Economy

NGX Group’s Profit Rises 82.4% in Six Months

By Adedapo Adesanya

Nigerian Exchange (NGX) Group Plc has recorded an 82.4 per cent growth in profit in the first six months of the year, rising to N820.167 million from N449.658 million in H1 2021.

This information was contained in the NGX group’s unaudited results for the half-year ended June 30, 2022, which noted that revenue rose by 140.4 per cent to N3.823 billion during the period from N1.59 billion in 2021.

Highlights of the result included gross earnings of 138.3 per cent improvement to N4.22 billion from N1.77 billion, driven by 165.1 per cent growth in treasury investment income (26.6 per cent of revenue) to N1,017.4 million in June 2022 relative to N383.7 million in the comparative period in 2021 driven largely by relatively higher yields on the Group’s treasury bills, bonds and fixed deposit investments.

There was a 198.4 per cent growth in transaction fees (60.7 per cent of revenue) to N2.3 billion in June 2022 from N777.7 million recorded in June 2021 due to a significant increase in trading activities in the Exchange.

The company also saw an 18.6 per cent increase in listing fees (9.5 per cent of revenue) to N363.8 million in June 2022 from N306.8 million in June 2021 buoyed by improved listing on the Exchange in the first half of 2022 relative to the first half of 2021.

Rental income (1.4 per cent of revenue) earned from NGX Real Estate lease of office floor spaces recorded a 60.5 per cent increase from N32.2 million in June 2021 to N51.7 million.

However, there was a 15.4 per cent decline in other fees (1.8 per cent of revenue) to N69.7 million in June 2022 from N82.4 million in June 2021 which represents rental income from the trading floor, annual charges from brokers, dealing license and membership fees earned by the Group.

There was a 119.6 per cent increase in other income (9 per cent of gross earnings) driven primarily by a 376.5 per cent improvement in market data income (56 per cent of other income) to N220.94 million from N46.3 million reported in June 2021 which is made up of technology income, other sub-lease income, and penalty fees.

There was a 15.99 per cent growth in other operating income (31 per cent of other income) from N105.6 million in June 2021 to N122.5 million in June 2022.

Also, total expenses grew by 102.6 per cent from N1.9 billion in June 2021 to N3.9 billion in June 2022 primarily driven by a 231.6 per cent growth in operating expenses (59.1 per cent of total expenses) to N2.3 billion from N702.9 million in June 2021. This was largely as a result of a finance cost (57 per cent of operating expenses) of N1.3 billion related to a term loan taken during the period. Personnel expenses (34.4 per cent of total expenses) also grew by 27 per cent from N1.01 billion in June 2021 to N1.35 billion during the period under review.

The exchange’s made an operating profit of N273.2 million in June 2022 compared to an operating loss of N177.2 million in June 2021, as a result of 138.3 per cent growth in gross earnings.

Profit before income tax grew by 134.4 per cent to N1.22 billion in June 2022 from N521.9 million in the corresponding period in 2021 due to an impressive growth in the top line which was more than sufficient to mitigate the impact of the increases in key expense lines.

Despite an increase in effective tax rate to 32.9 per cent relative to 13.8 per cent in June 2021, profit after income tax grew by 82.4 per cent to N820.2 million from N449.7 million. This resulted in a decline in profit after tax margin to 19.5 per cent from 25.4 per cent recorded in June 2021.

Total assets rose by 59.9 per cent to N39.8 billion from N24.9 billion in December 2021, driven primarily by 91.3 per cent growth in investment in associates to N31.99 billion from N14.8 billion in Dec. 2021, and 116.8 per cent growth in Cash and Cash equivalent to N4.3 billion from N2.2 billion in December 2021.

Total liabilities recorded a 394.7 per cent increase from N3.8 billion in December 2021 to N18.6 billion as a result of a N14.5 billion term loan used to facilitate the increase in investment in select associates.

Speaking on the result, the Group Managing Director/Chief Executive Officer, Mr Oscar Onyema said, “In 2021, we took strategic steps to reorganise our business by laying the foundation for the rebirth of our franchise as we became a fully-fledged for-profit making company with a clear focus on maximizing resources and improving stakeholder returns.

“Our performance in the first half of 2022 is a testament to our ability to deliver long-term value. We recorded impressive growth in our top line to deliver a profit before tax of N1.22 billion despite the peculiar challenges inherent in our operating environment.

“Our goal remains to sustain our position as a leading integrated market infrastructure group in Africa, by diversifying our revenue streams, and identifying and investing in new businesses. We remain focused on building formidable businesses through broader and deeper involvement in every sphere of the capital market value chain through informed investments in profitable verticals and enhanced risk management practices, without losing sight of emerging opportunities in unrelated businesses within the Sub-Saharan African region.”

Economy

NNPC Targets 230% LPG Supply Surge to 5MTPA Under Gas Master Plan 2026

By Adedapo Adesanya

The Nigerian National Petroleum Company (NNPC) Limited has said the Gas Master Plan 2026 targets over 230 per cent scale-up of Liquefied Petroleum Gas (LPG) supply from 1.5 million tonnes per annum (MTPA) to 5 MTPA this year.

The Executive Vice President for Gas, Power and New Energy at NNPC, Mr Olalekan Ogunleye, unveiled the strategic direction of the NNPC Gas Master Plan 2026, outlining an aggressive expansion drive to position Nigeria as a regional and global gas powerhouse.

Mr Ogunleye delivered the keynote address at the 2026 Lagos Energy Week, organised by the Society of Petroleum Engineers (SPE), where he detailed plans to accelerate gas development, deepen infrastructure and significantly scale domestic supply.

According to him, the Gas Master Plan targets a scale-up of LPG or cooking gas supply from 1.5 MTPA to 5 MTPA, alongside expanded feedstock for Mini-LNG and Compressed Natural Gas (CNG) projects.

“The NNPC Gas Master Plan 2026 is a blueprint to unlock Nigeria’s vast gas potential and translate it into tangible economic value,” Mr Ogunleye said.

He added that the strategy would also drive exponential growth in Gas-Based Industries, GBIs, strengthening local manufacturing, fertiliser production and power generation.

“Our renewed focus is on turning abundant gas resources into inclusive economic growth and improved quality of life for Nigerians,” he stated.

Mr Ogunleye said the plan aligns with the Federal Government’s Decade of Gas initiative and the presidential production targets of achieving 10 billion cubic feet per day by 2027 and 12 BCF/D by 2030.

Industry leaders at the event, including executives from Chevron Corporation, Esso Exploration and Production Nigeria Limited, Midwestern Oil and Gas Company Limited, Abuja Gas Processing Company and Shell Nigeria Gas, commended the plan and praised Ogunleye’s leadership in driving implementation excellence.

The new blueprint signals NNPC’s determination to anchor Nigeria’s energy transition on gas, leveraging infrastructure expansion and domestic utilisation to consolidate the country’s status as Africa’s largest gas reserve holder.

Economy

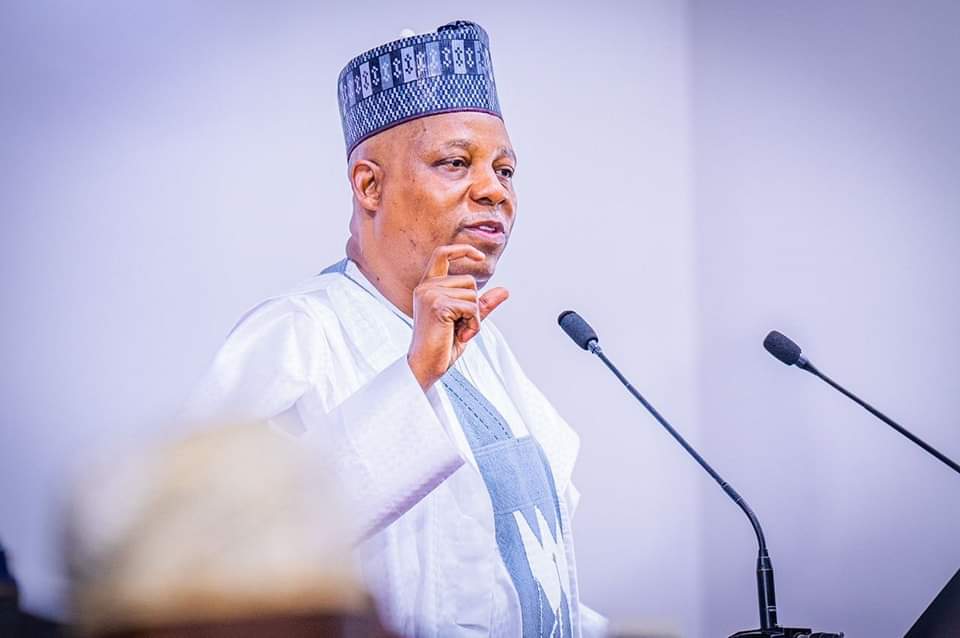

Shettima Blames CBN’s FX Intervention for Naira Depreciation

By Adedapo Adesanya

Vice President Kashim Shettima has attributed the Naira’s recent depreciation to the intervention of the Central Bank of Nigeria (CBN) in the foreign exchange (FX) market, stating that the currency could have strengthened to around N1,000 per Dollar within weeks if the apex bank had allowed market forces to prevail.

The local currency has dropped over N8.37 on the Dollar in the last week, as it closed at N1,355.37/$1 on Tuesday at the Nigerian Autonomous Foreign Exchange Market (NAFEM), after it went on a spree late last month and into the early weeks of February.

However, speaking on Tuesday at the Progressive Governors’ Forum (PGF), Renewed Hope Ambassadors Strategic Summit in Abuja, the Nigerian VP said the intervention was to ensure stability.

“In fact, if not for the interventions by the Central Bank of Nigeria yesterday, the 1,000 Naira to a Dollar we are going to attain in weeks, not in months. But for the purpose of market stability, the CBN generously intervened yesterday.

“So, for some of my friends, especially one of our party leaders who takes delight in stockpiling dollars, it is a wake-up call,” the vice president said.

He was alluding to CBN buying US Dollars from the market to slow down the rapid rise of the Naira.

Latest information showed that last week, the apex bank bought about $189.80 million to reduce excess Dollar supply and control how fast the Naira was gaining value.

The move was aimed at preventing foreign portfolio investors from exiting Nigeria’s fixed-income market, as large-scale sell-offs could heighten demand for US Dollars, intensify capital flight, and exert further pressure on the exchange rate.

Amid this, speaking after the 304th meeting of the monetary policy committee (MPC) of the CBN on Tuesday, Governor of the central bank, Mr Yemi Cardoso, said Nigeria’s gross external reserves have risen to $50.45 billion, the highest level in 13 years.

This strengthens the country’s foreign exchange buffers, enhances the apex bank’s capacity to defend the Naira when needed, and boosts investor confidence in the stability of the Nigerian FX market.

Economy

Dangote Refinery Exports 20 million Litres Surplus of PMS

By Aduragbemi Omiyale

Up to 20 million litres in surplus of Premium Motor Spirit (PMS), otherwise known as petrol, is being exported daily by the Dangote Petroleum Refinery and Petrochemicals after supplying about 65 million litres to the domestic market.

Nigeria’s average daily petrol consumption stands at between 50 and 60 million litres, indicating that the refinery’s output exceeds current domestic requirements, marking a decisive break from decades of fuel import dependence and recurrent scarcity.

The president of Dangote Group, Mr Aliko Dangote, speaking in Lagos, while confirming a structured offtake agreement with selected marketers to ensure nationwide distribution and eliminate supply instability, said the structured model was designed to eliminate supply bottlenecks and curb speculative practices that have historically triggered disruptions.

“We have agreed an offtake framework to supply up to 65 million litres daily for the domestic market. Any surplus, estimated at between 15 and 20 million litres, will be exported,” he said.

Under a revised distribution framework endorsed by the Nigerian Midstream and Downstream Petroleum Regulatory Authority, the refinery will channel nationwide supply through major marketing companies, including MRS Oil Nigeria Plc, Nigerian National Petroleum Company Limited Retail (NNPC), 11 plc (Mobil Producing Nigeria), TotalEnergies Marketing Nigeria Plc, Rainoil Limited, Northwest Petroleum & Gas Company Limited, Ardova Plc, Bovas & Company Limited, AA Rano Nigeria Limited, AYM Shafa Limited, Conoil and Masters Energy.

With local refining now exceeding national demand, the country stands to conserve billions of dollars annually in foreign exchange previously spent on petrol imports. Analysts say this would ease pressure on the naira, strengthen external reserves, and improve trade balance stability.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn