Economy

NGX Develops Framework for Certifications in Carbon Credits Trading

By Dipo Olowookere

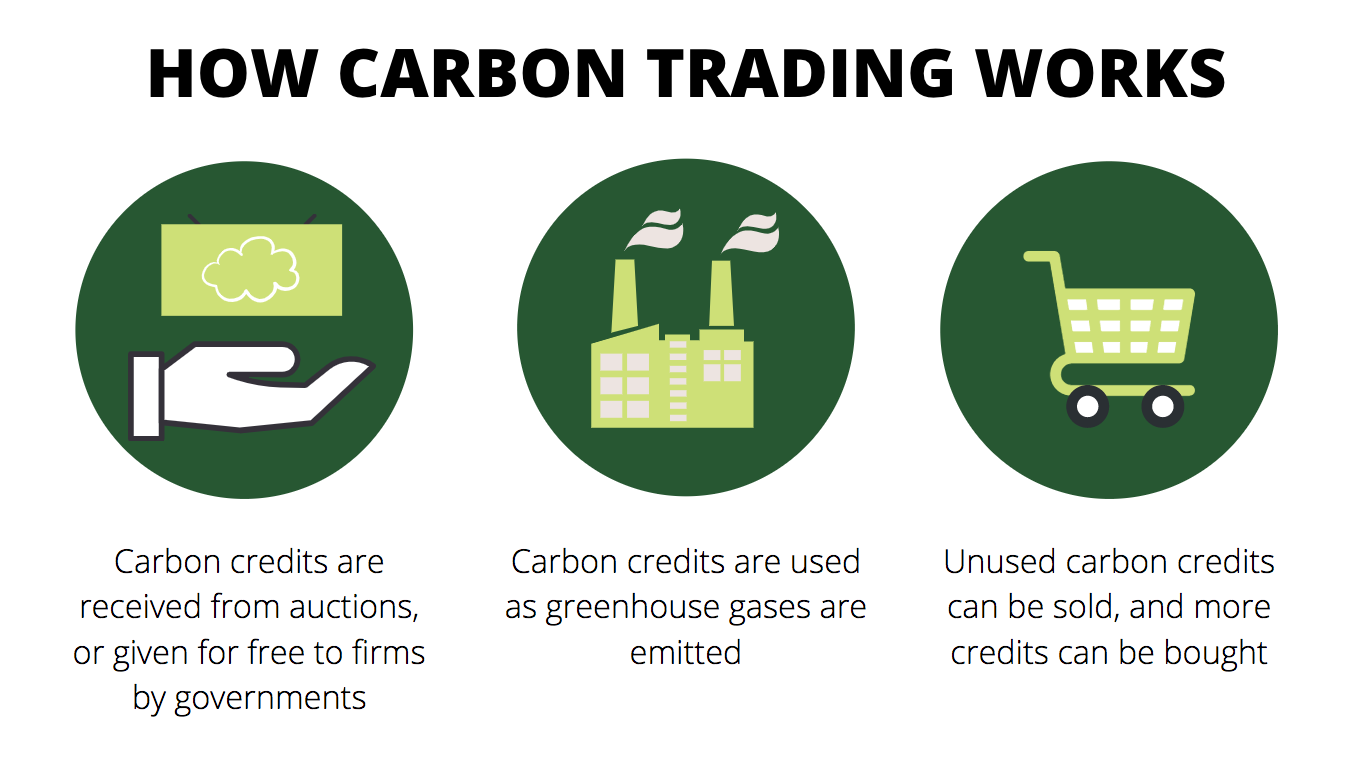

The chief executive of the Nigerian Exchange (NGX) Limited, Mr Temi Popoola, has disclosed that the bourse was working on a framework for certifications in carbon credits trading.

Speaking on Wednesday at the NGX 2022 Market Recap and 2023 Outlook in Lagos, he said this is one of the ways the exchange wants to encourage investments in sustainable projects.

According to him, “NGX sees sustainability as not just important but also a profitable frontier of its business and work is ongoing on developing a framework for certifications in carbon credits trading, pending regulatory approval.”

Mr Popoola described 2022 as wonderful for the Nigerian stock market because it witnessed a few landmark listings which shaped the direction of the ecosystem in the year.

“In 2022, the equities market performance was buoyed by the 19.98 per cent increase in the NGX All-Share Index, which rose from 40270.72 points to 51,251.06 points just as the market capitalisation also closed at a high of N27.92 trillion, up from N21.06 trillion the previous year.

“The total turnover of trades in 2022 improved by 27 per cent from N916 billion to N1.16 trillion year-on-year from 2021.

“Market participation was heavily skewed to the domestic investors. The fixed income market saw a slight uptick in turnover to N3.89 billion in 2022 from N3.53 billion recorded in 2021, representing a 10.20 per cent YoY increase.

“The Exchange Traded Funds market capitalisation increased from N7.35 billion in 2021 to N8.42 billion in 2022, representing a 14.56 per cent increase in the market capitalisation.

“Stanbic IBTC ETF 30, which tracks the performance of the NGX 30 index, was the best performing ETF in 2022, having begun the year at N68.5 and closed at N245, reflective of 257.66 per cent returns. ETF transactions fell from N34.22 billion in 2021 to N211.02 million in 2022, representing a 99.38 per cent decline in ETF turnover,” he stated, adding that, “Altogether, this signalled a good year for the Exchange despite global macroeconomic headwinds.”

On the outlook for this year, Mr Popoola said Customs Street would take a flexible approach to strategy execution in 2023, doubling down on its 2022 achievements and expanding on several levers.

“As you know, the NGX Technology Board Listing Rules were approved by the apex regulator, the Securities and Exchange Commission (SEC), in December 2022.

“With this, we aim to drive more technology companies to the Exchange and deepen capital formation in the technology sector.

“Currently, we are in consultations with stakeholders in the sector, and we are confident of securing a few big names within the year.”

“On the capital market’s digital transformation, the Exchange is working on USSD launch in collaboration with Telcos and Banks, unlocking the African Capital markets via payment integration with Afreximbank’s Pan African Payment Settlement System,” he added.

Economy

NASD OTC Market Cap Declines to N2.53trn After 0.28% Dip

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange further lost 0.28 per cent on Wednesday, March 11, cutting down the market capitalisation by N7.21 billion to N2.533 trillion from the preceding session’s N2.540 trillion.

In the same vein, the NASD Unlisted Security Index (NSI) was down during the session by 12.06 points to finish at 4,233.91 points compared with the 4,245.97 points it ended on Tuesday.

The midweek session experienced a decline in the volume of securities by 91.3 per cent to 1.3 million units from 14.9 million units, as the value of securities decreased by 75.9 per cent to N31.9 million from the N132.7 million recorded on Tuesday, and the number of deals fell 37.9 per cent to 36 deals from the preceding session’s 58 deals.

The session ended with Central Securities Clearing System (CSCS) Plc as the most traded stock by value on a year-to-date basis with 38.1 million units valued at N2.4 billion. Okitipupa Plc followed with 6.3 million units traded at N1.1 billion, and FrieslandCampina Wamco Nigeria Plc recorded the sale of 5.8 million units worth N529.9 million.

Resourcery Plc remained as the most traded stock by volume on a year-to-date basis with 1.05 billion units sold for N408.7 million, trailed by Geo-Fluids Plc with 130.6 million units exchanged for N503.8 million, and CSCS Plc with 38.1 million units worth N2.4 billion.

The alternative stock market closed the day with three price decliners and three price gainers led by IPWA Plc, which added 41 Kobo to sell at N4.56 per unit versus the previous day’s N4.15 per unit, MRS Oil Plc appreciated by 10 Kobo to N210.10 per share from N210.00 per share, and Lighthouse Financial Services Plc increased its value by 5 Kobo to 55 Kobo per unit from 50 Kobo per unit.

Conversely, FrieslandCampina Wamco Nigeria Plc lost N3.92 to quote at N132.78 per share versus N136.70 per share, UBN Property Plc dropped 20 Kobo to settle at N2.38 per unit from N2.18 per unit, and First Trust Mortgage Bank Plc declined by 1 Kobo to N1.90 per share from N1.91 per share.

Economy

Naira Rebounds 1.8% to N1,376/$ at Official Market

By Adedapo Adesanya

For the first time in a while, the value of the Nigerian Naira improved against its United States counterpart, the Dollar, in the Nigerian Autonomous Foreign Exchange Market (NAFEX) on Wednesday, March 11.

At the midweek session, it gained N25.21 or 1.8 per cent on the greenback in the official market to trade at N1,376.19/$1 compared with the previous day’s value of N1,401.40/$1.

It was also a positive outcome for the Naira in the spot market, as it appreciated against the Pound Sterling yesterday by N40.26 to close at N1,845.47/£1 versus Tuesday’s value of N1,885.73/£1, but closed flat against the Euro at N1,631.51/€1.

At the GTBank FX desk, the Nigerian currency appreciated against the Dollar yesterday by N9 to settle at N1,407/$1, in contrast to the N1,416/$1 it was exchanged a day earlier, and in the black market, it maintained stability at N1,420/$1.

The FX market pressure eased from a two-month low, as foreign reserves topped the $50 billion mark for the first time since January 2009, buoyed by a positive oil price threshold and forex inflows that could strengthen the current account balance and improve FX liquidity.

Inflows into the FX market have strengthened in recent weeks, but likewise, the US Dollar has strengthened in the international market due to the recent crisis facing the global markets involving the United States, Israel, and Iran.

As for the digital currency market, it was mixed on Wednesday amid renewed Middle East tensions, as on-chain data show persistent selling pressure and weak demand as investors grapple with conflict-driven stagflation fears and fading prospects for near-term Federal Reserve rate cuts ahead of next week’s meeting.

Solana (SOL) slumped 0.9 per cent to $85.11, Ripple (XRP) declined by 0.6 per cent to $1.38, Bitcoin (BTC) dropped 0.4 per cent to sell for $69,433.43, and Cardano (ADA) depreciated 0.2 per cent to $0.2591.

But TRON (TRX) added 1.0 per cent to sell at $0.2900, Binance Coin (BNB) gained 0.8 per cent to close at $644.54, Ethereum (ETH) appreciated by 0.5 per cent to $2,027.98, and Dogecoin (DOGE) grew by 0.2 per cent to $0.0919, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

Economy

Oil Prices Jump 5% as Hormuz Attacks Intensify Supply Fears

By Adedapo Adesanya

Oil prices appreciated by nearly 5 per cent on Wednesday as fresh attacks on ships in the Strait of Hormuz worsened supply disruption fears.

Brent futures gained $4.18 or 4.8 per cent to settle at $91.98 a barrel, while the US West Texas Intermediate (WTI) futures increased by $3.80 or 4.6 per cent to $87.25 a barrel.

Three more vessels have been hit by projectiles in the Strait of Hormuz, maritime security and risk firms said on Wednesday. That brought the number of ships struck in the region to at least 14 since the Iran war began.

Iran warned that no oil shipments will be allowed to pass through the Strait of Hormuz until the attacks stop, placing the world’s most critical oil trade point at the centre of the escalating conflict. The narrow waterway between Iran and Oman normally handles roughly 20 per cent of global oil supply and a large share of liquified natural gas (LNG) trade, making any sustained disruption a major threat to global energy markets.

Tanker movements through the region have already begun slowing as insurers and ship operators reassess the risks of transiting the corridor.

The country, which is one of the largest producers in the Organisation of the Petroleum Exporting Countries, on Wednesday said that crude could surge to $200 per barrel if the war involving the US and Israel continues to destabilise the Middle East’s energy corridors.

Crude briefly surged to around three digits earlier this week before retreating toward the $90 range after US President Donald Trump suggested the conflict might end soon. However, renewed attacks on shipping and infrastructure have quickly revived fears of supply disruptions.

Meanwhile, the International Energy Agency (IEA) recommended the release of 400 million barrels of oil, the largest such move in its history, to try to rein in energy prices, which are now up more than 25 per cent since the war began. The energy watchdog said the time frame for the release will be decided in due course.

The proposed volume is more than double the 182 million barrels released in 2022 following Russia’s invasion of Ukraine. Analysts, however, said it was ultimately insufficient to resolve supply losses from a prolonged war in the Middle East.

Member countries collectively hold roughly 1.2 billion barrels of strategic reserves, which can be tapped during supply emergencies.

Crude oil inventories in the US increased by 3.8 million barrels during the week ending March 6, according to data from the US Energy Information Administration (EIA). The EIA’s data release follows figures from the American Petroleum Institute (API) that were released a day earlier, which reported that crude oil inventories fell by 1.7 million barrels in the period.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn