Economy

NEITI Calls for Review of Oil Producing Agreements

By Modupe Gbadeyanka

The need to urgently review the Deep Offshore and Inland Basin Production Sharing Agreement between Nigeria and oil companies has been stressed by the Nigeria Extractive Industries Transparency Initiative (NEITI).

In a statement signed by its Director in charge of Communications and Advocacy, Dr Orji Ogbonnaya Orji, the agency explained that the urgency to review the obsolete legislation without further delay was in view of the revenue losses to the federation by the use of the old agreement in computation of revenues to be shared between the government and oil companies.

NEITI recalled that the Deep Offshore and Inland Basin Production Sharing Contracts Act of 1993 provides for: “ a review of the terms when prices of oil crosses $20 in real term; and a review of the terms 15 years after operation of the agreement and five years subsequently.”

However, NEITI said it observes with concern that Nigeria was yet to adhere to this important provision even now that the price of oil was revolving around $70 per barrel.

In an Occasional Paper released by NEITI which reviewed three years of NNPC’s financial and operations reports, NEITI has noted that crude oil production under the Production Sharing Contracts (PSCs) has since overtaken production under the Joint Venture arrangements.

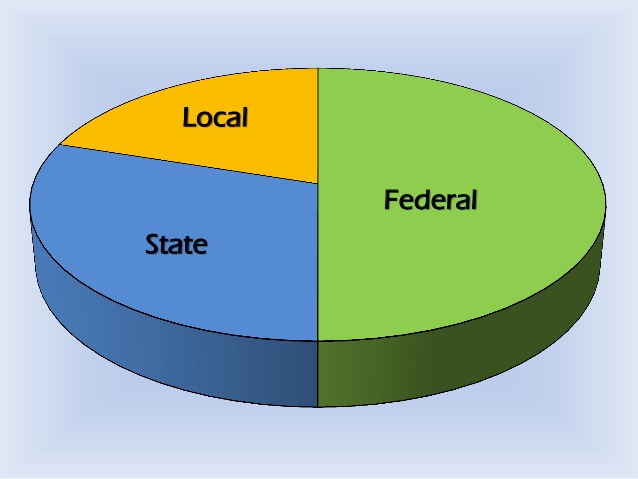

A careful look shows that the Production Sharing Contracts (PSCs) accounted for 44.8 percent of total oil production while the Joint Ventures (JVs) contributed 31.35 percent.

A historical analysis of this development by NEITI shows that JV Companies accounted for over 97 percent of Production in 1998 while PSCs contributed only 0.50 percent.

This trend continued until 2012 when PSCs accounted for 37.58 percent while JVs contributed 36.91 percent.

From the publication in 2013, PSCs contributed 39.22 percent while JVs contributed 36.65 percent, 2014: PSCs; 40.10 percent and JVs 32.10 percent; 2015: PSCs 41.45 percent and JVs 31.99 percent while in 2017 the contributions stood at PSCs 44.32 percent and 30.85 percent respectively.

The NEITI Occasional Paper further explained that: “Other companies, comprising Nigerian Petroleum Development Company (NPDC), Alternative Financing (AF), and Independent/ Marginal Fields contributed 2.39 percent to total production in 1998 and by 2017 this had risen to 24.83 percent.

“This figure clearly shows the changing structure of oil production in Nigeria, where PSCs (which contributed a mere 0.5 percent to total production 20 years ago) have dramatically overtaken JVs (which contributed 97 percent to total production 20 years ago)”.

Between 2015 and 2017 covered by NEITI’s Occasional Paper review of NNPC Report, Nigeria produced 2.126 billion barrels of crude oil and condensate.

A Further review of the NNPC Report shows that: “Production was highest in 2015 with 775.6 million barrels produced. Production was lowest in 2016 with 661.1 million barrels produced, while production in 2017 was 690 million barrels.

“The year 2016 was a difficult year for oil production because production was shut in a number of oil terminals”.

NEITI said its major concern is that now that the PSCs account for about 50 percent of total oil production and major source of revenues, the delay or failure to review and renew the agreement means that payment of royalty on oil production under PSCs would not be made while computation of taxes would be based on the old rates.

On lifting of crude oil, the NNPC Monthly Financial and Operations Report disclosed “international oil companies (IOCs) lifted more crude oil than the government.

“Total lifting of crude oil and condensates was 2.135 billion barrels. Of this sum, IOCs and Independents lifted a total of 1.367 billion barrels, while government’s lifting by NNPC was 721.16 million barrels.

“This means that the operators lifted 64.01 percent of total crude lifting’s, while government through NNPC lifted 33.76 percent. When expressed in monetary terms, total government lifting of oil amounted to $35.893 billion while the figure for IOCs and Independents was $68.591 billion”

The NNPC Report further disclosed that refineries received 15.15 percent of total domestic crude lifting out of which 41.32 percent was utilized under the Direct Sale Direct Purchase (DSDP) program of NNPC.

On Refineries and domestic crude utilization, the report disclosed that for the 3 years under review, Nigeria’s refineries recorded an average capacity utilization of 12.26 percent.

A further breakdown shows that Kaduna refinery had the lowest capacity utilization of 9 percent while Warri and Port Harcourt recorded 9.73 percent and 15.4 percent respectively.

One striking feature of the NNPC financial operations report is the disclosure that the corporation lost the sum of N547 billion in its operation between 2015 and 2017.

Out of this amount, the NNPC Corporate Headquarters recorded the highest revenue loss to the tune of N336.268 billion.

On the contrary, the report revealed that the Nigeria Gas company made a huge profit of N141.324 billion.

NEITI said while it applauds the monthly voluntary disclosures by the NNPC, it was important to note that NEITI through its auditors under the EITI framework has not independently verified the information and data from the NNPC reports.

“NEITI has not, except for the year 2015, independently validated the data from NNPC. This will be done in ongoing and future reconciliation reports. What has been done here is a preliminary analysis of the data that NNPC has made available for the three-year period. The figures examined here do not represent the sum total of all revenues from the sector, as other payment streams like royalties and taxes from JVs, signature bonuses, transportation rental fees, NESS fees, penalties and others are not covered by the NNPC financial and operational reports” the NEITI Report concluded.

NEITI however commended the NNPC for the reconciliation of the crude swap under-delivery transaction executed during the crude- for- product- swap.

NEITI also urged the corporation to sustain the new spirit of openness while encouraging the citizens to use the information and data from the NNPC’s disclosures to promote public debate required in implementing the on-going reforms in the extractive sector.

The NEITI Occasional Paper series which reviewed the 3 years of NNPC operations and financial reports is the third in the series. In the pursuit of EITI global Open Data Policy, NEITI has data set for the three years (2015 -2017) in excel format readily available on its website in support of public interest, analysis and debate.

Economy

Naira Trades N1,390/$1 at Parallel Market, N1,335/$1 at Official Market

By Adedapo Adesanya

It was another wonderful day for the Nigerian Naira in the different segments of the foreign market (FX) market on Tuesday, February 17, as it appreciated against the United States Dollar at the close of business.

In the parallel market, it improved its value on the greenback by N30 to sell for N1,390/$1 compared with the previous day’s rate of N1,420/$1, and at the GTBank forex desk, it gained N4 to trade at N1,363/$1 versus the preceding session’s N1,367/$1.

As for the official market, which is known as the Nigerian Autonomous Foreign Exchange Market (NAFEX), the local currency gained N11.82 or 0.88 per cent to close at N1,335.96/$1 versus Monday’s price of N1,347.78/$1.

In the same segment of the market, the domestic currency chalked up N32.43 against the Pound Sterling to finish at N1,806.75/£1 compared with the previous day’s N1,839.18/£1, and gained N18.82 on the Euro to close at N1,579.24/€1 compared with the N1,598.06/€1 it was traded a day earlier.

Improved foreign exchange supply levels following recent high demand pressures helped to sustain the currency’s advance. A portion of the delayed demand was eliminated with licensed Bureau De Change (BDC) businesses fully helping to alleviate any development.

While other supply sources, including exporters, non-bank corporations, and other market actors, pause stoked pressures on the exchange rate, their presence is anticipated to increase liquidity and flow.

Foreign reserves were last reported at $47.80 billion after appreciating by $135.75 million. The build-up in reserves has been supported by favourable external conditions, including stronger oil-related inflows and improved FX market stability.

The market is looking forward to a rate cut when the Monetary Policy Committee (MPC) meets next week after inflation decelerated further to 15.10 per cent.

Meanwhile, the cryptocurrency market was down as software stocks continued to plunge, creating a ripple effect on the digital assets.

Market analysts noted that consolidation is expected as crypto searches for a new narrative strong enough to pull capital back from AI stocks and commodities.

Litecoin (LTC) declined by 1.8 per cent to $53.99, Bitcoin decreased by 1.7 per cent to $67,446.46, Cardano (ADA) dropped 1.5 per cent to trade at $0.2810, Binance Coin (BNB) slumped 1.4 per cent to $617.60, Solana (SOL) depreciated by 0.9 per cent to $84.97, Ripple (XRP) shrank by 0.7 per cent to $1.47, and Dogecoin (DOGE) went down by 0.04 per cent to $0.1005.

On the flip side, Ethereum (ETH) appreciated by 0.2 per cent to $1,992.22, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 apiece.

Economy

Oil Dips 2% Amid Progress in US-Iran Nuclear Talks

By Adedapo Adesanya

Oil was down by about 2 per cent on Tuesday on hopes tensions between the United States and Iran were easing after Iran’s foreign minister said the countries had reached an understanding regarding nuclear talks.

Brent futures fell $1.23 or 1.8 per cent to $67.42 a barrel, and the US West Texas Intermediate (WTI) futures slipped 56 cents or 0.9 per cent to $62.33 per barrel.

According to Iranian Foreign Minister, Mr Abbas Araqchi, his country and the United States reached an understanding on the main “guiding principles” in a second round of indirect talks in Geneva, Switzerland, over their nuclear dispute on Tuesday.

However, this does not mean a deal is imminent.

Iran’s supreme leader said on Tuesday that any US attempt to depose his government would fail as the US continued a military buildup exercise in the Middle East.

Iran will close parts of the critical oil shipping lane in the Middle East, the Strait of Hormuz, for a few hours on Tuesday as it is conducting military drills in the area. The government said the partial closure is due to security precautions.

The Strait of Hormuz, the narrow lane between Iran and Oman, is the world’s most critical oil transit chokepoint, and the oil market has time and again feared Iran could attempt to close the lane. In 2024, oil flow through the strait averaged 20 million barrels per day, or the equivalent of about 20 per cent of global petroleum liquids consumption.

Iran and fellow Organisation of the Petroleum Exporting Countries (OPEC) members Saudi Arabia, United Arab Emirates, Kuwait and Iraq export most of their crude via the Strait, mainly to Asia.

Negotiators from Ukraine and Russia concluded the first of two days of US-mediated peace talks in Geneva on Tuesday, with US President Donald Trump pressing Ukraine to act fast to reach a deal to end the four-year conflict.

Meanwhile, Ukraine continued its attacks on Russian energy infrastructure. Its military said on Tuesday it struck the Ilsky refinery, while a drone attack was also reported at the port of Taman.

A peace resolution could see a lifting of sanctions on Russia, bringing Russian oil back to the mainstream market. In 2025, Russia was the third-biggest crude producer in the world behind the United States and Saudi Arabia.

Economy

MTN Reaches $6.2bn Deal to Fully Own IHS Towers

By Adedapo Adesanya

MTN Group has agreed to take full control of IHS Holding, buying the roughly 75 per cent stake it does not already own in a deal that values the tower operator at about $6.2 billion.

According to a statement, MTN, which is Africa’s biggest mobile operator, will pay $8.50 per share in cash.

The deal will be funded through the rollover of MTN’s existing stake of around 24% in IHS, as well as about $1.1 billion in cash from MTN, roughly $1.1 billion from IHS’s balance sheet, and the rollover of no more than existing IHS debt.

The offer represents a 239 per cent premium to the company’s share price when it announced a strategic review on March 12, 2024, a 36 per cent premium to its 52-week volume-weighted average price as of February 4, 2026, and a three per cent premium to its unaffected closing price of $8.23 on that same date.

The transaction will see MTN transition from being a minority shareholder in IHS to a full owner. Upon completion, IHS will delist from the New York Stock Exchange and become a wholly owned subsidiary of MTN.

For MTN, the deal represents a decisive shift as data demand surges and digital infrastructure becomes increasingly strategic with a booming digitally-oriented youth population on the continent.

Over the past decade, many African telecom operators sold tower assets to independent infrastructure firms to unlock capital and reduce balance sheet pressure. This marks a reversal of the trend.

MTN itself had reduced its direct exposure to tower ownership, retaining a roughly 24 per cent fully diluted stake in IHS before the agreement.

Speaking on this, Mr Ralph Mupita, group president and CEO, MTN Group, described the proposed acquisition as a pivotal step in strengthening MTN’s strategic and financial position in a future where digital infrastructure will be central to Africa’s development.

He said the deal would enhance MTN’s ability to partner with governments and support long-term connectivity growth across its markets.

“This proposed transaction is a pivotal step in further strengthening MTN Group’s strategic and financial position for a future where digital infrastructure will become ever more essential to Africa’s growth and development,” he said.

The board of IHS unanimously approved the agreement and recommended that shareholders vote in favor.

MTN has committed to vote all its shares in support of the deal, while long-term shareholder Wendel has also issued a letter backing the transaction. Together, they account for more than 40 per cent of shareholder support already secured.

On his part, Mr Sam Darwish, chairman and CEO of IHS, said the agreement offers shareholders certainty and immediate value realisation following a strategic review launched during a period of macroeconomic and geopolitical volatility across key markets.

Founded 25 years ago with a single tower in one market, IHS grew into one of the world’s largest independent tower companies by count, operating in 11 countries and managing approximately 40,000 towers at its peak.

If completed, the acquisition will create the largest standalone and integrated tower company in Africa under MTN’s control, tightening the alignment between network operations and physical infrastructure in a region where connectivity remains both a commercial battleground and a development imperative.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn