estimated at between 15 and 20 million litres, will be exported,” he said.

Under a revised distribution framework endorsed by the Nigerian Midstream and Downstream Petroleum Regulatory Authority, the refinery will channel nationwide supply through major marketing companies, including MRS Oil Nigeria Plc, Nigerian National Petroleum Company Limited Retail (NNPC), 11 plc (Mobil Producing Nigeria), TotalEnergies Marketing Nigeria Plc, Rainoil Limited, Northwest Petroleum & Gas Company Limited, Ardova Plc, Bovas & Company Limited, AA Rano Nigeria Limited, AYM Shafa Limited, Conoil and Masters Energy.

With local refining now exceeding national demand, the country stands to conserve billions of dollars annually in foreign exchange previously spent on petrol imports. Analysts say this would ease pressure on the naira, strengthen external reserves, and improve trade balance stability.

Economy

NECA, CPPE Laud CBN’s 0.50% Interest Rate Cut

By Adedapo Adesanya

The Nigeria Employers’ Consultative Association (NECA) and the Centre for the Promotion of Private Enterprise (CPPE) have separately commended the Central Bank of Nigeria (CBN) for reducing the Monetary Policy Rate (MPR) from 27.0 per cent to 26.5 per cent at its 304th Monetary Policy Committee (MPC) meeting.

In reaction, NECA Director-General, Mr Adewale-Smatt Oyerinde, praised the decision in a statement, noting that the 50 basis-point cut is “a cautious but noteworthy signal” that authorities were responding to sustained pressures on businesses.

He said the marginal reduction might not immediately lower lending rates, but reflected “a gradual shift toward supporting growth without undermining price stability”.

According to him, the overall stance remained tight, with the Cash Reserve Ratio retained at 45 per cent and the liquidity ratio at 30 per cent.

He added that the asymmetric corridor around the MPR was also maintained, reinforcing a cautious monetary approach.

“With a substantial portion of deposits still sterilised, banks’ capacity to expand credit to the real sector may remain constrained in the near term,” he said.

Mr Oyerinde described the move as “a careful balancing act” aimed at moderating inflation without worsening pressures on businesses.

He noted that firms continued to grapple with high operating costs, exchange rate volatility and weakened consumer demand.

“Inflation, particularly in food, energy and transportation, remains a significant challenge to employers and households,” he said.

He stressed that the modest easing must be supported by coordinated fiscal and structural reforms to address supply-side constraints.

Such reforms, he said, should improve infrastructure and enhance productivity across key sectors of the economy.

Mr Oyerinde urged financial institutions to ensure the MPR reduction was gradually reflected in lending conditions for manufacturers and SMEs.

He affirmed that although the MPC had not fully relaxed its tightening stance, the rate cut signalled cautious optimism.

“Sustained improvements in inflation, exchange rate stability and investor confidence will determine scope for further easing that supports growth and employment,” he said.

On its part, the CPPE said the decision reflected improving macroeconomic fundamentals and a cautious shift from aggressive tightening.

The organisation noted that sustained disinflation, stronger external reserves, an improved trade balance and relative exchange-rate stability had created room for monetary easing.

It said the rate cut could boost investor confidence and support private-sector growth, but cautioned that weak monetary transmission might limit its impact on lending rates.

The CPPE identified high cash reserve requirements, elevated lending rates, government borrowing and structural banking costs as major constraints to effective transmission.

The group also stressed the need for fiscal consolidation, citing high public debt, persistent deficits and rising debt-service obligations as risks to macroeconomic stability.

According to the chief executive of CPPE, Mr Muda Yusuf, effective policy coordination and stronger transmission mechanisms were critical to unlocking investment and sustaining growth, lauding the CBN for what he described as a measured and data-driven policy adjustment.

The CPPE boss noted that the easing reflected strengthening macroeconomic performance, declining inflation, growing reserves, improved trade balance and enhanced foreign exchange stability.

Mr Yusuf added that for the benefits of monetary easing to be fully realised, authorities must strengthen transmission to ensure lower lending rates for the real sector and advance credible fiscal consolidation to safeguard stability.

He said that if supported by structural reforms and disciplined fiscal management, the current policy direction could unlock a stronger investment cycle and more durable economic growth.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn