Economy

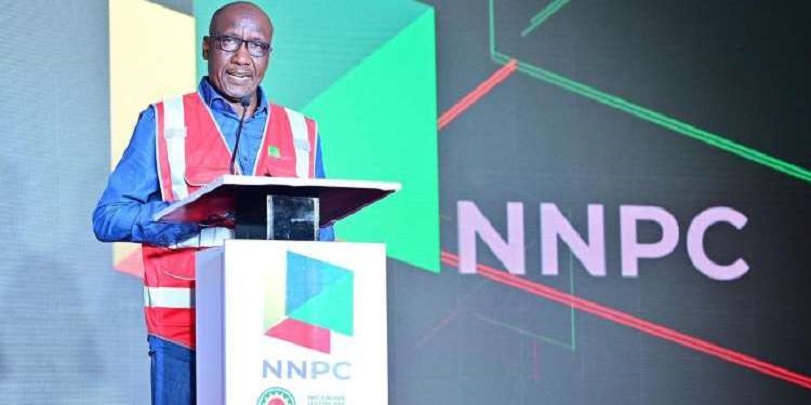

New NNPC Will Guarantee Energy Security in Nigeria—Buhari

By Adedapo Adesanya

President Muhammadu Buhari has revealed that the new Nigerian National Petroleum Company (NNPC) Limited will guarantee energy security in the country.

He made this disclosure on Tuesday when he unveiled the new company in Abuja.

Mr Buhari, who was accompanied by the Senate President, Mr Ahmad Lawan; and Speaker of the House of Representatives, Mr Femi Gbajabiamila, among other dignitaries at the State House Conference Centre, said the new private company would also support sustainable growth across other sectors of the economy as it delivers energy to the world.

“We are transforming our petroleum industry, to strengthen its capacity and market relevance for the present and future global energy priorities,” the President was quoted as saying in a statement by his spokesman, Mr Femi Adesina.

According to the President, NNPC Limited will sustainably deliver value to its over 200 million shareholders and the global energy community; operate without relying on government funding and be free from institutional regulations such as the Treasury Single Account (TSA).

The President, therefore, assured stakeholders in the industry that Africa’s largest NOC will adhere to its fundamental corporate values of Integrity, Excellence and Sustainability while operating as a commercial, independent and viable NOC at par with its peers around the world.

He added that the company would focus on becoming a dynamic global energy company of choice to deliver energy for today, for tomorrow, and for the day days after tomorrow.

“Our country places a high premium on creating the right atmosphere that supports investment and growth to boost our economy and continue to play an important role in sustaining global energy requirements.

“We are transforming our petroleum industry, to strengthen its capacity and market relevance for the present and future global energy priorities.

“By chance of history, I was privileged to lead the creation of the Nigerian National Petroleum Corporation on the 1st July 1977. 44 years later, I was again privileged to sign the Petroleum Industry Act (PIA) in 2021, heralding the long-awaited reform of our petroleum sector.

“The provisions of PIA 2021, have given the Nigerian petroleum industry a new impetus, with an improved fiscal framework, transparent governance, enhanced regulation and the creation of a commercially-driven and independent National Oil Company that will operate without relying on government funding and free from institutional regulations such as the Treasury Single Account (TSA), Public Procurement and Fiscal Responsibility Acts.

“It will, of course, conduct itself under the best international business practice in transparency, governance and commercial viability.

“Coincidentally, I, on the 1st of July 2022 authorized the transfer of assets from the Nigerian National Petroleum Corporation to its successor company, the Nigerian National Petroleum Company Limited, and steered the implementation leading to the unveiling of Africa’s largest National Oil Company today,” he stated.

He thanked the leadership and members of the National Assembly for demonstrating uncommon courage and patriotism in the passage of PIA that culminated in the creation of NNPCL.

In his remarks, the Minister of State for Petroleum Resources, Mr Timipre Sylva, said with the signing of the PIA, which assures international and local oil companies of adequate protection for their investments, the nation’s petroleum industry is no longer rudderless.

Mr Sylva described the unveiling of NNPC Limited as a new dawn in the quest for the growth and development of the Nigerian Oil and Gas Industry, opening new vintages for partnerships.

He thanked the President for his unparalleled leadership, steadfastness, and unalloyed support for ensuring that the country’s oil and gas industry is on a sound footing.

The Group Chief Executive Officer of NNPC Limited, Mr Mele Kyari, stated that the company had adopted a strategic initiative to achieve the mandate of energy security for the country by rolling out a comprehensive expansion plan to grow its fuel retail presence from 547 to over 1,500 outlets within the next six months.

Economy

Nigeria to Export New Crude Grade Cawthorne in March

By Adedapo Adesanya

The Nigerian National Petroleum Company (NNPC) Limited is set to commence export of a new light, sweet crude grade known as Cawthorne from March 2026.

According to a report by Reuters, an NNPC spokesperson confirmed the development, describing it as part of efforts to increase output and consolidate Nigeria’s recent recovery in crude oil production.

The move aligns with Nigeria’s broader strategy to boost production after years of constraints caused by pipeline vandalism, crude theft, and unrest in oil-producing regions.

This follows the launch of two other new grades, Obodo in 2025 and Utapate in 2024, Nigeria, whic,h as Africa’s top oil exporter, seeks to strengthen its standing within the Organisation of the Petroleum Exporting Countries and its allies (OPEC+)

Cawthorne crude is scheduled for export in the third week of March and has an API gravity of 36.4, making it similar in quality to Nigeria’s Bonny Light, which is prized for high petrol and diesel yields.

According to Reuters, citing a trading source, the state oil national company issued a tender last week for cargo loading between March 24 and 25.

Analysts at Kpler noted that the new grade is expected to be exported via the Floating Storage and Offloading (FSO) vessel Cawthorne, which has a storage capacity of about 2.2 million barrels. The vessel is designed to enhance transportation and production from Oil Mining Lease (OML) 18 and nearby assets in the Eastern Niger Delta.

Kpler estimates that, based on storage capacity, Cawthorne could increase Nigeria’s crude and condensate output from roughly 1.65 million barrels per day to around 1.7 million barrels per day for the remainder of the year.

Nigeria’s crude oil production recently dropped from the OPEC+ quota of 1.5 million barrels per day, with output at 1.48 million barrels per day recorded in January, according to OPEC data.

Beyond increasing Nigeria’s crude offerings to the international market, the introduction of Cawthorne could also attract buyers seeking specific light, sweet crude qualities, buoy foreign exchange earnings, which would help strengthen government revenue and ease borrowing needs.

New crude grades are typically differentiated by sulfur content, API gravity, and production source, enabling producers to target specific refinery configurations and market segments.

In November 2024, NNPC officially launched the Utapate crude oil blend in the international market, describing it as a milestone for Nigeria’s export profile.

Earlier in July 2024, NNPC and its partner, Sterling Oil Exploration & Energy Production Company (SEEPCO), lifted the first 950,000-barrel cargo of Utapate crude, which was shipped to Spain.

Economy

Moniepoint Research Shows Diminishing Role of Cash in Nightlife Payments

By Modupe Gbadeyanka

A new report released by Africa’s leading all-in-one financial ecosystem, Moniepoint Incorporated, has revealed that the use of cash for financial transactions is gradually dying due to security concerns.

The study, which looked into transaction data of over 27,000 clubs, bars, and lounges, showed that bank transfers dominated, followed closely by card payments, with cash actively discouraged. It was observed that transfers outpace card payments by nearly 2 million transactions during peak nighttime hours across its network.

In the research titled The Business of Community Nightlife in Nigeria, findings provided a rare, data-driven look into the country’s informal night economy.

While high-end Detty December venues grabbed headlines with daily revenues of N360 million and table prices reaching N1.2 million, Moniepoint’s study shifted the spotlight to the “community nightlife” where roadside bars, suya spots, and neighbourhood joints form the bedrock of social life for millions of Nigerians.

One of the study’s most operationally significant findings concerns the timing of spending. Nightlife in Nigeria runs late, but economically, the night is decided early.

Transaction volumes begin climbing sharply from 8 pm, peak before midnight, and then decline steadily even as venues remain full. By the time the night is at its longest, purchasing activity has already wound down.

However, for bar operators, this has clear practical implications – the most critical hours for staffing, stocking, vendor payment and cash flow management are the earliest hours of the day between midnight and 6 am.

The report further underscores the sector’s role in employment, noting that local bars typically expand their workforce by 30-50 per cent on peak nights. Conservative estimates suggest that at least 54,000 people are engaged in nightlife labour every night across Nigeria.

It was also observed that the most common transaction narrations from the data sourced – “food”, “pay”, “sent”, “pos”, “cash” – reflect the full breadth of nightlife spending: street food, club entry, lounge tabs, transport, and afterparties. Digital payments have gained huge traction in Nigeria’s social space.

While alcohol remains a key revenue driver, the data shows that food is the quiet stabiliser of Nigeria’s night economy, particularly in local and informal settings. In several neighbourhood venues, bottled water and meals outsell beer and spirits, especially early in the evening.

Lagos leads in sheer concentration of nightlife establishments, with 4,856 bars, clubs, and lounges on the Moniepoint network. FCT follows with 2,515, then Rivers (2,362), Delta (1,930), and Edo (1,574).

Katsina leads the country in nighttime food truck payment value, with vendors pulling in over N130 million in the last 12 months. Kwara State leads in transaction count. Nigeria’s nightlife economy is distributed, not overly elitist.

On the lending side, the report noted that a significant share of loan requests from bar and lounge operators is directed toward renovations, furniture, lighting, and sound systems, showing that investments are intended to attract and retain customers in a competitive sector where ambience plays a decisive role.

Commenting on the report, the chief executive of Moniepoint, Mr Tosin Eniolorunda, said, “Nigeria’s local bars and night-time operators are not peripheral to the economy; they are a critical part of its architecture. We see a substantial and sustained economic sector that employs hundreds of thousands of Nigerians every night and deserves the same attention we give to agriculture, healthcare, and retail.

“Our goal is to make sure every one of those businesses has the tools to grow. From giving credit to finance renovations and sound systems to providing same-day settlement that allows vendors to restock and with tools like Moniebook that power inventory management and reconciliation, Moniepoint is ensuring that this vital artery of the nation’s economy remains viable and empowering.”

Economy

CBN Reduces Interest Rate by 50 Basis Points to 26.50%

By Adedapo Adesanya

The Central Bank of Nigeria (CBN) has cut the interest rate by 50 basis points to 26.50 per cent from 27 per cent.

Nigeria’s apex bank announced this during its two-day 304th Monetary Policy Committee (MPC) meeting, which concluded on Tuesday in Abuja.

This comes after the country’s interest rate cooled in January to 15.10 per cent from 15.15 per cent, according to the National Bureau of Statistics (NBS), strengthening the case for a reduction.

The CBN Governor, Mr Yemi Cardoso, said all members of the MPC unanimously agreed upon the decision.

“The committee decided to reduce the monetary policy rate by 50 basis points to 26.50 per cent,” he said.

Mr Cardoso stated that the liquidity ratio was maintained at 30 per cent, and the standing facilities corridor was adjusted to +50 to -450 basis points around the monetary policy rate.

He said the committee retained the Cash Reserve Ratio (CRR) at 45 per cent for commercial banks and 16 per cent for merchant banks, while the 75 per cent CRR on non-TSA public sector deposits was equally maintained.

The CBN uses the MPR, which works as the benchmark interest rate, to manage inflation, macroeconomic stability, and liquidity.

Last November, the MPC retained the Monetary Policy Rate (MPR) at 27.00 per cent. The last time the apex bank cut interest rates was in September last year, to 27 per cent from 27.50 per cent after a series of easing in inflation.

Market analysts had argued for higher interest cuts due to results seen in the CBN’s inflation targeting framework. Meanwhile, some say the 50 basis points reduction will offer a temporary reprieve as inflation heads for a single-digit target in the coming months.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn